Sallie Mae 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

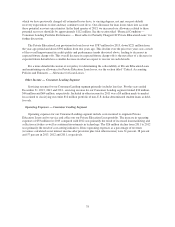

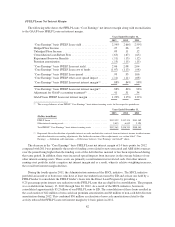

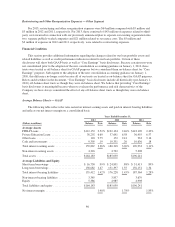

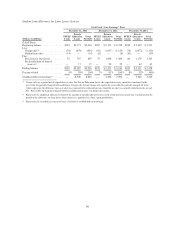

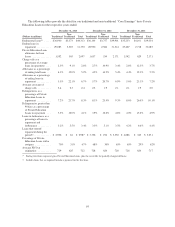

Rate/Volume Analysis — GAAP

The following rate/volume analysis shows the relative contribution of changes in interest rates and asset

volumes.

Increase

(Decrease)

Change Due To(1)

(Dollars in millions) Rate Volume

2013 vs. 2012

Interest income .............................. $(392) $ 286 $(678)

Interest expense .............................. (351) (54) (297)

Net interest income ........................... $ (41) $ 344 $(385)

2012 vs. 2011

Interest income .............................. $(161) $ 175 $(336)

Interest expense .............................. 160 312 (152)

Net interest income ........................... $(321) $(130) $(191)

(1) Changes in income and expense due to both rate and volume have been allocated in proportion to the relationship of the

absolute dollar amounts of the change in each. The changes in income and expense are calculated independently for

each line in the table. The totals for the rate and volume columns are not the sum of the individual lines.

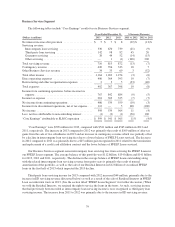

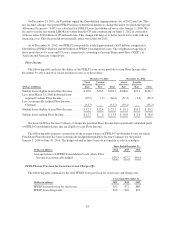

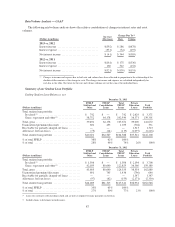

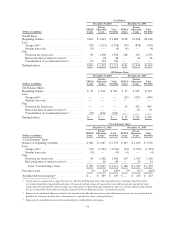

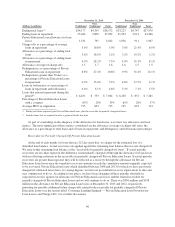

Summary of our Student Loan Portfolio

Ending Student Loan Balances, net

December 31, 2013

(Dollars in millions)

FFELP

Stafford and

Other

FFELP

Consolidation

Loans

Total

FFELP

Loans

Private

Education

Loans

Total

Portfolio

Total student loan portfolio:

In-school(1) ............................... $ 742 $ — $ 742 $ 2,629 $ 3,371

Grace, repayment and other(2) ................ 38,752 64,178 102,930 36,371 139,301

Total, gross ................................. 39,494 64,178 103,672 39,000 142,672

Unamortized premium/(discount) ............... 602 433 1,035 (704) 331

Receivable for partially charged-off loans ......... — — — 1,313 1,313

Allowance for loan losses ..................... (75) (44) (119) (2,097) (2,216)

Total student loan portfolio .................... $40,021 $64,567 $104,588 $37,512 $142,100

% of total FFELP ............................ 38% 62% 100%

% of total .................................. 28% 46% 74% 26% 100%

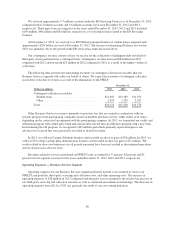

December 31, 2012

(Dollars in millions)

FFELP

Stafford and

Other

FFELP

Consolidation

Loans

Total

FFELP

Loans

Private

Education

Loans

Total

Portfolio

Total student loan portfolio:

In-school(1) ............................... $ 1,506 $ — $ 1,506 $ 2,194 $ 3,700

Grace, repayment and other(2) ................ 42,189 80,640 122,829 36,360 159,189

Total, gross ................................. 43,695 80,640 124,335 38,554 162,889

Unamortized premium/(discount) ............... 691 745 1,436 (796) 640

Receivable for partially charged-off loans ......... — — — 1,347 1,347

Allowance for loan losses ..................... (97) (62) (159) (2,171) (2,330)

Total student loan portfolio .................... $44,289 $81,323 $125,612 $36,934 $162,546

% of total FFELP ............................ 35% 65% 100%

% of total .................................. 27% 50% 77% 23% 100%

(1) Loans for customers still attending school and are not yet required to make payments on the loan.

(2) Includes loans in deferment or forbearance.

87