Sallie Mae 2005 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2005 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SLM CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(Dollars in thousands, except per share amounts, unless otherwise stated)

F-58

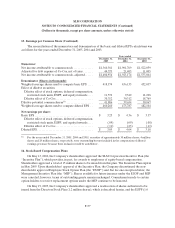

16. Stock-Based Compensation Plans (Continued)

million shares), to the Incentive Plan. This increased the total number of shares authorized to be issued

from the Incentive Plan from 15.0 million shares to 17.2 million shares.

Awards under the Incentive Plan may be in the form of stock, stock options, performance stock,

restricted stock and/or stock units. Awards under the MIP were made in the form of stock, stock options,

performance stock and/or stock units. Awards under the ESOP were in the form of stock, stock options

and/or performance stock. Under all three plans, the maximum term for stock options is 10 years and the

exercise price must be equal to or greater than the market price of SLM common stock on the date of

grant.

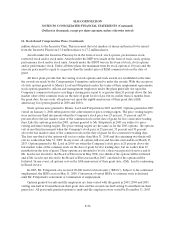

All three plans provide that the vesting of stock options and stock awards are established at the time

the awards are made by the Compensation Committee authorized to make the awards. With the exception

of stock options granted to Messrs. Lord and Fitzpatrick under the terms of their employment agreements,

stock options granted to officers and management employees under the plans generally vest upon the

Company’s common stock price reaching a closing price equal to or greater than 20 percent above the fair

market value of the common stock on the date of grant for five days, but no earlier than 12 months from

the grant date. In any event, all options vest upon the eighth anniversary of their grant date (fifth

anniversary for options granted in 2000 and 2001).

Stock options were granted to Messrs. Lord and Fitzpatrick in 2003 and 2005. Options granted in 2003

vested on January 1, 2006 subsequent to the achievement of price-vesting targets. The price vesting targets

were met in one-third increments when the Company’s stock price was 25 percent, 33 percent and 50

percent above the fair market value of the common stock on the date of grant for five consecutive trading

days. Like the options granted in 2003, options granted to Mr. Fitzpatrick in 2005 are subject to price-

vesting and time-vesting targets. The price-vesting targets are the same as for the 2003 options: the options

vest in one-third increments when the Company’s stock price is 25 percent, 33 percent and 50 percent

above the fair market value of the common stock on the date of grant for five consecutive trading days.

The first one-third of the options will vest no earlier than May 31, 2008 and the remaining two-thirds will

vest no earlier than May 31, 2009. In any event, all options will vest and become exercisable on March 17,

2013. Options granted to Mr. Lord in 2005 vest when the Company’s stock price is 20 percent above the

fair market value of the common stock on the date of grant for five trading days, but no earlier than 12

months from the date of grant. These options are intended to be for a three-year period of service and if

Mr. Lord is not elected to the Board of Directors in May 2006, two-thirds of the options will be forfeited

and if Mr. Lord is not elected to the Board of Directors in May 2007, one-third of the options will be

forfeited. In any event, all options vest on the fifth anniversary of their grant date, if Mr. Lord is continuing

in Board service.

In 2005, Mr. Fitzpatrick also received 90,000 restricted stock units (“RSUs”). Subject to his continued

employment, the RSUs vest on May 31, 2008. Conversion of vested RSUs to common stock is deferred

until Mr. Fitzpatrick’s retirement or termination of employment.

Options granted to rank-and-file employees are time-vested with the grants in 2003, 2004 and 2005

vesting one-half in 18 months from their grant date and the second one-half vesting 36 months from their

grant date. All previously granted options to rank-and-file employees were vested by December 31, 2005.