Saks Fifth Avenue 2011 Annual Report Download - page 21

Download and view the complete annual report

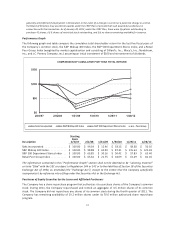

Please find page 21 of the 2011 Saks Fifth Avenue annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Item 7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations.

Management’s Discussion and Analysis (“MD&A”) is intended to provide an analytical view of the business from

management’s perspective of operating the business and has the following components:

▪Overview

▪Results of Operations

▪Liquidity and Capital Resources

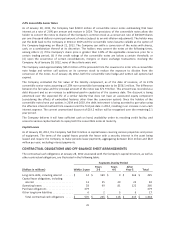

▪Contractual Obligations and Off-Balance Sheet Arrangements

▪Critical Accounting Policies and Estimates

MD&A should be read in conjunction with the consolidated financial statements and related notes thereto

contained elsewhere in this Form 10-K.

OVERVIEW

GENERAL

The operations of Saks Incorporated, a Tennessee corporation first incorporated in 1919, and its subsidiaries

(together the “Company”) consist of Saks Fifth Avenue (“SFA”) stores and SFA e-commerce operations (“Saks

Direct”) as well as Saks Fifth Avenue OFF 5TH (“OFF 5TH”). Previously, the Company also operated Club Libby Lu

(“CLL”), the operations of which were discontinued in January 2009. The operations of CLL are presented as

discontinued operations on the Consolidated Statements of Income and the Consolidated Statements of Cash

Flows for the prior year periods and are discussed below in “Discontinued Operations.”

The Company is an omni-channel luxury retailer offering a wide assortment of distinctive fashion apparel,

shoes, accessories, jewelry, cosmetics, and gifts. SFA stores are principally free-standing stores in exclusive

shopping destinations or anchor stores in upscale regional malls. Customers may also purchase SFA products

online at saks.com or by catalog. OFF 5TH is intended to be the premier luxury off-price retailer in the United

States. OFF 5TH stores are primarily located in upscale mixed-use and off-price centers and offer luxury apparel,

shoes, and accessories, targeting the value-conscious customer. As of January 28, 2012, the Company

operated 46 SFA stores with a total of approximately 5.5 million square feet and 60 OFF 5TH stores with a total

of approximately 1.7 million square feet.

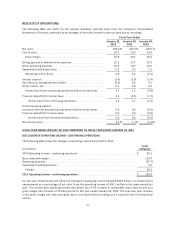

The Company is primarily focused on the luxury retail sector. All of the goods that the Company sells are

discretionary items. Consequently, a downturn in the economy or difficult economic conditions may result in

fewer customers shopping in the Company’s stores or online. In response, the Company may have to increase

the duration and/or frequency of promotional events and offer larger discounts in order to attract customers,

which would reduce gross margin and adversely affect results of operations.

The Company continues to make targeted investments in key areas to improve customer service and enhance

merchandise assortment and allocation effectiveness. In addition, strategic investments are being made to

remodel existing selling space with a heightened focus on return on investment. The Company believes that its

long-term strategic plans can deliver additional operating margin expansion in future years.

The Company seeks to create value for its shareholders by improving returns on its invested capital. The

Company attempts to generate improved operating margins by generating sales increases while improving

merchandising margins and controlling expenses. The Company uses operating cash flows to reinvest in the

business and to repurchase debt or equity. The Company actively manages its real estate portfolio by routinely

evaluating opportunities to improve or close underproductive stores and open new stores.

19