Safeway 2004 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2004 Safeway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

from Safeway’s former Florida division. In 2002, Furr’s and

Homeland emerged from bankruptcy and, based on the

resolution of various leases, Safeway reversed $12.1 million

of this accrual.

SALES Total sales increased only slightly to $35.8 billion in

2004 from $35.7 billion in 2003, primarily because of the

strike and because fiscal 2004 had one fewer week than

fiscal 2003.

Historically, Safeway has classified certain minor revenue

items such as partner gift card and vending machine income

as a reduction of costs and expenses. As the value of these

items has grown, the Company has determined that they are

more appropriately classified as other revenue in 2004.

These items have been reclassified for prior periods to

conform to the 2004 presentation. These reclassifications

had no effect on previously reported operating profit or net

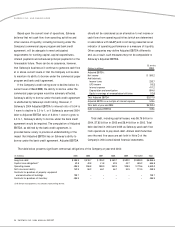

income (loss) and are summarized below (in millions):

2004 2003 2002

Sales, before reclassifications $ 35,621.9 $ 35,552.7 $ 34,767.5

Reclassifications 201.0 174.5 149.7

Sales and other revenue,

as adjusted $ 35,822.9 $ 35,727.2 $ 34,917.2

Cost of goods sold, before

reclassifications $(25,230.0) $(25,018.9) $(23,955.5)

Reclassifications 2.4 15.9 34.7

Cost of good sold, as adjusted $(25,227.6) $(25,003.0) $(23,920.8)

Gross profit, before

reclassifications $ 10,391.9 $ 10,533.8 $ 10,812.0

Reclassifications 203.4 190.4 184.4

Gross profit, as adjusted $ 10,595.3 $ 10,724.2 $ 10,996.4

Operating and administrative

expense, before

reclassifications $ (9,219.1) $ (9,230.8) $ (8,576.4)

Reclassifications (203.4) (190.4) (184.4)

Operating and administrative

expense, as adjusted $ (9,422.5) $ (9,421.2) $ (8,760.8)

These reclassifications did not change previously

reported comparable-store sales or identical-store sales by

more than 10 basis points in either 2004, 2003 or 2002.

Same-store sales increases (decreases) for 2004 were

as follows:

Comparable-Store Identical-Store

Sales (includes Sales (excludes

replacement stores) replacement stores)

Including Fuel:

Excluding strike-affected stores 1.5% 0.9%

Including strike-affected stores 0.9% 0.3%

Excluding Fuel:

Excluding strike-affected stores (0.2%) (0.8%)

Including strike-affected stores (0.7%) (1.3%)

In 2003, total sales increased 2.3% to $35.7 billion from

$34.9 billion in 2002 due primarily to the additional week in

2003, new store openings and additional fuel sales, partially

offset by the estimated impact of the strike in Southern

California. Excluding the estimated effects of the strike in

Southern California, comparable-store sales were flat, while

identical-store sales declined 0.4%. Further excluding the

effects of fuel sales, 2003 comparable-store sales

decreased 1.6% and identical-store sales decreased 2.0%.

In 2002, comparable-store sales decreased by 0.7%,

while identical-store sales declined 1.7%. Excluding the

effects of fuel sales, 2002 comparable-store sales decreased

1.3% and identical-store sales decreased 2.2%. Sales in

2002 were impacted by continued softness in the economy,

an increase in competitive activity, an overly aggressive

shrink-reduction effort and disruptions associated with the

centralization of buying and merchandising.

22 SAFEWAY INC. 2004 ANNUAL REPORT

SAFEWAY INC. AND SUBSIDIARIES

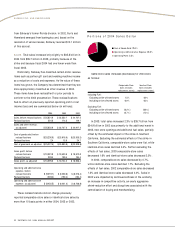

Portions of 2004 Sales Dollar

■ Cost of Goods Sold: 70.4%

■ Operating & Administrative Expense: 26.3%

■ Operating Profit: 3.3%