Saab 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 Saab annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SAAB ANNUAL REPORT 2011 1

SAAB 2011

SAAB 2011

tćFPSEFSJOUBLFEFDSFBTFEJOQBSUMZCFDBVTFPSEFSTXFSF

OPUBTMBSHFBTJO*OBEEJUJPOXFTBXGVSUIFSEFMBZTJOPVS

DVTUPNFSTJOWFTUNFOUQSPDFTTFTEVSJOHUIFTFDPOEIBMGPG

BTBSFTVMUPGTVCEVFEHMPCBMFDPOPNJDDPOEJUJPOT

t4BMFTEFDSFBTFEDPNQBSFEUPQBSUMZBTBSFTVMUPGMPXFS

BDUJWJUZMFWFMTJONBKPSQSPKFDUTBOEDIBMMFOHJOHNBSLFUDPOEJ-

UJPOTJO4PVUI"GSJDB

t1SPĕUBCJMJUZTUSFOHUIFOFEJO%VSJOHUIFZFBSXFGPDVTFE

POGVSUIFSJNQSPWJOHFďDJFODJFTJOPVSJOUFSOBMQSPDFTTFT

*NQSPWFNFOUTXFSFFTQFDJBMMZFWJEFOUJOPVSBCJMJUZUPNBOBHF

MPOHUFSNDVTUPNFSQSPKFDUTXIJDIMFEUPBOJNQSPWFEHSPTT

NBSHJO

t0QFSBUJOHJODPNFJOJODMVEFEDBQJUBMHBJOTPG

.4&,ڀ4USVDUVSBMDPTUTSFMBUFEUPUIFBDRVJTJUJPOPG4BBC

4FOTJTUPUBMMFE.4&,BOEDPTUTSFMBUFEUPUIFBDRVJTJUJPO

QSPDFTTPG4BBC4FOTJTBNPVOUFEUP.4&,

OUTLOOK FOR 2012:

t*OXFFTUJNBUFUIBUTBMFTXJMMJODSFBTFTMJHIUMZDPNQBSFE

UP

tćFPQFSBUJOHNBSHJOJOFYDMVEJOHNBUFSJBMOFUDBQJUBM

HBJOTJTFYQFDUFEUPCFJOMJOFXJUIUIFPQFSBUJOHNBSHJOJO

FYDMVEJOHNBUFSJBMOFUDBQJUBMHBJOTPGQFSDFOU

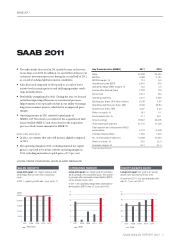

Key financial ratios (MSEK) 2011 2010

Sales 23,498 24,434

EBITDA 4,088 2,187

EBITDA margin, % 17.4 9.0

Operating income (EBIT) 2,941 975

Operating margin (EBIT margin), % 12.5 4.0

Income after financial items 2,783 776

Net income 2,217 454

Operating cash flow 2,477 4,349

Earnings per share, SEK (after dilution) 20.38 3.97

Operating cash flow per share, SEK 22.69 39.84

Dividend per share, SEK 4.501) 3.50

Return on equity, % 18.1 4.1

Equity/assets ratio, % 41.1 39.1

Order bookings 18,907 26,278

Order backlog at year-end 37,172 41,459

Total research and development (R&D)

expenditures 5,116 5,008

Internally financed R&D 1,355 1,203

No. of employees at year-end 13,068 12,536

Share of women, % 22.0 22.0

Academic degree, % 54.1 51.4

1SPQPTBMCZ#PBSEPG%JSFDUPST

LONG-TERM FINANCIAL GOALS AND RESULTS

SALES GROWTH

Long-term goal: Our organic sales growth

will average five per cent over a business

cycle.

In 2011, organic growth was -4 per cent (-1).

20112010200920082007

0

5,000

10,000

15,000

20,000

25,000

MSEK

Trend line

OPERATING MARGIN

Long-term goal: Our margin goal is formulated

as an average over a business cycle. The operat-

ing margin after depreciation/amortisation (EBIT)

will be at least 10 per cent.

In 2011, the operating margin after depreciation/

amortisation (EBIT) was 12.5 per cent (4.0).

20112010200920082007

0

3

6

9

12

15

%

Goal

EQUITY/ASSETS RATIO

Long-term goal: Our goal is an equity/

assets ratio exceeding 30 per cent.

At year-end 2011, the equity/assets ratio

was 41.1 per cent (39.1).

2

20112010200920082007

0

10

20

30

40

50

%

Goal