Ross 2009 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2009 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.— 2 —

We are very pleased with our exceptional performance in fiscal 2009. Strong execution

of our value-focused strategies enabled us to deliver much better-than-planned

revenues while achieving double digit operating profits as a percent of sales. These

results reflect the resilience of our off-price business model and demonstrate that

bargains are always in style!

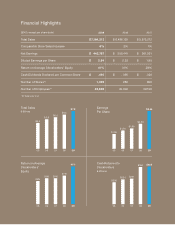

Record Sales and Earnings

For the 52 weeks ended January 30, 2010, sales increased 11% to a record $7.2 billion,

with same store sales up 6% on top of a 2% gain in the prior year. Dresses, Shoes and

Home were our best performing merchandise categories in 2009, while the Mid-Atlantic

and Southeast regions had the largest same store sales gains.

Net earnings for the year grew 45% to a record $442.8 million, up from $305.4 million in

2008. Earnings per share rose 52% to $3.54, on top of a 23% increase in 2008. Operating

margin increased about 250 basis points to 10.1%. Key drivers of this significant

improvement in profitability were much higher gross margin and increased leverage on

operating expenses from the healthy gains in same store sales.

Strong Inventory Management Increases Profitability

As we ended 2009, average in-store inventories were down about 11% on top of a 14%

decline in the prior year. We plan to further reduce in-store inventories in 2010, with

average store levels targeted to be down in the mid-to-high-single digit percentage range

compared to 2009.

Operating the business on lower inventory levels increases the percentage of fresh and

exciting merchandise customers see when they shop our stores. By exceeding our sales

targets with leaner inventories, we also realized significantly faster turns in 2009, which

resulted in much fewer markdowns.

Looking ahead, we believe this ongoing focus on strict inventory management will

continue to help us speed inventory turns and maximize merchandise gross margin.

Expansion Continues as Planned

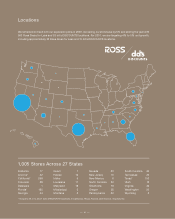

We added 56 new stores in 2009, consisting of 52 Ross and four dd’s DISCOUNTS

locations. We ended 2009 with 1,005 locations in 27 states and Guam. For 2010, we

are planning total unit expansion of about 4% to 5%, with approximately 35 new Ross

and 15 new dd’s DISCOUNTS stores.

Accelerating Growth at dd’s DISCOUNTS

Significant progress was made over the past year at dd’s DISCOUNTS, where sales and

operating profits were also well ahead of our original expectations. In fact, the earnings

Earnings per share rose 52% to $3.54 on top of

a 23% increase in 2008.

To our Stockholders