Ross 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Ross annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are always in style!

BARGAINS

Ross Stores, Inc.

2009 Annual Report

Table of contents

-

Page 1

BARGAINS are always in style! Ross Stores, Inc. 2009 Annual Report -

Page 2

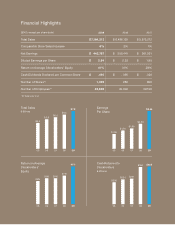

...Highlights ($000, except per share data) 2009 2008 2007 Total Sales Comparable Store Sales Increase Net Earnings Diluted Earnings per Share Return on Average Stockholders' Equity Cash Dividends Declared per Common Share Number of Stores (1) Number of Employees (1) 1 $ 7,184,213 6% $ 442,757 $ 3.54... -

Page 3

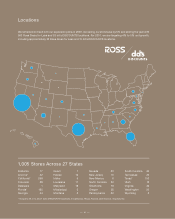

California-based Ross Stores is the second largest off-price retailer in the United States with 953 Ross Dress for Less ® ("Ross") stores in 27 states and Guam, and 52 dd's DISCOUNTS® locations in four states as of the end of fiscal year 2009. Ross, which was founded in 1982, offers a wide ... -

Page 4

... inventory management will continue to help us speed inventory turns and maximize merchandise gross margin. Expansion Continues as Planned We added 56 new stores in 2009, consisting of 52 Ross and four dd's DISCOUNTS locations. We ended 2009 with 1,005 locations in 27 states and Guam. For 2010... -

Page 5

... enthusiastic about dd's DISCOUNTS' long-term prospects and our plans to accelerate its expansion in 2010 and beyond. Healthy Cash Flows Fund Growth and Enhance Stockholder Returns Operating cash ï¬,ow in 2009 continued to provide the necessary resources to fund new store growth and infrastructure... -

Page 6

...detailed planning process will strengthen our ability to get the right merchandise to the right store at the right time. It is also expected to enhance sales and merchandise gross margin performance over the long term in both new and existing markets. Resilient and Flexible Off-Price Business Model... -

Page 7

... be used to fund our dividend and stock repurchase programs. In closing, we extend our appreciation to all of our customers, business partners and stockholders for their continued support. We especially want to acknowledge and thank our more than 45,000 Ross and dd's DISCOUNTS associates who remain... -

Page 8

... Alabama Arizona* California* Colorado Delaware Florida* Georgia 17 52 259 28 1 125 44 Guam Hawaii Idaho Louisiana Maryland Mississippi Montana 1 12 9 11 18 5 6 Nevada New Jersey New Mexico North Carolina Oklahoma Oregon Pennsylvania 20 10 6 32 18 25 32 South Carolina Tennessee Texas* Utah Virginia... -

Page 9

Form 10-K -

Page 10

Table of Contents Business Selected Financial Data Management's Discussion and Analysis Financial Statements and Supplementary Data Notes to Consolidated Financial Statements Report of Independent Registered Public Accounting Firm Signatures Index to Exhibits Certiï¬cations 10 22 24 34 38 56 62 63 ... -

Page 11

... (Exact name of registrant as speciï¬ed in its charter) Delaware (State or other jurisdiction of incorporation or organization) 4440 Rosewood Drive, Pleasanton, California (Address of principal executive ofï¬ces) Registrant's telephone number, including area code 94-1390387 (I.R.S. Employer Identi... -

Page 12

... moderate department and discount store regular prices at dd's DISCOUNTS. We sell recognizable brand-name merchandise that is current and fashionable in each category. New merchandise typically is received from three to six times per week at both Ross and dd's DISCOUNTS stores. Our buyers review... -

Page 13

... to effectively execute certain off-price buying strategies is a key factor in our success. Our buyers use a number of methods that enable us to offer our customers brand-name and designer merchandise at strong everyday discounts relative to department and specialty stores for Ross and moderate... -

Page 14

...specialty store. This strategy enables us to offer customers consistently low prices. On a weekly basis our buyers review speciï¬ed departments in our stores for possible markdowns based on the rate of sale as well as at the end of fashion seasons to promote faster turnover of merchandise inventory... -

Page 15

... supply chain network. We also implemented a new labor time and attendance system at all of our distribution centers. • We completed the rollout of new tools to better support the continued growth of our import business. These new tools provide our merchants with greater visibility into item cost... -

Page 16

...and home-related businesses may become even more competitive in the future. dd's DISCOUNTS At January 30, 2010, we operated 52 dd's DISCOUNTS in four states: 39 in California, 7 in Texas, 5 in Florida, and 1 in Arizona. At January 31, 2009, we had 39 dd's DISCOUNTS stores in California, 6 in Florida... -

Page 17

The dd's DISCOUNTS business generally has similar merchandise departments and categories to those of Ross, but features a different mix of brands at lower average price points. The typical dd's DISCOUNTS store is located in an established shopping center in a densely populated urban or suburban ... -

Page 18

... insurance for business interruption, inventory, and personal property to mitigate our risk on our corporate headquarters, distribution centers, buying ofï¬ces, and all of our stores. Our real estate strategy in 2010 is to open stores in states where we currently operate to increase our market... -

Page 19

..., 2010 and January 31, 2009. State/Territory Alabama Arizona California Colorado Delaware Florida Georgia Guam Hawaii Idaho Louisiana Maryland Mississippi Montana Nevada New Jersey New Mexico North Carolina Oklahoma Oregon Pennsylvania South Carolina Tennessee Texas Utah Virginia Washington Wyoming... -

Page 20

..., Pennsylvania Carlisle, Pennsylvania Fort Mill, South Carolina Fort Mill, South Carolina Ofï¬ce space Los Angeles, California New York City, New York Pleasanton, California In October 2008, we purchased 167 acres of land in the Southeast. See additional discussion under "Distribution" in Item... -

Page 21

..., Strategic Planning and Marketing. From 1991 to 2003, Mr. O'Sullivan was a partner with Bain & Company providing consulting advice to retail, consumer goods, ï¬nancial services and private equity clients. Ms. Rentler has served as President and Chief Merchandising Ofï¬cer of Ross Dress for... -

Page 22

.... In January 2010 our Board of Directors approved a two-year $750 million stock repurchase program for ï¬scal 2010 and 2011. 2 See Note H of Notes to Consolidated Financial Statements for equity compensation plan information. The information under Item 12 of this Annual Report on Form 10-K under... -

Page 23

... reinvestment of dividends. Fiscal year ended January 31. Indexes calculated on month-end basis. Indexed Returns for Years Ended Company / Index Base Period 2005 2006 2007 2008 2009 2010 Ross Stores, Inc. S&P 500 Index S&P Retailing Group 100 100 100 106 110 109 119 126 124 110 123 106 110 76... -

Page 24

... the section "Forward-Looking Statements" in this Annual Report on Form 10-K and our consolidated ï¬nancial statements and notes thereto. ($000, except per share data) 2009 2008 2007 20061 2005 Operations Sales Cost of goods sold Percent of sales Selling, general and administrative Percent of... -

Page 25

...2009 2008 2007 20061 2005 Financial Position Merchandise inventory Property and equipment, net Total assets Return on average assets Working capital Current ratio Long-term debt Long-term debt as a percent of total capitalization Stockholders' equity Return on average stockholders' equity Book... -

Page 26

...second largest off-price apparel and home goods retailer in the United States. At the end of ï¬scal 2009, we operated 953 Ross Dress for Less ("Ross") locations in 27 states and Guam, and 52 dd's DISCOUNTS stores in four states. Ross offers ï¬rst-quality, in-season, name brand and designer apparel... -

Page 27

... continuing to strengthen our organization, to diversify our merchandise mix, and to more fully develop our organization and systems to improve regional and local merchandise offerings. Although our strategies and store expansion program contributed to sales gains in ï¬scal 2009, 2008, and 2007, we... -

Page 28

... was mainly driven by a 20 basis point increase in store operating expenses and a 10 basis point increase in general and administrative costs as a percent of sales. The largest component of SG&A is payroll. The total number of employees, including both full and part-time, as of ï¬scal year end 2009... -

Page 29

... trade credit. Our primary ongoing cash requirements are for merchandise inventory purchases, payroll, capital expenditures in connection with opening new stores, and investments in distribution centers and information systems. We also use cash to repurchase stock under our stock repurchase program... -

Page 30

... in capital requirements in 2010 to fund expenditures for ï¬xtures and leasehold improvements to open both new Ross and dd's DISCOUNTS stores, for the relocation, or upgrade of existing stores, for investments in store and merchandising systems, buildings, equipment and systems, and for various... -

Page 31

... our corporate headquarters in Pleasanton, California, under several facility leases. The terms for these leases expire between 2011 and 2015 and contain renewal provisions. We lease approximately 197,000 and 26,000 square feet of ofï¬ce space for our New York City and Los Angeles buying ofï¬ces... -

Page 32

... inventory purchase orders, commitments related to store ï¬xtures and supplies, and information technology service and maintenance contracts. Merchandise inventory purchase orders of $1,044 million represent purchase obligations of less than one year as of January 30, 2010. Commercial Credit... -

Page 33

...rights, restricted stock bonuses, restricted stock units, performance shares, performance units, and deferred compensation awards. Critical Accounting Policies The preparation of our consolidated ï¬nancial statements requires our management to make estimates and assumptions that affect the reported... -

Page 34

...vesting period. We use historical data to estimate pre-vesting forfeitures and to recognize stock-based compensation expense. All stock-based compensation awards are expensed over the service or performance periods of the awards. Income taxes. We account for our uncertain tax positions in accordance... -

Page 35

...ï¬scal 2009, and information we provide in our Annual Report to Stockholders, press releases, telephonic reports, and other investor communications including on our corporate website, may contain a number of forward-looking statements regarding, without limitation, planned store growth, new markets... -

Page 36

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. Consolidated Statements of Earnings Year ended January 30, 2010 Year ended January 31, 2009 Year ended February 2, 2008 ($000, except per share data) Sales Costs and Expenses Costs of goods sold Selling, general and administrative Interest ... -

Page 37

... ($000, except share data) January 30, 2010 January 31, 2009 Assets Current Assets Cash and cash equivalents Short-term investments Accounts receivable Merchandise inventory Prepaid expenses and other Deferred income taxes Total current assets Property and Equipment Land and buildings Fixtures and... -

Page 38

... earnings Unrealized investment loss Total comprehensive income Common stock issued under stock plans, net of shares used for tax withholding Tax beneï¬t from equity issuance Stock based compensation Common stock repurchased Dividends declared Balance at January 31, 2009 Comprehensive income: Net... -

Page 39

...stock-based compensation Change in assets and liabilities: Merchandise inventory Other current assets Accounts payable Other current liabilities Other long-term, net Net cash provided by operating activities Cash Flows From Investing Activities Additions to property and equipment Proceeds from sales... -

Page 40

... and other home-related merchandise. At the end of ï¬scal 2009, the Company operated 953 Ross Dress for Less® ("Ross") locations in 27 states and Guam and 52 dd's DISCOUNTS ® stores in four states, all of which are supported by four distribution centers. The Company's headquarters, one buying of... -

Page 41

... stores. For stores that are closed, the Company records a liability for future minimum lease payments net of estimated sublease recoveries and related ancillary costs at the time the liability is incurred. In 2009, the Company closed three Ross Dress for Less and four dd's DISCOUNTS locations... -

Page 42

...' compensation, general liability insurance costs and costs of certain medical plans. The self-insurance liability is determined actuarially, based on claims ï¬led and an estimate of claims incurred but not yet reported. Self-insurance reserves as of January 30, 2010 and January 31, 2009 consisted... -

Page 43

...based compensation. The Company recognizes compensation expense based upon the grant date fair value of all stock-based awards, typically over the vesting period. See Note C for more information on the Company's stock-based compensation plans. Taxes on earnings. The Company accounts for income taxes... -

Page 44

..., principally unrealized investment gains or losses. Components of comprehensive income are presented in the consolidated statements of stockholders' equity. New accounting standards. In June 2009, the Financial Accounting Standards Board ("FASB") issued ASC 810 (originally issued as SFAS No. 167... -

Page 45

... value of the Company's available-for-sale securities as of January 31, 2009 were: Amortized cost Unrealized gains Unrealized losses Fair value Shortterm... are valued using quoted market prices or alternative pricing sources and models utilizing market observable inputs. The Company's investment in... -

Page 46

... 31, 2009 are summarized below: Fair Value Measurements at Reporting Date Quoted Prices in Active Markets for Identical...16,386 $ 21,326 $ 1,100 The maturities of investment securities at January 30, 2010 were: Estimated fair value ($000) Cost basis Maturing in one year or less Maturing after... -

Page 47

...market prices in active markets (Level 2) totaled $6.8 million as of January 30, 2010. Fair market value for these funds is considered to be the sum of participant funds invested under the contract plus accrued interest. Note C: Stock-based compensation For ï¬scal 2009, 2008, and 2007, the Company... -

Page 48

... covenants. The senior notes are subject to prepayment penalties for early payment of principal. Letters of credit. The Company uses standby letters of credit to collateralize certain obligations related to its self-insured workers' compensation and general liability programs. The Company had $65... -

Page 49

... headquarters in Pleasanton, California, under several facility leases. The lease terms for these facilities expire between 2011 and 2015 and contain renewal provisions. The Company leases approximately 197,000 and 26,000 square feet of ofï¬ce space for its New York City and Los Angeles buying... -

Page 50

...768 In ï¬scal 2009, 2008, and 2007, the Company realized tax beneï¬ts of $8.6 million, $8.5 million and $6.5 million, respectively, related to employee equity programs that were credited to additional paid-in capital. The provision for taxes for ï¬nancial reporting purposes is different from the... -

Page 51

... Deferred Tax Assets Deferred compensation Deferred rent Employee beneï¬ts Accrued liabilities California franchise taxes Stock-based compensation Other $ 29,014 11,094 - 20,275 5,399 7,224 9,995 83,001 Deferred Tax Liabilities Depreciation Merchandise inventory Employee beneï¬ts Supplies Prepaid... -

Page 52

... 2010 and January 31, 2009, respectively, of long-term plan investments, at market value, set aside or designated for the Non-qualiï¬ed Deferred Compensation Plan (See Note B). Plan investments are designated by the participants, and investment returns are not guaranteed by the Company. The Company... -

Page 53

... and other in the accompanying consolidated balance sheets as of January 30, 2010 and January 31, 2009, respectively. Note H: Stockholders' Equity Common stock. In January 2008 the Company's Board of Directors approved a two-year stock repurchase program of up to $600 million for ï¬scal 2008 and... -

Page 54

...are available for reissuance. As of January 30, 2010 and January 31, 2009, the Company held 1,291,000 and 1,128,000 shares of treasury stock, respectively. Intrinsic value for restricted stock, deï¬ned as the market value on the last business day of ï¬scal year 2009 (or $45.93), was $117.9 million... -

Page 55

...the Employee Stock Purchase Plan, eligible full-time employees participating in the annual offering period can choose to have up to the lesser of 10% or $21,250 of their annual base earnings withheld to purchase the Company's common stock. The purchase price of the stock is 85% of the closing market... -

Page 56

... data) Sales Cost of goods sold Selling, general and administrative Interest expense, net Total costs and expenses Earnings before taxes Provision for taxes on earnings Net earnings Earnings per share - basic1 Earnings per share - diluted1 Dividends declared per share on common stock Stock price... -

Page 57

...2009 ($000, except per share data) Sales Cost of goods sold Selling, general and administrative Interest (income) expense, net Total costs and expenses Earnings before taxes Provision for taxes... 2009. Ross Stores, Inc. common stock trades on The NASDAQ Global Select Market® under the symbol ROST. - ... -

Page 58

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Board of Directors and Stockholders Ross Stores, Inc. Pleasanton, California We have audited the accompanying consolidated balance sheets of Ross Stores, Inc. and subsidiaries (the "Company") as of January 30, 2010 and January 31, 2009, and ... -

Page 59

... position of Ross Stores, Inc. and subsidiaries as of January 30, 2010 and January 31, 2009, and the results of their operations and their cash ï¬,ows for each of the three years in the period ended January 30, 2010, in conformity with accounting principles generally accepted in the United States of... -

Page 60

... report, dated March 25, 2010, which is included in Item 8 in this Annual Report on Form 10-K. Because of its inherent limitations, internal control over ï¬nancial reporting may not prevent or detect misstatements. It should be noted that any system of controls, however well designed and operated... -

Page 61

... Part I of this report; and to the sections of the Ross Stores, Inc. Proxy Statement for the Annual Meeting of Stockholders to be held on Wednesday, May 19, 2010 (the "Proxy Statement") entitled "Information Regarding Nominees and Incumbent Directors." Information required by Item 405 of Regulation... -

Page 62

...Certain Transactions." ITEM 14. PRINCIPAL ACCOUNTANT FEES AND SERVICES. Information concerning principal accountant fees and services will appear in the Proxy Statement in the Ross Stores, Inc. Board of Directors Audit Committee Report under the caption "Summary of Audit, Audit-Related, Tax and All... -

Page 63

... ended January 30, 2010, January 31, 2009, and February 2, 2008. Notes to Consolidated Financial Statements. Report of Independent Registered Public Accounting Firm. 2. List of Consolidated Financial Statement Schedules. Schedules are omitted because they are not required, not applicable, or such... -

Page 64

... G. Call Title Vice Chairman and Chief Executive Ofï¬cer, Director Senior Vice President, Chief Financial Ofï¬cer and Principal Accounting Ofï¬cer Chairman of the Board, Director Date March 30, 2010 March 30, 2010 /s/Norman A. Ferber Norman A. Ferber /s/K. Gunnar Bjorklund K. Gunnar Bjorklund... -

Page 65

... 28, 2006. Lease dated July 23, 2003 of Certain Property located in Perris, California, incorporated by reference to Exhibit 10.1 to the Form 10-Q ï¬led by Ross Stores, Inc. for its quarter ended August 2, 2003. 3.2 4.1 10.1 Management Contracts and Compensatory Plans (Exhibits 10.2 - 10.72... -

Page 66

... by Ross Stores, Inc. for its quarter ended July 30, 2005. Ross Stores, Inc. 2008 Equity Incentive Plan, incorporated by reference to the appendix to the Deï¬nitive Proxy Statement on Schedule 14A ï¬led by Ross Stores, Inc. on April 14, 2008. Form of Nonemployee Director Equity Notice of Grant of... -

Page 67

...May 5, 2007. Ross Stores, Inc. Form of Notice of Grant and Performance Share Agreement incorporated by reference to Exhibit 10.4 to the Form 10-Q ï¬led by Ross Stores, Inc. for its quarter ended May 2, 2009. Form of Indemnity Agreement between Ross Stores, Inc. for Directors and Executive Ofï¬cers... -

Page 68

... 2010 between Norman A. Ferber and Ross Stores, Inc. Employment Agreement effective May 31, 2001 between Michael Balmuth and Ross Stores,...by Ross Stores, Inc. for its quarter ended July 30, 2005. Third Amendment to the Employment Agreement executed April 2007 between Michael Balmuth and Ross Stores, ... -

Page 69

... to the Form 10-Q ï¬led by Ross Stores, Inc. for its quarter ended May 2, 2009. Executive Employment Agreement effective December 4, 2009 between Lisa Panattoni and Ross Stores, Inc. Employment Agreement executed April 2007 between Barbara Rentler and Ross Stores, Inc., incorporated by reference to... -

Page 70

... statements of Ross Stores, Inc. and subsidiaries (the "Company"), and the effectiveness of the Company's internal control over ï¬nancial reporting, appearing in this Annual Report on Form 10-K of the Company for the year ended January 30, 2010. /s/DELOITTE & TOUCHE LLP San Francisco, California... -

Page 71

... 31.1 Ross Stores, Inc. Certiï¬cation of Chief Executive Ofï¬cer Pursuant to Sarbanes-Oxley Act Section 302(a) I, Michael Balmuth, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Ross Stores, Inc.; Based on my knowledge, this report does not contain any untrue statement of... -

Page 72

...I, John G. Call, certify that: 1. 2. I have reviewed this annual report on Form 10-K of Ross Stores, Inc.; Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances... -

Page 73

... the Report fairly presents, in all material respects, the ï¬nancial condition and results of operations of the Company. (2) Date: March 30, 2010 /s/J. Call John G. Call Senior Vice President, Chief Financial Ofï¬cer and Principal Accounting Ofï¬cer A signed original of this written statement... -

Page 74

... President Merchandising dd's DISCOUNTS® Bernie Brautigan Executive Vice President Merchandising Ken Caruana Executive Vice President Strategy, Marketing and Human Resources Dan Cline Executive Vice President Merchandising Gary L. Cribb Executive Vice President Stores and Loss Prevention Michael... -

Page 75

... Data Corporate Headquarters Ross Stores, Inc. 4440 Rosewood Drive Pleasanton, California 94588-3050 (925) 965-4400 Corporate Website: www.rossstores.com New York Buying Ofï¬ce Ross Stores, Inc. 1372 Broadway, 8th Floor New York, New York 10018-6141 (212) 382-2700 Los Angeles Buying Ofï¬ce Ross... -

Page 76

Ross Stores, Inc. 4440 Rosewood Drive Pleasanton, CA 94588-3050 (925) 965-4400 www.rossstores.com Printed on recycled paper. Please be kind to the environment and recycle.