Redbox 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

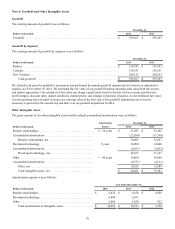

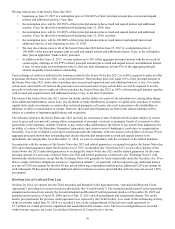

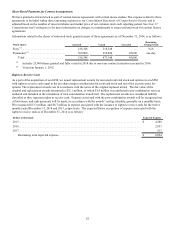

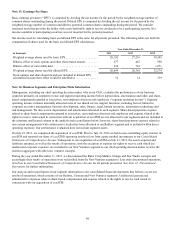

Certain information regarding our share-based payments is as follows:

Year Ended December 31,

Dollars in thousands except per share data 2014 2013 2012

Share-based payments expense:

Share-based compensation - stock options . . . . . . . . . . . . . . . . . $ 803 $ 1,566 $ 2,654

Share-based compensation - restricted stock . . . . . . . . . . . . . . . . 11,214 10,504 10,593

Share-based payments for content arrangements. . . . . . . . . . . . . 1,367 4,761 6,115

Total share-based payments expense. . . . . . . . . . . . . . . . . . . . . $ 13,384 $ 16,831 $ 19,362

Tax benefit on share-based payments expense . . . . . . . . . . . . . . . . . . $ 5,134 $ 6,392 $ 7,246

Per share weighted average grant date fair value of stock options

granted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ 53.90 $ 27.24

Per share weighted average grant date fair value of restricted stock

granted. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 71.37 $ 53.94 $ 55.94

Total intrinsic value of stock options exercised . . . . . . . . . . . . . . . . . $ 3,263 $ 10,567 $ 10,509

Grant date fair value of restricted stock vested. . . . . . . . . . . . . . . . . . $ 13,036 $ 12,641 $ 11,648

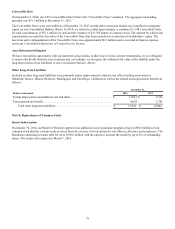

December 31, 2014

Dollars in thousands

Unrecognized Share-

Based Payments

Expense

Weighted-Average

Remaining Life

Unrecognized share-based payments expense:

Share-based compensation - stock options . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 863 1.8 years

Share-based compensation - restricted stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,714 2.1 years

Share-based payments for content arrangements (1) . . . . . . . . . . . . . . . . . . . . . . . . 1,041 0.8 years

Total unrecognized share-based payments expense. . . . . . . . . . . . . . . . . . . . . $ 22,618

(1) Related to 25,000 shares of restricted stock granted to Sony in connection with extending our existing content license

agreement. The unrecognized expense associated with these vested shares is recognized over the agreement term.