Radio Shack 2010 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2010 Radio Shack annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

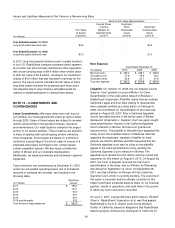

Restricted Stock Plan: The 2007 Restricted Stock Plan

(“2007 RSP”) permitted the grant of up to 0.5 million shares

of restricted stock to selected officers of the company, as

determined by the MD&C. This plan was terminated in 2009

upon shareholder approval of the 2009 ISP, and no further

grants may be made under this plan. Transactions related

to restricted stock awards issued under the 2007 RSP and

the 2009 ISP for the year ended December 31, 2010, are

summarized as follows:

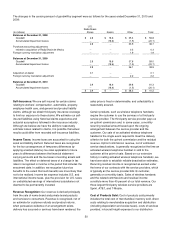

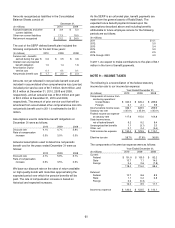

(In thousands, except

per share amounts)

Shares

Weighted-

Average

Fair Value

Per Share

Non-vested at January 1, 2010 353 $ 9.99

Granted 298 19.21

Vested or released

(1)

(191) 13.68

Canceled or forfeited (6) 14.90

Non-vested at December 31, 2010 454 $ 14.43

(1)

For plan participants age 55 and older, certain granted but unvested

shares are released from the plan for tax withholdings on the

participants’ behalf.

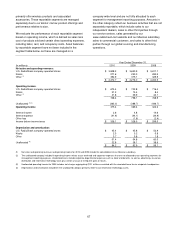

We granted approximately 298,000, 346,000, and 158,000

shares of restricted stock in 2010, 2009 and 2008,

respectively, under these plans.

Restricted stock awards are valued at the market price of a

share of our common stock on the date of grant. In general,

these awards vest at the end of a three-year period from

the date of grant and are expensed on a straight-line basis

over that period, which is considered to be the requisite

service period. This expense totaled $4.7 million, $1.8

million, and $1.5 million for the years ended December 31,

2010, 2009 and 2008, respectively.

The weighted-average grant-date fair value per share of

restricted stock awards granted was $19.21, $7.05 and

$18.15 in 2010, 2009 and 2008, respectively. The total fair

value of restricted stock awards vested was approximately

$1.7 million, $1.3 million and $1.1 million in 2010, 2009 and

2008, respectively.

The compensation cost charged against income for all

stock-based compensation plans was $9.9 million, $12.1

million and $12.8 million in 2010, 2009 and 2008,

respectively. The total income tax benefit recognized for all

stock-based compensation plans was $2.6 million, $3.9

million and $3.4 million in 2010, 2009 and 2008,

respectively. At December 31, 2010, there was $4.0 million

of unrecognized compensation expense related to the

unvested portion of our stock-based awards that is

expected to be recognized over a weighted average period

of 1.2 years.

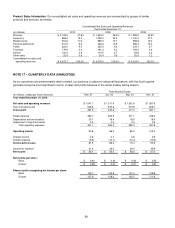

Deferred Stock Units: In 2004, the stockholders approved

the RadioShack 2004 Deferred Stock Unit Plan for Non-

Employee Directors (“Deferred Plan”). The Deferred Plan

replaced the one-time and annual stock option grants to non-

employee directors (“Directors”) as specified in the 1997,

1999 and 2001 ISPs. New Directors received a one-time

grant of 5,000 deferred stock units (“Units”) on the date

they attended their first Board meeting. The Deferred Plan

also specified that each Director who had served one year

or more as of June 1 of any year would automatically be

granted 3,500 Units on the first business day of June of

each year in which he or she served as a Director.

In February 2007, the Board of Directors amended the

Deferred Plan to provide that, in lieu of the original amounts

described above, each non-employee director now receives

a one-time initial grant of units equal to the number of

shares of our common stock that represent a fair market

value of $150,000 on the grant date, and an annual grant of

units equal to the number of shares of our common stock

that represent a fair market value of $105,000 on the

annual grant date.

Under the Deferred Plan, one-third of the Units vest annually

over three years from the date of grant. Vesting of

outstanding awards is accelerated under certain

circumstances. At termination of service, death, disability or

change in control of RadioShack, Directors will receive

shares of common stock equal to the number of vested

Units. Directors may receive these shares in a lump sum or

they may defer receipt of these shares in equal installments

over a period of up to ten years. We granted approximately

29,000, 45,000, and 59,000 Units in 2010, 2009 and 2008,

respectively. The weighted-average grant-date fair value

per Unit granted was $21.75, $13.97 and $14.24 in 2010,

2009 and 2008, respectively. There were approximately

211,000 Units outstanding and 705,000 Units available for

grant at December 31, 2010.