Quest Diagnostics 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

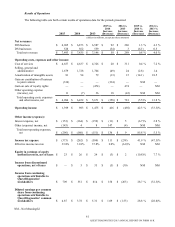

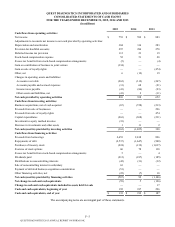

Cash Flows from Financing Activities

Net cash (used in) provided by financing activities for the year ended December 31, 2015 was $(507) million,

compared to $92 million for the year ended December 31, 2014. This $599 million increase in cash used in financing activities

was primarily a result of a $455 million decrease in net borrowings (proceeds from borrowings less repayments of debt), a $92

million increase in repurchases of our common stock (discussed in "Share Repurchases"), a $25 million increase in dividends

paid as a result of higher dividend rates in 2015 (discussed in "Dividends") and an $18 million decrease in proceeds from the

exercise of stock options. Net cash used in financing activities for the year ended December 31, 2015, also includes $51

million of deferred acquisition consideration payments, primarily to UMass Memorial Medical Center ("UMass") related to the

business acquisition in 2013, and $63 million of proceeds from the sale of a noncontrolling interest in a subsidiary to UMass.

Net cash provided by (used in) financing activities for the year ended December 31, 2014 was $92 million, compared

to $(1.1) billion for the year ended December 31, 2013. The $1.2 billion increase in cash provided by financing activities was

primarily a result of a $375 million net increase in debt, primarily a result of borrowings of $598 million from our Senior Notes

Offering in March 2014, partially offset by the $200 million repayment of our floating rate senior notes due March 2014, and a

$904 million decrease in repurchases of our common stock (discussed in "Share Repurchases"). These increases in cash

provided by financing activities were partially offset by a $60 million decrease in proceeds from the exercise of stock options.

In 2015, we borrowed $1.3 billion under our secured receivables credit facility, all of which was repaid in 2015. In

2014, we borrowed $1.2 billion under our secured receivables credit facility and $200 million under our senior unsecured

revolving credit facility, all of which was repaid in 2014.

For details regarding our 2015 Senior Notes Offering, see "Recent Transactions: Senior Notes Offering" and Note 13

to the consolidated financial statements. For details regarding our 2014 Senior Notes Offering, see Note 13 to the consolidated

financial statements

Dividends

During each of the quarters of 2015, our Board of Directors declared a quarterly cash dividend of $0.38 per common

share. During each of the quarters of 2014, our Board of Directors declared a quarterly cash dividend of $0.33 per common

share. During each of the quarters in 2013, our Board of Directors declared a quarterly cash dividend of $0.30 per common

share. We expect to fund future dividend payments with cash flows from operations, and do not expect the dividend to have a

material impact on our ability to finance future growth.

On January 28, 2016, we announced that our Board of Directors authorized a 5% increase in our quarterly dividend

from $0.38 per share to $0.40 per share, or $1.60 annually, commencing with the dividend payable in April 2016.

Share Repurchases

In December 2015, our Board of Directors authorized us to repurchase an additional $500 million of our common

stock. In August 2013, our Board of Directors authorized us to repurchase an additional $1 billion of our common stock. At

December 31, 2015, $972 million remained available under the share repurchase authorization.

For the year ended December 31, 2015, we repurchased 3.2 million shares of our common stock for $224 million. For

the year ended December 31, 2014, we repurchased 2.2 million shares of our common stock for $132 million. For the year

ended December 31, 2013, we repurchased 17.4 million shares of our common stock for $1.0 billion, including 13.3 million

shares repurchased under accelerated share repurchase agreements for $800 million. For further details regarding our share

repurchases, see Note 15 to the consolidated financial statements.

QUEST DIAGNOSTICS 2015 ANNUAL REPORT ON FORM 10-K