Public Storage 1998 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 1998 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Public Storage, Inc. 1998 Annual Report

6

Dividend. The Board of Directors declared a $0.22 per common

share quarterly dividend on March 4, 1999, along with quarterly

dividends on the Company’s various series of preferred stock.

Distributions are payable on March 31, 1999 to shareholders of

record as of the close of business on March 15, 1999. Dividends

of $0.88 per share were paid on the common stock in 1998.

Minimizing distributions is one method available to us to

enhance common shareholder value. Retaining a substantial por-

tion of funds from operations (after funding distributions and

capital improvements) enables us to acquire and develop proper-

ties, invest in our other operations and reduce debt using internal

cash resources. This is an example of our Self-Storage Plus strategy

benefiting shareholders. We distributed 39 percent of funds from

operations available to common shareholders for 1998 and 44 per-

cent for 1997. Through this relatively moderate payout ratio in 1998,

we retained $128,000,000 of funds to purchase and develop prop-

erties and invest in our other operations.

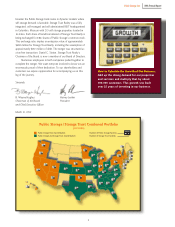

An efficient external growth strategy. Our development joint

venture minimizes earnings dilution and provides a portfolio of

properties we can purchase in the future. We formed the joint

venture partnership with a state pension fund to develop up to

$220,000,000 of self-storage facilities. The venture is funded solely

with equity capital provided 30 percent by the Company and

70 percent by the state pension fund. The Company has invested

approximately $42,500,000 in the joint venture at December 31,1998.

During the year ended December 31,1998, the joint venture

partnership opened 17 new self-storage facilities that it had devel-

oped. As of December 31, 1998, the joint venture partnership

was committed to developing six additional facilities that were

in process, with total costs incurred of about $28,600,000 and

estimated remaining costs to complete of about $3,900,000.

The joint venture partnership is reviewing the final 20 projects

and upon approval the joint venture will be fully committed. These

properties are currently being developed by the Company until they

are approved by the joint venture partnership. As of December 31,

1998, the Company has incurred total development costs of

approximately $44,800,000 (estimated remaining costs to complete

of approximately $49,700,000) with respect to these 20 projects.

The Company has identified 34 additional self-storage

development projects with total estimated development costs

of approximately $143,200,000. These projects are subject to

significant contingencies.

The 10 facilities which have been opened by the joint

venture partnership or the Company between January 1, 1996

and July 1, 1997 have occupancies averaging 81.9 percent at

December 31, 1998. The 19 facilities which opened between July 1,

1997 and December 1,1998 have been open an average of 7 months

and have occupancies averaging 49.4 percent at December 31,1998.

Improving market value of outstanding shares. Last year, the

Company’s Board of Directors authorized the repurchase from

time to time of up to 10,000,000 shares of the Company’s common

stock on the open market or in privately negotiated transactions.

Through December 31, 1998 the Company has repurchased a total

of 2,819,400 shares of common stock at an aggregate cost of

approximately $72,300,000.

Analyzing Financial Performance

Revenues for 1998 increased to $582,151,000 compared to

$470,844,000 in 1997, an increase of $111,307,000 or 24 percent.

Net income for 1998 was $227,019,000 compared to $178,649,000

in 1997, an increase of $48,370,000 or 27 percent. The increase in

net income for 1998 compared to 1997 was primarily the result of

improved property operations and the acquisition of additional real

estate facilities and partnership interests during 1997 and 1998.

Net income allocable to common shareholders was

$148,644,000 or $1.30 per common share on a diluted basis (based

upon 114,357,000 weighted average diluted shares) for the year

ended December 31, 1998 compared to $90,256,000 or $0.91 per

common share on a diluted basis (based upon 98,961,000 weighted

average diluted shares) for the same period in 1997. In computing net

income per common share, dividends to the Company’s preferred

shareholders ($78,375,000 and $88,393,000 for the year ended

December 31, 1998 and 1997, respectively) have been deducted from

net income in determining net income allocable to the Company’s

common shareholders. Operating losses from the portable self-storage

business for the year ended December 31, 1998 were $31,022,000 or

approximately $0.27 per common share, compared to $31,665,000

or approximately $0.32 per common share for the same period in

1997. For the year ended December 31, 1997, net income allocable

to common shareholders was reduced by $13,412,000 or $0.14 per

common share as a result of a special one-time dividend paid to

the holder of the Series CC Convertible Preferred Stock.

Funds from operations per common share on a fully-diluted

basis for 1998 were $2.24, compared to $1.97 for 1997, increasing

$0.27 per common share. Funds from operations per common

share on a fully-diluted basis for 1998 were negatively affected by

the dilutive effects of start-up losses from Public Storage Pickup &

Delivery,SM (PSPUD). PSPUD incurred approximately $31,022,000

of operating losses for the year ended December 31, 1998, compared

to operating losses of approximately $31,665,000 for the previous

year. Operating losses for this business are declining, reflected by

results for the 1998 fourth quarter, $5,865,000 in losses versus

results for the 1997 fourth quarter, $10,480,000 in such losses. As

PSPUD has strengthened its infrastructure and efficiencies, operat-

ing effectiveness has risen; we believe operating losses from PSPUD

will continue to decrease.

Same stores benefit from a winning strategy. Rental income

and net operating income are two of the notable measurements of

financial performance that responded to our Self-Storage Plus strategy.

For 1998, occupancy at the self-storage properties on a Same Store

basis averaged 92.5 percent, compared to 91.7 percent during 1997.

Same Store average annual realized rents were $9.84 per square

foot for 1998, a 6.8 percent increase compared to $9.21 per square

foot for 1997. Realized rent per square foot represents the actual

revenue earned per occupied square foot, a more relevant measure

than posted or scheduled rates, because posted rates can be dis-

counted through promotions. Same Store rental income increased

to $523,394,000 for 1998, compared to $486,510,000 for 1997, a

7.6 percent rise. Same Store cost of operations increased 6.5 percent,

to $183,629,000 for 1998, from $172,455,000 for 1997. Net operating

income equaled $339,765,000 for 1998, compared to $314,055,000

for 1997.