Progressive 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

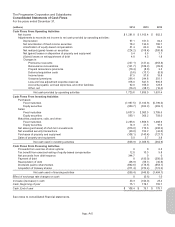

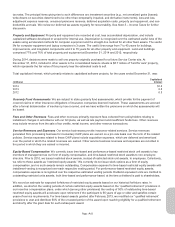

The following tables show the composition of gross unrealized losses by major security type and by the length of time that

individual securities have been in a continuous unrealized loss position:

Total

No. of

Total

Fair

Gross

Unrealized

Less than 12 Months 12 Months or Greater

No. of Fair Unrealized No. of Fair Unrealized

($ in millions) Sec. Value Losses Sec. Value Losses Sec. Value Losses

December 31, 2014

Fixed maturities:

U.S. government obligations 11 $ 428.2 $ (1.3) 5 $ 150.7 $ (0.3) 6 $ 277.5 $ (1.0)

State and local government

obligations 46 234.2 (1.1) 28 177.9 (0.4) 18 56.3 (0.7)

Corporate debt securities 53 843.2 (10.4) 43 647.5 (6.1) 10 195.7 (4.3)

Residential mortgage-backed

securities 70 844.2 (10.8) 33 465.2 (3.1) 37 379.0 (7.7)

Commercial mortgage-backed

securities 63 723.4 (2.6) 54 667.5 (1.4) 9 55.9 (1.2)

Other asset-backed securities 44 741.8 (0.8) 42 715.7 (0.7) 2 26.1 (0.1)

Redeemable preferred stocks 3 103.0 (5.7) 1 33.0 (1.0) 2 70.0 (4.7)

Total fixed maturities 290 3,918.0 (32.7) 206 2,857.5 (13.0) 84 1,060.5 (19.7)

Equity securities:

Nonredeemable preferred stocks 8 231.4 (6.4) 5 143.2 (3.6) 3 88.2 (2.8)

Common equities 20 68.4 (10.1) 19 61.8 (9.6) 1 6.6 (0.5)

Total equity securities 28 299.8 (16.5) 24 205.0 (13.2) 4 94.8 (3.3)

Total portfolio 318 $4,217.8 $(49.2) 230 $3,062.5 $(26.2) 88 $1,155.3 $(23.0)

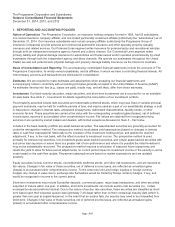

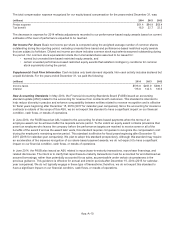

Total

No. of

Total

Fair

Gross

Unrealized

Less than 12 Months 12 Months or Greater

No. of Fair Unrealized No. of Fair Unrealized

($ in millions) Sec. Value Losses Sec. Value Losses Sec. Value Losses

December 31, 2013

Fixed maturities:

U.S. government obligations 29 $1,444.3 $ (16.6) 28 $1,434.6 $(16.3) 1 $ 9.7 $ (0.3)

State and local government

obligations 141 844.2 (18.4) 119 759.3 (17.1) 22 84.9 (1.3)

Corporate debt securities 51 997.6 (20.4) 45 831.1 (17.8) 6 166.5 (2.6)

Residential mortgage-backed

securities 66 763.5 (14.1) 45 597.6 (7.9) 21 165.9 (6.2)

Commercial mortgage-backed

securities 76 1,061.9 (37.8) 60 809.2 (19.7) 16 252.7 (18.1)

Other asset-backed securities 25 287.2 (2.1) 22 233.3 (1.8) 3 53.9 (0.3)

Redeemable preferred stocks 4 122.7 (9.7) 0 0 0 4 122.7 (9.7)

Total fixed maturities 392 5,521.4 (119.1) 319 4,665.1 (80.6) 73 856.3 (38.5)

Equity securities:

Nonredeemable preferred stocks 7 142.3 (4.5) 7 142.3 (4.5) 0 0 0

Common equities 24 59.7 (2.4) 20 58.5 (2.4) 4 1.2 0

Total equity securities 31 202.0 (6.9) 27 200.8 (6.9) 4 1.2 0

Total portfolio 423 $5,723.4 $(126.0) 346 $4,865.9 $(87.5) 77 $857.5 $(38.5)

App.-A-14