Pottery Barn 2008 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2008 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

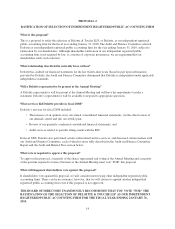

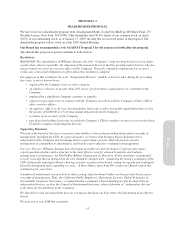

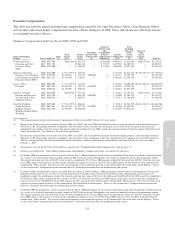

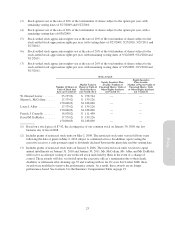

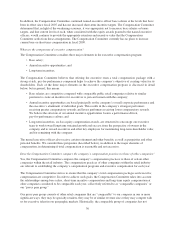

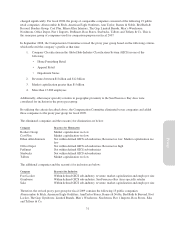

Grants of Plan-Based Awards

This table sets forth certain information regarding all grants of plan-based awards made to the named executive

officers during fiscal 2008.

Grant

Date

Estimated Future

Payouts Under

Non-Equity Incentive

Plan Awards

Estimated Future

Payouts Under

Equity Incentive

Plan Awards

All

Other

Stock

Awards;

Number

of Shares

of Stock

or Units

(#)(3)

All Other

Option

Awards;

Number of

Securities

Underlying

Options

(#)(4)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Grant Date

Fair Value

of Stock

and Option

Awards ($)

Threshold

($)

Target

($)(1)

Maximum

($)(2)

Threshold

($)

Target

($)

Maximum

($)

W. Howard Lester .... — — $975,000 $2,925,000 — — — — — — —

05/02/2008 — — — — — — 35,195 — — $ 332,241(5)

11/07/2008 — — — — — — 425,000 $8.56 $1,335,478

Sharon L. McCollam . . — — $362,500 $2,175,000 — — — — — — —

05/02/2008 — — — — — — 17,579 — — $ 165,946(5)

11/07/2008 — — — — — — — 275,000 $8.56 $ 864,133

Laura J. Alber ....... — — $400,000 $2,400,000 — — — — — — —

05/02/2008 — — — — — — 17,579 — — $ 165,946(5)

11/07/2008 — — — — — — — 230,000 $8.56 $ 722,729

Patrick J. Connolly . . . — — $285,000 $1,710,000 — — — — — — —

05/02/2008 — — — — — — 14,078 — — $ 132,896(5)

11/07/2008 — — — — — — — 160,000 $8.56 $ 502,768

David M. DeMattei . . . — — $337,500 $2,025,000 — — — — — — —

05/02/2008 — — — — — — 17,579 — — $ 165,946(5)

11/07/2008 — — — — — — — 300,000 $8.56 $ 942,690

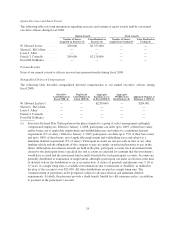

(1) Target potential payment for each executive pursuant to our established incentive targets. To ensure deductibility under our

shareholder-approved 2001 Incentive Bonus Plan (intended to qualify as performance-based compensation under Internal Revenue

Code Section 162(m)), the Compensation Committee specifies a performance objective in the first quarter of each fiscal year. The

Committee set an earnings per share target of $1.25 as the performance objective for fiscal 2008. On March 18, 2009, the Committee

certified that the performance objective was not achieved for fiscal 2008.

(2) Maximum potential payment pursuant to our 2001 Incentive Bonus Plan is equal to three times the executive’s base salary as of

February 2, 2009, the first day of fiscal 2009. To ensure deductibility under our shareholder-approved 2001 Incentive Bonus Plan

(intended to qualify as performance-based compensation under Internal Revenue Code Section 162(m)), the Compensation Committee

specifies a performance objective in the first quarter of each fiscal year. The Committee set an earnings per share target of $1.25 as the

performance objective for fiscal 2008. On March 18, 2009, the Committee certified that the performance objective was not achieved

for fiscal 2008.

(3) Grants of restricted stock units.

(4) Grants of stock-settled stock appreciation rights.

(5) The awards made on May 2, 2008 were modified on October 28, 2008 to remove a performance-based vesting criterion. The grant date

fair value reflects the modification date fair market value of $9.44. Generally, the full grant date fair value is the amount that the

company would expect to expense on the grant date in its financial statements over the award’s vesting schedule, disregarding

forfeiture assumptions. The fair market value assumptions used in the calculation of these amounts are included in Note I to our

Consolidated Financial Statements which is included in our Annual Report on Form 10-K for the fiscal year ended February 1, 2009.

Please see the section titled “Compensation Discussion and Analysis” for further discussion about the modification of these awards.

21

Proxy