Pottery Barn 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

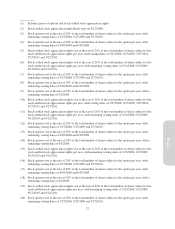

incur would result from fluctuations in our stock price during the period the exchange program is open (that is,

during the period between the time the exchange ratios are set, shortly before the exchange program begins, and

when the exchange actually occurs), which we expect to be immaterial. As a result, the exchange program will

allow the company to realize real incentive and retention benefits from the restricted stock units issued, while

recognizing essentially the same amount of compensation expense as we would have recognized for the eligible

awards.

Which equity awards will be eligible for the exchange program?

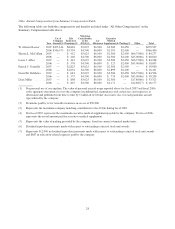

Eligible awards will include outstanding options and SSARs granted at least 20 months prior to the anticipated

end of the exchange program with an exercise price per share above the 52-week high for our common stock.

The 52-week high will be measured as of the start date of the exchange program. As of March 31, 2008, options

and SSARs for approximately 9,582,644 shares of our common stock were outstanding under all of our equity

incentive plans. Because the eligibility of options and SSARs will be determined based on the 52-week high of

our common stock measured as of the start date of the exchange program, we are unable to determine as of the

date of the Annual Meeting the exact number of eligible awards. For example, if we were to start the exchange

program on December 10, 2008, then the per-share 52-week high price of our common stock would be $30.51,

and based on the number of options and SSARs currently held by eligible employees, approximately 3,526,005

shares would be eligible for the exchange. In addition, because the exchange ratios will not be calculated until

shortly before the start of the exchange program, we are unable to determine as of the date of the Annual Meeting

the number of restricted stock units which may be granted in connection with the exchange program.

What are the employee eligibility requirements for the exchange program?

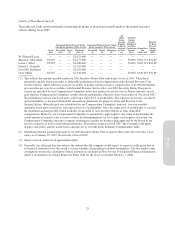

As noted above, only employees based in the United States (who are not members of our Board of Directors or

our named executive officers) as of the start of the exchange program may participate in the exchange program.

In addition to being employed as of the start of the exchange program, an employee must continue to be

employed by us through the date the restricted stock units are granted in exchange for the surrendered eligible

awards. Any employee holding eligible awards who elects to participate in the exchange program but whose

employment terminates for any reason prior to the grant of the restricted stock units, including voluntary

resignation, retirement, involuntary termination, layoff, death or disability, will retain his or her eligible awards

subject to their existing terms.

How many restricted stock units will an individual receive if he or she participates in the exchange

program?

The exchange ratios of shares associated with surrendered eligible awards to issued restricted stock units will be

established shortly before the start of the exchange program. The exchange ratios will be established by grouping

together eligible awards with similar exercise prices and assigning an appropriate exchange ratio to each

grouping.

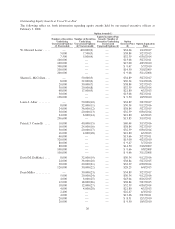

These exchange ratios will be based on the fair value of the eligible awards (calculated using the Black-Scholes

model) within the relevant grouping. The calculation of fair value using the Black-Scholes model takes into

account many variables, such as the volatility of our stock and the expected term of an award. As a result, the

exchange ratios do not necessarily increase as the exercise price of the award increases. Setting the exchange

ratios in this manner is intended to result in the issuance of restricted stock units that have a fair value

approximately equal to or less than the fair value of the surrendered eligible awards they replace. This will

eliminate any additional compensation cost that we must recognize on the restricted stock units, other than

immaterial compensation expense that might result from fluctuations in our stock price after the exchange ratios

have been set but before the exchange actually occurs. For instance, eligible awards with exercise prices from

$35.59-$38.83 per share might have an exchange ratio of 4.8 shares of the eligible award for each 1 restricted

stock unit to be received in exchange, while eligible awards with exercise prices from $34.89-$35.58 per share

might have an exchange ratio of 4.3 shares of the eligible award for each 1 restricted stock unit to be received in

exchange.

17

Proxy