Popeye's 2004 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2004 Popeye's annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

In AFC’s case, our portfolio reduction provides us with three distinct advantages. First,

it allows us to focus on the brand that we believe has the superior growth potential, is

overwhelmingly franchised, requires lower capital expenditure, has the capacity to promote

a more diverse and contemporary menu, and provides the greatest point of differentiation

in a highly competitive arena.

Second, by consolidating our operations to Popeyes’

corporate offices, we eliminate a shared service center

that has ceased adding financial leverage. This initiative

also saves considerable expense.

And third, the transactions have allowed us to monetize

certain assets of slower growing and less profitable

businesses in a positive financial market. This has

generated cash that should provide for enhanced

shareholder value. Frankly, we feel very positive about

our strategic direction and the execution of our plan.

We believe our current structure will prove to be a better

vehicle for growth and value creation in the future.

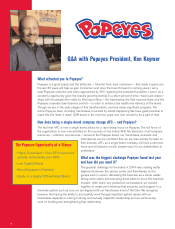

AFC is now Popeyes Chicken & Biscuits. We have hired

Ken Keymer, the former president of Sonic Corporation, to

lead this great brand. Additionally, we have put a number

of people back in the field, decentralized our field operations, reenergized Popeyes’ marketing,

built a new management team, and strengthened the relationship between the corporate

service center and the franchisees. The result is that we have a franchise community today

that is enthusiastic and highly supportive.

It is no coincidence that Popeyes

saw an improvement in perform-

ance during the last two quarters

of the year. In the fourth quarter

of 2004, Popeyes’ domestic

same-store sales growth was 3.2

percent compared to a decrease

of 1.2 percent for the fourth

quarter of 2003. That was the

most improved year-over-year quarterly performance for Popeyes since the first quarter of

2002. Popeyes reported full-year domestic same-store sales growth of 1.3 percent for 2004,

slightly higher than what we had previously projected.

It is an exciting and invigorating time for Popeyes. There is a lot of new product activity, a lot of

new design activity, a lot of new re-imaging activity, and a lot of focused development activity.

For 2005, Popeyes expects domestic same-store sales growth of 2.0 to 3.0 percent driven by

continued operational improvements and increased food-focused advertising, as well as addi-

tional menu and promotional products focused on further driving lunch and snack day-parts.

The company expects the Popeyes system to open 120 to 130 restaurants in 2005, with a

“We evaluated and assessed

everything about AFC. Our

people. Our systems. Our

brands. Our portfolio.Then we

created and invented and

improved and fixed. The result

will be an AFC Enterprises that

is as strong and valuable as we

can make it.”

—Frank J. Belatti, AFC 2003 Annual Report

“We are setting objectives for

ourselves that are well in excess of

what many people may expect of us.”

—Frank J. Belatti, AFC 2003 Annual Report