Paychex 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Paychex annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

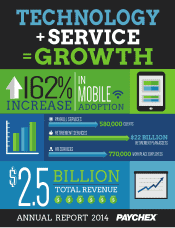

BILLION

2.5

TOTAL REVENUE

ANNUAL REPORT 2014

Table of contents

-

Page 1

2.5 BILLION TOTAL REVENUE ANNUAL REPORT 2014 -

Page 2

... for small- to medium-sized businesses. The company offers comprehensive payroll services, including payroll processing, payroll tax administration, and employee pay services, including direct deposit, check signing, and Readychex. Human resource services include 401(k) plan recordkeeping, section... -

Page 3

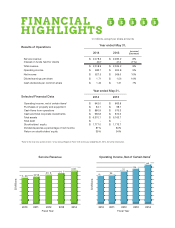

... section of Item 7 of our Annual Report on Form 10-K for the year ended May 31, 2014, for further information. Service Revenue Operating Income, Net of Certain Items1 ;64 4.69: :86 :32 8:; 95: 3.; 68 4.258 4.3: 8 4.4: 7 $ Millions $ Millions 2010 2010 2011 2012 Fiscal Year 2013 2014... -

Page 4

... has garnered national attention for Paychex. Our 12,700 employees across more than 100 Paychex locations were key to our success this year. Their work developing, selling, and servicing our products and services produced the strongest growth in sales, client base, revenue, and profitability since... -

Page 5

.... We moved $600 billion for our clients and their employees. That makes Paychex the ninth-largest mover of funds based on transaction volume. Our leadership in the retirement services industry continues. For the fourth straight year, a leading retirement industry publication ranked Paychex Topping... -

Page 6

... one pop-up screen, and our industry-leading Paychex Report Center, which allows our clients easy access to their information and the ability to customize their reports. We are leveraging the latest technologies, our online HR administration, and time and attendance products, and integrating them... -

Page 7

... partners. product purchasing decisions or put off making changes We also expanded our virtual sales team that directly sells products such as payroll, time and attendance, and insurance in certain markets. A new product that this team is also selling across the U.S. is Paychex Payment Processing... -

Page 8

.... The leadership of our Paychex Insurance Agency is recognized nationally. Ranked as the 25th largest broker in the United States by Business Insurance magazine, it now has nearly 110,000 clients across the country. also executed a stock repurchase program and acquired nearly $250 million worth... -

Page 9

2014 -

Page 10

-

Page 11

-

Page 12

... W-2s distributed to client employees 11.6 More than an 80 % increase in R&D spending over last six years in active users of Paychex Mobile App CLOUD ACCOUNTING Paychex Accounting Online expanded our industry-leading suite of online services for small businesses with a simple, secure, cloud... -

Page 13

...000 HR Services Worksite Employees 82% Payroll Base Retention client satisfaction all-time high TOP 25 Insurance Agency Over $1 billion in annual premiums HEALTH CARE REFORM SERVICES The Paychex Employer Shared Responsibility Service makes it easy for business owners to determine if ESR applies... -

Page 14

... in 2004. BRAZIL 6,500 65,000 RETIREMENT SERVICE PLANS That's 1 out of every 10 U.S. plans, serving about 700,000 participants Number of regulatory changes affecting small-business owners in ï¬scal 2014 servicing nearly 22 in retirement plan assets 401(k) ADVISOR TOOL Paychex now offers Mid... -

Page 15

... 000 checks issued to client employees , , 600 BILLION moved on behalf of clients Measured by 209 million ACH transactions, Paychex ranks as the 9th largest mover of funds in the U.S. All numbers are for the ï¬scal year ended May 31, 2014. PAYCHEX BENEFIT ACCOUNTS Paychex Beneï¬t Accounts allow... -

Page 16

... Admired Companies by Fortune magazine, which ranked companies in 57 industries. Paychex was among the top companies in the category of ï¬nancial data services. TOP INSURANCE BROKER Paychex Insurance Agency, Inc. ranked number 25 on Business Insurance magazine's 2013 list of the Top 100 Brokers of... -

Page 17

..., D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended May 31, 2014 Commission file number 0-11330 Paychex, Inc. 911 Panorama Trail South Rochester, New York 14625-2396 (585) 385-6666 A Delaware Corporation IRS Employer... -

Page 18

PAYCHEX, INC. INDEX TO FORM 10-K For the fiscal year ended May 31, 2014 Description Page PART I Cautionary Note Regarding Forward-Looking Statements Pursuant to the United States Private Securities Litigation Reform Act of 1995 ...Item 1 Business ...Item 1A Risk Factors ...Item 1B Unresolved Staff ... -

Page 19

... of payroll taxes, professional employer organizations, and employee benefits, including retirement plans, workers' compensation, health insurance (including health care reform legislation), state unemployment, and section 125 plans; • changes in health insurance and workers' compensation rates... -

Page 20

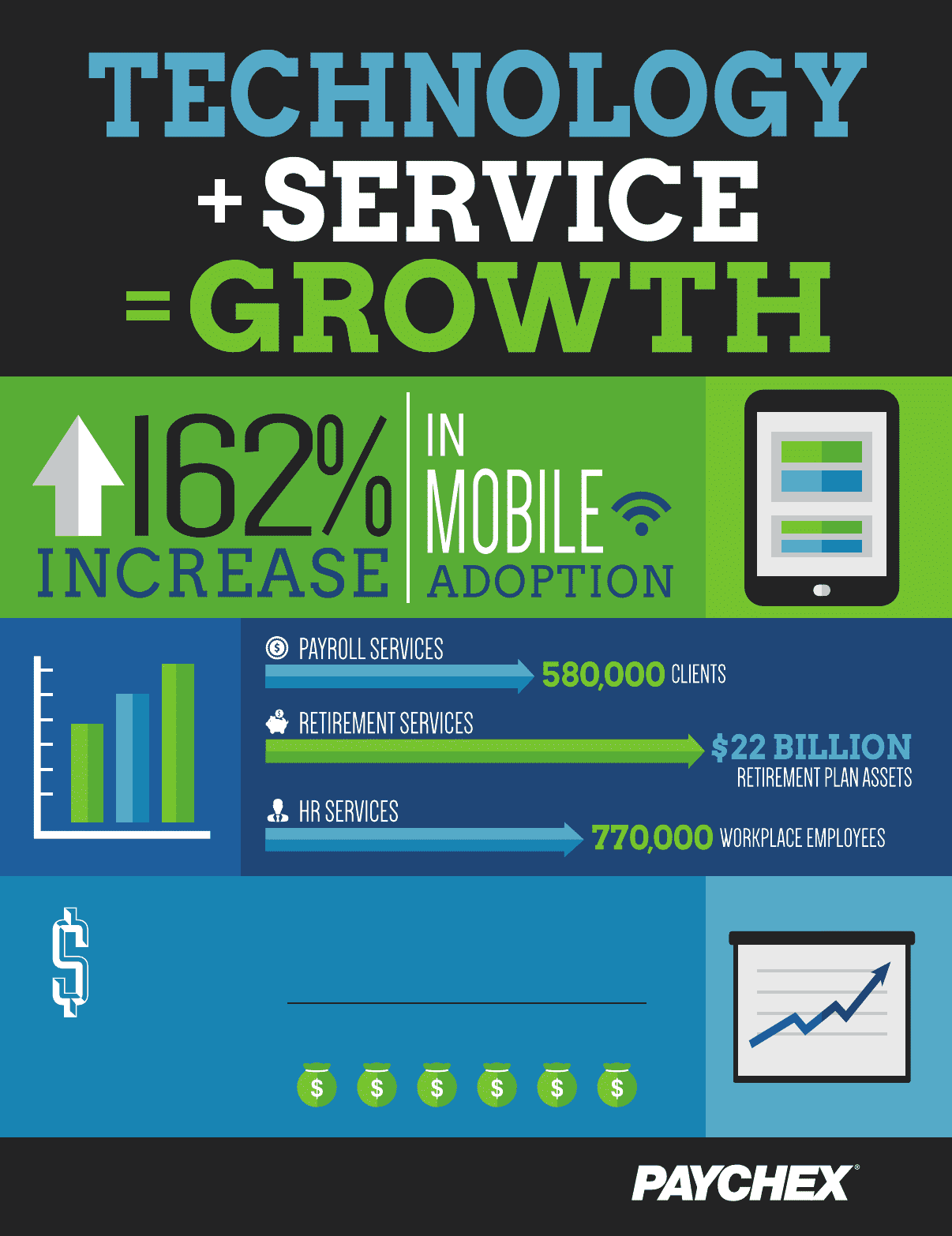

... payroll, human resource, insurance, and benefits outsourcing solutions for small- to medium-sized businesses. As of May 31, 2014, we serviced approximately 580,000 payroll clients. We maintain our corporate headquarters in Rochester, New York, and have more than 100 offices. Our company was formed... -

Page 21

...®, Internet Time Sheet, Paychex Online Reports, and General Ledger Reporting Service. Using these services, clients can communicate payroll information, access current and historical payroll information, and transfer payroll information calculated by us to their general ledger accounting software... -

Page 22

...the option of paying their employees by direct deposit, payroll debit card, a check drawn on a Paychex account (Readychex®), or a check drawn on the employer's account and electronically signed by us. For the first three methods, we electronically collect net payroll from the clients' bank accounts... -

Page 23

... our new ESR Complete Analysis and Monitoring Service for those clients that want a more robust solution. The Paychex Benefit Account product allows employers to offer Flexible Savings Accounts, Health Savings Accounts, and Health Reimbursement Accounts on a single platform with one debit card for... -

Page 24

...required regulatory forms. These products are designed to simplify clients' office processes and enhance their employee benefits programs. Accounting and Finance Services We offer various accounting and finance services to small- to medium-sized businesses. Paychex Accounting Online is a cloud-based... -

Page 25

...that impact the small business community and provide a monthly regulatory update. Our newly redesigned Paychex Accountant Knowledge Center is a free online resource available through our website that brings valuable information and time-saving online tools to accounting professionals. The BuildMyBiz... -

Page 26

....paychex.com. Our Form 10-Ks, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other SEC filings, as well as any amendments to such reports and filings, are made available, free of charge, on our website. You can access them under the Corporate tab on the Investor Relations section... -

Page 27

... could compromise Company and personal customer information: We rely upon information technology networks and systems to process, transmit, and store electronic information, and to support a variety of business processes. If we experience a problem with the functioning of key systems or a security... -

Page 28

... the accurate and timely provision of services to our clients. This information includes bank account numbers, credit card numbers, tax return information, social security numbers, health care information, retirement account information, payroll information, and Paychex system passwords. In addition... -

Page 29

... of Rochester, New York are at various locations throughout the U.S. and Germany and house our regional, branch, and sales offices and data processing centers. These locations are concentrated in metropolitan areas. We believe that adequate, suitable lease space will continue to be available to meet... -

Page 30

...the Paychex, Inc. Employee Stock Ownership Plan. The high and low sale prices for our common stock as reported on the NASDAQ Global Select Market and dividends for fiscal 2014 and fiscal 2013 are as follows: Fiscal 2014 Sales prices High Low Cash dividends declared per share Fiscal 2013 Sales prices... -

Page 31

... information relating to our repurchase of common stock during the three months ended May 31, 2014: Total number of shares purchased Average price paid per share Approximate dollar value of shares that may yet be purchased under the program Period March 1, 2014 - March 31, 2014 ...April 1, 2014... -

Page 32

.... (direct competitor) Fiserv, Inc. The Western Union Company Total Systems Services, Inc. Global Payments Inc. The Brink's Company DST System, Inc. The Dun & Bradstreet Corporation Item 6. Selected Financial Data In millions, except per share amounts Year ended May 31, 2014(1) 2013(2) 2012 2011 2010... -

Page 33

... Paychex HR Essentials, an ASO product that provides support to our clients over the phone or online to help manage employee-related topics; • retirement services administration; • insurance services; • online HR administration services, including time and attendance and benefit enrollment... -

Page 34

... funds held for clients is an adjustment to operating income due to the volatility of interest rates, which are not within the control of management. Operating income, net of certain items, is not calculated through the application of GAAP and is not the required form of disclosure by the Securities... -

Page 35

... demonstrate the growth in selected HRS ancillary service offerings: Balance at May 31, 2014 Growth rates for fiscal year 2014 2013 2012 Paychex HR Services client employees served ...Paychex HR Services clients ...Health and benefits services applicants ...Retirement services plans ... 766,000 28... -

Page 36

...and information to clients, small businesses, and other interested parties. We provide free webinars, white papers, and other information on our website to aid existing and prospective clients with the impact of regulatory changes. The Paychex Insurance Agency, Inc. website, www.paychexinsurance.com... -

Page 37

...a new health insurance offering within the PEO during fiscal 2014, we began classifying PEO direct costs related to certain benefit plans where we retain risk as operating expenses rather than as a reduction in service revenue. This had no impact on operating income. The amounts reported for service... -

Page 38

...measure used by other companies. Had the direct costs of certain benefit plans been reported as a reduction in service revenue, the following would have been reflected for fiscal 2014: For the twelve months ended May 31, 2014 PEO direct As cost HRS net reported adjustment revenue % Change HRS As net... -

Page 39

... As of May 31, 2014 Change 2013 Change 2012 Paychex HR Services client employees served ...766,000 Paychex HR Services clients ...28,000 Health and benefits services applicants ...134,000 Retirement services plans ...65,000 Asset value of retirement services participants' funds ...$ 21.9 14% 13... -

Page 40

... in higher employee social security withholdings. In addition, the average investment balances for both fiscal 2014 and fiscal 2013 benefited from increases in checks per payroll and client base, and wage inflation. Refer to the "Market Risk Factors" section, contained in Item 7A of this Form 10... -

Page 41

... Lenders may require that collateral be transferred from the pooled account into segregated accounts for the benefit of such individual Lenders. The primary uses of the lines of credit would be to meet short-term funding requirements related to deposit account overdrafts and client fund obligations... -

Page 42

... advisory services, for which they have received, and will continue to receive in the future, customary fees and expenses. Letters of credit: As of May 31, 2014, we had irrevocable standby letters of credit outstanding totaling $43.0 million, required to secure commitments for certain insurance... -

Page 43

... of premiums on available-for-sale securities as the Company has increased its holdings of longer-duration investments. The fluctuations in our operating assets and liabilities between periods were primarily related to the timing of collections from clients and payments for compensation, PEO payroll... -

Page 44

... primarily relate to timing of purchases, sales, or maturities of investments. The amount of funds held for clients will vary based upon the timing of collection of client funds, and the related remittance of funds to applicable tax or regulatory agencies for payroll tax administration services and... -

Page 45

... Net change in client fund obligations: The client fund obligations liability will vary based on the timing of collecting client funds, and the related required remittance of funds to applicable tax or regulatory agencies for payroll tax administration services and to employees of clients utilizing... -

Page 46

... benefit premiums. In fiscal 2014, with the addition of a new health care offering within the PEO, direct costs related to certain benefit plans where the Company retains risk were classified as operating expenses rather than as a reduction in service revenue. Interest on funds held for clients... -

Page 47

...and, as a result, goodwill is associated with one reporting unit. We perform our annual impairment testing in our fiscal fourth quarter. Based on the results of our reviews, no impairment loss was recognized in the results of operations for fiscal years 2014, 2013, or 2012. Subsequent to this review... -

Page 48

... is less sensitive to interest rate changes. We manage the available-for-sale securities to a benchmark duration of two and one-half to three and three-quarters years. During fiscal 2014, our primary short-term investment vehicles were VRDNs and bank demand deposit accounts. We have no exposure to... -

Page 49

...% invested in available-for-sale securities with an average duration of two and one-half to three and three-quarters years. The combined funds held for clients and corporate available-for-sale securities reflected a net unrealized gain of $34.5 million as of May 31, 2014, compared with an unrealized... -

Page 50

... of May 31, 2014 and 2013 held an AA rating or better. We do not currently intend to sell these investments until the recovery of their amortized cost basis or maturity, and further believe that it is not morelikely-than-not that we will be required to sell these investments prior to that time. Our... -

Page 51

... Control Over Financial Reporting ...Reports of Independent Registered Public Accounting Firms ...Consolidated Statements of Income and Comprehensive Income for the Years Ended May 31, 2014, 2013, and 2012 ...Consolidated Balance Sheets as of May 31, 2014 and 2013 ...Consolidated Statements of... -

Page 52

... 31, 2014, and as a part of their integrated audit, has issued their report, included herein, on the effectiveness of the Company's internal control over financial reporting. /s/ Martin Mucci Martin Mucci President and Chief Executive Officer /s/ Efrain Rivera Efrain Rivera Senior Vice President... -

Page 53

... the financial statement schedule, and on the Company's internal control over financial reporting based on our integrated audit. We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform... -

Page 54

... and schedules based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of... -

Page 55

PAYCHEX, INC. CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME In millions, except per share amounts Year ended May 31, 2014 2013 2012 Revenue: Service revenue ...Interest on funds held for clients ...Total revenue ...Expenses: Operating expenses ...Selling, general and administrative ... -

Page 56

PAYCHEX, INC. CONSOLIDATED BALANCE SHEETS In millions, except per share amount As of May 31, 2014 2013 Assets Cash and cash equivalents ...Corporate investments ...Interest receivable ...Accounts receivable, net of allowance for doubtful accounts ...Deferred income taxes ...Prepaid income taxes ...... -

Page 57

... ...Stock-based award transactions ...2.8 Balance as of May 31, 2013 ...365.4 Net income ...Unrealized losses on securities, net of tax ...Cash dividends declared ...Repurchases of common shares ...(6.2) Stock-based compensation ...Stock-based award transactions ...3.8 Balance as of May 31, 2014... -

Page 58

...Amortization of premiums and discounts on available-for-sale securities ...Stock-based compensation costs ...(Benefit)/provision for deferred income taxes ...Provision for allowance for doubtful accounts ...Net realized gains on sales of available-for-sale securities ...Changes in operating assets... -

Page 59

... certain health insurance products. PEO services are sold through the Company's registered and licensed subsidiary, Paychex Business Solutions, Inc. Paychex HR Essentials is an ASO product that provides support to the Company's clients over the phone or online to help manage employee-related topics... -

Page 60

... accounts when the Company has exhausted all collection efforts without success. No single client had a material impact on total accounts receivable, service revenue, or results of operations. Funds held for clients and corporate investments: Marketable securities included in funds held for clients... -

Page 61

... on funds held for clients also includes net realized gains and losses from the sales of available-for-sale securities. PEO insurance services: As part of the PEO service, the Company offers workers' compensation insurance and health insurance to client companies for the benefit of client employees... -

Page 62

...: All stock-based awards to employees are recognized as compensation costs in the consolidated financial statements based on their fair values measured as of the date of grant. The Company estimates the fair value of stock option grants using a Black-Scholes option pricing model. This model requires... -

Page 63

... are expected to reverse. The Company records a deferred tax asset related to the stock-based compensation costs recognized for certain stock-based awards. At the time of the exercise of non-qualified stock options or vesting of stock awards, the Company accounts for the resulting tax deduction by... -

Page 64

.... 2014-12, "Compensation - Stock Compensation (Topic 718): Accounting for Share-Based Payments When the Terms of an Award Provide That a Performance Target Could Be Achieved after the Requisite Service Period (a consensus of the FASB Emerging Issues Task Force)." This guidance requires a performance... -

Page 65

... of the Company's common stock. As of May 31, 2014, there were 20.2 million shares available for future grants under the 2002 Plan. All stock-based awards to employees are recognized as compensation costs in the consolidated financial statements based on their fair values measured as of the date of... -

Page 66

... such a change. Stock options: Stock options entitle the holder to purchase, at the end of the vesting term, a specified number of shares of Paychex common stock at an exercise price per share set equal to the closing market price of the common stock on the date of grant. All stock options have... -

Page 67

... ended May 31, 2014 2013 2012 Total intrinsic value of stock options exercised ...Total grant-date fair value of stock options vested ... $18.9 $ 3.0 $7.8 $3.0 $ 0.8 $10.4 Performance stock options: In July 2011, the Board approved a special award of performance-based stock options under a Long... -

Page 68

... per share amounts 2014 Year ended May 31, 2013 2012 Weighted-average grant-date fair value of RSUs granted ...Total intrinsic value of RSUs vested ...Total grant-date fair value of RSUs vested ... $36.37 $ 18.3 $ 12.1 $28.59 $ 15.5 $ 13.4 $27.67 $ 11.0 $ 9.5 Restricted stock awards: The Board... -

Page 69

...occur directly through the Company's transfer agent and no brokerage fees are charged to employees, except for when stock is sold. The plan has been deemed non-compensatory and therefore, no stock-based compensation costs have been recognized for fiscal years 2014, 2013, or 2012 related to this plan... -

Page 70

... Funds held for clients and corporate investments are as follows: Amortized cost May 31, 2014 Gross Gross unrealized unrealized gains losses Fair value In millions Type of issue: Funds held for clients money market securities and other cash equivalents ...Available-for-sale securities: General... -

Page 71

...: May 31, In millions 2014 2013 Funds held for clients ...Corporate investments ...Long-term corporate investments ...Total funds held for clients and corporate investments ... $4,198.6 398.7 385.6 $4,982.9 $4,072.5 398.2 369.1 $4,839.8 The Company's available-for-sale securities reflected a net... -

Page 72

... 1 valuations are based on quoted prices in active markets for identical instruments that the Company can access at the measurement date. • Level 2 valuations are based on inputs other than quoted prices included in Level 1 that are observable for the instrument, either directly or indirectly, for... -

Page 73

... in funds held for clients and corporate investments consist primarily of securities classified as available-for-sale and are recorded at fair value on a recurring basis. The Company's financial assets and liabilities measured at fair value on a recurring basis were as follows: May 31, 2014 Quoted... -

Page 74

... under the Company's non-qualified and unfunded deferred compensation plans. The related liability is reported as other long-term liabilities. The mutual funds are valued based on quoted market prices in active markets. The preceding methods described may produce a fair value calculation that may... -

Page 75

... May 31, 2014 2013 Client lists ...Other intangible assets ...Total intangible assets, gross ...Less: Accumulated amortization ...Intangible assets, net of accumulated amortization ... $240.9 2.6 243.5 202.9 $ 40.6 $231.0 2.4 233.4 188.2 $ 45.2 During fiscal 2014, the Company acquired intangible... -

Page 76

... 31, 2014 2013 Deferred tax assets: Compensation and employee benefit liabilities ...Other current liabilities ...Tax credit carry forward ...Depreciation ...Stock-based compensation ...Other ...Gross deferred tax assets ...Deferred tax liabilities: Capitalized software ...Depreciation ...Goodwill... -

Page 77

... liabilities on the Consolidated Balance Sheets. A reconciliation of the beginning and ending amounts of the Company's gross unrecognized tax benefits, not including interest or other potential offsetting effects, is as follows: In millions Year ended May 31, 2014 2013 2012 Balance as of beginning... -

Page 78

... fiscal years 2014, 2013, and 2012, respectively. Note L - Employee Benefit Plans 401(k) plan: The Company maintains a contributory savings plan that qualifies under section 401(k) of the Internal Revenue Code. The Paychex, Inc. 401(k) Incentive Retirement Plan (the "Plan") allows all employees to... -

Page 79

...4% of eligible pay that an employee contributed to the Plan between January 2011 and February 2012. Company contributions to the Plan for fiscal years 2014, 2013, and 2012 were $16.4 million, $13.1 million, and $10.3 million, respectively. The Plan is 100% participant directed. Plan participants can... -

Page 80

... in the period in which any such effect is recorded. Lease commitments: The Company leases office space and data processing equipment under terms of various operating leases. Rent expense for fiscal years 2014, 2013, and 2012 was $39.1 million, $39.9 million, and $43.0 million, respectively. As... -

Page 81

... insurance company. Note N - Related Parties During fiscal years 2014, 2013, and 2012, the Company purchased approximately $4.7 million, $6.5 million, and $2.6 million, respectively, of data processing equipment and software from EMC Corporation. The Chairman, President, and Chief Executive Officer... -

Page 82

..., except per share amounts With the introduction of a new health insurance offering within the PEO during fiscal 2014, the Company began classifying PEO direct costs related to certain benefit plans where the Company retains risk as operating expenses rather than as a reduction in service revenue... -

Page 83

... amounts reported for service revenue and total revenue for the first through third quarters of fiscal 2014 differ from that reported in the Company's Quarterly Reports on Form 10-Q ("Form 10-Q"), as a result of the PEO direct cost adjustment. There was no impact to operating income from this change... -

Page 84

... reporting to determine whether any changes occurred during the quarter ended May 31, 2014. Based on such evaluation, there have been no changes in the Company's internal controls over financial reporting that occurred during the Company's most recently completed fiscal quarter ended May 31, 2014... -

Page 85

... roles. Mr. Gibson joined Paychex in May 2013 as Senior Vice President of Service. Prior to joining the Company, Mr. Gibson served as President and Chief Executive Officer for AlphaStaff, a national provider of human resource outsourcing services to small and medium-sized businesses. Prior to... -

Page 86

...the role of Vice President of Insurance Sales and Operations in 2010. Mr. Hill also serves as President of Paychex Insurance Agency, Inc., and has executive leadership responsibility for BeneTrac. In July 2011, he also took on leadership of the PEO and the HR Services operations organizations. Prior... -

Page 87

... with Related Persons" within the section "CORPORATE GOVERNANCE," and is incorporated herein by reference. Item 14. Principal Accounting Fees and Services The information required by this item is set forth in the Company's Definitive Proxy Statement for its 2014 Annual Meeting of Stockholders... -

Page 88

... Exhibit 10.22 to the Company's Form 10-K filed with the Commission on July 15, 2011. Paychex, Inc. 2002 Stock Incentive Plan (as amended and restated effective October 13, 2010) Form of Non-Qualified Stock Option Award Agreement (Officer) Long Term Incentive Program ("LTIP"), incorporated herein by... -

Page 89

... 2009. Paychex, Inc. Employee Deferred Compensation Plan, incorporated herein by reference from Exhibit 10.30 to the Company's Form 10-K filed with the Commission on July 20, 2009. Stock Purchase Plan Engagement Agreement between Paychex, Inc. and JP Morgan Securities LLC, dated as of March 26, 2013... -

Page 90

..., thereunto duly authorized, on July 22, 2014. PAYCHEX, INC. By: /s/ Martin Mucci Martin Mucci President and Chief Executive Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the... -

Page 91

{This page is intentionally blank} -

Page 92

PAYCHEX, INC. ELEVEN-YEAR SUMMARY OF SELECTED FINANCIAL DATA In millions, except per share amounts Year ended May 31, 2014 2013 2012 2011 2010 Results of operations Revenue: Service revenue ...Interest on funds held for clients ...Total revenue ...Total expenses ...Operating income ...Investment ... -

Page 93

2009 2008 2007 2006 2005 2004 $2,007.3 75.5 2,082.8 1,277.6 805.2 6.9 $ 812.1 $ 533.5 $ 1.48 $ 1.48 360.8 361.0 1.24 $1,934.5 131.8 2,066.3 1,238.0 828.3 26.5 $ 854.8 $ 576.1 $ 1.56 $ 1.56 368.4 ... -

Page 94

.... Transfer Agent and Registrar Please send inquiries, certificates for transfer, address changes, and dividend reinvestment and stock purchase requests to: American Stock Transfer & Trust Co. 6201 15th Avenue, 2nd Floor Brooklyn, NY 11219 1-800-937-5449 Direct Reinvestment and Stock Purchase Plan... -

Page 95

... Product Operations and Support • Robert Morin Vice President, Major Market Services Sales • Lonny C. Ostrander Vice President, Human Resource Services Sales • Neil F. Rohrer Vice President, Core Payroll Sales, Eastern U.S. • Stephanie L. Schaeffer Vice President, Chief Legal Officer... -

Page 96

...'s businesses. OUR VALUES We act with uncompromising integrity. We provide outstanding service and build trusted relationships with clients. We drive innovation in products and services and continually improve processes. We work in partnership and support each other. We are personally accountable... -

Page 97

paychex.com