PNC Bank 2011 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2011 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

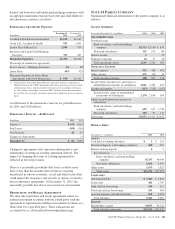

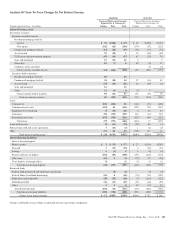

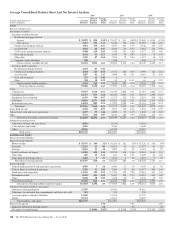

Nonaccrual loans are included in loans, net of unearned income. The impact of financial derivatives used in interest rate risk management is included in the interest

income/expense and average yields/rates of the related assets and liabilities. Basis adjustments related to hedged items are included in noninterest-earning assets and

noninterest-bearing liabilities. Average balances of securities are based on amortized historical cost (excluding adjustments to fair value, which are included in other

assets). Average balances for certain loans and borrowed funds accounted for at fair value, with changes in fair value recorded in trading noninterest income, are

included in noninterest-earning assets and noninterest-bearing liabilities. The interest-earning deposits with the Federal Reserve are included in the “Other” interest-

earning assets category.

Loan fees for the years ended December 31, 2011, 2010, and 2009 were $175 million, $154 million, and $162 million, respectively.

Interest income includes the effects of taxable-equivalent adjustments using a marginal federal income tax rate of 35% to increase tax-exempt interest income to a

taxable-equivalent basis. The taxable-equivalent adjustments to interest income for the years ended December 31, 2011, 2010, and 2009 were $104 million, $81

million, and $65 million, respectively.

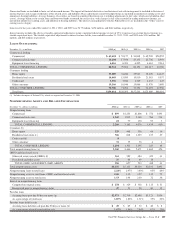

L

OANS

O

UTSTANDING

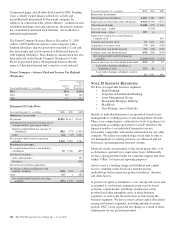

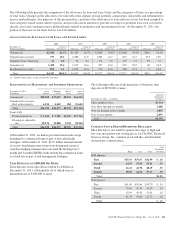

December 31 – in millions 2011 (a) 2010 (a) 2009 (a) 2008 (a) 2007

Commercial lending

Commercial $ 65,694 $ 55,177 $ 54,818 $ 69,220 $28,952

Commercial real estate 16,204 17,934 23,131 25,736 8,903

Equipment lease financing 6,416 6,393 6,202 6,461 2,514

TOTAL COMMERCIAL LENDING 88,314 79,504 84,151 101,417 40,369

Consumer lending

Home equity 33,089 34,226 35,947 38,276 14,447

Residential real estate 14,469 15,999 19,810 21,583 9,557

Credit card 3,976 3,920 2,569 2,237 247

Other consumer 19,166 16,946 15,066 11,976 3,699

TOTAL CONSUMER LENDING 70,700 71,091 73,392 74,072 27,950

Total loans $159,014 $150,595 $157,543 $175,489 $68,319

(a) Includes the impact of National City, which we acquired on December 31, 2008.

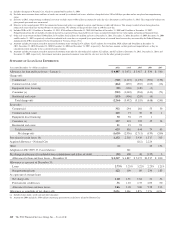

N

ONPERFORMING

A

SSETS AND

R

ELATED

I

NFORMATION

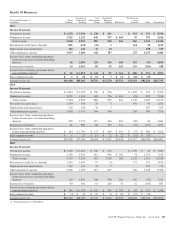

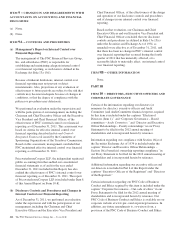

December 31 - dollars in millions 2011 (a) 2010 (a) 2009 (a) 2008 (a) 2007

Nonperforming loans

Commercial $ 899 $1,253 $1,806 $ 576 $193

Commercial real estate 1,345 1,835 2,140 766 214

Equipment lease financing 22 77 130 97 3

TOTAL COMMERCIAL LENDING 2,266 3,165 4,076 1,439 410

Consumer (b)

Home equity 529 448 356 66 16

Residential real estate (c) 726 818 1,203 153 27

Credit card (d) 8

Other consumer 31 35 36 4 1

TOTAL CONSUMER LENDING 1,294 1,301 1,595 223 44

Total nonperforming loans (e) 3,560 4,466 5,671 1,662 454

OREO and foreclosed assets

Other real estate owned (OREO) (f) 561 589 484 422 41

Foreclosed and other assets 35 68 49 16

TOTAL OREO AND FORECLOSED ASSETS 596 657 533 438 41

Total nonperforming assets $4,156 $5,123 $6,204 $2,100 $495

Nonperforming loans to total loans 2.24% 2.97% 3.60% .95% .66%

Nonperforming assets to total loans, OREO and foreclosed assets 2.60 3.39 3.92 1.19 .72

Nonperforming assets to total assets 1.53 1.94 2.30 .72 .36

Interest on nonperforming loans

Computed on original terms $ 278 $ 329 $ 302 $ 115 $ 51

Recognized prior to nonperforming status 47 53 90 60 32

Past due loans

Accruing loans past due 90 days or more (g) $2,973 $2,709 $2,698 $1,321 $136

As a percentage of total loans 1.87% 1.80% 1.71% .75% .20%

Past due loans held for sale

Accruing loans held for sale past due 90 days or more (h) $49 $65 $72 $40 $8

As a percentage of total loans held for sale 1.67% 1.86% 2.84% .92% .20%

The PNC Financial Services Group, Inc. – Form 10-K 209