PNC Bank 2008 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2008 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

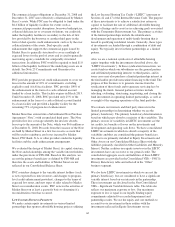

N

OTE

7I

NVESTMENT

S

ECURITIES

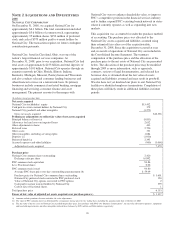

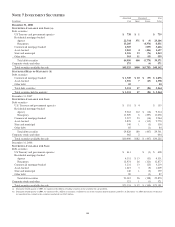

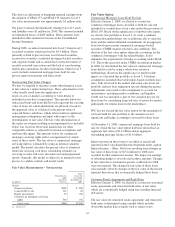

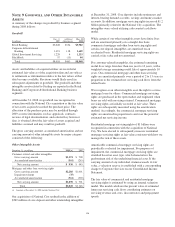

Amortized Unrealized Fair

In millions Cost Gains Losses Value

December 31, 2008

S

ECURITIES

A

VAILABLE FOR

S

ALE

(a)

Debt securities

US Treasury and government agencies $ 738 $ 1 $ 739

Residential mortgage-backed

Agency 22,744 371 $ (9) 23,106

Nonagency 13,205 (4,374) 8,831

Commercial mortgage-backed 4,305 (859) 3,446

Asset-backed 2,069 4 (446) 1,627

State and municipal 1,326 13 (76) 1,263

Other debt 563 11 (15) 559

Total debt securities 44,950 400 (5,779) 39,571

Corporate stocks and other 575 (4) 571

Total securities available for sale $45,525 $400 $(5,783) $40,142

S

ECURITIES

H

ELD TO

M

ATURITY

(b)

Debt securities

Commercial mortgage-backed $ 1,945 $ 10 $ (59) $ 1,896

Asset-backed 1,376 7 (25) 1,358

Other debt 10 10

Total debt securities 3,331 17 (84) 3,264

Total securities held to maturity $ 3,331 17 (84) $ 3,264

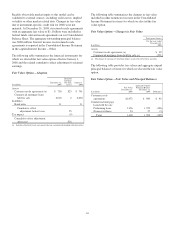

December 31, 2007

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

U.S. Treasury and government agencies $ 151 $ 4 $ 155

Residential mortgage-backed

Agency 9,218 112 $ (16) 9,314

Nonagency 11,929 6 (297) 11,638

Commercial mortgage-backed 5,227 53 (16) 5,264

Asset-backed 2,878 4 (112) 2,770

State and municipal 340 1 (5) 336

Other debt 85 (1) 84

Total debt securities 29,828 180 (447) 29,561

Corporate stocks and other 662 2 664

Total securities available for sale $30,490 $182 $ (447) $30,225

December 31, 2006

S

ECURITIES

A

VAILABLE FOR

S

ALE

Debt securities

US Treasury and government agencies $ 611 $ (3) $ 608

Residential mortgage-backed

Agency 4,351 $ 13 (33) 4,331

Nonagency 12,974 26 (123) 12,877

Commercial mortgage-backed 3,231 13 (25) 3,219

Asset-backed 1,615 3 (9) 1,609

State and municipal 140 1 (2) 139

Other debt 90 (3) 87

Total debt securities 23,012 56 (198) 22,870

Corporate stocks and other 321 1 (1) 321

Total securities available for sale $23,333 $ 57 $ (199) $23,191

(a) During the fourth quarter of 2008, we transferred $.6 billion of trading securities to the available for sale portfolio.

(b) During the fourth quarter of 2008, we transferred $3.2 billion of securities available for sale to the securities held to maturity portfolio. At December 31, 2008, the balance of the after-

tax unrealized loss related to the securities transferred was $342 million.

108