PNC Bank 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

S

TOCK

-B

ASED

C

OMPENSATION

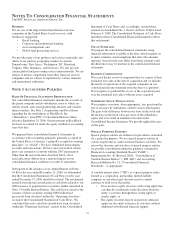

We did not recognize stock-based employee compensation

expense related to stock options granted before 2003 as

permitted under Accounting Principles Board Opinion No. 25,

“Accounting for Stock Issued to Employees,” (“APB 25”).

Effective January 1, 2003, we adopted the fair value

recognition provisions of SFAS 123, “Accounting for Stock-

Based Compensation,” as amended by SFAS 148,

“Accounting for Stock-Based Compensation-Transition and

Disclosure,” prospectively to all employee awards granted,

modified or settled after January 1, 2003. We did not restate

results for prior years upon our adoption of SFAS 123. Since

we adopted SFAS 123 prospectively, the cost related to stock-

based employee compensation included in net income for

2005 was less than what we would have recognized if we had

applied the fair value based method to all awards since the

original effective date of the standard.

In December 2004, the FASB issued SFAS 123R “Share-

Based Payment,” which replaced SFAS 123 and superseded

APB 25. SFAS 123R requires compensation cost related to

share-based payments to employees to be recognized in the

financial statements based on their fair value. We adopted

SFAS 123R effective January 1, 2006, using the modified

prospective method of transition, which required the

provisions of SFAS 123R be applied to new awards and

awards modified, repurchased or cancelled after the effective

date. It also required changes in the timing of expense

recognition for awards granted to retirement-eligible

employees and clarified the accounting for the tax effects of

stock awards. The adoption of SFAS 123R did not have a

significant impact on our consolidated financial statements.

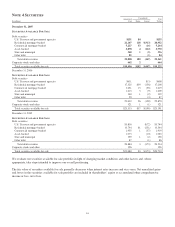

The following table shows the effect on 2005 net income and

earnings per share if we had applied the fair value recognition

provisions of SFAS 123, as amended, to all outstanding and

unvested awards.

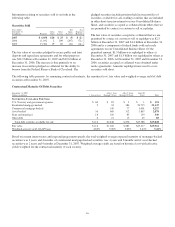

Pro Forma Net Income And Earnings Per Share (a)

In millions, except for per share data 2005

Net income $1,325

Add: Stock-based employee compensation expense

included in reported net income, net of related tax

effects 54

Deduct: Total stock-based employee compensation

expense determined under the fair value method for all

awards, net of related tax effects (60)

Pro forma net income $1,319

Earnings per share

Basic-as reported $ 4.63

Basic-pro forma 4.60

Diluted-as reported $ 4.55

Diluted-pro forma 4.52

(a) There were no differences between the GAAP basis and pro forma basis of reporting

2006 net income and related per share amounts.

See Note 18 Stock-Based Compensation Plans for additional

information.

R

ECENT

A

CCOUNTING

P

RONOUNCEMENTS

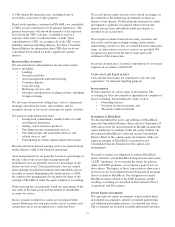

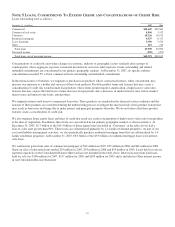

In December 2007, the FASB issued SFAS 141(R), “Business

Combinations.” This statement will require all businesses

acquired to be measured at the fair value of the consideration

paid as opposed to the cost-based provisions of SFAS 141. It

will require an entity to recognize the assets acquired, the

liabilities assumed, and any noncontrolling interest in the

acquiree at the acquisition date, measured at their fair values

as of that date. SFAS 141(R) requires the value of

consideration paid including any future contingent

consideration to be measured at fair value at the closing date

of the transaction. Also, restructuring costs and acquisition

costs are to be expensed rather than included in the cost of the

acquisition. This guidance is effective for all acquisitions with

closing dates after January 1, 2009.

In December 2007, the FASB issued SFAS 160, “Accounting

and Reporting of Noncontrolling Interests in Consolidated

Financial Statements, an amendment of ARB No. 51.” This

statement amends ARB No. 51 to establish accounting and

reporting standards for the noncontrolling interest in a

subsidiary and for the deconsolidation of a subsidiary. It

clarifies that a noncontrolling interest should be reported as

equity in the consolidated financial statements. This statement

requires expanded disclosures that identify and distinguish

between the interests of the parent’s owners and the interests

of the noncontrolling owners of an entity. This guidance is

effective January 1, 2009. We are currently analyzing the

standard but do not expect the adoption to have a material

impact on our consolidated financial statements.

In November 2007, the SEC issued Staff Accounting Bulletin

(“SAB”) No. 109, that provides guidance regarding measuring

the fair value of recorded written loan commitments. The

guidance indicates that the expected future cash flows related

to servicing should be included in the fair value measurement

of all written loan commitments that are accounted for at fair

value through earnings. SAB 109 is effective January 1, 2008,

prospectively to loan commitments issued or modified after

that date. The adoption of this guidance is not expected to

have a material effect on our results of operations or financial

position.

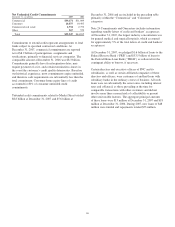

In June 2007, the AICPA issued Statement of Position 07-1,

“Clarification of the Scope of the Audit and Accounting Guide

“Investment Companies” and Accounting by Parent

Companies and Equity Method Investors for Investments in

Investment Companies” (“SOP 07-1”). This statement

provides guidance for determining whether an entity is within

the scope of the AICPA Audit and Accounting Guide

Investment Companies (“Guide”) and whether the specialized

industry accounting principles of the Guide should be retained

in the financial statements of a parent company of an

investment company or an equity method investor in an

78