Orbitz 2008 Annual Report Download

Download and view the complete annual report

Please find the complete 2008 Orbitz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FORM 10-K/A

Orbitz Worldwide, Inc. - OWW

Filed: August 28, 2008 (period: December 31, 2007)

Amendment to a previously filed 10-K

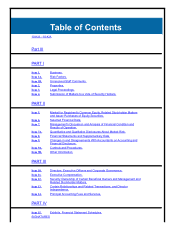

Table of contents

-

Page 1

FORM 10-K/A Orbitz Worldwide, Inc. - OWW Filed: August 28, 2008 (period: December 31, 2007) Amendment to a previously filed 10-K -

Page 2

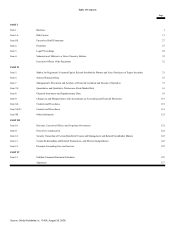

... About Market Risk. Financial Statements and Supplementary Data. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. Controls and Procedures. Other Information. PART III Item 10. Item 11. Item 12. Item 13. Item 14. Directors, Executive Officers and Corporate... -

Page 3

EX-23.1 (EX-23.1) EX-31.1 (EX-31.1) EX-31.2 (EX-31.2) EX-32.1 (EX-32.1) EX-32.2 (EX-32.2) EX-99.1 (EX-99.1) -

Page 4

... reporting company) Smaller reporting company � Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes � At June 30, 2007, there was no public market for the registrant's Common Stock. Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008... -

Page 5

As of August 22, 2008, 83,231,614 shares of Common Stock, par value $0.01 per share, of Orbitz Worldwide, Inc. were outstanding. DOCUMENTS INCORPORATED BY REFERENCE Part III of this Annual Report on Form 10-K/A incorporates by reference certain information from the definitive proxy statement for the... -

Page 6

... conjunction with our filings made with the Securities and Exchange Commission subsequent to the Original Filing. New certifications of our principal executive officer and principal financial officer are included as exhibits to this Form 10-K/A. Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 7

... Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accounting Fees and Services 121 122 122 122 122 Market... -

Page 8

..., from over 85,000 suppliers worldwide, including air travel, hotels, vacation packages, car rentals, cruises, travel insurance and destination services such as ground transportation, event tickets and tours. As of December 31, 2007, we had approximately 1,590 full-time employees, more than half of... -

Page 9

... travel company that offers customers the ability to book an array of travel products and services from numerous suppliers on a stand-alone basis or as part of a dynamic vacation package. These travel products and services include airline tickets, hotel rooms, car rentals, cruises, travel insurance... -

Page 10

... hotel rates. For larger companies with many travelers, our Orbitz for Business product offers full-service online corporate travel and managed travel program services. ebookers ebookers offers customers the ability to book an array of travel products and services through our U.K.-based website... -

Page 11

... Merchant Models Retail Model Our retail model provides customers the ability to book air, hotel, cruise and car rental reservations. Air transactions comprise the majority of this business. Through our retail model, we earn fees and commissions from travel suppliers for airline tickets, hotel rooms... -

Page 12

... Systems Infrastructure and Web and Database Servers We use SAVVIS colocation services in the U.S. to host our systems infrastructure and web and database servers for our Orbitz, CheapTickets, the Away Network and Orbitz for Business brands as well as our ebookers brand in the U.K. and Ireland. The... -

Page 13

...back office automation and by centralizing certain business functions such as customer service, fulfillment and accounting; increase the options available to our white label partners by tailoring their website experiences to match their customer bases and brand identities; and offer our suppliers an... -

Page 14

... to increase the overall number of booked transactions in a cost-effective manner. We use various forms of online marketing to drive traffic to our websites, including search engine marketing, display advertising, affiliate programs and email marketing. We also generate traffic and transactions from... -

Page 15

... travel; portions of our white label dynamic packaging technology; and our extranet supplier connectivity function currently being developed as part of our global technology platform. The Master License Agreement granted us the right to use a corporate online booking product that Travelport... -

Page 16

...Inc. and American Express Travel Related Services Company, Inc. We compete with travel suppliers, such as airlines, hotel and rental car companies, many of which have their own branded websites and toll-free numbers through which they generate business. • • Travel suppliers have been steadily... -

Page 17

... back office automation and by centralizing certain business functions such as customer service, fulfillment and accounting; increase the options available to our white label partners by tailoring their website experience to match their customer base and brand identity; and offer our suppliers an... -

Page 18

...expanding our brands, including Orbitz, CheapTickets, ebookers, Orbitz for Business, HotelClub, RatesToGo and the Away Network, are important aspects of our efforts to attract and expand our customer and advertiser base. As our competitors spend increasingly more on marketing and advertising, we are... -

Page 19

... Amadeus International, to process a significant portion of our travel bookings, and any interruption or deterioration in our GDS partners' products or services could prevent us from searching and booking airline and car rental reservations, which would have a material adverse effect on our business... -

Page 20

... the competitive success of our businesses include price, the availability of travel inventory, brand recognition, customer service, ease of use, fees charged to travelers, accessibility and reliability. We compete with online travel companies such as expedia.com, hotels.com and hotwire.com, which... -

Page 21

...of our businesses also utilize third-party fare search solutions and GDSs or other technologies. As our operations grow in both size and scope, we must continuously improve and upgrade our systems and infrastructure to offer an increasing number of customers enhanced products, services, features and... -

Page 22

... of our products and online booking tools for corporate travel; portions of our white label dynamic packaging technology; and our extranet supplier connectivity function currently being developed as part of our global technology platform. 15 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 23

... adverse tax events. New sales, use, occupancy or other tax laws, statutes, rules, regulations or ordinances could be enacted at any time. Those enactments could adversely affect our domestic and international business operations and our business and financial performance. Further, existing tax laws... -

Page 24

... and closing processes and inadequate written policies and procedures. Specifically, the following items were identified: • insufficient complement of external reporting, technical accounting or tax staff commensurate to support stand-alone external financial reporting under public company or SEC... -

Page 25

...of our business is directed to our own websites through our relationships with search engines, including metasearch companies, and through our participation in pay-per-click advertising campaigns on Internet search engines whose pricing and operating dynamics can experience rapid change commercially... -

Page 26

... affiliates are in the business of making investments in companies. They currently have, and may from time to time in the future acquire, interests in businesses that directly or indirectly compete with certain portions of our business or our suppliers or customers of ours. In addition, Travelport... -

Page 27

... fees paid to, and indemnities provided for the benefit of, officers, directors, employees or consultants of Travelport, any of its direct or indirect parent companies or any of its restricted subsidiaries, including us; (3) any agreement as in effect on the date of the consummation of this offering... -

Page 28

..., 2007, we had net operating income of $42 million; however, we may not be able to maintain such profitability in future periods, particularly since we will continue to incur significant sales and marketing expenses as we execute on our plan to expand our business. If our uncertain tax positions are... -

Page 29

...with our views. The imposition of additional taxes could cause us to have to pay taxes that we currently do not collect or pay or increase the costs of our products or services to track and collect such taxes, which would increase our costs of operations. Our businesses are highly regulated, and any... -

Page 30

... certain risks as a result of having international operations and from having operations in multiple countries generally, including: • delays in the development of the Internet as a broadcast, advertising and commerce medium in overseas markets; 23 Source: Orbitz Worldwide, In, 10-K/A, August 28... -

Page 31

..., train and retain a sufficient number of qualified employees could materially hinder our business by, for example, delaying our ability to bring new products and services to market or impairing the success of our operations. Even if we are able to 24 Source: Orbitz Worldwide, In, 10-K/A, August 28... -

Page 32

... reflected in our income tax provisions and accruals. Seasonal fluctuations in the travel industry could adversely affect us. Some of our businesses experience seasonal fluctuations, reflecting seasonal trends for the products and services we offer. These trends cause our net revenue to be generally... -

Page 33

... strategies with Travelport and other businesses, including the GDS and wholesale travel businesses. Although we entered into a transition services agreement and other agreements with Travelport in connection with our initial public offering, these temporary arrangements may not capture the benefits... -

Page 34

... feet of leased office space globally. Our corporate headquarters are located in approximately 141,000 square feet of leased office space in Chicago, Illinois. We also lease approximately 17,000 square feet of additional office space for our 27 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 35

... of Los Angeles on behalf of all Californians who were assessed a "Taxes/Fees" charge when paying for a hotel, motel, or resort room through the defendants' websites. The complaint was brought against a number of Internet travel companies, including Trip Network, Inc. (d/b/a CheapTickets), Cendant... -

Page 36

... other governmental entities involving hotel occupancy taxes and our merchant hotel business model. Some of the cases are purported class actions and most of the cases were brought simultaneously against other Internet travel companies, including Expedia, Travelocity and Priceline. The cases allege... -

Page 37

...of Gallup, New Mexico* City of Madison, Wisconsin Mecklenburg County, North Carolina February 1, 2007 February 2, 2007 February 2, 2007 February 28, 2007 June 27, 2007 June 29, 2007 July 6, 2007 November 30, 2007 January 10, 2008 * Indicates purported class action filed on behalf of named City or... -

Page 38

... Property DDR Holdings, LLC v. Hotels.com, L.P., et al. On January 31, 2006, DDR Holdings, LLC ("DDR") filed an action in the United States District Court for the Eastern District of Texas (Marshall Division) against a number of Internet companies, including Cendant Corporation, for alleged... -

Page 39

... joined the Company in 2002. Previously, Mr. Petito was a Vice President in the mergers and acquisitions group of Hambrecht & Quist, a technology-focused investment bank in San Francisco. Mr. Petito also worked as an investment banker for Roberts Capital Markets in Buenos Aires, 32 Source: Orbitz... -

Page 40

... was no public market for our common stock. The following table sets forth the high and low sales prices for our common stock for each of the periods presented: High Low Holders 2007: Fourth Quarter Third Quarter (from July 20, 2007) $ $ 12.00 15.00 $ $ 7.53 9.40 As of March 10, 2008, there... -

Page 41

... stock price performance. All values assume reinvestment of the full amount of all dividends and are calculated as of the last day of each month. COMPARISON OF CUMULATIVE TOTAL RETURN* Among Orbitz Worldwide, Inc., The S&P Midcap 400 Index And The RDG Internet Composite Index 34 Source: Orbitz... -

Page 42

... stock during the fourth quarter of 2007: Total number of shares purchased as part of publicly announced plans or programs(b) Maximum number of shares that may yet be purchased under the plans or programs(b) Period Total number of shares purchased(a) Average price paid per share October 1, 2007... -

Page 43

...146) $ (430) (42) - (388) $ (60) 3 - (63) $ (59) - - (59) Period from July 18, 2007 to December 31, 2007 Net loss Net loss per share-basic and diluted Net loss per share Weighted average shares outstanding $ (42) $ (0.51) 81,600,478 36 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 44

...event tickets and tours. We generate revenue through multiple sources, including our retail model, merchant model, incentive payments, advertising, and white label and hosting business. Through our retail model, we earn fees and commissions from travel suppliers for airline tickets, hotel rooms, car... -

Page 45

... back office automation and by centralizing certain business functions such as customer service, fulfillment and accounting; increase the options available to our white label partners by tailoring their website experience to match their customer base and brand identity; and offer our suppliers an... -

Page 46

... airlines, hotels and car rental companies, have continued to focus their efforts on direct sale of their products through their own websites, further promoting the migration of customers to online booking. In the current environment, suppliers' websites are believed to be taking market share... -

Page 47

... and merchant models as well as advertising revenue and certain other fees and commissions. Gross bookings provide insight into changes in overall travel activity levels, changes in industry-wide online booking activity, and more specifically, changes in the number of bookings through our websites... -

Page 48

... bookings for hotels also increased due to a higher price per transaction, primarily driven by higher average daily rates ("ADRs") and a longer average length of stay. For our international business, which is comprised principally of ebookers, HotelClub and RatesToGo, total gross bookings increased... -

Page 49

...online business for the year ended December 31, 2006 contributed substantially to the increase in gross bookings. This growth was partially offset by a decrease in ebookers' offline business. Net Revenue-See discussion of net revenue in the Results of Operations section. 42 Source: Orbitz Worldwide... -

Page 50

... ended December 31, 2006 Year Ended December 31, 2007 Successor (in millions) 2006 Combined $ Change % Change Net revenue Air Non-air and other Total net revenue Cost and expenses Cost of revenue Selling, general and administrative Marketing Depreciation and amortization Impairment of goodwill and... -

Page 51

... hotel and dynamic packaging net revenue was partially offset by decreases in net revenue from car rentals and cruises. The sale of our offline U.K. travel business in July 2007 reduced the overall growth in international non-air and other net revenue due to the inclusion of seven months of net... -

Page 52

... channels. Internationally, marketing expense increased due to higher online marketing costs driven primarily by the growth in transaction volume. We also experienced higher traditional marketing costs due to the launch of a new marketing campaign in September 2007 to promote our ebookers brand... -

Page 53

... reduced, and as a result of Cendant's acquisition of Orbitz in 2004, our net revenue during 2005 was also reduced. These reductions occurred because deferred revenue was written off at the time of the acquisitions and therefore we could not 46 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 54

... new packaging combinations on our websites. Domestic net revenue from hotel bookings increased due primarily to a shift in mix from retail to merchant and higher volume. Domestic non-air and other net revenue also increased due to growth in revenue from car rentals, travel insurance and destination... -

Page 55

... the year ended December 31, 2005. The increase in marketing expense was primarily due to higher online marketing costs, expanded advertising campaigns promoting our Orbitz brand and the full-year impact of ebookers. Depreciation and Amortization Depreciation and amortization decreased $23 million... -

Page 56

... merchant model, customers generally pay us for reservations in advance, at the time of booking, and we pay our suppliers at a later date. Initially, we record these advance payments as deferred income and accrued merchant payables. We recognize net revenue when customers use the reservation and pay... -

Page 57

... will decrease as a percentage of total net revenue as our business continues to grow. We expect a positive impact on our liquidity as we continue to execute our strategic plan, including increasing growth in non-air categories and in international markets as well as realizing operating efficiencies... -

Page 58

... U.K. travel business in July 2007. The sale of this business resulted in a net decrease in cash of $31 million primarily due to the buyer's assumption of this business' cash balance at the time of sale, partially offset by the cash proceeds we received for the sale. 51 Source: Orbitz Worldwide, In... -

Page 59

... of cash generated from earnings and due to changes in our working capital accounts. The increase in the working capital deficit was primarily due to additional accrued travel supplier payments, deferred revenue and customer advances, which relate primarily to merchant model transactions. Investing... -

Page 60

... in connection with commercial agreements or leases entered into or replaced by us. At December 31, 2007, there were $74 million of letters of credit issued by Travelport on our behalf. Although currently, under the terms of the separation agreement, Travelport is not required to issue new, or... -

Page 61

...interest rate as of December 31, 2007 and includes certain fixed payments under interest rate swaps. Represents costs to exit an online marketing service agreement. The Travelport GDS service agreement is structured such that we receive an incentive payment for each segment that is processed through... -

Page 62

... Financial Statements). No payments were made to Travelport in 2007 related to the required minimum segments. (e) We expect to make approximately $277 million of payments in connection with the tax sharing agreement with the Founding Airlines (see Note 8-Tax Sharing Liability of the Notes... -

Page 63

... versus Net as an Agent." We offer customers the ability to book airline, hotel, car rental and other travel reservations through our various brands, including Orbitz, CheapTickets, ebookers, HotelClub and RatesToGo. These products and services are made available to our customers for booking on... -

Page 64

...of the flight, hotel room, or car rental; we take no inventory risk; we have no ability to determine or change the products or services delivered; and we have no discretion in the selection of the service supplier. We recognize net revenue under the merchant model when customers use the reservations... -

Page 65

... statements. Accounting for Income Taxes We account for income taxes in accordance with SFAS No. 109, "Accounting for Income Taxes." Accordingly, our provision for income taxes is determined using the asset and liability method. Under 58 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 66

... of tax benefits resulting from a taxable exchange that took place in connection with the Orbitz initial public offering in December 2003 ("Orbitz IPO"). As a result of this exchange, the Founding Airlines incurred a taxable gain when they sold their Orbitz common stock at the time of the Orbitz IPO... -

Page 67

... method," as defined in the SEC Staff Accounting Bulletin No. 107, "Shared-Based Payments." The risk-free interest rate is based on yields on U.S. Treasury strips with a maturity similar to the estimated expected life of the stock options. 60 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 68

...of Position ("SOP") No. 98-1, "Accounting for the Costs of Computer Software Developed or Obtained for Internal Use" ("SOP 98-1") and EITF Issue No. 00-2, "Accounting for Website Development Costs." Capitalization commences when the preliminary project stage of the application has been completed and... -

Page 69

... the sensitivity analysis, primarily due to assumptions that foreign exchange rate movements are linear and instantaneous. The effect of a hypothetical change in market rates of interest on interest expense would be $3 million at December 31, 2007. 62 Source: Orbitz Worldwide, In, 10-K/A, August 28... -

Page 70

... Supplementary Data. REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Orbitz Worldwide, Inc. We have audited the accompanying consolidated balance sheets of Orbitz Worldwide, Inc. and subsidiaries (for all periods the "Company") (the "Successor... -

Page 71

... net of tax Net loss $ (85) $ $ (121) $ Period from July 18, 2007 to December 31, 2007 Net loss Net loss per share-basic and diluted: Net loss per share Weighted average shares outstanding $ $ (42) (0.51) 81,600,478 See Notes to Consolidated Financial Statements. 64 Source: Orbitz Worldwide... -

Page 72

...liabilities: Accounts payable Accrued merchant payable Accrued expenses Deferred income Due to Travelport, net Term loan, current Other current liabilities Total current liabilities Due to Travelport, non-current Term loan, non-current Line of credit Tax sharing liability Unfavorable contracts Other... -

Page 73

...contributions from Cendant or Travelport Capital lease and debt payments Advances to Travelport Payment for settlement of tax sharing liability Proceeds from line of credit Payments on line of credit Net cash provided by (used in) financing activities Effects of changes in exchange rates on cash and... -

Page 74

... of common stock in connection with initial public offering, net of offering costs Dividend paid to Travelport Contributions from Travelport Amortization of equity-based compensation awards granted to employees of Orbitz Worldwide, Inc. Comprehensive (loss): Net (loss) from January 1, 2007 through... -

Page 75

...000 suppliers worldwide, including air travel, hotels, vacation packages, car rentals, cruises, travel insurance and destination services such as ground transportation, event tickets and tours. We have an efficient, customized and user-friendly system that enables all bookings to occur online. Basis... -

Page 76

... the periods presented. Prior to the IPO, certain corporate general and administrative expenses, including those related to executive management, information technology, tax, insurance, accounting, legal, treasury services and certain employee benefits, were allocated to us by Travelport and Cendant... -

Page 77

... an arrangement exists, services have been rendered, the price is fixed or determinable, and collectability is reasonably assured. We record revenue earned net of all amounts paid to our suppliers under both our retail and merchant models, in accordance with the 70 Source: Orbitz Worldwide, In, 10... -

Page 78

... versus Net as an Agent." We offer customers the ability to book airline, hotel, car rental and other travel reservations through our various brands, including Orbitz, CheapTickets, ebookers, HotelClub and RatesToGo. These products and services are made available to our customers for booking on... -

Page 79

... customers assemble a dynamic vacation package, we may offer them the ability to book a mix of travel products that use both the retail and merchant model. For example, travel products booked in a dynamic vacation package may include a combination of air, hotel and car reservations. We recognize net... -

Page 80

..., we did not have a Separate Company income tax payable. For the period January 1, 2007 to February 7, 2007, the operations of Travelport will be included in the consolidated U.S. federal and state income tax returns for the year ended December 31, 2007 for Orbitz Worldwide Inc. and its subsidiaries... -

Page 81

... credit quality. Our accounts receivable are derived from revenue earned from customers located in the U.S. and internationally. Accounts receivable balances are settled through customer credit cards and debit cards with the majority of accounts receivable collected upon processing of credit card... -

Page 82

...of Position ("SOP") No. 98-1, "Accounting for the Costs of Computer Software Developed or Obtained for Internal Use" ("SOP 98-1") and EITF Issue No. 00-2, "Accounting for Website Development Costs." Capitalization commences when the preliminary project stage of the application has been completed and... -

Page 83

... balance sheets that relates to a tax sharing agreement between Orbitz and the Founding Airlines. The agreement governs the allocation of approximately $277 million of tax benefits resulting from a taxable exchange that took place in 76 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 84

... Summary of Significant Accounting Policies (Continued) connection with the Orbitz initial public offering in December 2003 ("Orbitz IPO"). As a result of this exchange, the Founding Airlines incurred a taxable gain when they sold their Orbitz common stock at the time of the Orbitz IPO. The taxable... -

Page 85

... statement users to evaluate the nature and financial effects of the business combination. SFAS No. 141(R) applies prospectively to business combinations for which the acquisition date is on or after the beginning of the first annual reporting period beginning on or after December 15, 2008, and... -

Page 86

... and TCV acquired Travelport, which consisted of Cendant's travel distribution services businesses, for $4.1 billion in cash. The assets acquired and liabilities assumed in connection with the Blackstone Acquisition were recorded at their relative fair values on the acquisition date. This allocation... -

Page 87

...) 2005 Acquisitions ebookers On February 28, 2005, Cendant acquired ebookers, a leading full service travel company in Europe. ebookers offered a wide range of discount and standard price travel products and services including air travel, hotels, car rentals, cruises and travel insurance. The... -

Page 88

...presented had purchase accounting been applied, and therefore impairment would not have existed. The adjustments for 2005 also include the operating results of ebookers, from January 1, 2005 through February 28, 2005, the date of acquisition. 81 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 89

... depreciation and amortization Property and equipment, net $ 149 60 15 7 $ 84 44 21 28 177 (11) 231 (47) $ 184 $ 166 In July 2007, we placed the first phase of our new global technology platform into service. As a result, construction in progress costs of $42 million were transferred to... -

Page 90

... the applicable tax rate and period of payment, previously used to determine the net present value of the tax sharing liability as of the date of the Blackstone Acquisition (see Note 8-Tax Sharing Liability). This amount represents other adjustments to goodwill related to purchase price allocations... -

Page 91

... Net Carrying Amount Weighted Average Useful Life (in years) Finite-Lived Intangible Assets: Customer relationships $ Vendor relationships and other Total Finite...Year (in millions) 2008 2009 2010 2011 2012 Thereafter Total 84 $ 19 19 13 4 3 10 68 $ Source: Orbitz Worldwide, In, 10-K/A, August... -

Page 92

... owe our suppliers, which includes the negotiated net rate plus estimated taxes. The amount recorded to deferred income represents the net revenue that we will ultimately recognize when the customer uses the reservation. During 2007, we terminated an online marketing services agreement. As a result... -

Page 93

... affiliates; and make restricted payments. The Credit Agreement requires us to maintain a maximum total leverage ratio and minimum fixed charge coverage ratio, each as defined in the Credit Agreement. As of December 31, 2007, we were in compliance with these covenants. 86 Source: Orbitz Worldwide... -

Page 94

... taxable exchange. The tax sharing agreement commenced upon consummation of the Orbitz IPO and continues until all tax benefits have been utilized. As of December 31, 2007, the remaining payments that may be due under this agreement were approximately $277 million. We estimate that the net present... -

Page 95

... one of the Founding Airlines under the tax sharing agreement. This cash settlement was made in connection with the renegotiation of an agreement between Galileo, a subsidiary of Travelport, and the Founding Airline. The net present value of our obligation to the Founding Airline at the time of cash... -

Page 96

..., at which time we reversed the unfavorable contract liability and recorded a corresponding capital contribution in the amount of $28 million from Travelport in our consolidated balance sheet. We believe the rates earned under the new agreement approximate market 89 Source: Orbitz Worldwide, In, 10... -

Page 97

... payments earned under the new contract that we entered into with Travelport in July 2007 (see Note 16-Related Party Transactions). The rebate structure under the Charter Associate Agreements was considered unfavorable when compared to market conditions at the time of Cendant's acquisition of Orbitz... -

Page 98

... of payments in connection with the tax sharing agreement with the Founding Airlines (see Note 8-Tax Sharing Liability). Also excluded from the above table are $2 million of liabilities for uncertain tax positions for which the period of settlement is not determinable. 91 Source: Orbitz Worldwide... -

Page 99

... U.S. governmental entities involving hotel occupancy taxes and our merchant hotel business. Some of the cases are purported class actions and most of the cases were brought simultaneously against other Internet travel companies, including Expedia, Travelocity and Priceline. The cases allege, among... -

Page 100

ORBITZ WORLDWIDE, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) 10. Commitments and Contingencies (Continued) We are currently seeking to recover insurance reimbursement for costs incurred to defend the hotel occupancy tax cases. In December 2007, we were reimbursed for $3 million of ... -

Page 101

... income taxes was computed as if we filed our U.S. federal, state and foreign income tax returns on a Separate Company basis without the inclusion of the results of operations of Travelport for the period January 1, 2007 to February 7, 2007. 94 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 102

... benefit Rate change impact on deferred income taxes Taxes on non-U.S. operations at differing rates Taxes on other repatriated foreign income, net of tax credits Change in valuation allowance Foreign deemed dividends Non deductible public offering costs Reserve for uncertain tax positions Other... -

Page 103

... Tax sharing liability Capital loss carryforward Change in reserve accounts Other Valuation allowance Non-current net deferred income tax assets $ 27 113 39 93 47 - 7 (2) (312) 12 $ 22 98 21 118 166 14 21 (3) (399) 58 The current and deferred income tax assets and liabilities are presented... -

Page 104

... tax benefits that management believes to be adequate. Once established, unrecognized tax benefits are adjusted if more accurate information is available, or a change in circumstance or an event occurs necessitating a change to the liability. 97 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 105

... state combined and unitary income tax returns filed are only applicable in the post-acquisition accounting period. We and our domestic subsidiaries currently file a consolidated income tax return for U.S. federal income tax purposes. The number of years with open tax audits varies depending on the... -

Page 106

... Under the Plan, 6,100,000 shares of our common stock are reserved for issuance. As of December 31, 2007, 985,274 shares were available for future issuance under the Plan. Stock Options The exercise price of stock options is equal to the fair market value of the underlying stock on the date of grant... -

Page 107

.... We use historical turnover to estimate employee forfeitures. Assumptions: Dividend yield - Expected volatility 38% Expected life (in years) 6.16 Risk-free interest rate 4.86% Based on the above assumptions, the weighted average grant-date fair value of stock options granted from July 18, 2007 to... -

Page 108

...31, 2007 and the total fair value thereof was 181,003 restricted stock units and $2 million, respectively. Restricted Stock Shares of restricted stock were granted upon conversion of the Class B partnership interests previously held by employees under the Travelport Plan. The restricted stock vested... -

Page 109

... events. On July 18, 2007, the unvested restricted equity units and Class B partnership interests held by our employees were converted to restricted stock units and restricted shares in Orbitz Worldwide under its 2007 Equity and Incentive Plan. This conversion affected 14 employees of Orbitz... -

Page 110

... on the date of grant based on the fair market value of Travelport's common equity relative to the number of Class A shares then outstanding. The fair value of the Class B, Class C and Class D partnership interests was estimated on the date of grant using the Monte-Carlo valuation model with the... -

Page 111

... on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions: Assumptions: Dividend yield Expected volatility Expected life (in years) Risk-free interest rate 104 1.7% 30.0% 5.5 3.8% Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 112

... Fair Value (per share) Year Ended December 31, 2005 Number of Restricted Stock Units Weighted Average Grant Date Fair Value (per share) Balance at beginning of year or period Granted(a) Vested/exercised Forfeited/cancelled Vested/converted as a result of the Blackstone Acquisition Balance at end... -

Page 113

... forward contracts ("forward contracts") from time to time to manage exposure to changes in the foreign currency associated with foreign receivables, payables, intercompany transactions and forecasted earnings. As of December 31, 2007, we have forward contracts outstanding with a total net notional... -

Page 114

... loss per share calculation above because they would have had an antidilutive effect: Antidilutive equity awards As of December 31, 2007 Stock options Restricted stock units Restricted stock Total 107 2,560,676 2,296,351 42,079 4,899,106 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 115

... - - 37 - 1 - These amounts include net revenue related to bookings sourced through Donvand Limited and OctopusTravel Group Limited (doing business as Gulliver's Travel Associates, "GTA") for the periods presented. In connection with our IPO, we paid a dividend to Travelport in the amount of $109... -

Page 116

...certain transition services, including insurance, human resources and employee benefits, payroll, tax, communications, collocation and data center facilities, information technology and other existing shared services. We have also provided Travelport with certain services, including accounts payable... -

Page 117

... pay us fees for related maintenance and support services. The licenses include our supplier link technology; portions of ebookers' booking, search and dynamic packaging technologies; certain of our products and online booking tools for corporate travel; portions of our white label dynamic packaging... -

Page 118

.... The GTA Agreement became effective on January 1, 2008. Under this agreement, we pay GTA a contract rate for hotel and destination services inventory it makes available to us for booking on our websites. The contract rate exceeds the prices at which suppliers make their inventory available to GTA... -

Page 119

.... Financial Advisory Services Agreement On July 16, 2007, we completed the sale of an offline U.K. travel subsidiary. Pursuant to an agreement between Travelport and Blackstone, Blackstone provided financial advisory services to Travelport and to us in connection with certain business transactions... -

Page 120

... on services used plus a share of revenue from reservations of select hotels. Media Services Avis Budget Group provided us with media planning and advertising buying services until December 31, 2006. We paid advertising costs directly to the third-party vendors. 113 Source: Orbitz Worldwide, In... -

Page 121

... our online reservation systems. Wright Express earns money from the interchange rate a vendor is charged for all purchases made on any rotating account, and Wright Express pays us a rebate based upon our purchase volume. Corporate Travel Agreements We provide Cendant, Wyndham Worldwide Corporation... -

Page 122

..., the table below does not present earnings (loss) per share information for periods prior to the Reorganization. Three Months Ended December 31, 2007 Successor September 30, 2007 Successor (in millions) June 30, 2007 Successor March 31, 2007 Successor Net revenue Cost and expenses Operating income... -

Page 123

... 2006 and "Net cash (used in) investing activities" in our consolidated statement of cash flows for the year ended December 31, 2005. The purchase price allocation previously disclosed for the Blackstone Acquisition and Cendant's acquisition 116 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 124

...437) (479) 433 (9) 4 24 28 $ 36 $ (a) Due to Cendant's acquisition of ebookers in February 2005, the reclassification of credit card receipts in-transit impacted net cash used in investing activities for the year ended December 31, 2005. 117 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 125

... reductions related to a corresponding reduction in deferred tax assets not recorded through the consolidated statements of operations. Represents the additional valuation allowance required for ebookers Limited upon acquisition by Cendant. 118 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 126

... Plan for Material Weakness in Internal Control over Financial Reporting. Pursuant to rules of the Securities and Exchange Commission that provide a transition period for newly public companies, this Annual Report on Form 10-K/A does not include a report of management's assessment of internal... -

Page 127

...-party tax consulting firm to assist with U.S. tax provision and compliance efforts; and installed a global reporting structure for tax personnel at ebookers and HotelClub to manage and record our global tax position accurately and on a timely basis. 120 • • • Source: Orbitz Worldwide, In... -

Page 128

... of Regulation S-K is included under the caption "Corporate Governance-Committees of the Board of Directors-Audit Committee" in the 2008 Proxy Statement, and that information is incorporated by reference herein. Code of Business Conduct We have adopted the Orbitz Worldwide, Inc. Code of Business... -

Page 129

... principal accounting officer. In addition, we have adopted a Code of Ethics for our chief executive officer and senior financial officers. The Code of Business Conduct and the Code of Ethics are available on the corporate governance page of our Investor Relations website at http://www.orbitz-ir.com... -

Page 130

... to the Amended and Restated By-laws of Orbitz Worldwide, Inc., effective as of December 4, 2007 (incorporated by reference to Exhibit 3.1 to the Orbitz Worldwide, Inc. Current Report on Form 8-K filed on December 5, 2007). Specimen Stock Certificate (incorporated by reference to Exhibit 4.1 to... -

Page 131

... on July 27, 2007). Transition Services Agreement, dated as of July 25, 2007, by and between Travelport Inc. and Orbitz Worldwide, Inc. (incorporated by reference to Exhibit 10.3 to the Orbitz Worldwide, Inc. Current Report on Form 8-K filed on July 27, 2007). Tax Sharing Agreement, dated as of July... -

Page 132

..., LLC, Galileo International, LLC, Orbitz, LLC, ebookers Limited, Donvand Limited, Travelport for Business, Inc., Orbitz Development, LLC and Neat Group Corporation (incorporated by reference to Exhibit 10.5 to the Orbitz Worldwide, Inc. Current Report on Form 8-K/A filed on February 27, 2008... -

Page 133

...2007). Form of Option Award Agreement for Converted Travelport Equity Awards (incorporated by reference to Exhibit 10.15 to the Orbitz Worldwide, Inc. Quarterly Report on 10-Q for the Quarterly Period ended September 30, 2007). Orbitz Worldwide, Inc. Non-Employee Directors Deferred Compensation Plan... -

Page 134

...Vice President of Global Accounting and External Reporting (Principal Accounting Officer) Date: August 27, 2008 By: /s/ JEFF CLARKE Jeff Clarke Chairman of the Board of Directors Date: August 27, 2008 By: /s/ WILLIAM C. COBB William C. Cobb Director 127 Source: Orbitz Worldwide, In, 10-K/A, August... -

Page 135

... Director Date: August 27, 2008 By: /s/ WILLIAM J.G. GRIFFITH William J.G. Griffith Director Date: August 27, 2008 By: /s/ PAUL C. SCHORR IV Paul C. Schorr IV Director Date: August 27, 2008 By: /s/ JAYNIE MILLER STUDENMUND Jaynie Miller Studenmund Director 128 Source: Orbitz Worldwide... -

Page 136

... Risk. Item 8. Financial Statements and Supplementary Data. REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM ORBITZ WORLDWIDE, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (in millions, except share and per share data) ORBITZ WORLDWIDE, INC. CONSOLIDATED BALANCE SHEETS (in millions, except... -

Page 137

... from January 1, 2006 through August 22, 2006, and the year ended December 31, 2005, appearing in this Annual Report on Form 10-K/A of Orbitz Worldwide, Inc. for the year ended December 31, 2007. DELOITTE & TOUCHE LLP Chicago, Illinois August 27, 2008 Source: Orbitz Worldwide, In, 10-K/A, August 28... -

Page 138

...not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. b) August 27, 2008 /s/ STEVEN BARNHART Steven Barnhart President, Chief Executive Officer and Director Source: Orbitz Worldwide, In, 10-K/A, August... -

Page 139

QuickLinks Exhibit 31.1 CERTIFICATIONS Certification of Principal Executive Officer Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 140

..., that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. b) August 27, 2008 /s/ MARSHA C. WILLIAMS Marsha C. Williams Senior Vice President and Chief Financial Officer Source: Orbitz Worldwide, In, 10-K/A, August... -

Page 141

QuickLinks Exhibit 31.2 CERTIFICATIONS Certification of Principal Financial Officer Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 142

... ACT OF 2002 In connection with the Annual Report of Orbitz Worldwide, Inc. (the "Company") on Form 10-K/A for the year ended December 31, 2007 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Steven Barnhart, Chief Executive Officer of the Company, certify... -

Page 143

QuickLinks Exhibit 32.1 CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 144

... OF 2002 In connection with the Annual Report of Orbitz Worldwide, Inc. (the "Company") on Form 10-K/A for the year ended December 31, 2007 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Marsha C. Williams, Chief Financial Officer of the Company, certify... -

Page 145

QuickLinks Exhibit 32.2 CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 Source: Orbitz Worldwide, In, 10-K/A, August 28, 2008 -

Page 146

Exhibit 99.1 August 26, 2008 Orbitz Worldwide, Inc. 500 West Madison Street, Suite 1000 Chicago, IL 60661 Ladies and Gentlemen: We hereby consent to the use of our name and PhoCusWright's U.S. Online Travel Overview Seventh Edition report for use in the Annual Report on Form 10-K/A for the Fiscal ...