OG&E 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 OG&E annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

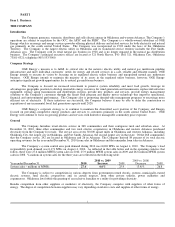

Capital Expenditures

The Company’s estimates of capital expenditures for the years 2011 through 2016 are shown in the following table. These

capital expenditures represent the base maintenance capital expenditures (i.e., capital expenditures to maintain and operate the

Company’s businesses) plus capital expenditures for known and committed projects.

(In millions) 2011 2012 2013 2014 2015 2016

Base Transmission $ 50 $ 30 $ 20 $ 20 $ 20 $ 20

Base Distribution 240 200 200 200 200 200

Base Generation 95 80 70 70 70 70

Other 45 30 30 30 30 30

Total Base Transmission, Distribution,

Generation and Other 430 340 320 320 320 320

Known and Committed Projects:

Transmission Projects:

Sunnyside-Hugo (345 kV) 150 20 --- --- --- ---

Sooner-Rose Hill (345 kV) 35 15 --- --- --- ---

Balanced Portfolio 3E Projects 50 170 140 30 --- ---

SPP Priority Projects (A) 10 60 155 90 --- ---

Total Transmission Projects 245 265 295 120 --- ---

Other Projects:

Smart Grid Program (B) 70 70 25 30 10 10

Crossroads 250 30 --- --- --- ---

System Hardening 20 --- --- --- --- ---

Total Other Projects 340 100 25 30 10 10

Total Known and Committed Projects 585 365 320 150 10 10

Total capital expenditures (C) $ 1,015 $ 705 $ 640 $ 470 $ 330 $ 330

(A) On February 4, 2011, the Company responded to the SPP that the Company will construct the revised Priority Project as discussed

in Note 13 of Notes to Financial Statements.

(B) These capital expenditures are net of the Smart Grid $130 million grant approved by the DOE.

(C) The capital expenditures above exclude any environmental expenditures associated with BART requirements due to the

uncertainty regarding BART costs. As discussed in “Item 7. Management’s Discussion and Analysis of Financial Condition and

Results of Operations – Environmental Laws and Regulations,” pursuant to a proposed regional haze agreement the Company has

agreed to install low NOX burners and related equipment at the three affected generating stations. Preliminary estimates indicate the

cost will be $100 million (plus or minus 30 percent). For further information, see “Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations – Environmental Laws and Regulations.”

Additional capital expenditures beyond those identified in the table above, including additional incremental growth

opportunities in electric transmission assets, will be evaluated based upon their impact upon achieving the Company’s financial

objectives.

Pension and Postretirement Benefit Plans

During each of 2010 and 2009, OGE Energy made contributions to its Pension Plan of $50 million, of which $47 million in

each of 2010 and 2009 was the Company’s portion, to help ensure that the Pension Plan maintains an adequate funded status, of which

$47 million in each of 2010 and 2009 was the Company’s portion. During 2011, OGE Energy may contribute up to $50 million to its

Pension Plan, of which $47 million is expected to be the Company’s portion. See “Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations – Liquidity and Capital Resources – Future Capital Requirements and Financing

Activities” for a discussion of OGE Energy’s pension and postretirement benefit plans.

Future Sources of Financing

Management expects that cash generated from operations, proceeds from the issuance of long and short-term debt and funds

received from OGE Energy (from proceeds from the sales of its common stock to the public through OGE Energy’s DRIP/DSPP or

other offerings) will be adequate over the next three years to meet anticipated cash needs and to fund future growth opportunities. The

Company utilizes short-term borrowings (through a combination of bank borrowings, commercial paper and borrowings from OGE

12