O'Reilly Auto Parts 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 O'Reilly Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Growing Brand

Awareness

We have and will continue to

work hard to establish O’Reilly

as the most trusted source for

customers’ automotive needs.

Our company strives to drive

customers into our stores. From

retail sales flyers, radio ads,

and sports sponsorships, our

goal is to create a strong brand

awareness. These advertising

programs do generate customer

traffic; however, we continue to

believe our best advertising is

the referrals we receive from

customers who have experienced

the top-notch problem-solving

skills of our professional

parts people.

The automotive aftermarket

continued to see a favorable external

macro-economic environment in

2011. Annual miles driven in the U.S.

is an important driver for demand in

the automotive aftermarket and has

historically been a key barometer for

the health of the industry. However,

in recent years, the degree to which

miles driven in the U.S. affects

aftermarket demand has been

impacted by the aging of the vehicle

population and the corresponding

increase in the miles driven on older

on to their existing vehicles for

longer periods of time. The average

age of the U.S. vehicle population

increased to 10.8 years in 2011. Miles

driven on older vehicles results in a

better yield for auto parts demand

since these vehicles are outside of

manufacturer warranty periods,

undergo more routine maintenance

cycles and incur more frequent

mechanical failures. This trend

towards holding on to vehicles for

longer periods accelerated with the

U.S. economic downturn over the

consumers will continue to feel the

pressure of increasing prices at the

gas pump with both of these factors

acting as a headwind to demand for

our business. However, we believe

the change in the value perception of

vehicle ownership will persist with

the willingness of consumers to keep

their vehicles and drive them at

higher mileages mitigating the

impact of macro-economic pressures

from unemployment and gas prices.

This scenario is consistent with our

expectations heading into 2011 which

played out with our solid comparable

store performance in a challenging

economic environment. To the extent

the U.S. economy recovers and

unemployment decreases, the

resulting increase in commuter

miles will drive higher demand for

the aftermarket and we believe will

offset any corresponding increase in

new vehicle sales.

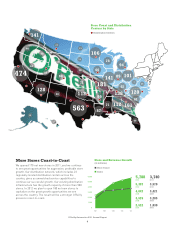

New Store Growth

With the bulk of the physical integra-

tion of the CSK stores in our rear

view mirror, 2011 proved to be a

productive year for new store growth.

We opened 170 net new stores during

the year, an increase of 21 stores

from the 149 net new stores that we

opened in 2010. Our growth strategy

remains two-fold: entering new

markets in regions contiguous to our

existing distribution network and

backfilling in existing regions where

we have outstanding opportunities to

more fully penetrate the market. As a

result, a bulk of our growth in 2011

was in Southeast, East Coast and

Ohio Valley markets, including the

opening of our first store in West

Virginia, our 39th state.

Our plan is to open 180 stores

in 2012, and we expect to have the

ability to incrementally increase that

number over time. Although we

certainly have the capital resources

to open more stores than currently

planned, we remain disciplined and

focused on only opening stores we

are confident can achieve our return

vehicles. Total miles driven in the

U.S. was slightly lower in 2011 versus

2010, primarily due to a lack of

commuter miles driven resulting

from unemployment above historical

levels and pressures from increased

gas prices. The total number of

vehicles on the road has remained

fairly constant, as new car sales have

been below historical averages over

the last two years and vehicle scrap

rates have not increased. The

headwinds in miles driven and a flat

vehicle population were offset by the

continuing trend of an increasing

vehicle age as consumers are holding

past several years as consumers

have realized that, with proper

maintenance, older vehicles can be

reliably driven at higher miles due to

the improved quality of vehicles

manufactured in the past decade. We

believe this has led to a change in

overall consumer sentiment towards

vehicle ownership and we believe

consumers will continue to keep

their vehicles even longer as the

economy recovers maintaining the

trend of an aging vehicle population.

Looking forward to 2012, we

expect the rate of unemployment to

remain relatively high and believe

O’Reilly Automotive 2011 Annual Report

6