Northrop Grumman 2014 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2014 Northrop Grumman annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORTHROP GRUMMAN CORPORATION

-6-

Our long-term contracts typically fall into one of two broad categories:

Cost-type contracts – Cost-type contracts include cost plus fixed fee, award fee and incentive fee contracts. Cost-

type contracts provide for reimbursement of the contractor’s allowable costs incurred plus a fee. Cost-type contracts

generally require that the contractor use its best efforts to accomplish the scope of the work within some specified

time and some stated dollar limitation. Fees on cost-type contracts can be fixed in terms of dollar value or

percentage of costs. Award and incentive fees are based on performance criteria such as cost, schedule, quality and

technical performance. Award fees are determined and earned based on customer evaluation of the company's

performance against negotiated criteria, and are intended to provide motivation for excellence in contract

performance. Incentive fees that are based on cost provide for an initially negotiated fee to be adjusted later,

typically using a formula to measure performance against the associated criteria, based on the relationship of total

allowable costs to total target costs. Award and incentive fees that can reasonably be estimated and are deemed

reasonably assured are recorded over the performance period of the contract.

Fixed-price contracts – A firm fixed-price contract is a contract in which the specified scope of work is agreed to for

a price that is a pre-determined, negotiated amount and not generally subject to adjustment regardless of costs

incurred by the contractor, absent changes in scope by the customer. Certain fixed-price incentive fee contracts

provide for reimbursement of the contractor’s allowable costs plus a fee up to a ceiling amount, typically through a

cost-sharing ratio that affects profitability. These types of fixed-price incentive fee contracts effectively become firm

fixed-price contracts once the cost-share ceiling is reached. Time-and-materials contracts are considered fixed-price

contracts as they specify a fixed hourly rate for each labor hour charged.

See Note 1 to our consolidated financial statements in Part II, Item 8 and Risk Factors in Part I, Item 1A.

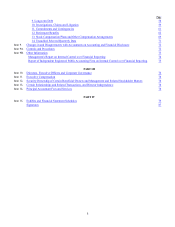

The following table summarizes sales for the year ended December 31, 2014, recognized by contract type and

customer:

($ in millions) U.S.

Government Other

Customers(1) Total Percent

of Total

Cost-type contracts $ 11,691 $ 506 $ 12,197 51%

Fixed-price contracts 8,394 3,388 11,782 49%

Total sales $ 20,085 $ 3,894 $ 23,979 100%

(1) Other customer sales include foreign military sales.

Profit margins may vary materially depending on, among other things, negotiated contract fee arrangements,

achievement of performance objectives and the stage of performance at which the right to receive fees, particularly

under incentive and award fee contracts, is determined.

We monitor our policies and procedures with respect to our contracts on a regular basis to enhance consistent

application under similar terms and conditions, as well as compliance with applicable government regulations and

laws. In addition, costs incurred and allocated to contracts with the U.S. Government are routinely audited by the

Defense Contract Audit Agency.

Environmental

Our manufacturing operations are subject to and affected by federal, state, local and foreign laws and regulations

relating to the protection of the environment. In 2010, we established goals for the reduction of water use and solid

waste through implementation of best management practices; those goals were achieved as of December 31, 2014.

In addition, after achieving the greenhouse gas (GHG) reduction goals established by the company in 2009, we

announced in 2014 our commitment to reduce GHG emissions by 2020 from our 2010 GHG emissions level.

We have incurred and expect to continue to incur capital and operating costs to comply with applicable

environmental laws and regulations and to achieve our environmental sustainability commitments. See Risk Factors

in Part I, Item 1A; Note 1 and Note 11 to the consolidated financial statements in Part II, Item 8.

EXECUTIVE OFFICERS

See Part III, Item 10, for information about our executive officers.

AVAILABLE INFORMATION

Our principal executive offices are located at 2980 Fairview Park Drive, Falls Church, Virginia 22042. Our

telephone number is (703) 280-2900 and our home page on the Internet is www.northropgrumman.com.