Nordstrom 2008 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2008 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 43

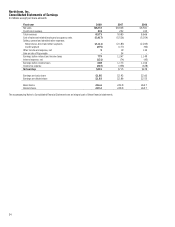

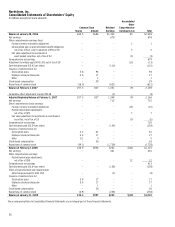

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

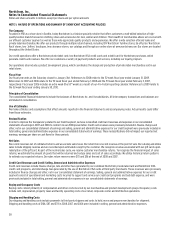

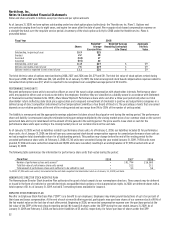

In February 2008, the FASB issued FASB Staff Position No. FAS 157-2, (“FSP FAS 157-2”), which delayed the effective date of SFAS 157 for all nonfinancial

assets and nonfinancial liabilities, except those that are recognized or disclosed at fair value in the financial statements on a recurring basis (at least

annually), to fiscal years beginning after November 15, 2008. We are presently evaluating the impact of the adoption of SFAS 157 for our nonfinancial

assets and nonfinancial liabilities and do not believe it will have a material effect on our consolidated financial statements.

In March 2008, the FASB issued Statement of Financial Accounting Standards No. 161,

Disclosures About Derivative Instruments and Hedging Activities —

an amendment of FASB Statement No. 133

(“SFAS 161”). SFAS 161 expands the disclosure requirements in SFAS 133 about an entity’s derivative instruments

and hedging activities. This statement will be effective for Nordstrom as of the beginning of fiscal year 2009. We do not believe the adoption of SFAS 161

will have a material impact on our consolidated financial statements.

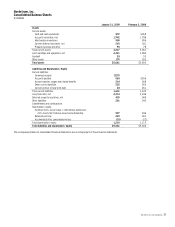

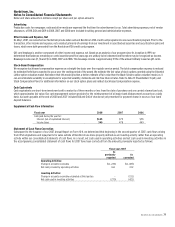

NOTE 2: ACCOUNTS RECEIVABLE

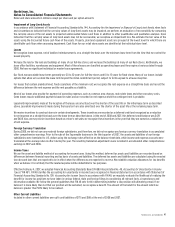

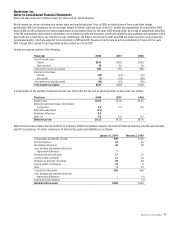

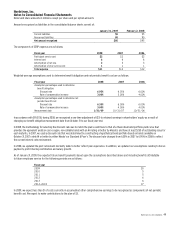

The components of accounts receivable are as follows:

January 31, 2009 February 2, 2008

Trade receivables:

Unrestricted $14 $18

Restricted 2,005 1,760

Allowance for doubtful accounts (138) (73)

Trade receivables, net 1,881 1,705

Other 61 83

Accounts receivable, net $1,942 $1,788

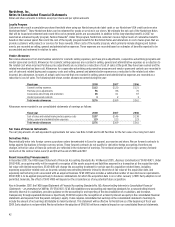

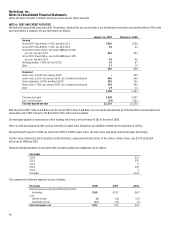

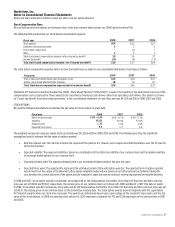

The following table summarizes the restricted trade receivables:

January 31, 2009 February 2, 2008

Private label card receivables $636 $630

Nordstrom VISA credit card receivables 1,369 1,130

Restricted trade receivables $2,005 $1,760

The restricted trade receivables secure our Series 2007-1 Notes, the Series 2007-2 Notes and our two variable funding notes. The restricted trade

receivables relate to substantially all of our Nordstrom private label card receivables and our Nordstrom VISA credit card receivables.

The unrestricted trade receivables consist primarily of the remaining portion of our Nordstrom private label and Nordstrom VISA credit card

receivables and accrued finance charges not yet allocated to customer accounts.

Other accounts receivable consist primarily of credit card receivables due from third-party financial institutions and vendor claims.