Nordstrom 1999 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

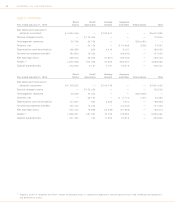

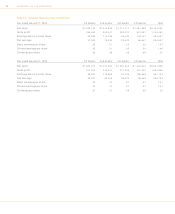

NORDSTROM, INC. AND SUBSIDIARIES

38

Note 1: Summary of Significant Accounting Policies

The Company: Nordstrom, Inc. is a fashion specialty

retailer offering a wide selection of high-quality apparel,

shoes and accessories for women, men and children,

principally through 71 large specialty stores and 28 clear-

ance stores.All of the Company’s stores are located in the

United States, with approximately 34% of its retail square

footage located in the state of California.

The Company purchases a significant percentage of its

merchandise from foreign countries, principally in the

Far East. An event causing a disruption in imports from

the Far East could have a material adverse impact on the

Company’s operations. In connection with the purchase

of foreign merchandise, the Company has outstanding

letters of credit totaling $60,038 at January 31, 2000.

On November 1, 1999 the Company established a sub-

sidiary to operate its Internet commerce and catalog busi-

nesses, N ORD STROM .com LLC . The Company contributed

certain assets and liabilities associated with its Internet

commerce and catalog businesses, and $10 million in cash.

Funds associated with Benchmark Capital and Madrona

Investment Group collectively contributed $16 million in

cash to the new entity. At January 31, 2000 the Company

owns approximately 81.4% of NORD STROM .com LLC, with

Benchmark Capital and Madrona Investment Group

holding the remaining minority interest. The minority

interest holders have the right to put their shares of

NORD STROM .com LLC to the Company at a multiple of

their original investment in the event that certain events

do not occur. This put right will expire if the Company

provides additional funding to N O RD ST RO M .com LLC prior

to September 2002.

Basis of Presentation: The consolidated financial state-

ments include the accounts of Nordstrom, Inc. and

its subsidiaries, the most significant of which are

Nordstrom Credit, Inc., Nordstrom National Credit Bank

and N ORD STRO M.com LLC . All significant intercompany

transactions and balances are eliminated in consolidation.

The presentation of these financial statements in con-

formity with generally accepted accounting principles

requires management to make estimates and judgments

that affect the reported amounts of assets, liabilities,

revenues and expenses. Actual results could differ from

those estimates.

Prior to 1999, the Company did not record sales returns

on the accrual basis of accounting because the difference

between the cash and accrual basis of accounting was not

material. In 1999, the Company began accruing sales

returns.Accordingly, the Company recorded the cumula-

tive effect of this change on prior periods, which resulted

in an increase in current assets of $9,840, an increase

in current liabilities of $25,948 and a corresponding

decrease in retained earnings of $16,108 as of February 1,

1997. Because the effects of this change were insignifi-

cant in 1997 and 1998, the Company recorded such

amounts in 1999 as a reduction in net income of $1,313,

or $.01 per share.

Notes to Consolidated

Financial Statements

Dollars in thousands except per share amounts