Nokia 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.81

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

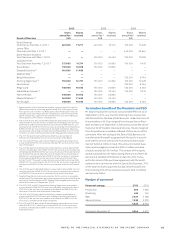

closing, the agreed transaction price of EUR . billion was

increased by approximately EUR million as a result of the

estimated adjustments made for net working capital and cash

earnings. However this adjustment is based on an estimate

which will be fi nalized when the fi nal cash earnings and net

working capital numbers are expected to be available during

the second quarter .

Nokia expects to book a gain on sale of approximately EUR

. billion from the transaction. As a result of the gain, Nokia

expects to record tax expenses of approximately EUR

million.

Additionally, as is customary for transactions of this size,

scale and complexity, Nokia and Microsoft made certain

adjustments to the scope of the assets originally planned to

transfer. These adjustments have no impact on the mate-

rial deal terms of the transaction and Nokia will be materially

compensated for any retained liabilities.

In India, our manufacturing facility remains part of Nokia

following the closing of the transaction. Nokia and Microsoft

have entered into a service agreement whereby Nokia would

produce mobile devices for Microsoft for a limited time. In

Korea, Nokia and Microsoft agreed to exclude the Masan

facility from the scope of the transaction and Nokia is taking

steps to close the facility, which employs approximately

people. Altogether, and accounting for these adjustments,

approximately employees transferred to Microsoft at

the closing.

The EUR . billion convertible bonds issued by Nokia to

Microsoft following the announcement of the transaction have

been redeemed and netted against the deal proceeds by the

amount of principal and accrued interest.