Nokia 2003 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2003 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

36. Differences between International Accounting Standards and U.S. Generally Accepted

Accounting Principles (Continued)

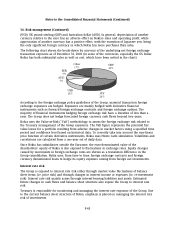

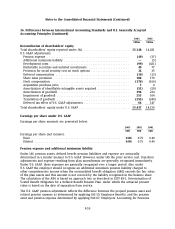

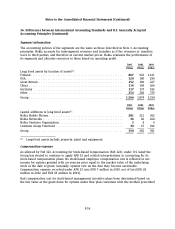

2003 2002

EURm EURm

Reconciliation of shareholders’ equity

Total shareholders’ equity reported under IAS ............................ 15,148 14,281

U.S. GAAP adjustments:

Pension expense ................................................. (49) (37)

Additional minimum liability ....................................... —(5)

Development costs ................................................ (99) (421)

Marketable securities and unlisted investments ......................... 49 77

Provision for social security cost on stock options ....................... 14 35

Deferred compensation ............................................ (10) (13)

Share issue premium .............................................. 186 179

Stock compensation ............................................... (176) (166)

Acquisition purchase price ......................................... 34

Amortization of identifiable intangible assets acquired ................... (51) (29)

Amortization of goodwill ........................................... 396 234

Impairment of goodwill ........................................... 255 104

Translation of goodwill ............................................ (293) (240)

Deferred tax effect of U.S. GAAP adjustments ........................... 64 147

Total shareholders’ equity under U.S. GAAP .............................. 15,437 14,150

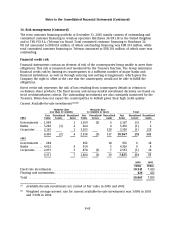

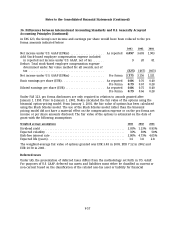

Earnings per share under U.S. GAAP

Earnings per share amounts are presented below:

2003 2002 2001

EUR EUR EUR

Earnings per share (net income):

Basic ...................................................... 0.86 0.76 0.40

Diluted .................................................... 0.86 0.75 0.40

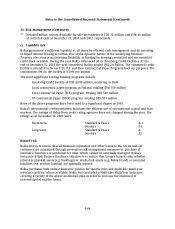

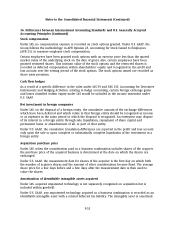

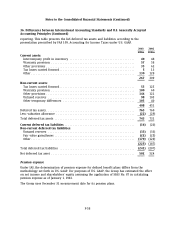

Pension expense and additional minimum liability

Under IAS, pension assets, defined benefit pension liabilities and expense are actuarially

determined in a similar manner to U.S. GAAP. However, under IAS the prior service cost, transition

adjustments and expense resulting from plan amendments are generally recognized immediately.

Under U.S. GAAP, these expenses are generally recognized over a longer period. Also, under

U.S. GAAP the employer should recognize an additional minimum pension liability charged to

other comprehensive income when the accumulated benefit obligation (ABO) exceeds the fair value

of the plan assets and this amount is not covered by the liability recognized in the balance sheet.

The calculation of the ABO is based on approach two as described in EITF 88-1, Determination of

Vested Benefit Obligation for a Defined Benefit Pension Plan, under which the actuarial present

value is based on the date of separation from service.

The U.S. GAAP pension adjustment reflects the difference between the prepaid pension asset and

related pension expense as determined by applying IAS 19, Employee Benefits, and the pension

asset and pension expense determined by applying FAS 87, Employers’ Accounting for Pensions.

F-50