Netgear 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Netgear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

advantage of complex applications, advanced communication capabilities and rich multimedia content, users are

upgrading their Internet connections by deploying high-speed broadband access technologies. Users also seek the

convenience and flexibility of operating their PCs, laptops and related computing devices in a more mobile, or

wireless, manner. Finally, as the usage of networks, including the Internet, has increased, users have become much

more focused on the security of their connections and the protection of the data within their networks.

Small business and home users demand a complete set of wired and wireless networking and broadband

solutions that are tailored to their specific needs and budgets and also incorporate the latest networking technologies.

These users require the continual introduction of new and refined products. Small business and home users often lack

extensive IT resources and technical knowledge and therefore demand ‘plug-and-play’ or easy-to-install and use

solutions. These users seek reliable products that require little or no maintenance, and are supported by effective

technical support and customer service. We believe that these users also prefer the convenience of obtaining a

networking solution from a single company with whom they are familiar; as these users expand their networks, they

tend to be loyal purchasers of that brand. In addition, purchasing decisions of users in the small business and home

markets are also driven by the affordability of networking products. To provide reliable, easy-to-use products at an

attractive price, we believe a successful supplier must have a company-wide focus on the unique requirements of

these markets and the operational discipline and cost-efficient company infrastructure and processes that allow for

efficient product development, manufacturing and distribution.

Sales Channels

We sell our products through multiple sales channels worldwide, including traditional retailers, online retailers,

wholesale distributors, DMRs, VARs, and broadband service providers.

Retailers.

Our retail channel primarily supplies products that are sold into the home market. We sell directly to,

or enter into consignment arrangements with, a number of our traditional retailers. The remaining traditional retailers,

as well as our online retailers, are fulfilled through wholesale distributors, the largest of which are Ingram Micro, Inc.

and Tech Data Corporation. We work directly with our retail channels on market development activities, such as co-

advertising, in-store promotions and demonstrations, instant rebate programs, event sponsorship and sales associate

training, as well as establishing “store within a store” websites and banner advertising.

DMRs and VARs. We primarily sell into the small business market through an extensive network of DMRs and

VARs. Our DMRs include companies such as CDW and Insight. VARs include our network of registered Powershift

Partners, or resellers who achieve prescribed quarterly sales goals and as a result may receive sales incentives,

marketing support and other program benefits from us. Our products are also resold by a large number of smaller

VARs whose sales are not large enough to qualify them for our Powershift Partner program. Our DMRs and VARs

generally purchase our products through our wholesale distributors, primarily Ingram Micro, Inc. and Tech Data

Corporation.

Broadband Service Providers. We also supply our products directly to broadband service providers in the

United States and internationally, who distribute our products to their small business and home subscribers.

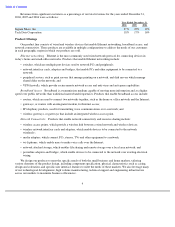

We derive the majority of our net revenue from international sales. International sales as a percentage of net

revenue grew from 56% in 2005 to 62% in 2006. Sales in Europe, Middle-East and Africa, or EMEA, grew from

$200.0 million in 2005 to $298.2 million in 2006, representing an increase of approximately 49% during that period.

We continue to penetrate new markets such as Brazil, Eastern Europe, India, and the Middle-East. The table below

sets forth our net revenue by major geographic region.

3

Year Ended December 31,

Percentage

Percentage

2004

Change

2005

Change

2006

(In thousands, except percentage data)

United States

$

186,836

7

%

$

199,208

11

%

$

220,440

EMEA

159,615

25

%

199,951

49

%

298,234

Asia Pacific and rest of world

36,688

38

%

50,451

9

%

54,896

Total

$

383,139

17

%

$

449,610

28

%

$

573,570