Napa Auto Parts 2014 Annual Report Download

Download and view the complete annual report

Please find the complete 2014 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2014 ANNUAL REPORT

GENUINE

PARTS

COMPANY

Table of contents

-

Page 1

GENUINE PARTS COMPANY 201 4 ANNUAL REPORT -

Page 2

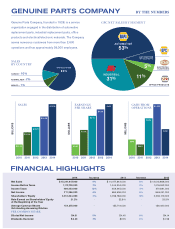

FINANCIAL HISTORY YEAR NET SALES INCOME BEFORE INCOME TAXES INCOME TAXES 87 YEARS OF GROWTH NET INCOME TOTAL EQUITY END OF YEAR...2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 $ 75,129 227,978 339,...Financial information as reported in the Company's annual reports (includes discontinued operations... -

Page 3

... in the distribution of automotive replacement parts, industrial replacement parts, ofï¬ce products and electrical/electronic materials. The Company serves numerous customers from more than 2,600 operations and has approximately 39,000 employees. AUTOMOTIVE BY THE NUMBERS GPC NET SALES BY SEGMENT... -

Page 4

... increase for the year. Our core sales were up 6%, while the 2013 acquisition of the Australasian business and two small automotive SHARE REPURCHASES We repurchased approximately 1.1 million shares of our Company stock in 2014, and we continue to view this as a good use of our cash. As of December... -

Page 5

DIVIDENDS & SHAREHOLDER RETURN The Company has paid a cash dividend to shareholders every year since going public in 1948, and on February 16, 2015 the Board of Directors raised the cash dividend payable April 1, 2015 to an annual rate of $2.46 per share, up 7% from $2.30 in 2014. $1.64 $1.56 $1.46 ... -

Page 6

..., production supplies, specialty wire and cable and custom-engineered value added fabricated parts to more than 20,000 customers. Markets include original equipment manufacturers, motor repair shops and a broad variety of industrial assembly and specialty wire and cable markets in North America... -

Page 7

... the fiscal year ended December 31, 2014 ' Or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 1-5690 GENUINE PARTS COMPANY (Exact name of registrant as specified in its charter) Georgia (State or... -

Page 8

PART I. ITEM 1. BUSINESS. Genuine Parts Company, a Georgia corporation incorporated on May 7, 1928, is a service organization engaged in the distribution of automotive replacement parts, industrial replacement parts, office products and electrical/electronic materials through our four operating ... -

Page 9

... replacement parts and accessories for automobiles and trucks. NAPA Canada/UAP employs approximately 3,900 people and operates a network of 12 distribution centers supplying approximately 594 NAPA stores and 107 Traction wholesalers. The NAPA stores and Traction wholesalers are significant suppliers... -

Page 10

... ("jobbers") to return certain merchandise on a scheduled basis. The Company offers its NAPA AUTO PARTS store customers various management aids, marketing aids and service on topics such as inventory control, cost analysis, accounting procedures, group insurance and retirement benefit plans, as well... -

Page 11

... automation, hose, hydraulic and pneumatic components, industrial supplies and material handling products to MRO (maintenance, repair and operation) and OEM (original equipment manufacturer) customers throughout the United States, Canada and Mexico. In Canada, industrial parts are distributed by... -

Page 12

...The service centers provide hydraulic, hose and mechanical repairs for customers. Approximately 38% of 2014 total industrial product purchases were made from 10 major suppliers. Sales are generated from the Industrial Parts Group's branches located in 49 states, Puerto Rico, nine provinces in Canada... -

Page 13

... Financial Statements beginning on page F-1. Competition. The industrial parts distribution business is highly competitive. The Industrial Parts Group competes with other distributors specializing in the distribution of such items, general line distributors and others who provide similar services... -

Page 14

... Group provides distribution services to OEM's, motor repair shops, specialty wire and cable users and a broad variety of industrial assembly markets. EIS actively utilizes its e-commerce Internet site to present its products to customers while allowing these on-line visitors to conveniently... -

Page 15

... Group's integrated supply programs are a part of the marketing strategy, as a greater number of customers - especially national accounts - are given the opportunity to participate in this low-cost, high-service capability. EIS has developed AIMSâ„¢ (Advanced Inventory Management Solutions System... -

Page 16

... earnings, including the introduction of new and expanded product lines, strategic acquisitions, geographic expansion (including through acquisitions), sales to new markets, enhanced customer marketing programs and a variety of gross margin and cost savings initiatives. If we are unable to implement... -

Page 17

... we do business. The sale of automotive and industrial parts, office products and electrical materials is highly competitive and impacted by many factors, including name recognition, product availability, customer service, changing customer preferences, store location, and pricing pressures. Because... -

Page 18

... automotive parts is highly competitive and subjects us to a wide variety of competitors. We compete primarily with national and regional auto parts chains, independently owned regional and local automotive parts and accessories stores, automobile dealers that supply manufacturer replacement parts... -

Page 19

...Not applicable. ITEM 2. PROPERTIES. The Company's headquarters and Automotive Parts Group headquarters are located in two office buildings owned by the Company in Atlanta, Georgia. The Company's Automotive Parts Group currently operates 60 NAPA Distribution Centers in the United States distributed... -

Page 20

...Company's Industrial Parts Group, operating through Motion and Motion Canada, operates 15 distribution centers, 39 service centers and 523 branches. Approximately 90% of these locations are operated in leased facilities. The Company's Office Products Group operates 39 facilities in the United States... -

Page 21

... SECURITIES. Market Information Regarding Common Stock The Company's common stock is traded on the New York Stock Exchange under the ticker symbol "GPC". The following table sets forth the high and low sales prices for the common stock per quarter as reported on the New York Stock Exchange and... -

Page 22

... 100 75 50 25 0 Genuine Parts Company S&P 500 Peer Index DOLLARS 2009 2010 2011 2012 2013 2014 Genuine Parts Company, S&P 500 Index and peer group composite index Cumulative Total Shareholder Return $ at Fiscal Year End 2009 2010 2011 2012 2013 2014 Genuine Parts Company S&P 500 Peer Index... -

Page 23

...information about the purchases of shares of the Company's common stock during the three month period ended December 31, 2014: Total Number of Shares Purchased(1) Average Price Paid per Share Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs(2) Maximum Number of Shares... -

Page 24

...807,061 $ 6,202,774 $ 5,788,227 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. OVERVIEW Genuine Parts Company is a service organization engaged in the distribution of automotive parts, industrial parts, office products and electrical/electronic materials. We... -

Page 25

...expanded product lines, geographic expansion, sales to new markets, enhanced customer marketing programs and a variety of gross margin and cost savings initiatives. We discuss these initiatives further below. With regard to the December 31, 2014 consolidated balance sheet, the Company's cash balance... -

Page 26

... the ongoing diversification of product and customer portfolios, market share gains and acquisitions to further improve the Office business in 2015. Net sales for Office were $1.6 billion in 2013, a 3% decrease in sales from 2012. The industry-wide weakness in office products consumption, driven by... -

Page 27

... the 100% company owned store model at GPC Asia Pacific. In 2014 and 2013, the Industrial, Office and Electrical/Electronic business segments experienced slight vendor price increases. In 2012, only the Industrial and Office business segments experienced vendor price increases. In any year where we... -

Page 28

... in volume incentives for the year. These items were partially offset by effective cost control measures. Office Group Office's operating margin decreased to 7.4% in 2014, down from 7.5% in 2013, primarily related to the lower operating margin generated by new business with a large primary customer... -

Page 29

... sales compared to 5.0% of net sales in 2012. FINANCIAL CONDITION Our cash balance of $138 million at December 31, 2014 compares to our cash balance of $197 million at December 31, 2013. The Company's accounts receivable balance at December 31, 2014 increased by approximately 12% from the prior year... -

Page 30

..., 2014 and 2013. Currently, we believe that our cash on hand and available short-term and long-term sources of capital are sufficient to fund the Company's operations, including working capital requirements, scheduled debt payments, interest payments, capital expenditures, benefit plan contributions... -

Page 31

...Our purchase orders are based on our current distribution needs and are fulfilled by our vendors within short time horizons. The Company does not have significant agreements for the purchase of inventory or other goods specifying minimum quantities or set prices that exceed our expected requirements... -

Page 32

... required for 2015 and future years will depend on a number of unpredictable factors including the market performance of the plans' assets and future changes in interest rates that affect the actuarial measurement of the plans' obligations. Share Repurchases In 2014, the Company repurchased... -

Page 33

... year with many of its vendors that provide for inventory purchase incentives. Generally, the Company earns inventory purchase incentives upon achieving specified volume purchasing levels or other criteria. The Company accrues for the receipt of these incentives as part of its inventory cost based... -

Page 34

... cash flow matching analysis, we selected a weighted average discount rate for the plans of 4.26% at December 31, 2014. Net periodic benefit (income) cost for our defined benefit pension plans was ($9.6) million, $51.1 million and $26.8 million for the years ended December 31, 2014, 2013 and 2012... -

Page 35

... amounts reported in the interim condensed consolidated financial statements. Specifically, the Company makes estimates and assumptions in its interim condensed consolidated financial statements for inventory adjustments, the accrual of bad debts, customer sales returns and volume incentives earned... -

Page 36

... by reference to the "Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting", which is set forth in a separate section of this report. See "Index to Consolidated Financial Statements and Financial Statement Schedules" beginning on page F-1. Changes... -

Page 37

... Operating Officer of S.P. Richards Company from 2004 to 2007 and was Executive Vice President-Sales and Marketing in 2003, the year he joined the Company. Carol B. Yancey, age 51, was appointed Executive Vice President, Chief Financial Officer and Corporate Secretary of the Company in March 2013... -

Page 38

...-Term Incentive Plan (4) Genuine Parts Company Director's Deferred Compensation Plan, as amended (5) All of these shares are available for issuance pursuant to grants of full-value stock awards. ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. Information required... -

Page 39

... Genuine Parts Company and subsidiaries are included in this Annual Report on Form 10-K. See, also, the Index to Consolidated Financial Statements on Page F-1. Report of independent registered public accounting firm on internal control over financial reporting Report of independent registered public... -

Page 40

... No. 8 to the Genuine Parts Company Tax-Deferred Savings Plan, dated December 7, 2012, effective December 7, 2012. (Incorporated herein by reference from the Company's Annual Report on Form 10-K, dated February 26, 2013.) The Genuine Parts Company Original Deferred Compensation Plan, as amended and... -

Page 41

... 29, 2008.) Genuine Parts Company Stock Appreciation Rights Agreement. (Incorporated herein by reference from the Company's Annual Report on Form 10-K, dated February 26, 2013.) Form of Executive Officer Change in Control Agreement. * Indicates management contracts and compensatory plans and... -

Page 42

... requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized. GENUINE PARTS COMPANY /s/ Thomas C. Gallagher Thomas C. Gallagher Chairman and Chief Executive Officer... -

Page 43

...requirements of the Securities Exchange Act of 1934, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated. /s/ Thomas C. Gallagher Thomas C. Gallagher Director Chairman and Chief Executive Officer (Principal Executive... -

Page 44

-

Page 45

... SCHEDULE Page Report of Management ...Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting . . Report of Independent Registered Public Accounting Firm on the Financial Statements ...Consolidated Balance Sheets as of December 31, 2014 and 2013... -

Page 46

... the policies or procedures may deteriorate. The Company's management, including our Chief Executive Officer and Chief Financial Officer, assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2014. In making this assessment, it used the criteria set... -

Page 47

... of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting The Board of Directors and Shareholders of Genuine Parts Company and Subsidiaries We have audited Genuine Parts Company and Subsidiaries' internal control over financial reporting as of December 31, 2014... -

Page 48

... material respects the information set forth therein. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Genuine Parts Company and Subsidiaries' internal control over financial reporting as of December 31, 2014, based on criteria... -

Page 49

Genuine Parts Company and Subsidiaries Consolidated Balance Sheets December 31 2014 2013 (In Thousands, Except Share Data and per Share Amounts) Assets Current assets: Cash and cash equivalents ...Trade accounts receivable, net ...Merchandise inventories, net ...Prepaid expenses and other current ... -

Page 50

Genuine Parts Company and Subsidiaries Consolidated Statements of Income and Comprehensive Income Year Ended December 31 2014 2013 2012 (In Thousands, Except per Share Amounts) Net sales ...Cost of goods sold ...Gross margin ...Operating expenses: Selling, administrative, and other expenses ...... -

Page 51

... in Subsidiaries Retained Earnings Total Equity Balance at January 1, 2012 ...155,651,116 $155,651 $ - Net income ...- - - Other comprehensive loss, net of tax ...- - - Cash dividends declared, $1.98 per share ...- - - Stock options exercised, including tax benefit of $11,018 ...551,779 552 3,423... -

Page 52

...Excess tax benefits from share-based compensation ...Dividends paid ...Purchase of stock ...Net cash used in financing activities ...Effect of exchange rate changes on cash ...Net decrease in cash and cash equivalents ...Cash and cash equivalents at beginning of year ...Cash and cash equivalents at... -

Page 53

...to Consolidated Financial Statements December 31, 2014 1. Summary of Significant Accounting Policies Business Genuine Parts Company and all of its majority-owned subsidiaries (the Company) is a distributor of automotive replacement parts, industrial replacement parts, office products, and electrical... -

Page 54

... year with many of its vendors that provide for inventory purchase incentives. Generally, the Company earns inventory purchase incentives upon achieving specified volume purchasing levels or other criteria. The Company accrues for the receipt of these incentives as part of its inventory cost based... -

Page 55

... December 31 2014 2013 (In Thousands) Retirement benefit assets ...Deferred compensation benefits ...Investments ...Cash surrender value of life insurance policies ...Customer sales returns inventories ...Guarantees related to borrowings ...Other long-term prepayments and receivables ...Total other... -

Page 56

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 The guarantees related to borrowings are discussed further in the guarantees footnote. Self-Insurance The Company is self-insured for the majority of group health insurance costs. A ... -

Page 57

... years ended December 31, 2014, 2013, and 2012, respectively. Accounting for Legal Costs The Company's legal costs expected to be incurred in connection with loss contingencies are expensed as such costs are incurred. Share-Based Compensation The Company maintains various long-term incentive plans... -

Page 58

...required to cross-reference to other disclosures that provide additional details about those amounts. ASU 2013-02 does not change the current requirements for reporting net income or other comprehensive income in the financial statements. ASU 2013-02 is effective for the Company's interim and annual... -

Page 59

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 2. Goodwill and Other Intangible Assets The changes in the carrying amount of goodwill during the years ended December 31, 2014 and 2013 by reportable segment, as well as other ... -

Page 60

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 3. Credit Facilities The principal amounts of the Company's borrowings subject to variable rates totaled approximately $265,466,000 and $264,658,000 at December 31, 2014 and 2013, ... -

Page 61

...on the price of the Company's stock on the date of grant. The total fair value of shares vested during the years ended December 31, 2014, 2013, and 2012, was $13,800,000, $8,100,000, and $6,700,000, respectively. A summary of the Company's share-based compensation activity and related information is... -

Page 62

...444 165 (125) (64) 420 $62 87 53 77 $72 For the years ended December 31, 2014, 2013, and 2012 approximately $17,800,000, $12,900,000, and $11,000,000, respectively, of excess tax benefits was classified as a financing cash inflow. 6. Income Taxes Deferred income taxes reflect the net tax effect of... -

Page 63

... tax liabilities related to: Employee and retiree benefits ...Inventory ...Other intangible assets ...Property, plant, and equipment ...Other ......$1,044,304 $ 903,698 115,234 $1,018,932 2014 2013 (In Thousands) 2012 Current: Federal ...State ...Foreign ...Deferred ... $224,591 43,513 84,030... -

Page 64

... rate. During 2014, the Company settled certain transfer pricing methodologies with tax authorities, and on a consolidated basis, the difference, in related payments and refunds and the amount reflected in the tax reserves, was not material. During the years ended December 31, 2014, 2013, and 2012... -

Page 65

... December 31, 2014 and 2013 were: 2014 2013 (In Thousands) Changes in benefit obligation Benefit obligation at beginning of year ...Service cost ...Interest cost ...Plan participants' contributions ...Actuarial loss (gain) ...Foreign currency exchange rate changes ...Gross benefits paid ...Acquired... -

Page 66

... the pension benefit obligations for the plans at December 31, 2014 and 2013, were: 2014 2013 Weighted-average discount rate ...Rate of increase in future compensation levels ...Changes in plan assets for the years ended December 31, 2014 and 2013 were: 4.26% 5.10% 3.07% 3.04% 2014 2013 (In... -

Page 67

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 the pension plans' actuarially assumed long-term rates of return. The Company's investment strategy with respect to pension plan assets is to generate a return in excess of the passive ... -

Page 68

..., 2014 and 2013, respectively. Dividend payments received by the plan on Company stock totaled approximately $4,650,000 and $4,336,000 in 2014 and 2013, respectively. Fees paid during the year for services rendered by parties in interest were based on customary and reasonable rates for such services... -

Page 69

... 2024 ...Net periodic benefit (income) cost included the following components: 2014 2013 (In Thousands) 2012 $ 50,000 $ 87,000 95,000 103,000 111,000 118,000 692,000 Service cost ...Interest cost ...Expected return on plan assets ...Amortization of prior service credit ...Amortization of actuarial... -

Page 70

...Prior service credit ...Total ...The assumptions used in measuring the net periodic benefit (income) cost for the plans follow: 2014 2013 2012 $38,893 (566) $38,327 Weighted average discount rate ...Rate of increase in future compensation levels ...Expected long-term rate of return on plan assets... -

Page 71

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 marketing and promotional initiatives, pricing and selling activities, credit decisions, monitoring and maintaining appropriate inventories, and store hours. Separately, the Company ... -

Page 72

... comparable in line of business, size, operating performance, and financial condition to GPC Asia Pacific to develop a market multiple. For the income approach, the Company utilized GPC Asia Pacific's projected cash flows, an appropriate discount rate, and an expected long-term growth rate. For both... -

Page 73

..., one-time purchase accounting adjustments, interest expense on acquisition related debt, and any associated tax effects. Quaker City Motor Parts On May 1, 2012 the Company acquired Quaker City Motor Parts Co. ("Quaker City") for $343,000,000, net of cash acquired. Quaker City, headquartered in... -

Page 74

... Financial Statements - (Continued) December 31, 2014 annual revenues of approximately $300,000,000. Quaker City serves approximately 260 auto parts stores, of which approximately 140 are company-owned. The Company funded the acquisition with cash on hand and short-term borrowings under credit... -

Page 75

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 For management purposes, net sales by segment exclude the effect of certain discounts, incentives, and freight billed to customers. The line item "other" represents the net effect of the... -

Page 76

Genuine Parts Company and Subsidiaries Notes to Consolidated Financial Statements - (Continued) December 31, 2014 2014 2013 2012 (In Thousands) 2011 2010 Depreciation and amortization: Automotive ...$ Industrial ...Office products ...Electrical/electronic materials ...Corporate ...Intangible asset ... -

Page 77

Annual Report on Form 10-K Item 15(a) Financial Statement Schedule II - Valuation and Qualifying Accounts Genuine Parts Company and Subsidiaries Balance at Beginning of Period Charged to Costs and Expenses Balance at End of Period Deductions(1) Year ended December 31, 2012: Reserves and allowances... -

Page 78

... Consent of Independent Registered Public Accounting Firm. Certification signed by the Chief Executive Officer pursuant to SEC Rule 13a-14(a). Certification signed by the Chief Financial Officer pursuant to SEC Rule 13a-14(a). Statement of Chief Executive Officer of Genuine Parts Company pursuant to... -

Page 79

... 7, 2012 Description of Director Compensation. Genuine Parts Company 1999 Long-Term Incentive Plan, as amended and restated as of November 19, 2001. Genuine Parts Company 2006 Long-Term Incentive Plan, effective April 17, 2006. Amendment to the Genuine Parts Company 2006 Long-Term Incentive Plan... -

Page 80

.... SERVICES FINANCIERS UAP INC. WTC PARTS CANADA PIECES DE CAMION DE LA BEAUCE GPC GLOBAL SOURCING LIMITED GENUINE PARTS SOURCING (SHENZHEN) COMPANY LIMITED ALTROM CANADA CORP. EIS-GPC SERVICIOS de MEXICO, S. de R.L. de C.V. RIEBE'S AUTO PARTS, LLC AUTOPARTSPROS, LLC ADAMS AUTO PARTS, LLC MOTOR PARTS... -

Page 81

... and schedule of Genuine Parts Company and Subsidiaries and the effectiveness of internal control over financial reporting of Genuine Parts Company and Subsidiaries included in this Annual Report (Form 10-K) of Genuine Parts Company and Subsidiaries for the year ended December 31, 2014. /s/ Ernst... -

Page 82

... and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ Thomas C. Gallagher Thomas C. Gallagher Chairman and Chief Executive Officer Date... -

Page 83

...and report financial information; and b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. /s/ Carol B. Yancey Carol B. Yancey Executive Vice President and Chief Financial Officer... -

Page 84

... In connection with the Annual Report of Genuine Parts Company (the "Company") on Form 10-K for the year ended December 31, 2014 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Thomas C. Gallagher, Chairman and Chief Executive Officer, certify, pursuant to... -

Page 85

... with the Annual Report of Genuine Parts Company (the "Company") on Form 10-K for the year ended December 31, 2014 as filed with the Securities and Exchange Commission on the date hereof (the "Report"), I, Carol B. Yancey, Executive Vice President and Chief Financial Officer of the Company, certify... -

Page 86

... Chairman of the Board of Directors of UAP Inc. Gary P. Fayard Retired Chief Financial Officer of The Coca-Cola Company Thomas C. Gallagher Chairman and Chief Executive Officer George C. "Jack" Guynn Retired President and Chief Executive Officer of the Federal Reserve Bank of Atlanta John R. Holder... -

Page 87

...Chief Financial Officer Senior Vice President - Marketing Vice President - Supply Chain and Logistics Vice President - Retail Product Management and Merchandising Vice President - Wholesale Product Management Vice President - Finance Vice President - Store Operations Vice President - Human Resources... -

Page 88

... Executive General Manager - Logistics and Technology Craig Sandiford Executive General Manager - Human Resources Mark B. Sookias Executive General Manager - Motospecs Julian A. Buckley Chief Financial Officer Marc Anderle General Manager - Business Systems EIS, Inc. (Atlanta, GA) Robert W. Thomas... -

Page 89

... - Finance James F. Williams Vice President - Corporate Purchasing and Supplier Relations Michael D. Harper Treasurer Dermot R. Strong President - Motion Canada S. P. Richards Company (Atlanta, GA) C. Wayne Beacham Chairman and Chief Executive Officer Richard T. Toppin President and Chief Operating... -

Page 90

® -

Page 91

SHAREHOLDERS' INFORMATION GENUINE PARTS COMPANY STOCK LISTING Genuine Parts Company's common stock is traded on the New York Stock Exchange under the symbol "GPC". DIVIDEND REINVESTMENT PLAN Shareholders can build their investments in Genuine Parts Company through a low-cost plan for automatically... -

Page 92

GENUINE PARTS COMPANY 2999 CIRCLE 75 PARKWAY ATLANTA, GA 30339 770.953.1700 www.genpt.com