Napa Auto Parts 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Napa Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Genuine Parts Company

2002 Annual Report

75 Years of Progress

Table of contents

-

Page 1

75 Years of Progress Genuine Parts Company 2002 Annual Report -

Page 2

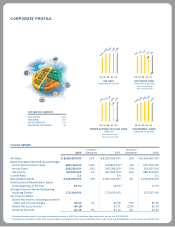

CORPORATE PROFILE 7, 95 1 8, 37 0 8, 22 1 8, 25 9 98 99 00 01 02 98 99 00 01 02 net sales IN MILLIONS OF DOLLARS net income (loss) IN MILLIONS OF DOLLARS After unusual charges After cumulative effect net sales by segment AUTOMOTIVE INDUSTRIAL OFFICE PRODUCTS ELECTRICAL/ELECTRONIC 52% 27% 17% ... -

Page 3

... customers from more than 1,850 operations and has approximately 30,700 employees. Corporate Profile Segments At A Glance A Letter to Our Shareholders Automotive Parts Group Industrial Parts Group Office Products Group Selected Financial Data 1 2 4 7 10 12 16 Segment Data Report of Management... -

Page 4

... Industrial Supplies Service Capabilities 24/7/365 Product Delivery Application and Design Repair and Fabrication Inventory Management Logistics Quality (ISO) Processes Extensive Training Programs Technology Web-based e-business format Real-time access to all transactions Knowledge Database Market... -

Page 5

... centers in the United States and Canada. S.P. Richards Company sells its products through a network of over 7,000 independent and national business products resellers. Web site: sprichards.com Major Products Filing Supplies Office Furniture Office Machines Computer Supplies & Accessories... -

Page 6

... to report for Genuine Parts Company. First, we can report that both sales and earnings increased for the year. The increases were modest but returned us to the pattern of improving our results as we have done consistently through the years. Secondly, we can report that we remain financially strong... -

Page 7

... time. Dividends 2002 was our 46th consecutive year of dividend increases, with dividends of $1.16 per share. We are proud of our dividend record, and are pleased that on February 17, 2003, the Board of Directors increased the cash dividend payable April 1, 2003 to an annual rate of $1.18 per share... -

Page 8

... market share gains as we look ahead. We hope you will take time to review the remainder of the Annual Report. Our plans and programs for our four business groups are described in some detail in these pages. In closing, we thank our outstanding group of customers, suppliers and the entire GPC team... -

Page 9

..., within the Automotive Group, we operate Johnson Industries, one of the nation's largest independent distributors of ACDelco, Motorcraft and other aftermarket parts, equipment and supplies. Our market reach extends throughout North America with enterprises in Canada and Mexico. UAP Inc., which we... -

Page 10

... to do business with our stores, increase customer loyalty, and help our stores build significant new sales. Enhanced Store Inventories Today's vehicles utilize more specialized and unique parts than ever before. The ability to effectively track and assess NAPA AUTO PARTS stores' inventories to... -

Page 11

...business. In 2003, we will continue to advertise on both a national and local level to reinforce brand awareness and NAPA as the source for the highest quality automotive parts and services - ultimately driving existing and new customers into NAPA AUTO PARTS stores. While employing a variety of high... -

Page 12

... customer's needs through a total of 504 locations that include 466 branches, 9 distribution centers and 29 service centers throughout North America. Headquartered in Birmingham, Alabama, Motion Industries began as a business enterprise in 1946 and has grown through acquisition and internal branch... -

Page 13

... service and efficiency through a centralized operating system with real-time access to all transactions. In recent years, traditional EDI and customized e-procurement programs for customers and suppliers have been enhanced with a web-based procurement site to simplify the automated parts ordering... -

Page 14

OFFICE PRODUCTS GROUP S.P. Richards Company, headquartered in Atlanta, Georgia, is one of North America's leading business products wholesalers. The Company distributes over 30,000 items to more than 7,000 resellers in the United States and Canada from a network of 43 distribution centers. Major ... -

Page 15

... Management System (PkMS). its offering of marketing tools with the their customers' business product needs, In 2002, PkMS was implemented in introduction of a Canadian version of resellers today need an expanded prodseveral distribution centers and the the Select Catalog, a consumer sale priced... -

Page 16

... repair markets throughout the United States and Mexico. With headquarters in Atlanta, Georgia, EIS provides world-class materials from manufacturers with superior products and services to the Electrical OEM, Electrical Repair, Electronic Assembly, and Printed Circuit Board markets. EIS distributes... -

Page 17

... into several new large multi-year contracts in both our Electrical and Electronic markets. In looking for new sales growth opportunities, EIS participates with several major product line vendors in targeted programs that share the cost to introduce and expand new product applications by dedicating... -

Page 18

... and other expenses. market and dividend information High and Low Sales Price and Dividends per Share of Common Shares Traded on the New York Stock Exchange Sales Price of Common Shares Quarter First Second Third Fourth High $38.08 37.80 33.63 32.00 2002 Low $33.92 34.17 27.64 29.48 High $28.45 31... -

Page 19

... and amortization Capital expenditures: Automotive Industrial Office products Electrical/electronic materials Corporate Total capital expenditures Net sales: United States Canada Mexico Other Total net sales Net long-lived assets: United States Canada Mexico Total net long-lived assets (59,640) (33... -

Page 20

... by cost reductions associated with distribution center closings and other headcount reductions. Industrial operating margins increased from 7.7% in 2001 to 7.9% in 2002, reflecting cost and headcount reductions resulting from branch closings. Office Products margins decreased slightly from 10.3% in... -

Page 21

... over 1%, generally consistent with the sales decrease. Operating profit as a percentage of sales was 8.5% in 2001 as compared to 9.0% in 2000. These results are reflective of the overall economic conditions in 2001 and the fixed costs inherent in distribution. Automotive operating margins decreased... -

Page 22

...'s new store acquisitions, and favorable buying opportunities in the Industrial and Office Groups, inventory increased 13.5% as compared to December 31, 2001. In connection with the Company's continuing focus on negotiating extended payment terms with vendors, accounts payable at December 31, 2002... -

Page 23

... nine years, are at fixed rates of interest. A 1% adverse change in interest rates would not have a material adverse impact on future earnings and cash flows of the Company. The Company has certain commercial commitments related to affiliate borrowing guarantees and residual values under operating... -

Page 24

...Generally, the Company earns inventory purchase rebates upon achieving specified volume purchasing levels and advertising allowances upon fulfilling its obligations related to cooperative advertising programs. The Company accrues for the receipt of inventory purchase rebates as part of its inventory... -

Page 25

...general economic conditions, the growth rate of the market for the Company's products and services, the ability to maintain favorable supplier arrangements and relationships, competitive product and pricing pressures, the effectiveness of the Company's promotional, marketing and advertising programs... -

Page 26

... and the internal audit function with representatives of financial management and with representatives from Ernst & Young LLP. JERRY W. NIX Executive Vice President Finance and Chief Financial Officer February 4, 2003 report of independent auditors Board of Directors Genuine Parts Company We have... -

Page 27

...: Trade accounts payable Current portion of long-term debt and other borrowings Accrued compensation Other accrued expenses Dividends payable Income taxes payable Total Current Liabilities Long-Term Debt Deferred Income Taxes Minority Interests in Subsidiaries Shareholders' Equity: Preferred Stock... -

Page 28

consolidated statements of income (in thousands, except per share data) Year ended December 31, 2002 $ 8,258,927 5,704,749 2,554,...747 - 646,750 261,427 385,323 - $ 385,323 Net sales Cost of goods sold Selling, administrative and other expenses Facility consolidation and impairment charges Income ... -

Page 29

... income taxes of $2,686 Comprehensive loss Cash dividends declared, $1.16 per share Stock options exercised, including tax benefit Purchase of stock Stock issued in connection with acquisition Balance at December 31, 2002 177,275,602 - - $177,276 - - $ - - - $ (6,857) - (6,184) $2,007,098 385... -

Page 30

... tax benefit of stock options exercised Changes in operating assets and liabilities: Trade accounts receivable Merchandise inventories Trade accounts payable Other, net Net cash provided by operating activities Investing activities Purchases of property, plant and equipment Proceeds from sale of... -

Page 31

...Generally, the Company earns inventory purchase rebates upon achieving specified volume purchasing levels and advertising allowances upon fulfilling its obligations related to cooperative advertising programs. The Company accrues for the receipt of inventory purchase rebates as part of its inventory... -

Page 32

... of derivative financial instruments has been determined based on quoted market prices. At December 31, 2002 and 2001, the carrying amount for variable rate long-term debt approximates fair market value since the interest rates on these instruments are reset periodically to current market rates. At... -

Page 33

...16"). EITF 02-16 addresses accounting and reporting issues related to how a reseller should account for cash consideration received from vendors. Generally, cash consideration received from vendors is presumed to be a reduction of the prices of the vendor's products or services and should, therefore... -

Page 34

... loss per share) as of January 1, 2002. This write-off was reported as a cumulative effect of a change in accounting principle in the Company's consolidated statement of income as of January 1, 2002. No tax benefits were recorded in connection with this goodwill impairment. For the year ended... -

Page 35

... cancelable on 30 days notice or due March 2003 Unsecured revolving lines of credit, CND$25,000,000, Banker's Acceptance rate plus .55%, due October 2002 Unsecured revolving lines of credit, CND$100,000,000, Banker's Acceptance rate plus .55%, due May 2003 Current portion of long-term debt and other... -

Page 36

... to key personnel for the purchase of the Company's stock at prices not less than the fair market value of the shares on the dates of grant. Most options may be exercised not earlier than twelve months nor later than ten years from the date of grant. Pro forma information regarding net income and... -

Page 37

... components of the Company's deferred tax assets and liabilities are as follows: (In Thousands) Deferred tax assets related to: Expenses not yet deducted for tax purposes Deferred tax liabilities related to: Employee and retiree benefits Inventory Property and equipment Other 2002 $ 87,256 104... -

Page 38

... used in accounting for the defined benefit plans and other postretirement plan are as follows: Pension Benefits Weighted-average discount rate Rate of increase in future compensation levels Expected long-term rate of return on assets Health care cost trend on covered charges 2002 6.75% 4.15... -

Page 39

... benefit obligation for health care benefits $(2,015) (206) $3,072 338 At December 31, 2002, the Company-sponsored pension plan held 1,619,480 shares of common stock of the Company with a market value of approximately $49,880,000. Dividend payments received by the plan on Company stock... -

Page 40

...- Human Resources Robert K. Reinkemyer Vice President- Operations Michael L. Swartz Vice President- Inventory and Procurement W. Larry Bevil Assistant Vice President- Information Systems CORPORATE OFFICERS Larry L. Prince Chairman of the Board of Directors and Chief Executive Officer Thomas... -

Page 41

...- North Central Division HORIZON (RENO, NV) Roger H. Woodward President and Chief Executive Officer S.P. RICHARDS CANADA (VANCOUVER) Roger H. Woodward Managing Director EIS, INC. (ATLANTA, GA) R. David James Chairman and Chief Executive Officer Robert W. Thomas President and Chief Operating Officer... -

Page 42

SHAREHOLDER INFORMATION Stock Listing Genuine Parts Company's common stock is traded on the New York Stock Exchange under the symbol "GPC." Stock Transfer Agent, Registrar of Stock and Dividend Disbursing Agent SunTrust Bank, Atlanta Post Office Box 4625 Atlanta, Georgia 30302-4625 (800) 568-3476 (... -

Page 43

... Net Income Shareholders' Equity End of Year $ 38,756 49,837 60,591... 1995 1996 1997 1998 1999 2000 2001 2002 $ 75,129 227,978 339,732 ...Financial Information As Reported In The Company's Annual Reports (includes discontinued operations) *Excludes unusual charges **Excludes cumulative ... -

Page 44

GENUINE PARTS COMPANY 2999 Circle 75 Parkway Atlanta, Georgia 30339 770.953.1700 www.genpt.com