MoneyGram 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

PART II

Item 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF

EQUITY SECURITIES

Our stock is traded on the New York Stock Exchange under the symbol MGI. Our Board of Directors declared and paid a quarterly cash dividend of $0.01 per

share of common stock in each of the third and fourth quarters of 2004. In addition, the Board of Directors declared a dividend of $0.01 per share of common

stock on February 17, 2005 to be paid on April 1, 2005 to stockholders of record on March 17, 2005. See "Management's Discussion and Analysis of

Financial Condition and Results of Operations — Stockholders' Equity" and Note 12 of the Notes to Consolidated Financial Statements. The terms of our

credit facility place restrictions on the payment of dividends. For a description of the restrictions, see Note 9 of the Notes to the Consolidated Financial

Statements. As of February 25, 2005, there were approximately 20,971 stockholders of record of our common stock.

Our separation from Viad Corp was completed on June 30, 2004 and our common stock began "regular-way trading" on the New York Stock Exchange on

July 1, 2004. Consequently, historical quarterly price information is not available for shares of our common stock for fiscal 2003 or for the quarterly periods

ended March 31, 2004 and June 30, 2004. The high and low sales prices for our common stock for the quarterly periods ended September 30, 2004 and

December 31, 2004 were as follows:

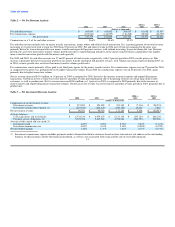

Third Quarter Fourth Quarter

Low High Low High

2004 $ 16.40 $ 22.75 $ 16.90 $ 21.52

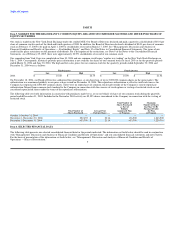

On November 18, 2004, our Board of Directors authorized the repurchase, at our discretion, of up to 2,000,000 common shares on the open market. The

authorization was announced publicly in our press release issued on November 18, 2004. This repurchase authorization is effective until such time as the

Company has repurchased 2,000,000 common shares. There were no repurchases of common stock made outside of the Company's current repurchase

authorization. MoneyGram common stock tendered to the Company in connection with the exercise of stock options or vesting of restricted stock are not

considered repurchased shares under the terms of the repurchase authorization.

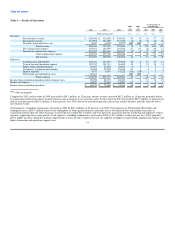

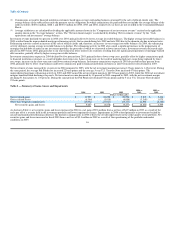

The following table sets forth information in connection with purchases made by us, or on our behalf, of shares of our common stock during the quarterly

period ended December 31, 2004. Included in the November 2004 activity are 85,955 shares surrendered to the Company in connection with the vesting of

restricted stock.

Total Number of Maximum

Shares Purchased Number of Shares

as Part of that May Yet Be

Publicly Purchased Under

Total Number of Average Price Announced Plan the Plan

Shares Purchased Paid per Share or Program or Program

October 1-October 31, 2004 — — — —

November 1-November 30, 2004 222,455 $ 20.16 136,500 1,863,500

December 1-December 31, 2004 633,799 $ 21.14 633,799 1,229,701

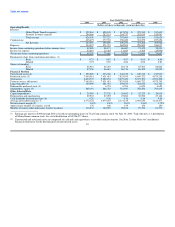

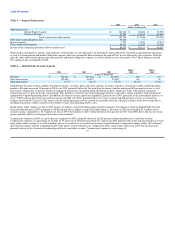

Item 6. SELECTED FINANCIAL DATA

The following table presents our selected consolidated financial data for the periods indicated. The information set forth below should be read in conjunction

with "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and notes thereto.

For the basis of presentation of the information set forth below, see "Management's Discussion and Analysis of Financial Condition and Results of

Operations — Basis of Presentation." 9