Mitsubishi 2000 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2000 Mitsubishi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Heart-Beat 21

9

will adopt new measures for evaluating managerial perfor-

mance to assist in the achievement of corporate reform tar-

gets. Heart-Beat 21 also encourages more rational business

assessment and decision making by promoting a common

awareness among all MMC group employees.

Heart-Beat 21 addresses four main areas that provide the

key to attaining the realistic growth-oriented volume and fi-

nancial targets set out in the new plan. These are managerial

reform, growth strategies for passenger car operations,

growth strategies for the commercial vehicle operations, and

corporate financial health.

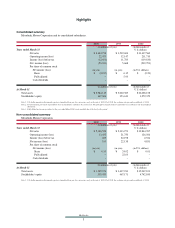

Heart-Beat 21's targets for fiscal 2000 include a mini-

mum sales volume of 2,000,000 units, with consolidated or-

dinary profit of ¥20 billion and net loss of ¥70 billion on

sales of ¥3,500 billion. A one-time charge of ¥140 billion to

cover postretirement benefit and other liabilities is expected

to result in a net loss of ¥70 billion.

For fiscal 2003, the final year of the Heart-Beat 21 plan,

the benefits of alliances with DaimlerChrysler and AB Volvo

and the aggressive introduction of new products that exploit

those benefits, are expected to contribute toward sales vol-

ume of 2,150,000 units, with consolidated ordinary profit of

¥100 billion and net profit of ¥50 billion on sales of ¥4,000

billion.

■Managerial reforms

MMC has introduced major reforms in its management struc-

ture that are designed to separate capital and executive man-

agement, to speed up the decision-making process, and to

promote accountability. The board of directors has been re-

duced in size from 36 to 10, with external directors given

more say. The Company has introduced an executive officer

system, to speed up implementation of management deci-

sions and to clarify authority and accountability in individual

operations.

MMC is currently pushing forward a number of mea-

sures designed to make it more market-oriented and to re-

structure the operations of the company itself and of group

companies. The latest round of changes incorporate elements

dubbed "Reform and Fighting Spirit" and "Giving Greater

Priority to Operational Autonomy" −the qualities consid-

ered essential at the current time for the company to achieve

these aims. The changes will result in a clearer delineation of

individual authority and responsibilities, will speed up the

decision-making process and will also help consolidate the

financial foundation and boost the competitiveness of indi-

vidual operations.

To realize the benefits of expanded economies of scale,

MMC has entered strategic alliances with DaimlerChrysler

(DC) and AB Volvo. Through the equity and operational ties

with these two companies, MMC will transform into a corpo-

ration that fully meets the international accounting and other

management standards due to be introduced into Japan in the

near future.

■Growth strategies; cars

The reforms completed under RM2001 together with the

newly formed alliances see the company well positioned to

start seeking value-adding growth. Heart-Beat 21 plots a

course driven by product strategies, by a further round of re-

structuring in the production organization in Japan, by on-

going cost reductions and by other strategic measures imple-

mented on a regional basis.

MMC will introduce attractive products that offer con-

sumers the full advantages of its revolutionary GDI engine,

CVT and other facets of compact car technology and that ac-

curately reflect market needs. MMC will also introduce

strategies to strengthen corporate and product brands.

The main thrust in the product drive will be the 2002 in-

troduction in Japan of a strategic world small car that clears

the voluntary fuel consumption standards due to be intro-

duced in Europe in 2008. To be developed using MMC com-

pact car technology and working in collaboration with

DaimlerChrysler, this new model will later be phased into

other world markets. The company will continue to introduce

attractive compact models tailored to specific needs and

tastes in other markets.

In Japan, MMC will strengthen its compact model line-