MetLife 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.MetLife, Inc.

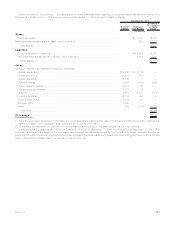

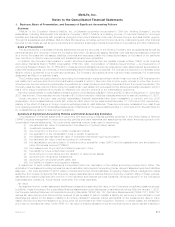

Notes to the Consolidated Financial Statements

1. Business, Basis of Presentation, and Summary of Significant Accounting Policies

Business

“MetLife” or the “Company” refers to MetLife, Inc., a Delaware corporation incorporated in 1999 (the “Holding Company”), and its

subsidiaries, including Metropolitan Life Insurance Company (“MLIC”). MetLife is a leading provider of individual insurance, employee

benefits and financial services with operations throughout the United States and the Latin America, Europe, and Asia Pacific regions.

Through its subsidiaries and affiliates, MetLife offers life insurance, annuities, auto and home insurance, retail banking and other financial

services to individuals, as well as group insurance and retirement & savings products and services to corporations and other institutions.

Basis of Presentation

The accompanying consolidated financial statements include the accounts of the Holding Company and its subsidiaries as well as

partnerships and joint ventures in which the Company has control. Closed block assets, liabilities, revenues and expenses are combined

on a line-by-line basis with the assets, liabilities, revenues and expenses outside the closed block based on the nature of the particular

item. See Note 9. Intercompany accounts and transactions have been eliminated.

In addition the Company has invested in certain structured transactions that are variable interest entities (“VIEs”) under Financial

Accounting Standards Board (“FASB”) Interpretation (“FIN”) No. 46(r), Consolidation of Variable Interest Entities — An Interpretation of

Accounting Research Bulletin No. 51 (“FIN 46(r)”). These structured transactions include reinsurance trusts, asset-backed securitizations,

trust preferred securities, joint ventures, limited partnerships and limited liability companies. The Company is required to consolidate those

VIEs for which it is deemed to be the primary beneficiary. The Company reconsiders whether it is the primary beneficiary for investments

designated as VIEs on a quarterly basis.

The Company uses the equity method of accounting for investments in equity securities in which it has more than a 20% interest and for

real estate joint ventures and other limited partnership interests in which it has more than a minor equity interest or more than a minor

influence over the joint venture’s or partnership’s operations, but does not have a controlling interest and is not the primary beneficiary. The

Company uses the cost method of accounting for investments in real estate joint ventures and other limited partnership interests in which it

has a minor equity investment and virtually no influence over the joint venture’s or the partnership’s operations.

Minority interest related to consolidated entities included in other liabilities was $251 million and $272 million at December 31, 2008 and

2007, respectively. There was also minority interest of $1.5 billion included in liabilities of subsidiaries held-for-sale at December 31, 2007.

Certain amounts in the prior year periods’ consolidated financial statements have been reclassified to conform with the 2008

presentation. Such reclassifications include $61 million and $47 million for the years ended December 31, 2007 and 2006, respectively,

relating to the effect of change in foreign currency exchange rates on cash balances. These amounts were reclassified from cash flows

from operating activities in the consolidated statements of cash flows for the years ended December 31, 2007 and 2006. See also Note 23

for reclassifications related to discontinued operations.

Summary of Significant Accounting Policies and Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

(“GAAP”) requires management to adopt accounting policies and make estimates and assumptions that affect amounts reported in the

consolidated financial statements. The most critical estimates include those used in determining:

(i) the estimated fair value of investments in the absence of quoted market values;

(ii) investment impairments;

(iii) the recognition of income on certain investment entities;

(iv) the application of the consolidation rules to certain investments;

(v) the existence and estimated fair value of embedded derivatives requiring bifurcation;

(vi) the estimated fair value of and accounting for derivatives;

(vii) the capitalization and amortization of deferred policy acquisition costs (“DAC”) and the establishment and amortization of

value of business acquired (“VOBA”);

(viii) the measurement of goodwill and related impairment, if any;

(ix) the liability for future policyholder benefits;

(x) accounting for income taxes and the valuation of deferred tax assets;

(xi) accounting for reinsurance transactions;

(xii) accounting for employee benefit plans; and

(xiii) the liability for litigation and regulatory matters.

A description of such critical estimates is incorporated within the discussion of the related accounting policies which follow. The

application of purchase accounting requires the use of estimation techniques in determining the fair values of assets acquired and liabilities

assumed — the most significant of which relate to the aforementioned critical estimates. In applying these policies, management makes

subjective and complex judgments that frequently require estimates about matters that are inherently uncertain. Many of these policies,

estimates and related judgments are common in the insurance and financial services industries; others are specific to the Company’s

businesses and operations. Actual results could differ from these estimates.

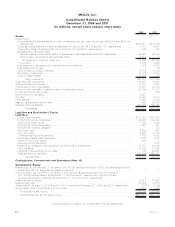

Fair Value

As described below, certain assets and liabilities are measured at estimated fair value on the Company’s consolidated balance sheets.

In addition, these footnotes to the consolidated financial statements include disclosures of estimated fair values. Effective January 1, 2008,

the Company adopted Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value Measurements (“SFAS 157”). SFAS 157

defines fair value as the price that would be received to sell an asset or paid to transfer a liability (an exit price) in the principal or most

advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. In many

cases, the exit price and the transaction (or entry) price will be the same at initial recognition. However, in certain cases, the transaction

price may not represent fair value. Under SFAS 157, fair value of a liability is based on the amount that would be paid to transfer a liability to

F-7MetLife, Inc.