Mercury Insurance 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Mercury Insurance annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

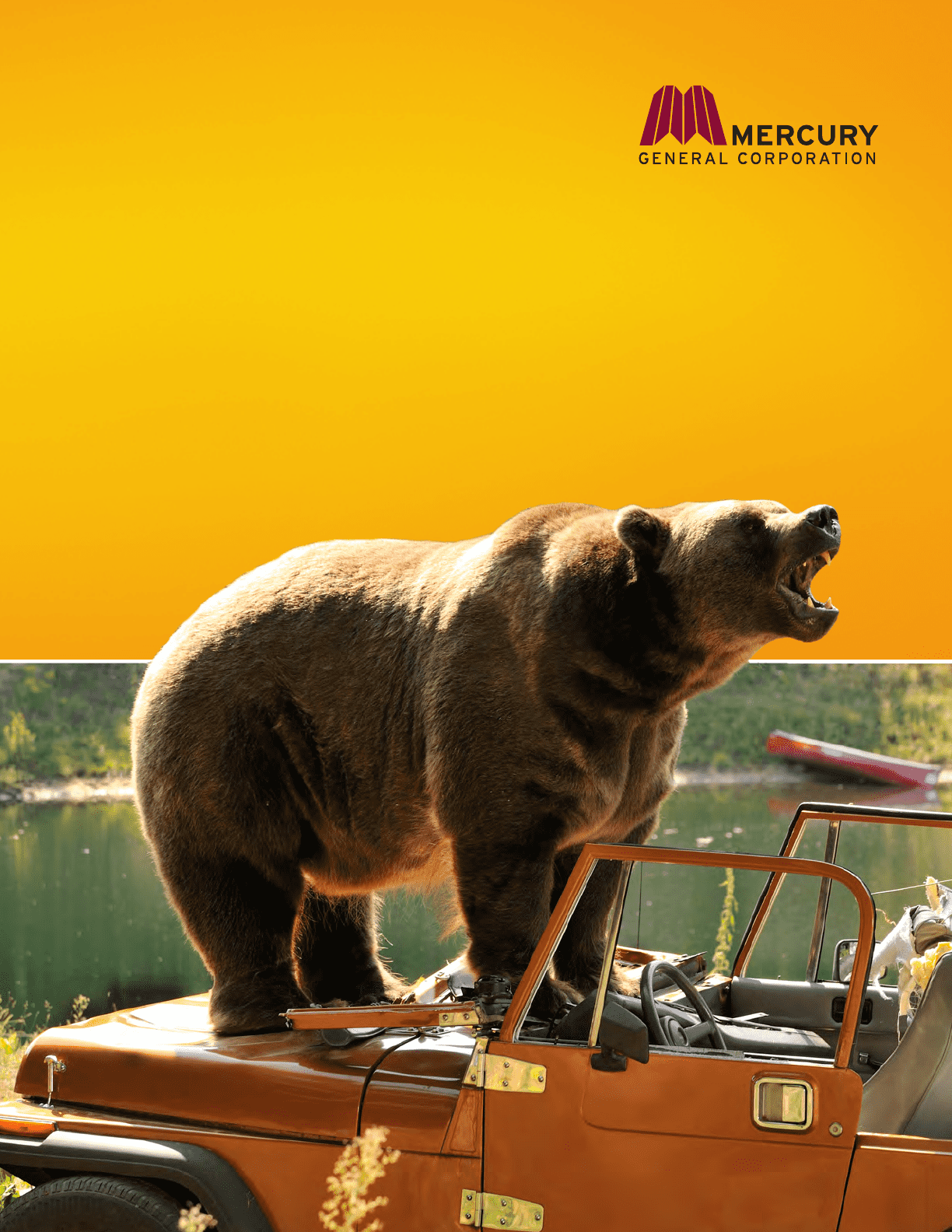

At a moment like this,

you’ll be glad you have Mercury.

2009 Annual Report

Table of contents

-

Page 1

At a moment like this, you'll be glad you have Mercury. 2009 Annual Report 2 -

Page 2

... television, Internet and sports advertising, as well as a number of direct mail pieces, the campaign highlighted Mercury's steadfast commitment to our three guiding principles - astonishing service, trustworthiness and savings. Inspired by actual experiences our customers have shared with us, we... -

Page 3

Seen above are stills from Mercury's current TV ad campaign showcasing several significant Mercury Moments. 2009 ANNUAL REPORT 1 -

Page 4

... every part of the car. At a moment like this, he's glad to have Mercury. Although he may have switched to Mercury because of the savings and multiple discounts, it was Mercury's personalized service and expansive, customized coverage that really made the difference. Mercury has come to the rescue... -

Page 5

2009 ANNUAL REPORT 3 -

Page 6

... comprehensive coverage and exceptional personalized service they've come to expect with Mercury. In addition to complete auto coverage, Mercury offers a variety of homeowners coverage options designed to protect both their home and growing family, including dwelling protection, personal property... -

Page 7

2009 ANNUAL REPORT 5 -

Page 8

... car. And, all you can think is, do I get a free side of fries with that? Luckily, the other driver is insured by Mercury. With affordable prices and local independent agents who provide personalized service, you actually may find that Mercury takes better care of you than your own insurance company... -

Page 9

2009 ANNUAL REPORT 7 -

Page 10

...'s customized coverage, low rates, excellent service and financial stability. They even provide new drivers a special list of guidelines to help them navigate the rules of the road. So, when it comes to teenage drivers, Mercury has you covered...that is, if they're ever allowed to use the car again... -

Page 11

2009 ANNUAL REPORT 9 -

Page 12

...2010. Inspired by actual experiences from some of our customers, this upbeat campaign highlights the breadth of Mercury's coverage across various lines of business as well as our core value proposition-offering low rates, providing stability and security and ensuring outstanding personalized service... -

Page 13

... progress we made this past year, and look forward to many more positive Mercury Moments to come. You are invited to attend our annual shareholder meeting on May 12, 2010. Sincerely, Gabriel Tirador President and Chief Executive Officer George Joseph Chairman of the Board 2009 ANNUAL REPORT 11 -

Page 14

... 151,099 15,436 5,185 9,180 312,409 97,592 214,817 3.93 3.92 67.5% 27.5% 95.0% Operating Results (GAAP Basis): Net premiums written Decrease (increase) in unearned premiums Earned premiums Losses and loss adjustment expenses Underwriting expenses Net investment income Net realized investment gains... -

Page 15

...,362 1.20 51.15-37.25 $ $ 9.6% 54,182 54,277 1.06 44.50-32.00 $ $ 11.0% 54,100 54,193 0.96 44.88-21.06 2009 ANNUAL REPORT 13 -

Page 16

... Accountants Allan Lubitz Senior Vice President and Chief Information Officer Joanna Moore Bruce A. Bunner 3 Retired President, Financial Structures Ltd. Senior Vice President and Chief Claims Officer John Sutton Michael D. Curtius Executive Consultant Senior Vice President - Customer Service... -

Page 17

..., Los Angeles, California (Address of principal executive offices) 90010 (Zip Code) Registrant's telephone number, including area code: (323) 937-1060 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock New York... -

Page 18

MERCURY GENERAL CORPORATION INDEX TO FORM 10-K Page PART I. Business ...General ...Website Access to Information ...Organization ...Production and Servicing of Business ...Underwriting ...Claims ...Losses and Loss Adjustment Expenses Reserves and Reserve Development ...Statutory Accounting ... -

Page 19

... located in St. Petersburg, Florida and in Oklahoma City, Oklahoma, which house the Company's employees and several third party tenants. The Company maintains branch offices in a number of locations in California; Richmond, Virginia; Latham, New York; Bridgewater, New Jersey; Vernon Hills, Illinois... -

Page 20

..., NY, VA CA CA Non-rated CA A+ IL A+ A+ A+ AAAA+ A+ GA GA IL, MI OK, FL, GA, TX TX TX FL, PA NJ Purpose Mercury Select Management Company, Inc. ("MSMC") ...American Mercury MGA, Inc. ("AMMGA") ...Concord Insurance Services, Inc. ("Concord") ...Mercury Insurance Services, LLC ("MIS LLC") ...Mercury... -

Page 21

... policies in force at December 31, 2009. In addition, the Company offers mechanical breakdown insurance in many states and homeowners insurance in Florida, Illinois, Oklahoma, New York, Georgia, Texas, and Arizona. In California, "good drivers" (as defined by the California Insurance Code) accounted... -

Page 22

...accident years' losses and loss adjustment expenses reserves due primarily to the result of re-estimates of accident year 2008 and 2007 California BI losses. See "Critical Accounting Estimates-Reserves" in "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations... -

Page 23

... to an increase in the Company's prior accident years' loss estimates for personal automobile insurance in Florida and New Jersey. In addition, an increase in estimates for loss severity for the 2004 accident year reserves for California and New Jersey automobile lines of business contributed to... -

Page 24

... Loss and expense ratios are used to interpret the underwriting experience of property and casualty insurance companies. Under SAP, losses and loss adjustment expenses are stated as a percentage of premiums earned because losses occur over the life of a policy, while underwriting expenses are stated... -

Page 25

... 3.6% of the Company's total investment portfolio at fair value. The Company held no redeemable preferred stocks at December 31, 2009. For more detailed information including credit ratings, see "Liquidity and Capital Resources-Portfolio Composition" in "Item 7. Management's Discussion and Analysis... -

Page 26

.... Competitive Conditions The Company operates in the highly competitive property-casualty industry subject to competition on pricing, claims, consumer recognition, coverage offered and other product features, customer service, and geographic coverage. Some of the Company's competitors are larger... -

Page 27

... provided by FHCF. The coverage is expected to change when new information is available later in 2010. For California homeowners policies, the Company has reduced its catastrophe exposure from earthquakes by placing earthquake risks with the California Earthquake Authority ("CEA"). However, the... -

Page 28

Insurance rates in Georgia, New York, New Jersey, Pennsylvania, and Nevada require prior approval from the state DOI, while insurance rates in Illinois, Texas, Virginia, Arizona, and Michigan must only be filed with the respective DOI before they are implemented. Oklahoma and Florida have a modified... -

Page 29

... date at which information was available, was approximately $53 million. The Insurance Companies in other states are also subject to the provisions of similar insurance guaranty associations. There were no material assessment payments during 2009 in other states. Holding Company Act The California... -

Page 30

... Underwriting Officer Vice President-Marketing Vice President and Chief Financial Officer Vice President and Chief Actuary Vice President-Corporate Affairs and Secretary Mr. Joseph, Chairman of the Board of Directors, has served in this capacity since 1961. He held the position of Chief Executive... -

Page 31

... named Chief Underwriting Officer in January 2010. Mr. Minnich, Vice President-Marketing, joined the Company as an underwriter in 1989. In 2007, he joined Superior Access Insurance Services as Director of Agency Operations and rejoined the Company as an Assistant Product Manager in 2008. In 2009, he... -

Page 32

... Risks Related to the Company's Business The Company remains highly dependent upon California and several other key states to produce revenues and operating profits. For the year ended December 31, 2009, the Company generated approximately 78.2% of its direct automobile insurance premiums written in... -

Page 33

... issues may adversely affect the Company's business by either extending coverage beyond its underwriting intent or by increasing the number or size of claims. In some instances, these changes may not become apparent until sometime after the Company has issued insurance policies that are affected by... -

Page 34

... or to attract new business in its insurance operations is affected by its rating by A.M. Best Company. A.M. Best Company currently rates all of the Company's insurance subsidiaries with sufficient operating history to be rated as either A+ (Superior) or A- (Excellent). If the Company is unable to... -

Page 35

... to continuous review, the Company cannot guarantee the continuation of the favorable ratings. If the ratings were lowered significantly by any one of these agencies relative to those of the Company's competitors, its ability to market products to new customers and to renew the policies of current... -

Page 36

... adverse effect on the Company's business, financial condition, and operating results. The acquisition of AIS, as with all acquisitions, involves numerous risks, including difficulties in integrating AIS operations, technologies, services and personnel; potential loss of AIS customers; diversion of... -

Page 37

..., the Company may incur a loss during the period in which that determination is made. In addition, A.M. Best, credit rating agency, has expressed a concern regarding the FHCF's ability to fund all obligations in the case of a severe hurricane. Based on its projected claims-paying capacity, coverage... -

Page 38

... time. The Company sells its insurance policies through approximately 5,100 independent agents and brokers. The Company must compete with other insurance carriers for these agents' and brokers' business. Some competitors offer a larger variety of products, lower prices for insurance coverage, higher... -

Page 39

... of operations and financial condition, management has included the assessment of a deferred tax asset valuation allowance as a critical accounting estimate. The carrying value of the Company's goodwill and other intangible assets could be subject to an impairment write-down. At December 31, 2009... -

Page 40

... of its business, including underwriting, policy acquisition, claims processing and handling, accounting, reserving and actuarial processes and policies, and to maintain its policyholder data. The Company is developing and deploying new information technology systems that are designed to manage many... -

Page 41

... hires and trains new employees and retains current employees to handle the resulting increase in new inquiries, policies, customers, and claims. The failure to successfully hire and retain a sufficient number of skilled employees could result in the Company having to slow the growth of its business... -

Page 42

...the Insurance Companies' statutory surplus. Challenging economic conditions also may impair the ability of the Company's customers to pay premiums as they fall due, and as a result, the Company's bad debt reserves and write-offs could increase. It is also possible that claims fraud may increase. The... -

Page 43

... insurance products, issue policies, and handle claims. Some states impose restrictions or require prior regulatory approval of specific corporate actions, which may adversely affect the Company's ability to operate, innovate, obtain necessary rate adjustments in a timely manner or grow its business... -

Page 44

... and underwriting associations, assessments and other governmental charges; reporting with respect to financial condition; periodic financial and market conduct examinations performed by state insurance department examiners; and the other regulations discussed in this Annual Report on Form 10... -

Page 45

... adversely affect the Company's business by changing the way policies are priced, extending coverage beyond its underwriting intent, or increasing the size of claims. Loss or significant restriction of the use of credit scoring in the pricing and underwriting of personal lines products could reduce... -

Page 46

... of the insurer or holding company, the state DOI will consider a number of factors relating to the acquirer and the transaction. These laws and regulations may discourage potential acquisition proposals and may delay, deter or prevent a change of control of the Company or the sale by the Company of... -

Page 47

... by the Company at December 31, 2009 Location Purpose Brea, CA ...Folsom, CA ...Los Angeles, CA ...Rancho Cucamonga, CA ...St. Petersburg, FL ...Oklahoma, OK ...Item 3. Legal Proceedings Home office and I.T. facilities (2 buildings) Administrative and Data Center Executive offices Administrative... -

Page 48

... insurance company is also required to notify the California DOI of any dividend after declaration, but prior to payment. There are similar limitations imposed by other states on the Insurance Companies' ability to pay dividends. As of December 31, 2009, the Insurance Companies are permitted to pay... -

Page 49

... Corporation, RLI Corporation, Selective Insurance Group, Travelers Companies, Inc., W.R. Berkley Corporation and XL Capital, Ltd. Recent Sales of Unregistered Securities None. Share Repurchases The Company has had a stock repurchase program since 1998. The Company's Board of Directors authorized... -

Page 50

...this Annual Report on Form 10-K. 2009 Year Ended December 31, 2008 2007 2006 (Amounts in thousands, except per share data) 2005 Income Data: Earned premiums ...Net investment income ...Net realized investment gains (losses) ...Other ...Total revenues ...Losses and loss adjustment expenses ...Policy... -

Page 51

... Tax Board ("FTB"), and decisions of courts, regulators and governmental bodies, particularly in California; the Company's ability to obtain and the timing of the approval of premium rate changes for insurance policies issued in states where the Company operates; the investment yields the Company is... -

Page 52

...factors such as changes in tax laws. The Company is headquartered in Los Angeles, California and operates primarily as a personal automobile insurer selling policies through a network of independent agents and brokers in thirteen states. The Company also offers homeowners, mechanical breakdown, fire... -

Page 53

... insurance companies pay claims after premiums are collected, the ultimate cost of an insurance policy is not known until well after the policy revenues are earned. Consequently, significant assumptions are made when establishing insurance rates and loss reserves. While insurance companies use... -

Page 54

...to legislative and regulatory changes. The Company has completed the rollout of NextGen for all underwriting, billing, claims, and commission functions supporting the private passenger auto line in seven states (Virginia, New York, Florida, California, Georgia, Illinois, and Texas), and expects that... -

Page 55

... by the consumer's insurance broker. Through this action, the California DOI seeks to impose a fine for each policy in which the Company allegedly permitted an agent to charge a broker fee, which the California DOI contends is the use of an unapproved rate, rating plan or rating system. Further, the... -

Page 56

... of business or coverage within a line of business. When establishing the reserve, the Company will generally analyze the results from all of the methods used rather than relying on one method. While these methods are designed to determine the ultimate losses on claims under the Company's policies... -

Page 57

... other coverages. BI coverage in the Company's policies includes injuries sustained by any person other than the insured, except in the case of uninsured or underinsured motorist BI coverage, which covers damages to the insured for BI caused by uninsured or underinsured motorists. BI payments are... -

Page 58

... in the total number of claims reported is reflective of declining loss frequencies and a decline in the number of insurance policies issued. The number of claims expected excludes those claims that were closed without any payment. For the 2009 accident year, the Company experienced increases in the... -

Page 59

..., a change in the number of litigated files, and whether the last day of the year falls on a weekday or a weekend. However, the Company is unable to determine which, if any, of the factors actually impact the number of claims reported and, if so, by what magnitude. At December 31, 2009, there... -

Page 60

... older accident years, even though a comprehensive claims file review was undertaken, or that the Company will experience additional development on these reserves. Discussion of loss reserves and prior period loss development at December 31, 2009 At December 31, 2009 and 2008, the Company recorded... -

Page 61

...trading markets, and were valued at the last transaction price on the balance sheet date. Fair Value of Financial Instruments The financial instruments recorded in the consolidated balance sheets include investments, receivables, interest rate swap agreements, accounts payable, equity contracts, and... -

Page 62

... 31, 2009, the fair value of the Company's reporting units substantially exceeds their carrying value. Contingent Liabilities The Company has known, and may have unknown, potential liabilities which include claims, assessments, or lawsuits relating to the Company's business. The Company continually... -

Page 63

... written by the Company's non-California operations were approximately $578 million in 2009, a 1.9% decrease from 2008. The decrease in net premiums written is primarily due to a decrease in the number of policies written and slightly lower average premiums per policy reflecting the continuing... -

Page 64

... of $395.5 million in 2009 due to changes in the fair value of total investments pursuant to election of the fair value accounting option compared with losses of $525.7 million in 2008. The gains during 2009 arise from the market value improvements on the Company's fixed maturity ($261.9 million... -

Page 65

... in premium volumes; an increase in technology-related expenses; the establishment of the product management function; and approximately $2 million of AIS acquisition-related expenses. The combined ratio is the key measure of underwriting performance traditionally used in the property and casualty... -

Page 66

... funds for the Insurance Companies are premiums, sales and maturity of invested assets, and dividend and interest income from invested assets. The principal uses of funds for the Insurance Companies are the payment of claims and related expenses, operating expenses, dividends to Mercury General, and... -

Page 67

...and agencies ...States, municipalities and political subdivisions ...Mortgage-backed securities ...Corporate securities ...Collateralized debt obligations ...Equity securities: Common stock: Public utilities ...Banks, trusts and insurance companies ...Industrial and other ...Non-redeemable preferred... -

Page 68

... preferred stocks, which may have fixed or variable principal payment schedules, may be held for indefinite periods of time, and may be used as a part of the Company's asset/liability strategy or sold in response to changes in interest rates, anticipated prepayments, risk/ reward characteristics... -

Page 69

..., at fair value, was downgraded to below investment grade. AAA AA(2) December 31, 2009 A(2) BBB(2) Non-Rated/Other (Amounts in thousands) Total U.S. government bonds and agencies: Treasuries ...Government Agency ...Total ...Municipal securities: Insured(1) ...Uninsured ...Total ...Mortgage-backed... -

Page 70

...Poor's, Moody's, and Fitch. The Company considers the strength of the underlying credit as a buffer against potential market value declines which may result from future rating downgrades of the bond insurers. In addition, the Company has a long-term time horizon for its municipal bond holdings which... -

Page 71

... investments include money market accounts, options, and short-term bonds which are highly rated short duration securities redeemable within one year. D. Debt Effective January 1, 2009, the Company acquired AIS for $120 million. The acquisition was financed by a $120 million credit facility that is... -

Page 72

...the variable interest rate. The swap is not designated as a hedge and changes in the fair value are adjusted through the consolidated statements of operations in the period of change. In February 2008, the Company acquired an 88,300 square foot office building in Folsom, California for approximately... -

Page 73

... Company is obligated under various non-cancellable lease agreements providing for office space and equipment rental that expire at various dates through the year 2019. (3) Reserve for losses and loss adjustment expenses is an estimate of amounts necessary to settle all outstanding claims, including... -

Page 74

... diversified primarily between cities, counties, schools, public works, hospitals and state general obligations. In California, the Company owns approximately $8.0 million at fair value of general obligations of the state at December 31, 2009. Credit risk is addressed by limiting exposure to any... -

Page 75

... a hypothetical parallel increase of 100 basis or 200 basis points in interest rates, the fair value of the bond portfolio at December 31, 2009 would decrease by approximately $145.2 million or $290.5 million, respectively. Interest rate swaps are used to manage interest rate risk associated with... -

Page 76

... Public Accounting Firm ...Consolidated Financial Statements: Consolidated Balance Sheets as of December 31, 2009 and 2008 ...Consolidated Statements of Operations for Each of the Years in the Three-Year Period Ended December 31, 2009 ...Consolidated Statements of Comprehensive Income (Loss) for... -

Page 77

... also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Mercury General Corporation's internal control over financial reporting as of December 31, 2009, based on criteria established in Internal Control-Integrated Framework issued by the... -

Page 78

... standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Mercury General Corporation and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of operations, comprehensive income (loss), shareholders' equity, and... -

Page 79

... SHAREHOLDERS' EQUITY Losses and loss adjustment expenses ...Unearned premiums ...Notes payable ...Accounts payable and accrued expenses ...Other liabilities ...Total liabilities ...Commitments and contingencies Shareholders' equity: Common stock without par value or stated value: Authorized 70,000... -

Page 80

MERCURY GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS (Amounts in thousands, except per share data) 2009 Year Ended December 31, 2008 2007 Revenues: Net premiums earned ...Net investment income ...Net realized investment gains (losses) ...Other ...Total revenues ...... -

Page 81

MERCURY GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS) (Amounts in thousands) Year Ended December 31, 2009 2008 2007 Net income (loss) ...Other comprehensive (loss) income, before tax: Losses on hedging instrument ...Unrealized gains on securities: ... -

Page 82

...of year ...Accumulated other comprehensive income, beginning of year ...Net increase (decrease) in other comprehensive income, net of tax ...Accumulated other comprehensive (loss) income, end of year ...Retained earnings, beginning of year ...Cumulative effect of accounting change, net of tax ...Net... -

Page 83

... ...Decrease in premiums notes ...Decrease (increase) in deferred policy acquisition costs ...(Decrease) increase in unpaid losses and loss adjustment expenses ...Decrease in unearned premiums ...Increase (decrease) in liability for taxes ...Increase (decrease) in accounts payable and accrued... -

Page 84

... Accounting Policies General Mercury General Corporation and its subsidiaries (referred to herein collectively as the Company) are engaged primarily in writing automobile insurance in a number of states, principally California. The Company also writes homeowners, mechanical breakdown, fire... -

Page 85

... at fair value with the corresponding unrealized gains (losses), net of deferred income taxes, reported in accumulated other comprehensive income. Premiums and discounts on fixed maturities are amortized using first call date and are adjusted for anticipated prepayments. Premiums and discounts on... -

Page 86

...the unadjusted quoted price for similar notes in active markets. Further, see Note 3 for methods and assumptions used in estimating fair values of interest rate swap agreements, and equity contracts. Due to their short-term maturity, the carrying value of receivables and accounts payable approximate... -

Page 87

...agent accounted for more than 2% of the Company's direct premiums written during 2009. However, AIS produced approximately 15% and 14% of the Company's direct premiums written during 2008 and 2007, respectively, prior to the AIS acquisition. Losses and Loss Adjustment Expenses Unpaid losses and loss... -

Page 88

... of business or coverage within a line of business. When establishing the reserve, the Company will generally analyze the results from all of the methods used rather than relying on one method. While these methods are designed to determine the ultimate losses on claims under the Company's policies... -

Page 89

... measured at fair value, which is based on information obtained from independent parties. In addition, changes in fair value are recognized in earnings unless specific hedge accounting criteria are met. The Company's derivative instruments include interest rate swap agreements and are used to hedge... -

Page 90

MERCURY GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) The annual direct premiums written attributable to private passenger automobile, commercial automobile, homeowners, and other lines of insurance were as follows: 2009 Year Ended December 31, 2008 2007... -

Page 91

MERCURY GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) January 1, 2006 is based on the estimated grant-date fair value. The Company recognizes these compensation costs on a straight-line basis over the requisite service period of the award, which is the ... -

Page 92

... on the Company's consolidated financial statements. Effective January 1, 2009, the FASB issued a new accounting standard related to business combinations wherein an acquirer is required to use the acquisition method, previously referred to as the purchase method, for all business combinations and... -

Page 93

... occurrence of a credit event such as a credit rating downgrade, to settle derivative instruments or post collateral. Existing financial accounting requirements for derivative instruments and hedging activities were not changed. The Company adopted the new standard on January 1, 2009. The adoption... -

Page 94

... held at December 31, 2009 and 2008, respectively. In 2007, net realized investment gains and losses included investment impairment write-downs of $22.7 million and also included gains of $2.0 million and losses of $1.4 million related to the change in the fair value of trading securities and hybrid... -

Page 95

... available for sale: Unrealized gains ...Unrealized losses ...Tax expense ...Total ...Contractual Maturity At December 31, 2009, bond holdings rated below investment grade or non-rated were 6.4% of total investments at fair value. Additionally, the Company owns securities that are credit enhanced by... -

Page 96

... on the following Quoted prices for similar assets or liabilities in active markets; Quoted prices for identical or similar assets or liabilities in non-active markets; or Either directly or indirectly observable as of the reporting date and fair value is determined through the use of models or... -

Page 97

... 31, 2008, the Company had no holdings in commercial mortgage-backed securities. Corporate securities/Short-term bonds/Agency bonds: Valued based on a multi-dimensional model using multiple observable inputs, such as benchmark yields, reported trades, broker/dealer quotes and issue spreads, for... -

Page 98

... ...Banks, trusts and insurance companies ...Industrial and other ...Non-redeemable preferred stock ...Short-term bonds ...Money market instruments ...Interest rate swap agreements ...Total assets at fair value ...Liabilities Equity contracts ...Interest rate swap agreements ...Total liabilities... -

Page 99

...Public utilities ...Banks, trusts and insurance companies ...Industrial and other ...Non-redeemable preferred stock ...Short-term bonds ...Money market instruments ...Equity contracts ...Interest rate swap agreements ...Total assets at fair value ...Liabilities Equity contracts ...Interest rate swap... -

Page 100

... of Company policies made by AIS are considered deferrable. For the year ended December 31, 2009, the amortization of deferred commissions related to policies written prior to January 1, 2009, offset by corresponding deferred direct sales costs, reduced pre-tax income in the statement of operations... -

Page 101

... Instruments The Company is exposed to certain risks relating to its ongoing business operations. The primary risks managed by using derivative instruments are equity price risk and interest rate risk. Equity contracts on various equity securities are entered into to manage the price risk associated... -

Page 102

MERCURY GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS-(Continued) On February 6, 2009, the Company entered into an interest rate swap of its floating LIBOR rate on the $120 million credit facility, which was used for the acquisition of AIS, for a fixed rate of 1.93... -

Page 103

... the parent company of AIS and PoliSeek. AIS is a major producer of automobile insurance in the state of California and was the Company's largest independent broker. This preexisting relationship did not require measurement at the date of acquisition as there was no settlement of executory contracts... -

Page 104

...month period ended March 31, 2009. The fair value of the liabilities assumed includes accounts payable and other accrued liabilities. The following table reflects the amount of revenue and net income of AIS, which are included in the Company's consolidated statements of operations for the year ended... -

Page 105

...investment gains/losses and commission revenues. (3) 2008 pro forma net income for the combined entity is not available as AIS was previously consolidated into its parent company and separate financial statements were not available. 9. Goodwill and Other Intangible Assets Goodwill The changes in the... -

Page 106

... December 31, 2009: Year Ending December 31, Amortization Expense (Amounts in thousands) 2010 ...2011 ...2012 ...2013 ...2014 ...Thereafter ...Total ... $ 6,812 6,358 6,144 5,969 5,964 35,576 $66,823 10. Income Taxes Income tax provision The Company and its subsidiaries file a consolidated federal... -

Page 107

...: Deferred acquisition costs ...Tax liability on net unrealized gain on securities carried at fair value ...Tax depreciation in excess of book depreciation ...Undistributed earnings of insurance subsidiaries ...Accounting method transition adjustments ...Other deferred tax liabilities ...Total gross... -

Page 108

... returns, the FTB has taken exception to the state apportionment factors used by the Company. Specifically, the FTB has asserted that payroll and property factors from MIS LLC, a subsidiary of MCC, that are excluded from the Mercury General California Franchise tax return, should be included in the... -

Page 109

.... The New Jersey reserves established at December 31, 2007 were too low and accounted for approximately $30 million of the adverse development. In California, the Company experienced a lengthening of the pay-out period for claims that are settled after the first year and a large increase in the... -

Page 110

...period-end have increased thereby affecting the loss reserve estimates at December 31, 2007. In New Jersey, due to a short operating history and rapid growth in that state, the Company had limited internal historical claims information to estimate BI, PIP and related loss adjustment expense reserves... -

Page 111

... were made by the Company during 2009 and 2008, compared to $1,900,000 for 2007. The Plan includes an option for employees to make salary deferrals under Section 401(k) of the Internal Revenue Code. The matching contributions, at a rate set by the Board of Directors, totaled $3,080,000, $6,802,000... -

Page 112

... the tax deduction from option exercises of the share-based payment awards totaled $5,000, $121,000, and $273,000 during 2009, 2008, and 2007, respectively. The fair value of stock option awards is estimated on the date of grant using a closed-form option valuation model (Black-Scholes) based on the... -

Page 113

... for 2009, 2008, and 2007, respectively. These shares are excluded due to their antidilutive effect. 17. Commitments and Contingencies Operating Leases The Company is obligated under various non-cancellable lease agreements providing for office space and equipment rental that expire at various dates... -

Page 114

... maximum total exposure to CEA assessments at April 30, 2009, the most recent date at which information was available, was approximately $53 million. Litigation The Company is, from time to time, named as a defendant in various lawsuits incidental to its insurance business. In most of these actions... -

Page 115

...0.58 Net income during 2009 was mainly affected by the favorable development on loss reserves and gains due to changes in the fair value of the Company's investment portfolio. The favorable development of loss reserves is largely the result of re-estimates of California BI losses. The primary cause... -

Page 116

..., is recorded, processed, summarized, and reported within the time periods specified in the Securities and Exchange Commission rules and forms, and that such information is accumulated and communicated to the Company's management, including its Chief Executive Officer and Chief Financial Officer, as... -

Page 117

... Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Item 13. Certain Relationships and Related Transactions, and Director Independence Item 14. Principal Accounting Fees and Services Information regarding executive officers of the Company is included in Part I. For... -

Page 118

... N.A., as Trustee dated as of June 1, 2001. Officers' Certificate establishing the Company's 7.25% Senior Notes due 2011 as a series of securities under the Indenture dated as of June 1, 2001 between Mercury General Corporation and Bank One Trust Company, N.A. Form of Agency Contract. Profit Sharing... -

Page 119

... 1, 2001 between Mercury Insurance Services, LLC and Mercury Indemnity Company of Illinois. Management Agreement effective January 1, 2002 between Mercury Insurance Services, LLC and Mercury Insurance Company of Florida and Mercury Indemnity Company of Florida. Management Agreement dated January 22... -

Page 120

... solely to accompany this Annual Report on Form 10-K and is not being filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not to be incorporated by reference into any filing of the Company. Certification of Registrant's Chief Financial Officer pursuant to 18... -

Page 121

... document was filed as an exhibit to the Company's Definitive Proxy Statement on Schedule 14A (File No. 001-12257) filed with the ...filed as an exhibit to Registrant's Form 10-Q for the quarterly period ended June 30, 2008, and is incorporated herein by this reference. * Denotes management contract... -

Page 122

... Date /S/ GEORGE JOSEPH George Joseph Chairman of the Board February 18, 2010 /S/ GABRIEL TIRADOR Gabriel Tirador President and Chief Executive Officer and Director (Principal Executive Officer) Vice President and Chief Financial Officer (Principal Financial Officer and Principal Accounting... -

Page 123

... Shareholders Mercury General Corporation: Under date of February 18, 2010, we reported on the consolidated balance sheets of Mercury General Corporation and subsidiaries (the Company) as of December 31, 2009 and 2008, and the related consolidated statements of operations, comprehensive income (loss... -

Page 124

...-backed securities ...Corporate securities ...Collateralized debt obligations ...Total fixed maturity securities ...Equity securities: Common stock: Public utilities ...Banks, trust and insurance companies ...Industrial and other ...Non-redeemable preferred stock ...Total equity securities ...Short... -

Page 125

...: U.S. government bonds and agencies ...Municipal securities ...Mortgage-backed securities ...Corporate securities ...Redeemable preferred stock ...Total fixed maturity securities ...Equity securities: Common stock: Public utilities ...Banks, trust and insurance companies ...Industrial and other... -

Page 126

...' EQUITY Notes payable ...Accounts payable and accrued expenses ...Income tax payable to affiliates ...Other liabilities ...Total liabilities ...Shareholders' equity: Common stock ...Accumulated other comprehensive loss ...Retained earnings ...Total shareholders' equity ...Total liabilities and... -

Page 127

SCHEDULE II, Continued MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF OPERATIONS Year Ended December 31, 2009 2008 2007 (Amounts in thousands) Revenues: Net investment income ...Net realized investment gains (losses) ...Total revenues ...Expenses: Other ... -

Page 128

SCHEDULE II, Continued MERCURY GENERAL CORPORATION CONDENSED FINANCIAL INFORMATION OF REGISTRANT STATEMENTS OF CASH FLOWS Year Ended December 31, 2009 2008 2007 (Amounts in thousands) Cash flows from operating activities: Net cash provided by (used in) operating activities ...Cash flows from ... -

Page 129

... Florida Mercury Indemnity Company of America Mercury Select Management Company, Inc. American Mercury MGA, Inc. Concord Insurance Services, Inc. Mercury Insurance Services, LLC Mercury Group, Inc. AIS Management, LLC Auto Insurance Specialists, LLC PoliSeek AIS Insurance Solutions, Inc. The method... -

Page 130

SCHEDULE IV MERCURY GENERAL CORPORATION REINSURANCE THREE YEARS ENDED DECEMBER 31, Property and Liability Insurance Earned Premiums Direct Amount Ceded to Other Companies Assumed (Amounts in thousands) Net Amount 2009 ...2008 ...2007 ... $2,628,507 $2,810,370 $2,996,927 $4,214 $3,801 $4,119 $ 840... -

Page 131

... Inc. Auto Insurance Specialists LLC** AIS Management LLC** PoliSeek AIS Insurance Solutions, Inc.** * Controlled by Mercury General Corporation ** Acquired effective January 1, 2009 TRANSFER AGENT & REGISTRAR BNY Mellon Shareowner Services P.O. Box 358015 Pittsburgh, PA 15252-8015 Telephone number... -

Page 132