McKesson 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 McKesson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

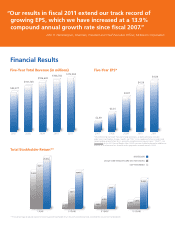

McKesson generated revenues of $112.1 billion and

exceeded expectations for both earnings and cash

flow. Earnings per diluted share from continuing

operations (EPS) was $4.86,*** and cash from

operations was $2.3 billion. We ended the year with

cash and equivalents of $3.6 billion. Our strong cash

flow creates additional opportunities for the company

to create value for our customers, suppliers and

stockholders. Our results in fiscal 2011 extend our

track record of growing EPS, which we have increased

at a 13.9% compound annual growth rate since

fiscal 2007.

Healthcare is an indispensable industry, with

spending projected to reach $4.3 trillion, or

approximately 20.3% of gross domestic product,

by 2018, according to the Centers for Medicare

and Medicaid Services. Nevertheless, all segments

of healthcare face a wide array of business, care

and connectivity challenges, creating significant

opportunities for McKesson to partner with its

customers in deeper and broader ways. Our fiscal

2011 performance reflects the clarity with which

we see the industry, the soundness of the strategy

we have developed to serve it, and our success

in working with our customers to build healthier

organizations that deliver better, more cost-effective

care. We are uniquely positioned to help improve the

business and clinical performance of all sectors of

the healthcare system, leading to better results for

our customers, better health for patients and better

returns to our stockholders.

We expect a combination of internal and external

factors to drive our ongoing success, ranging from

positive demographic trends and a robust market

for generic medications, to our diversified solution

portfolio and financial strength. In the remainder of

Dear Fellow Stockholders,

I am pleased to report that McKesson delivered another strong

performance in fiscal 2011, marked by outstanding execution

in Distribution Solutions, continued success in expanding our

relationships with customers and suppliers, and near record levels

of capital deployment, including the $2.1 billion acquisition of US

Oncology, our largest acquisition in a decade.

this letter, I will provide more detail on these factors

and explain why they create new opportunities to

extend the company’s lead in healthcare services

and continue our track record of strong revenue and

earnings growth.

Expanded Healthcare Needs of an

Aging Population

According to the Centers for Disease Control and

Prevention (CDC), the global population of people 65

years and older continues to grow, driving increased

demand for healthcare services and pharmaceuticals.

In the United States, this demographic segment is

expected to climb from 35 million people in 2000,

or 12% of the population, to 72 million people in

2030, or 20% of the population. According to the

CDC, healthcare costs for people over 65 are three

to five times more than for those younger than 65.

The rise in serious and chronic conditions, along

with advances in medical technologies, procedures

and pharmaceuticals, fuels the need for the kind of

improved, coordinated and streamlined healthcare

system McKesson supports in partnership with

customers in every sector.

Push for Access and Efficiency through

Healthcare Reform

Today’s public policy agenda supports greater access

to healthcare and improved efficiency, contributing to

the imperative for a more cost-effective, connected

and automated healthcare system. Providers,

physicians, payers and pharmacies are focused

on achieving operational improvements, meeting

regulatory requirements, and preparing for the

clinical, financial and administrative complexities

associated with evolving integrated care models.

These trends create additional demand for our

solutions and expertise in both our distribution and

***Diluted earnings per share from continuing operations excludes adjustments for litigation charges (credits) net (“EPS”). For supplemental financial data and corresponding reconciliation to U.S.

generally accepted accounting principles (“GAAP”), see Appendix A to this 2011 Annual Report. Non-GAAP measures should be viewed in addition to, and not as an alternative for, financial results

prepared in accordance with GAAP.