McKesson 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 McKesson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report

Fiscal Year Ended March 31, 2011

Table of contents

-

Page 1

Annual Report Fiscal Year Ended March 31, 2011 -

Page 2

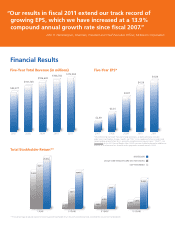

... and Chief Executive Ofï¬cer, McKesson Corporation Financial Results Five-Year Total Revenue (in millions) Five-Year EPS* *Diluted earnings per share from continuing operations, as displayed above, excludes adjustments for litigation charges (credits) net ("EPS"). For supplemental ï¬nancial data... -

Page 3

... execution in Distribution Solutions, continued success in expanding our relationships with customers and suppliers, and near record levels of capital deployment, including the $2.1 billion acquisition of US Oncology, our largest acquisition in a decade. McKesson generated revenues of $112... -

Page 4

... of best-in-class distribution and marketing services. Our adherence and compliance programs, for example, help patients stay on their prescribed medications, resulting in better health outcomes and incremental revenue for our manufacturing partners, our customers and McKesson. Further, our strong... -

Page 5

... and Chief Executive Ofï¬cer McKesson Corporation Industry Leadership In March 2011, McKesson was rated among the world's most admired companies in healthcare by FORTUNE Magazine for the second year in a row. Currently ranked 15th on the Fortune 500, McKesson is: •฀#1฀in฀pharmaceutical... -

Page 6

...which tests are covered by a patient's health plan. McKesson Helps Deliver Better Care As one of the largest providers of healthcare services and information technology in North America, we work with pharmacies, physician practices, hospitals and payers to reduce medication errors, standardize care... -

Page 7

... Commission File Number 1-13252 McKESSON CORPORATION (Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) 94-3207296 (I.R.S. Employer Identification No.) One Post Street, San Francisco, California (Address of principal... -

Page 8

... with Accountants on Accounting and Financial Disclosure ...Controls and Procedures...Other Information ...PART III 10. 11. 12. Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related Stockholder... -

Page 9

..., that file electronically with the SEC. The address of the website is http://www.sec.gov. Business Segments We operate in two segments. The McKesson Distribution Solutions segment distributes ethical and proprietary drugs, medical-surgical supplies and equipment and health and beauty care products... -

Page 10

... a two-tiered distribution network that supports best-in-class direct store delivery. EnterpriseRx® - A fully integrated and centrally hosted pharmacy management solution (software as a service model). EnterpriseRx® centralizes data, reporting, pricing and drug updates, providing the operational... -

Page 11

... - Strategic planning, merchandising and price maintenance program that helps independent pharmacies maximize store profitability. McKesson Home Health Care - Comprehensive line of more than 1,800 home health care products, including durable medical equipment, diabetes supplies, self-care supplies... -

Page 12

... management solution (software as a service model). EnterpriseRx® centralizes data, reporting, pricing and drug updates, providing the operational control, visibility and support needed to reduce costs and streamline administrative tasks. We also own a 39% interest in Parata, which sells automated... -

Page 13

..., care planning, physician order entry and documentation, nursing documentation with bar-coded medication administration, laboratory, radiology, pharmacy, surgical management, emergency department and ambulatory EHR systems, a Web-based physician portal and a comprehensive solution for homecare... -

Page 14

... well as strategic information systems planning and management, revenue cycle processes, payroll processing, business office administration and major system conversions. Professional Services: Professional services help customers achieve business results from their software or automation investment... -

Page 15

... 51% of our total consolidated revenues. Sales to our two largest customers, CVS Caremark Corporation ("CVS") and Rite Aid Corporation ("Rite Aid"), accounted for approximately 14% and 11% of our total consolidated revenues. At March 31, 2011, accounts receivable from our ten largest customers were... -

Page 16

McKESSON CORPORATION Suppliers: We obtain pharmaceutical and other products from manufacturers, none of which accounted for more than approximately 7% of our purchases in 2011. The loss of a supplier could adversely affect our business if alternate sources of supply are unavailable. We believe that ... -

Page 17

... illegal conduct that caused average wholesale prices to rise for certain prescription drugs during specified periods. Litigation is costly, time-consuming and disruptive to normal business operations. The defense of these matters could also result in continued diversion of our management's time and... -

Page 18

... industry's or our pharmaceutical suppliers' pricing, selling, inventory, distribution or supply policies or practices could significantly reduce our revenues and net income. Due to the diverse range of healthcare supply management and healthcare information technology products and services... -

Page 19

... our provision of products and services to government entities, subject our business to laws and regulations on fraud and abuse, which among other things (1) prohibit persons from soliciting, offering, receiving or paying any remuneration in order to induce the referral of a patient for treatment or... -

Page 20

... for systems purchased by these agencies. For example, the HITECH Act requires meaningful use of "certified" healthcare information technology products by healthcare providers in order to receive stimulus funds from the federal government. Effective September 27, 2010, CMS issued a rule that... -

Page 21

... recognition of revenue. Delays in providing software and systems that are in compliance with the new standards may result in postponement or cancellation of our customers' decisions to purchase our software and systems. Claims Transmissions: Medical billing and collection activities are governed by... -

Page 22

...ten largest customers were approximately 43% of total accounts receivable. Accounts receivable from CVS, Walmart and Rite Aid were approximately 13%, 10% and 9% of total accounts receivable. As a result, our sales and credit concentration is significant. We also have agreements with group purchasing... -

Page 23

... information systems in our business to obtain, rapidly process, analyze and manage data to (1) facilitate the purchase and distribution of thousands of inventory items from numerous distribution centers, (2) receive, process and ship orders and handle other product and services on a timely... -

Page 24

..., patient care, financial, supply chain, strategic management software solutions and pharmacy automation to hospitals, physicians, homecare providers, retail and mail order pharmacies and payers. Challenges integrating software products could impair our ability to attract and retain customers... -

Page 25

... claims, particularly if the access interruption is associated with problems in the timely delivery of medical care. We must maintain disaster recovery and business continuity plans that rely upon third-party providers of related services and if those vendors fail us at a time that our center... -

Page 26

McKESSON CORPORATION We may be required to record a significant charge to earnings if our goodwill or intangible assets become impaired. We are required under U.S. generally accepted accounting principles ("GAAP") to test our goodwill for impairment, annually or more frequently if indicators for ... -

Page 27

...credit markets will not impair our liquidity or increase our costs of borrowing. Our $1.35 billion accounts receivable sales facility is generally renewed annually and will expire in May 2011. Although we did not use this facility in 2010 or 2011, we have historically used it to fund working capital... -

Page 28

... from tighter capital and credit markets or a slowdown in the general economy. As a result, customers may modify, delay or cancel plans to purchase or implement our products or services and suppliers may increase their prices, reduce their output or change their terms of sale. Additionally, if... -

Page 29

...; Senior Vice President, Corporate Strategy and Business Development from September 2001 to April 2004. Service with the Company - 10 years. Executive Vice President, General Counsel and Chief Compliance Officer since April 2010 (functionally has served as chief compliance officer since March 2006... -

Page 30

McKESSON CORPORATION PART II Item 5. Market for the Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities (a) Market Information: The principal market on which the Company's common stock is traded is the New York Stock Exchange ("NYSE"). The following ... -

Page 31

McKESSON CORPORATION In October 2010, the Board approved a plan to repurchase up to $1.0 billion of the Company's common stock of which $500 million remained available for future repurchases as of March 31, 2011. In March 2011, we entered into an accelerated share repurchase ("ASR") program with a ... -

Page 32

McKESSON CORPORATION (f) Stock Price Performance Graph*: The following graph compares the cumulative total stockholder return on the Company's common stock for the periods indicated with the Standard & Poor's 500 Index and the Value Line Healthcare Sector Index (composed of 162 companies in the ... -

Page 33

... Position Working capital Days sales outstanding for: (1) Customer receivables Inventories Drafts and accounts payable Total assets Total debt, including capital lease obligations Stockholders' equity Property acquisitions Acquisitions of businesses, net Common Share Information Common shares... -

Page 34

... growth in our Distribution Solutions segment, which accounted for approximately 97% of our consolidated revenues. Additionally, revenues for 2011 benefited from our December 30, 2010 acquisition of US Oncology Holdings, Inc. ("US Oncology") of The Woodlands, Texas and revenues for 2010 benefited to... -

Page 35

... Wholesale Price ("AWP") litigation matters. Excluding these charges (credit), operating expenses increased in 2011 primarily reflecting higher employee compensation costs including expenses associated with our Profit Sharing Investment Plan ("PSIP") as well as due to our acquisition of US Oncology... -

Page 36

... large volume sales of pharmaceuticals primarily to a limited number of large self-warehousing retail chain customers whereby we order bulk product from the manufacturer, receive and process the product through our central distribution facility and subsequently deliver the bulk product (generally in... -

Page 37

... customer contracts, we do so based on our assessment of total customer profitability. As a result, we do not evaluate our performance or allocate resources based on sales to customers' warehouses or gross profit associated with such sales. Canadian pharmaceutical distribution and services revenues... -

Page 38

... our share of a settlement of an antitrust class action lawsuit brought against a drug manufacturer, which was recorded as a reduction to cost of sales. (2) Gross profit of our Technology Solutions segment for 2011 includes a $72 million asset impairment charge for capitalized software held for sale... -

Page 39

... benefits including the McKesson Corporation Profit Sharing Investment Plan ("PSIP") and the addition of US Oncology. Excluding the litigation charges (credit), operating expenses for 2010 approximated 2009 primarily due to lower PSIP expense, cost containment efforts and the sale of two businesses... -

Page 40

... AWP claims, which review included consideration of the pace and progress of settlement discussions during and after the third quarter relating to state and federal Medicaid claims, we recorded a pre-tax charge of $189 million. All AWP litigation charges were included in our Distribution Solutions... -

Page 41

McKESSON CORPORATION FINANCIAL REVIEW (Continued) As a result of our acquisition of US Oncology, we incurred a net $52 million of acquisition-related expenses as follows: Corporate & Interest Expense $ - - 2 2 (16) 25 11 $ (In millions) Distribution Solutions 22 9 10 41 - - 41 Total 22 9 12 43 (... -

Page 42

... Solutions segment. Our investment in Parata is accounted for under the equity method of accounting. In 2009, we also recorded a pre-tax impairment of $5 million ($5 million after-tax) on another equity-held investment within our Distribution Solutions segment. Segment Operating Profit and Corporate... -

Page 43

... the Canada Revenue Agency ("CRA") for a total of $169 million related to transfer pricing for 2003 through 2007. Payments of most of the assessments to the CRA have been made to stop the accrual of interest. We have appealed the assessment for 2003 to the Tax Court of Canada and have filed a notice... -

Page 44

... oncologists, and works with patients, hospitals, payers and the medical industry across all phases of the cancer research and delivery continuum. The acquisition of US Oncology expands our existing specialty pharmaceutical distribution business and adds practice management services for oncologists... -

Page 45

McKESSON CORPORATION FINANCIAL REVIEW (Continued) During the last three years, we also completed a number of other smaller acquisitions within both of our operating segments. Financial results for our business acquisitions have been included in our consolidated financial statements since their ... -

Page 46

... 51% of our total consolidated revenues. Sales to our two largest customers, CVS Caremark Corporation ("CVS") and Rite Aid Corporation ("Rite Aid"), accounted for approximately 14% and 11% of our total consolidated revenues. At March 31, 2011, accounts receivable from our ten largest customers were... -

Page 47

... estimated quantities of slow-moving inventory by reviewing on-hand quantities, outstanding purchase obligations and forecasted sales. Shifts in market trends and conditions, changes in customer preferences due to the introduction of generic drugs or new pharmaceutical products or the loss of one... -

Page 48

... carrying value. Supplier Incentives: Fees for service and other incentives received from suppliers, relating to the purchase or distribution of inventory, are generally reported as a reduction to cost of goods sold. We consider these fees and other incentives to represent product discounts and as... -

Page 49

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Supplier Reserves: We establish reserves against amounts due from suppliers relating to various price and rebate incentives, including deductions or billings taken against payments otherwise due to them. These reserve estimates are established based ... -

Page 50

...our accounts receivable sales facility and short-term borrowings under the revolving credit facility and commercial paper, will be sufficient to fund our long-term and short-term capital expenditures, working capital and other cash requirements. In addition, from time-to-time, we may access the long... -

Page 51

... business acquisitions, including approximately $244 million for our acquisition of US Oncology, and $109 million of cash received from the sale of MAP. Investing activities in 2011 also included $233 million and $155 million in capital expenditures for property acquisitions and capitalized software... -

Page 52

... outside the United States. The duration of this temporary loan to the United States was less than 60 days. Working capital primarily includes cash and cash equivalents, receivables and inventories, net of drafts and accounts payable, deferred revenue and other current liabilities. Our Distribution... -

Page 53

... Company's long-term obligations including an immaterial amount of capital lease obligations. (2) Represents our estimated benefit payments for the unfunded benefit plans and minimum funding requirements for the pension plans. (3) Primarily represents interest that will become due on our fixed rate... -

Page 54

... liability programs. Credit Resources: We fund our working capital requirements primarily with cash and cash equivalents, our accounts receivable sales facility, short-term borrowings under the revolving credit facility and commercial paper. Senior Bridge Term Loan Facility In connection with our... -

Page 55

McKESSON CORPORATION FINANCIAL REVIEW (Continued) Additional information regarding our accounts receivable sales facility is included in Financial Notes 1 and 11, "Significant Accounting Policies" and "Debt and Financing Activities," to the consolidated financial statements appearing in this Annual ... -

Page 56

... risk was approximately $4.3 billion and $2.5 billion. The estimated fair value of our long-term debt and other financing was determined using quoted market prices and other inputs that were derived from available market information and may not be representative of actual values that could have been... -

Page 57

McKESSON CORPORATION Item 8. Financial Statements and Supplementary Data INDEX TO CONSOLIDATED FINANCIAL INFORMATION Page 52 53 54 55 56 57 58 Management's Annual Report on Internal Control Over Financial Reporting Report of Independent Registered Public Accounting Firm Consolidated Financial ... -

Page 58

...The management of McKesson Corporation is responsible for establishing and maintaining an adequate system of internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). With the participation of the Chief Executive Officer and the Chief Financial... -

Page 59

... statement schedule, and an opinion on the Company's internal control over financial reporting based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to... -

Page 60

...684 (20) 3,668 2,008 43 (187) 1,864 (601) 1,263 - 1,263 $ 2011 Revenues Cost of Sales Gross Profit Operating Expenses Selling Distribution Research and development Administrative Litigation charge (credit), net Total Operating Expenses Operating Income Other Income, Net Interest Expense Income from... -

Page 61

...Capitalized Software Held for Sale, Net Goodwill Intangible Assets, Net Other Assets Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities Drafts and accounts payable Deferred revenue Deferred tax liabilities Current portion of long-term debt Other accrued liabilities Total Long-Term... -

Page 62

McKESSON CORPORATION CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY Years Ended March 31, 2011, 2010 and 2009 (In millions, except per share amounts) Common Stock Shares Amount Additional Paid-in Other Capital Capital $ 4,252 97 99 $ (10) Accumulated Other ESOP Notes Retained Comprehensive and ... -

Page 63

... software held for sale Impairment of investments Other non-cash items Changes in operating assets and liabilities, net of business acquisitions: Receivables Inventories Drafts and accounts payable Deferred revenue Taxes Litigation charge (credit) Litigation settlement payments Deferred tax (benefit... -

Page 64

...) is a corporation that delivers medicines, pharmaceutical supplies, information and care management products and services designed to reduce costs and improve quality across the healthcare industry. We conduct our business through two operating segments, McKesson Distribution Solutions and McKesson... -

Page 65

... of credit risk with customers primarily in our Distribution Solutions segment. During 2011, sales to our ten largest customers accounted for approximately 51% of our total consolidated revenues. Sales to our two largest customers, CVS Caremark Corporation ("CVS") and Rite Aid Corporation ("Rite Aid... -

Page 66

... a number of considerations including projections of revenues, earnings and discounted cash flows and determination of market value multiples for similar businesses or guideline companies whose securities are actively traded in public markets. The discount rate used for cash flows reflects capital... -

Page 67

... Solutions segment include large volume sales of pharmaceuticals to a limited number of large customers who warehouse their own product. We order bulk product from the manufacturer, receive and process the product through our central distribution facility and deliver the bulk product (generally... -

Page 68

... software functionality available on a remote hosting basis from our data centers. The data centers provide system and administrative support, as well as hosting services. Revenue on products sold on an application service provider basis is recognized on a monthly basis over the term of the contract... -

Page 69

...-remote subsidiary of McKesson Corporation that is consolidated in our financial statements. This SPE then sells undivided interests in the pool of accounts receivable to third-party purchaser groups, (the "Purchaser Groups"), which include financial institutions and commercial paper conduits... -

Page 70

McKESSON CORPORATION FINANCIAL NOTES (Continued) Prior to April 1, 2010, sales of undivided interests in the receivables by the SPE to the Purchaser Groups were accounted for as sales because we had relinquished control of the receivables. Accounts receivable sold under these transactions were ... -

Page 71

McKESSON CORPORATION FINANCIAL NOTES (Continued) Recently Adopted Accounting Pronouncements Accounting for Transfers of Financial Assets: On April 1, 2010, we adopted amended accounting guidance for transfers of financial assets, including securitization transactions, in which entities have ... -

Page 72

... oncologists, and works with patients, hospitals, payers and the medical industry across all phases of the cancer research and delivery continuum. The acquisition of US Oncology expands our existing specialty pharmaceutical distribution business and adds practice management services for oncologists... -

Page 73

...: bridge loan fees Total acquisition-related expenses $ $ $ On May 21, 2008, we acquired McQueary Brothers Drug Company ("McQueary Brothers") of Springfield, Missouri for approximately $190 million. McQueary Brothers is a regional distributor of pharmaceutical, health and beauty products to... -

Page 74

... is computed using the tax rates of applicable tax jurisdictions. Additionally, a portion of pre-tax compensation expense is not tax-deductible. Stock Plans The 2005 Stock Plan provides our employees, officers and non-employee director's share-based long-term incentives. The 2005 Stock Plan permits... -

Page 75

McKESSON CORPORATION FINANCIAL NOTES (Continued) Compensation expense for stock options is recognized on a straight-line basis over the requisite service period and is based on the grant-date fair value for the portion of the awards that is ultimately expected to vest. We continue to use the Black-... -

Page 76

...entitle the holder to receive at the end of a vesting term a specified number of shares of the Company's common stock are accounted for at fair value at the date of grant. Total compensation expense for RSUs under our stock plans is determined by the product of the number of shares that are expected... -

Page 77

... are accounted for as variable awards until the performance goals are reached and the grant date is established. Total compensation expense for PeRSUs is determined by the product of the number of shares eligible to be awarded and expected to vest, and the market price of the Company's common stock... -

Page 78

McKESSON CORPORATION FINANCIAL NOTES (Continued) Employee Stock Purchase Plan ("ESPP") The Company has an ESPP under which 16 million shares have been authorized for issuance. The ESPP allows eligible employees to purchase shares of our common stock through payroll deductions. The deductions occur ... -

Page 79

... the Canada Revenue Agency ("CRA") for a total of $169 million related to transfer pricing for 2003 through 2007. Payments of most of the assessments to the CRA have been made to stop the accrual of interest. We have appealed the assessment for 2003 to the Tax Court of Canada and have filed a notice... -

Page 80

... Deferred revenue Compensation and benefit related accruals AWP litigation accrual Loss and credit carryforwards Other Subtotal Less: valuation allowance Total assets Liabilities Basis difference for inventory valuation and other assets Basis difference for fixed assets and systems development costs... -

Page 81

..., our Technology Solutions segment sold its wholly-owned subsidiary, McKesson Asia Pacific Pty Limited ("MAP"), a provider of phone and web-based healthcare services in Australia and New Zealand, for net sales proceeds of $109 million. The divestiture generated a pre-tax and after-tax gain of $95... -

Page 82

...as they were anti-dilutive. 8. Receivables, Net March 31, (In millions) Customer accounts Other Total Allowances Net $ $ 2011 7,982 1,341 9,323 (136) 9,187 $ $ 2010 7,256 968 8,224 (149) 8,075 The allowances are primarily for estimated uncollectible accounts and sales returns to vendors. 76 -

Page 83

...Acquisition accounting and other adjustments Foreign currency translation adjustments Balance, March 31, 2011 Distribution Solutions 1,869 7 (26) 21 1,871 819 (32) 4 2,662 Technology Solutions Total...millions) Customer lists Service agreements Trademarks and trade names Technology Other Total Net ... -

Page 84

.... During the time it was outstanding, the Bridge Loan bore interest of 1.76%, which was based on the London Interbank Offered Rate plus a margin based on the Company's credit rating. Bridge Loan fees of $25 million were included in interest expense. US Oncology Debt Acquired Upon our purchase of US... -

Page 85

...-remote subsidiary of McKesson Corporation that is consolidated in our financial statements. This SPE then sells undivided interests in the pool of accounts receivable to third-party purchaser groups (the "Purchaser Groups"), which include financial institutions and commercial paper conduits... -

Page 86

... in 2011, fee charges from the Purchaser Groups are recorded in interest expense within the consolidated statements of operations. Prior to 2011, these fee charges were recorded in Corporate administrative expenses. Additionally, any proceeds from these accounts receivable transactions would be... -

Page 87

... employee's plan compensation and creditable service accrued to that date. The Company has made no annual contributions since this plan was frozen. The benefits for this defined benefit retirement plan are based primarily on age of employees at date of retirement, years of service and employees' pay... -

Page 88

McKESSON CORPORATION FINANCIAL NOTES (Continued) Information regarding the changes in benefit obligations and plan assets for our pension plans is as follows: Years Ended March 31, (In millions) 2011 $ 593 6 31 21 (32) 6 625 $ 2010 456 4 35 132 (38) 4 593 Change in benefit obligations Benefit ... -

Page 89

...-term rate of return on plan assets Benefit obligation Discount rates Rate of increase in compensation 5.30% 3.75 7.79 4.99% 3.74 2009 5.34% 3.93 7.75 7.74% 3.93 Our U.S. defined benefit pension plan liabilities are valued using a discount rate based on a yield curve developed from a portfolio of... -

Page 90

... and preferred stock of companies from diverse industries. Fixed income securities include corporate bonds of companies from diverse industries, government securities, mortgage-backed securities, asset-backed securities and other. Other investments include real estate funds, hedge funds and cash... -

Page 91

... and preferred stock Equity commingled funds Fixed income securities: Government securities Corporate bonds Mortgage-backed securities Asset-backed securities and other Fixed income commingled funds Other: Real estate funds Hedge funds Total Receivables (1) Payables (1) Total (1) Represents pending... -

Page 92

... 31, 2011, 11% of our plan assets is comprised of Bartram International Fund, which holds only actively traded stock. Other Defined Benefit Plans Under various U.S. bargaining unit labor contracts, we make payments into multi-employer pension plans established for union employees. We are liable for... -

Page 93

...with cash or treasury shares. The McKesson Corporation PSIP was a member of the settlement class in the Consolidated Securities Litigation Action. On April 27, 2009, the court issued an order approving the distribution of the settlement funds. On October 9, 2009, the PSIP received approximately $119... -

Page 94

... of actuarial gain in 2011). Other postretirement benefits are funded as claims are paid. Expected benefit payments for our postretirement welfare benefit plans, net of expected Medicare subsidy receipts of $1 million annually, are as follows: $12 million annually for 2012 to 2016 and $56 million... -

Page 95

... billion and $2.5 billion at March 31, 2010. The estimated fair value of our long-term debt and other financing was determined using quoted market prices and other inputs that were derived from available market information and may not be representative of actual values that could have been realized... -

Page 96

... and permits, court and fiduciary obligations and our workers' compensation and automotive liability programs. Our software license agreements generally include certain provisions for indemnifying customers against liabilities if our software products infringe a third party's intellectual property... -

Page 97

... for our products and services. For example, we provide warranties that the pharmaceutical and medical-surgical products we distribute are in compliance with the Food, Drug and Cosmetic Act and other applicable laws and regulations. We have received the same warranties from our suppliers, which... -

Page 98

...Claims Act, California Business and Professions Code §§ 17200 and 17500 and seeking damages, treble damages, civil penalties, restitution, interest and attorneys' fees, all in unspecified amounts, San Francisco Health Plan, et al. v. McKesson Corporation, (Civil Action No. 1:08-CV-10843-PBS) ("San... -

Page 99

... the court scheduled for January 19, 2011. On December 2, 2010, the Company executed a Memorandum of Understanding documenting an agreement in principle with the States of Oklahoma and Montana to settle and release those States' share of their Medicaid claims in the Douglas County, Kansas Action... -

Page 100

... as a crosspetition for review of the district court's decision to exclude all state entities from the certified class. The First Circuit has not yet ruled on the parties' petitions. No trial date is set in the San Francisco or Douglas County, Kansas Actions. B. State Medicaid AWP Cases Beginning in... -

Page 101

..., interest, attorneys' fees and costs of suit, all in unspecified amounts, State of Utah v. McKesson Corporation, et al., (Case No. CV 10-4743-SC). On December 22, 2010, the Company filed a motion to dismiss the Utah Action, which has not yet been ruled upon. The Arizona Administrative Proceeding On... -

Page 102

..., State of Louisiana v. McKesson Corporation, (Case No. C597634 Sec. 23). The Company filed a motion to dismiss the complaint on March 7, 2011. A hearing on the Company's motion to dismiss is scheduled for May 9, 2011. C. The New Jersey United States' Attorney's Office AWP Investigation In June of... -

Page 103

... rel. Jamison v. McKesson Corporation, et al., (Civil Action No. 2:08-CV-00214-SA). The United States ("USA") alleges violations of the federal False Claims Act, 31 U.S.C. Sections 3729-33, in connection with billing and supply services rendered by MediNet to the long-term care facility operator co... -

Page 104

... for independent pharmacies, alleging that the Company has breached, and continues to breach, a February 21, 2003, supply agreement between the parties, Independent Pharmacy Cooperative, v. McKesson Corporation, (Case No. 10-CV-00527 (BC)). In addition to alleging breach of contract, plaintiff... -

Page 105

... et al. v. McKesson Corporation et al., (Case No. 4:08-CV-0848 (ODS)). The complaint alleges that the defendants' conduct prior to the Company's losing the account to the competitor in January of 2006, caused the customer relator to file subsequent claims in violation of the False Claims Act. The... -

Page 106

...has taken testimony from a number of current and former NDC employees. There has been no activity in this matter for some time and the SEC has taken no action against NDC or its successor to date. Prior to its recent acquisition by the Company, US Oncology was informed that the United States Federal... -

Page 107

... 29, 2010. The total number of shares repurchased under this program was 14.6 million shares at an average price per share of $68.66. In March 2011, we entered into another ASR program with a third party financial institution to repurchase $275 million of the Company's common stock. The program was... -

Page 108

.... Related Party Balances and Transactions Notes receivable outstanding from certain of our current and former officers and senior managers totaled $15 million and $16 million at March 31, 2011 and 2010. These notes related to purchases of common stock under our various employee stock purchase plans... -

Page 109

McKESSON CORPORATION FINANCIAL NOTES (Continued) The Technology Solutions segment delivers enterprise-wide clinical, patient care, financial, supply chain, strategic management software solutions, pharmacy automation for hospitals, as well as connectivity, outsourcing and other services, including ... -

Page 110

.... Amounts include amortization of acquired intangible assets purchased in connection with acquisitions by the Company. Other amortization includes amortization of capitalized software held for sale and capitalized software for internal use. Long-lived assets consist of property, plant and equipment... -

Page 111

...include a credit of $51 million representing our share of a settlement of an antitrust class action lawsuit. Financial results for the second quarter and full year 2011 include a $72 million asset impairment charge for capitalized software held for sale. Financial results of US Oncology are included... -

Page 112

... such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) and the related report of our independent registered public accounting firm are included on page 52 and page 53 of this Annual Report on Form 10-K, under the headings, "Management's Annual Report on Internal Control Over Financial... -

Page 113

...Statement. Information about the Code of Ethics governing our Chief Executive Officer, Chief Financial Officer, Controller and Financial Managers can be found on our Web site, www.mckesson.com, under the Investors - Corporate Governance tab. The Company's Corporate Governance Guidelines and Charters... -

Page 114

McKESSON CORPORATION The following table sets forth information as of March 31, 2011 with respect to the plans under which the Company's common stock is authorized for issuance: Number of securities remaining available for future issuance under equity compensation plans (excluding securities ... -

Page 115

McKESSON CORPORATION 2000 Employee Stock Purchase Plan (the "ESPP"): The ESPP is intended to qualify as an "employee stock purchase plan" within the meaning of Section 423 of the Internal Revenue Code. In March 2002, the Board amended the ESPP to allow for participation in the plan by employees of ... -

Page 116

McKESSON CORPORATION PART IV Item 15. Exhibits and Financial Statement Schedule Page (a)(1) Consolidated Financial Statements...Report of Deloitte & Touche, LLP, Independent Registered Public Accounting Firm Consolidated Statements of Operations for the years ended March 31, 2011, 2010 and 2009 ... -

Page 117

... duly authorized. MCKESSON CORPORATION Dated: May 5, 2011 /s/ Jeffrey C. Campbell Jeffrey C. Campbell Executive Vice President and Chief Financial Officer Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf... -

Page 118

McKESSON CORPORATION SCHEDULE II SUPPLEMENTARY CONSOLIDATED FINANCIAL STATEMENT SCHEDULE VALUATION AND QUALIFYING ACCOUNTS For the Years Ended March 31, 2011, 2010 and 2009 (In millions) Additions Balance at Beginning of Year Charged to Costs and Expenses Charged to Other Accounts (3) Deductions ... -

Page 119

... known as The Bank of New York Trust Company, N.A.), and Wells Fargo Bank, National Association, as Trustee. McKesson Corporation 1994 Stock Option and Restricted Stock Plan as amended through July 31, 2001. Form 10-Q File Number 1-13252 Exhibit 3.1 Filing Date October 31, 2007 3.2 8-K 1-13252... -

Page 120

... 29, 2008. McKesson Corporation Change in Control Policy for Selected Executive Employees, as amended and restated on October 26, 2010. McKesson Corporation 2005 Management Incentive Plan, as amended and restated on April 21, 2010, effective July 28, 2010. Form 10-K File Number 1-13252 Exhibit 10... -

Page 121

... the McKesson Corporation 2005 Stock Plan, as amended and restated on October 26, 2010. Third Amended and Restated Receivables Purchase Agreement, dated as of May 19, 2010, among the Company, as servicer, CGSF Funding Corporation, as seller, the several conduit purchasers from time to time party to... -

Page 122

... Capital Corporation. Services Agreement, dated as of December 31, 2002, between McKesson Capital Corp. and General Electric Capital Corporation. Senior Bridge Term Loan Agreement, dated as of November 23, 2010, among The Company, Bank of America N.A., as Administrative Agent, and the Lenders party... -

Page 123

McKESSON CORPORATION Incorporated by Reference Exhibit Number 24†31.1†Description Power of Attorney. Certification of Chief Executive Officer Pursuant to Rule 13a-14(a) and Rule 15d-14(a) of the Securities Exchange Act of 1934, as amended, and adopted pursuant to Section 302 of the Sarbanes-... -

Page 124

... CERTIFICATION PURSUANT TO RULE 13a-14(a) AND RULE 15d-14(a) OF THE SECURITIES EXCHANGE ACT, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, John H. Hammergren, certify that: 1. 2. I have reviewed this annual report on Form 10-K of McKesson Corporation; Based on my knowledge... -

Page 125

... CERTIFICATION PURSUANT TO RULE 13a-14(a) AND RULE 15d-14(a) OF THE SECURITIES EXCHANGE ACT, AS ADOPTED PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002 I, Jeffrey C. Campbell, certify that: 1. 2. I have reviewed this annual report on Form 10-K of McKesson Corporation; Based on my knowledge... -

Page 126

Exhibit 32 CERTIFICATION PURSUANT TO 18 U.S.C. SECTION 1350, AS ADOPTED PURSUANT TO SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002 In connection with the annual report of McKesson Corporation (the "Company") on Form 10-K for the year ended March 31, 2011 as filed with the Securities and Exchange ... -

Page 127

(This page intentionally left blank) -

Page 128

...: (In millions, except per share data) 2011 Years Ended March 31, 2010 2009 2008 2007 Net income, as reported ...Exclude: Litigation charge (credit), net...Income tax expense (benefit), net ...Income tax reserve reversal...Litigation charge (credit), net of tax ...Discontinued operations, net of... -

Page 129

...and October. McKesson Corporation's Dividend Reinvestment Plan offers stockholders the opportunity to reinvest dividends in common stock and to purchase additional shares of common stock. Stock in an individual's Dividend Reinvestment Plan is held in book entry at the Company's transfer agent, Wells... -

Page 130

McKesson Corporation One Post Street San Francisco, CA 94104 www.mckesson.com © 2011 McKesson Corporation. All rights reserved.