Lockheed Martin 2003 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2003 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

DEAR FELLOW SHAREHOLDERS,

With our management team united behind a straightforward and keenly focused strategy of disciplined

growth, Lockheed Martin was, and continues to be, distinguished by robust operational and financial

performance in 2003. As a result, we enter 2004 well positioned to fulfill the potential and promise of

this innovative corporation of 130,000 dedicated men and women.

This strategy of disciplined growth is to increase shareholder value by:

■Putting operational performance and customer satisfaction at the top of our priorities.

■Maintaining consistent financial performance including strong cash flow and increasing financial

strength and flexibility.

■Focusing on profitable growth in our core markets of Defense, Homeland Security and Government

Information Technology (IT). We also look forward to working with NASA to support America’s

reinvigorated commitment to space exploration.

Successful execution of this strategy was demonstrated in the numbers with a third straight year of positive

momentum. Net sales in 2003 grew 20 percent to $31.8 billion. We have grown segment operating profit

faster than sales, reflecting steadily improving margins. For the third consecutive year, orders remain strong

with a backlog of $76.9 billion at the end of 2003. Our Aeronautics business enjoyed a record year for sales

and our Electronic Systems business completed a seventh consecutive year of organic growth.

We continued our record of consistent cash flow generation that reached $1.8 billion in 2003, and

deployed cash to enhance shareholder value through:

■Debt reduction. We reduced debt by $1.4 billion in 2003 and $3.7 billion since 2000. Our ratio of

debt to total capital, at 48 percent, is now within our goal of 40 to 50 percent. We also restructured

about $1 billion of debt to achieve lower interest expense.

■Share repurchase. We have been buying back our shares periodically. Since we started our share

repurchase activity about a year ago, we have retired approximately 11 million shares.

■Dividends. Financial flexibility and vitality are also reflected in our doubling the annual dividend

rate from 44 cents to 88 cents per common share.

■Acquisitions. Growing business in our core markets is key to competing successfully, and we have

made selective acquisitions to continue strengthening our position in defense and civil government IT.

Lockheed Martin last year completed strategic transactions with ACS and Orincon, and announced

the proposed acquisition of The Titan Corporation. We expect these transactions will bring additional

capabilities, a talented workforce and customers. These transactions will help us be more competitive

in the defense and civil government IT markets.

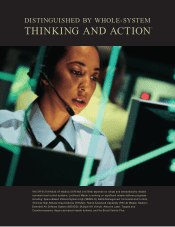

About 25 percent of our sales are from IT solutions and services to defense, intelligence and civil

government agencies.

The Titan acquisition, when completed and integrated with Orincon, will bolster our core capabilities

in critical intelligence, knowledge management and data fusion that are applicable to national defense.

In the ACS transaction, we acquired the defense and most of the civil government IT business of ACS,

while ACS acquired Lockheed Martin’s commercial IT business.

LOCKHEED MARTIN ANNUAL REPORT 2003 — 3