Lockheed Martin 1999 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 1999 Lockheed Martin annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

FOCUS

FOCUS 1

Contents

To Our Shareholders 14

Financial Section 20

Corporate Directory 66

General Information 68

FINANCIAL HIGHLIGHTS

LOCKHEED MARTIN

ON THE COVER

The F-22 Raptor performed superbly for our Air Force customer last year, meeting all of

the demanding flight test requirements.

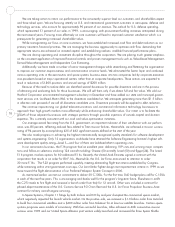

(In millions, except per share data and number of employees)

1999 1998 1997

Net sales $ 25,530 $ 26,266 $ 28,069

Net earnings 382(a)(b) 1,001(c)(d) 1,300(e)

Diluted earnings (loss) per share .99(a)(b) 2.63(c)(d) (1.56)(e)(f)

Pro forma diluted earnings per share excluding

nonrecurring and unusual items 1.50(g) 2.99(g) 2.87(g)

Cash dividends per common share .88 .82 .80

Total assets 30,012 28,744 28,361

Short-term borrowings 475 1,043 494

Long-term debt (including current maturities) 11,479 9,843 11,404

Stockholders’ equity 6,361 6,137 5,176(f)

Negotiated backlog $ 45,913 $ 45,345 $ 47,059

Employees 147,000 165,000 173,000

(a) Net earnings for 1999 include the effects of nonrecurring and unusual items related to gains from sales of

the Corporation’s remaining interest in L-3 Communications Holdings, Inc. (L-3), gains from the sale of surplus

real estate, and a net gain associated with sales of various non-core businesses and investments and other

portfolio shaping items. These gains were more than offset by the effect of the Corporation’s adoption of

Statement of Position No. 98-5 regarding the costs of start-up activities which resulted in a cumulative effect

adjustment. On a combined basis, these nonrecurring and unusual items decreased net earnings $193 mil-

lion, or $.51 per diluted share.

(b) Net earnings for 1999 include the effects of negative adjustments related to changes in estimate on the

C-130J airlift aircraft program and the Titan IV launch vehicle program. On a combined basis, these changes

in estimate decreased net earnings by $182 million, or $.47 per diluted share.

(c) Net earnings for 1998 include the effects of a charge related to the shutdown of CalComp Technology, Inc.,

a majority-owned subsidiary of the Corporation, partially offset by the effects of nonrecurring and unusual

items related to the gain on the initial public offering of L-3’s common stock, and gains related to the sales of

surplus real estate and other portfolio shaping items. On a combined basis, these nonrecurring and unusual

items reduced net earnings by $136 million, or $.36 per diluted share.

(d) Net earnings for 1998 include an adjustment resulting from significant improvement in the Atlas launch vehicle

program based upon a current evaluation of the program’s historical performance. This change in estimate

increased net earnings by $78 million, or $.21 per diluted share.

(e) Net earnings for 1997 include the effects of a tax-free gain related to a transaction with General Electric

Company (GE) to redeem the Corporation’s Series A preferred stock, and gains associated with the sale of

surplus real estate and other portfolio shaping items. These gains were partially offset by nonrecurring and

unusual charges related to the Corporation’s decision to exit certain lines of business and impairment in the

values of various non-core investments and certain other assets. On a combined basis, these items increased

net earnings by $66 million and decreased diluted loss per share by $.15.

(f) Loss per share for 1997 includes the effects of a deemed preferred stock dividend resulting from the transac-

tion with GE. The excess of the fair value of the consideration transferred to GE (approximately $2.8 billion)

over the carrying value of the Series A preferred stock ($1.0 billion) was treated as a deemed preferred stock

dividend and deducted from 1997 net earnings in determining net loss applicable to common stock used in

the computation of loss per share. The effect of this deemed dividend was to reduce the diluted per share

amount by $4.93.

(g) The calculations of pro forma diluted earnings per share exclude the effects of the nonrecurring and unusual

items described in (a), (c), (e) and (f) above and, for 1997, include the pro forma dilutive effects of preferred

stock conversion and stock options.