Lifetime Fitness 2009 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2009 Lifetime Fitness annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

We believe we have a disciplined and sophisticated site selection and development process.

We believe we have developed a disciplined and sophisticated process to evaluate metropolitan markets in which to

build or lease new centers, as well as specific sites for potential future centers within those markets. This multi-step

process is based upon applying our proven successful experience and analysis to predetermined physical,

demographic, psychographic and competitive criteria generated from profiles of each of our existing centers. We

continue to modify these criteria based upon the performance of our centers. A formal business plan is developed for

each proposed new center and the plan must pass multiple stages of approval by our management and Finance

Committee of the board of directors. By utilizing a wholly owned construction subsidiary, FCA Construction

Company, LLC (FCA Construction), that is dedicated solely to building and remodeling our centers, we maintain

maximum flexibility over the design process of our centers and control over the cost and timing of the construction

process subject to financing and capital availability.

Our Growth Strategy

Our growth strategy is driven by three primary elements:

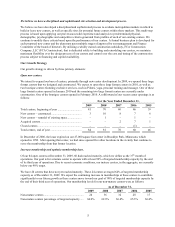

Open new centers.

We intend to expand our base of centers, primarily through new center development. In 2009, we opened three large

format centers that we designed and constructed. We expect to open three large format centers in 2010, as well as

two boutique centers featuring exclusive services, such as Pilates, yoga, personal training and massage. One of these

large format centers opened in January 2010 and the remaining two large format centers are currently under

construction. One of the boutique centers opened in February 2010. A rollforward of our recent center openings is as

follows:

For the Year Ended December 31,

2009 2008 2007 2006 2005

Total centers, beginning of year ................................

.

81 70 60 46 39

New centers – constructed .........................................

.

3 10 8 7 6

New centers – remodel of existing space ...................

.

– 1 – 1 –

Acquired centers ........................................................

.

– – 2 7 1

Closed centers ............................................................

.

– – – (1) –

Total centers, end of year ..........................................

.

84 81 70 60 46

In December of 2006, the lease expired on our 27,000 square foot center in Brooklyn Park, Minnesota, which

opened in 1992. After opening that center, we had since opened five other locations in the vicinity that continue to

serve the membership from that former location.

Increase membership and optimize membership dues.

Of our 84 open centers at December 31, 2009, 60 had reached maturity, which we define as the 37th month of

operations. Our goal is for a mature center to operate with at least 90% of targeted membership capacity by the end

of its third year of operations. Due to recent economic conditions, our mature centers, in the aggregate, are currently

below our 90% target.

We have 24 centers that have not yet reached maturity. These 24 centers averaged 64% of targeted membership

capacity as of December 31, 2009. We expect the continuing increase in memberships at these centers to contribute

significantly to our future growth as these centers move toward our goal of 90% of targeted membership capacity by

the end of their third year of operations. Our membership levels for our non-mature centers were as follows:

As of December 31,

2009 2008 2007 2006 2005

Non-mature centers ........................................................ 24 36 32 28 17

Non-mature centers percentage of targeted capacity ..... 64.0% 62.6% 66.4% 65.3% 66.4%