Lexmark 2009 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2009 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

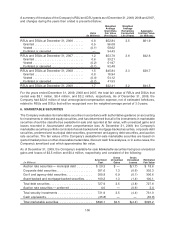

The accounting guidance for business combinations requires the acquirer to recognize the identifiable

assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at their acquisition

date fair values, with limited exceptions. The identifiable assets and liabilities were made up primarily of the

customer relationships intangible asset as well as various short-term monetary assets and liabilities. The

customer relationships intangible asset was determined using the discounted cash flow method under the

income approach. Based on the historical sales trend of the acquiree and the analysis of the market, the

Company assumed an annual attrition rate of three percent for the decrease in sales to the existing

customer base. The calculated fair value of the customer relationships intangible asset, using a 10 year

time frame, was $3.5 million. The remaining identifiable assets and liabilities were primarily cash, accounts

receivable and accounts payable whose book values already approximated fair value. In a business

combination achieved in stages, the acquisition date fair value of the acquirer’s previously held equity

interest in the acquiree is included in the total consideration for purposes of computing goodwill under the

acquisition method. The fair value of the Company’s previously held noncontrolling interest in the company

was also estimated using the income approach, specifically, the discounted cash flow method. Significant

assumptions included a two percent revenue growth rate, based on a combination of market research and

internal forecasts, with calculations performed over a five-year time frame plus the terminal year. The

Company believes the derived discount rate of 14.8% applied to both discounted cash flow analyses

reflects market participant assumptions based on the risk of the asset and the company acquired.

4. RESTRUCTURING AND RELATED CHARGES

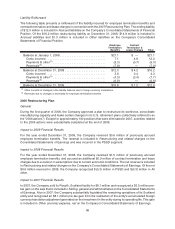

October 2009 Restructuring Plan

General

As part of Lexmark’s ongoing plans to improve the efficiency and effectiveness of all of our operations, the

Company announced restructuring actions (the “October 2009 Restructuring Plan”) on October 20, 2009.

The Company continues its focus on refining its selling and service organization, reducing its general and

administrative expenses, consolidating its cartridge manufacturing capacity, and enhancing the efficiency

of its supply chain infrastructure. The actions taken will reduce cost and expense across the organization,

with a focus in manufacturing and supply chain, service delivery overhead, marketing and sales support,

corporate overhead and development positions as well as reducing cost through consolidation of facilities

in supply chain and cartridge manufacturing. The Company expects these actions to be principally

completed by the end of the first quarter of 2011.

The October 2009 Restructuring Plan is expected to impact about 825 positions worldwide and should

result in total pre-tax charges of approximately $80.0 million. Charges of $59.6 million were incurred in

2009, with approximately $20.4 million expected to be incurred in 2010 — 2011. The company expects the

total cash cost of this plan to be approximately $65.0 million.

The Company expects to incur total charges related to the October 2009 Restructuring Plan of

approximately $58.0 million in PSSD, approximately $9.0 million in ISD and approximately

$13.0 million in All other.

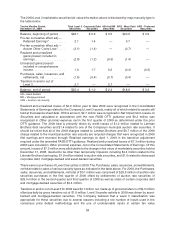

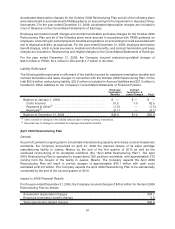

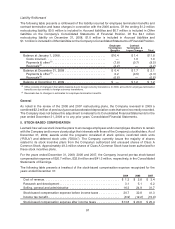

Impact to 2009 Financial Results

For the year ended December 31, 2009, the Company incurred charges of $59.6 million for the October

2009 Restructuring Plan as follows:

Accelerated depreciation charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6.2

Employee termination benefit charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52.4

Contract termination and lease charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.0

Total restructuring-related charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $59.6

90