Lenovo 2013 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2013 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE FINANCIAL STATEMENTS

Lenovo Group Limited 2012/13 Annual Report

148

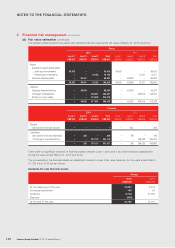

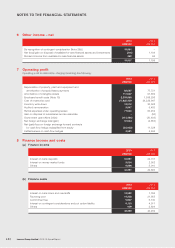

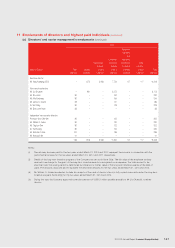

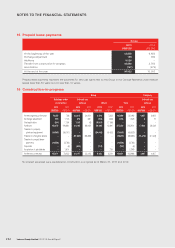

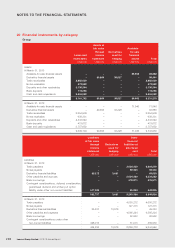

11 Emoluments of directors and highest paid individuals (continued)

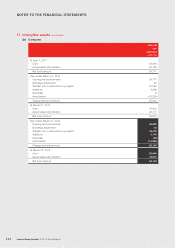

(b) Five highest paid individuals

The five individuals whose emoluments were the highest in the Group for the year include one (2012: two) director

whose emoluments are reflected in the analysis presented above. The emoluments of the remaining four (2012: three)

individuals during the year are as follows:

2013 2012

US$’000 US$’000

Basic salaries, allowances, and benefits-in-kind 2,222 1,556

Discretionary bonuses 8,760 3,933

Employer’s contribution to pension schemes 469 435

Long-term incentive awards 4,083 3,077

Others 1,074 926

16,608 9,927

The emoluments fell within the following bands:

Number of individuals

2013 2012

Emolument bands

US$3,219,928 – US$3,284,325 –1

US$3,284,326 – US$3,348,724 –1

US$3,348,725 – US$3,413,122 –1

US$3,800,028 – US$3,864,435 1–

US$4,122,065 – US$4,186,471 1–

US$4,186,471 – US$4,250,878 1–

US$4,315,287 – US$4,379,693 1–

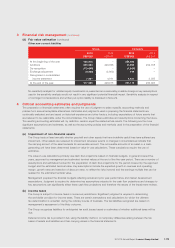

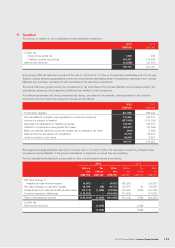

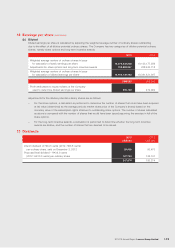

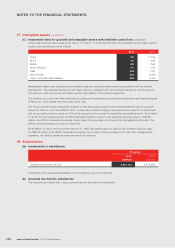

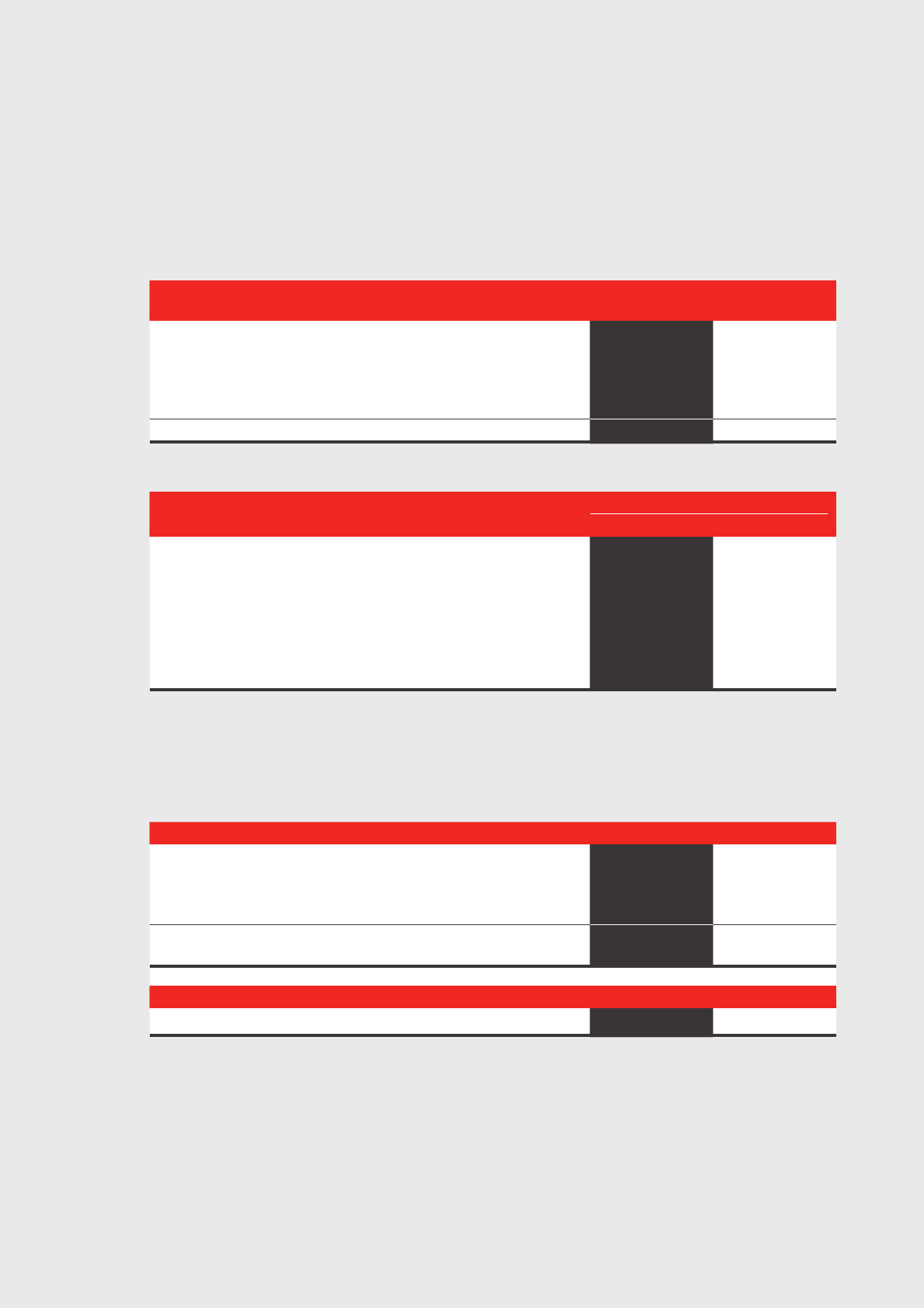

12 Earnings per share

(a) Basic

Basic earnings per share is calculated by dividing the profit attributable to equity holders of the Company by the

weighted average number of ordinary shares in issue during the year after adjusting shares held by the employee share

trusts and consideration shares in respect of business combination activities.

2013 2012

Weighted average number of ordinary shares in issue 10,386,943,985 10,211,315,987

Adjustment for shares held by employee share trust (76,705,750) (135,699,015)

Adjustment for consideration shares in respect of

business combination activities –57,560,317

Weighted average number of ordinary shares in issue

for calculation of basic earnings per share 10,310,238,235 10,133,177,289

US$’000 US$’000

Profit attributable to equity holders of the Company 635,148 472,992

Adjustments to the weighted average number of ordinary shares in issue are as follows:

– The shares of the Company held by the employee share trusts are for the purposes of awarding shares to eligible

employees under the long-term incentive program.

– 57,560,317 shares of the Company, representing the consideration shares in respect of the acquisition of Medion

AG (“Medion”) which serve as security for any potential damages were issued to the seller on February 15, 2013.