Kodak 2014 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2014 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sources of Liquidity

Available liquidity includes cash balances and the unused portion of the ABL Credit Agreement. The ABL Credit Agreement had $29 million of net availability as of

December 31, 2014. The amount of available liquidity is subject to fluctuations and includes cash balances held by various entities worldwide. At December 31, 2014 and

December 31, 2013, approximately $214 million and $307 million, respectively, of cash and cash equivalents were held within the U.S. and approximately $498 million and

$537 million, respectively, of cash and cash equivalents were held outside the U.S. Cash balances held outside of the U.S. are generally required to support local country

operations, may have high tax costs, or other limitations that delay the ability to repatriate, and therefore may not be readily available for transfer to other

jurisdictions. Additionally, in China, where approximately $241 million of cash and cash equivalents were held as of December 31, 2014, there are limitations related to net

asset balances that impact the ability to make cash available to other jurisdictions in the world. Under the terms of the Company’s Credit Agreements, the Company is

permitted to invest up to $100 million at any time in subsidiaries and joint ventures that are not party to the loan agreement.

Cash flows from investing activities included $43 million for capital expenditures for the year ended December 31, 2014. Kodak expects approximately $45 million of cash

flows for investing activities from capital expenditures for the year ended December 31, 2015. Additionally, Kodak intends to utilize a variety of methods to finance customer

equipment purchases in the future, including expansion of third party finance programs and internal financing through both leasing and installment loans.

Kodak believes that its liquidity position is adequate to fund its operating and investing needs and to provide the flexibility to respond to further changes in the business

environment. See “Item 1A. Risk Factors” for a discussion of potential challenges to liquidity.

Refer to Note 8, "Short-Term Borrowings and Long-Term Debt," in the Notes to Financial Statements for further discussion of long-term debt, related maturities and interest

rates as of December 31, 2014 and December 31, 2013.

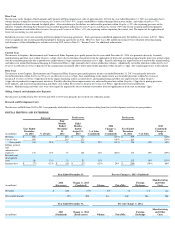

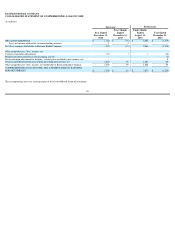

Contractual Obligations

The impact that contractual obligations are expected to have on Kodak's cash flow in future periods is as follows:

As of December 31, 2014

(in millions)

Total

2015

2016

2017

2018

2019

2020

+

Long

-

term debt

(1)

$

689

$

5

$

4

$

4

$

4

$

397

$

275

Interest payments on debt

326

64

64

65

62

51

20

Operating lease obligations

105

30

23

17

12

10

13

Purchase obligations

(2)

31

15

6

3

3

2

2

Total

(3) (4) (5)

$

1,151

$

114

$

97

$

89

$

81

$

460

$

310

(1)

Primarily represents the maturity values of Kodak's long-term debt obligations as of December 31, 2014. Annual amounts represent the minimum principal payments

owed each year. The contractual obligations do not reflect any contingent mandatory annual principal repayments that may be required to be made upon achieving certain

excess cash flow targets, as defined in the senior secured credit facility. Other prepayments may be required upon the occurrences of certain other events. Refer to Note

8, "Short

-

Term Borrowings and Long

-

Term Debt," in the Notes to Financial Statements.

(2)

Purchase obligations include agreements related to raw materials, supplies, production and administrative services, as well as marketing and advertising, that are

enforceable and legally binding on Kodak and that specify all significant terms, including: fixed or minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable without penalty.

(3)

Due to uncertainty regarding the completion of tax audits and possible outcomes, an estimate of the timing of payments related to uncertain tax positions and interest

cannot be made. See Note 14,

“

Income Taxes,

”

in the Notes to Financial Statements for additional information regarding Kodak

’

s uncertain tax positions.

(4)

Funding requirements for Kodak's major defined benefit retirement plans and other postretirement benefit plans have not been determined, therefore, they have not been

included.

(5)

Because timing of their future cash outflows are uncertain, the other long

-

term liabilities presented in Note 7,

“

Other Long

-

Term Liabilities,

”

in the Notes to Financial

Statements are excluded from this table.

42