Kodak 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

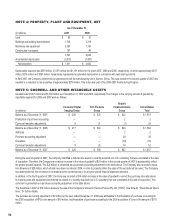

Long-term Debt, Including Lines of Credit

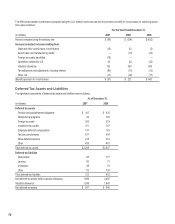

Long-term debt and related maturities and interest rates were as follows:

As of December 31,

(in millions) 2007 2006

Country Type Maturity Weighted-Average

Interest Rate

Amount Outstanding Weighted-Average

Interest Rate

Amount Outstanding

U.S. Medium-term 2008 3.63% $ 250 3.63% $ 250

U.S. Term note 2007 — 7.60%* 10

U.S. Term note 2012 — 7.60%* 861

Canada Term note 2012 — 7.60%* 277

U.S. Term note 2006-2013 6.16% 50 6.16% 47

Germany Term note 2006-2013 6.16% 201 6.16% 188

U.S. Term note 2013 7.25% 500 7.25% 500

U.S. Term note 2018 9.95% 3 9.95% 3

U.S. Term note 2021 9.20% 10 9.20% 10

U.S. Convertible 2033 3.38% 575 3.38% 575

U.S. Notes 2006-2010 — 5.90%* 8

Other — 2

1,589 2,731

Current portion of long-term debt (300) (17)

Long-term debt, net of current portion $ 1,289 $ 2,714

* Represents debt with a variable interest rate.

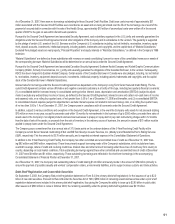

Annual maturities (in millions) of long-term debt outstanding at December 31, 2007 are as follows: $300 in 2008, $45 in 2009, $43 in 2010, $40 in 2011,

$38 in 2012 and $1,123 in 2013 and beyond.

Secured Credit Facilities

On October 18, 2005 the Company closed on $2.7 billion of Senior Secured Credit Facilities (Secured Credit Facilities) under a new Secured Credit Agree-

ment (Secured Credit Agreement) and associated Security Agreement and Canadian Security Agreement. The Secured Credit Facilities consisted of a

$1.0 billion 5-Year Committed Revolving Credit Facility (5-Year Revolving Credit Facility) expiring October 18, 2010 and $1.7 billion of Term Loan Facilities

(Term Facilities) expiring October 18, 2012.

The 5-Year Revolving Credit Facility can be used by Eastman Kodak Company (U.S. Borrower) for general corporate purposes including the issuance of

letters of credit. Amounts available under the facility can be borrowed, repaid and re-borrowed throughout the term of the facility provided the Company

remains in compliance with covenants contained in the Secured Credit Agreement. As of December 31, 2007, there was no debt outstanding and $141

million of letters of credit issued under this facility.

Under the Term Facilities, $1.2 billion was borrowed at closing primarily to refinance debt originally issued under the Company’s previous $1.225 billion

5-Year Facility to finance the acquisition of Creo Inc. on June 15, 2005. The $1.2 billion consisted of a $920 million 7-Year Term Loan to the U.S. Borrower

and a $280 million 7-Year Term Loan to Kodak Graphic Communications Canada Company (KGCCC or, the Canadian Borrower). Pursuant to the terms

of the Secured Credit Agreement, an additional $500 million was available to the U.S. Borrower under the seven-year term loan facility for advance at any

time through June 15, 2006. On June 15, 2006, the Company used this $500 million to refinance $500 million 6.375% Medium Term Notes, Series A, due

June 15, 2006. Due to the repayment described below, the Term Facilities are no longer available for new borrowings.

On January 10, 2007, the Company announced that it had entered into an agreement to sell its Health Group to Onex Healthcare Holdings, Inc., a subsid-

iary of Onex Corporation. The sale closed on April 30, 2007 for approximately $2.35 billion. Consistent with the terms of the Secured Credit Agreement, on

May 3, 2007 the Company used a portion of these proceeds to fully repay its approximately $1.15 billion of secured term debt.