Kodak 2001 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

photofinishing equipment. Under the partnership agreement between

Qualex and DCC, subject to certain conditions, ESF has exclusivity rights

to purchase Qualex’s long-term lease receivables. The term of the

partnership agreement continues through October 6, 2003. In light of the

Termination Event referred to above and the timing of the partnership

termination, Qualex is currently considering alternative financing

solutions for prospective leasing activity with its customers.

At December 31, 2001, the Company had outstanding letters of

credit totaling $42 million and surety bonds in the amount of $94 million

to ensure the completion of environmental remediations and payment of

possible casualty and workers’ compensation claims.

Rental expense, net of minor sublease income, amounted to $126

million in 2001, $155 million in 2000 and $142 million in 1999. The

approximate amounts of noncancelable lease commitments with terms of

more than one year, principally for the rental of real property, reduced by

minor sublease income, are $106 million in 2002, $85 million in 2003,

$70 million in 2004, $36 million in 2005, $25 million in 2006 and $45

million in 2007 and thereafter.

The Company and its subsidiary companies are involved in lawsuits,

claims, investigations and proceedings, including product liability,

commercial, environmental, and health and safety matters, which are

being handled and defended in the ordinary course of business. There are

no such matters pending that the Company and its General Counsel

expect to be material in relation to the Company’s business, financial

position or results of operations.

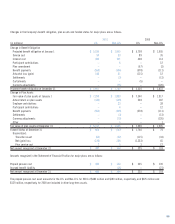

Note 11: Financial Instruments

The following table presents the carrying amounts of the assets

(liabilities) and the estimated fair values of financial instruments at

December 31, 2001 and 2000:

2001 2000

Carrying Fair Carrying Fair

(in millions) Amount Value Amount Value

Marketable

securities:

Current $3$3$5$5

Long-term 34 34 54 53

Other

investments ––22

Long-term debt (1,666) (1,664) (1,166) (1,184)

Foreign currency

forwards 11(44) (44)

Silver forwards 11(17) (17)

Interest rate swap (2) (2) ––

Marketable securities and other investments are valued at quoted market

prices. The fair values of long-term borrowings are determined by

reference to quoted market prices or by obtaining quotes from dealers.

The fair values for the remaining financial instruments in the above

table are based on dealer quotes and reflect the estimated amounts the

Company would pay or receive to terminate the contracts. The carrying

values of cash and cash equivalents, receivables, short-term borrowings

and payables approximate their fair values.

The Company, as a result of its global operating and financing

activities, is exposed to changes in foreign currency exchange rates,

commodity prices, and interest rates which may adversely affect its

results of operations and financial position. The Company manages such

exposures, in part, with derivative financial instruments. The fair value of

these derivative contracts is reported in other current assets or accounts

payable and other current liabilities.

Foreign currency forward contracts are used to hedge existing

foreign currency denominated assets and liabilities, especially those of

the Company’s International Treasury Center, as well as forecasted

foreign currency denominated intercompany sales. Silver forward

contracts are used to mitigate the Company’s risk to fluctuating silver

prices. The Company’s exposure to changes in interest rates results from

its investing and borrowing activities used to meet its liquidity needs.

Long-term debt is generally used to finance long-term investments, while

short-term debt is used to meet working capital requirements. An interest

rate swap agreement was used to convert some floating-rate debt to

fixed-rate debt. The Company does not utilize financial instruments for

trading or other speculative purposes.

On January 1, 2000, the Company adopted SFAS No. 133,

“Accounting for Derivative Instruments and Hedging Activities.” This

statement requires that an entity recognize all derivatives as either

assets or liabilities and measure those instruments at fair value. If

certain conditions are met, a derivative may be designated as a hedge.

The accounting for changes in the fair value of a derivative depends on

the intended use of the derivative and the resulting designation.

The transition adjustment was a loss of $1 million recorded in other

income (charges) for marking foreign exchange forward contracts to fair

value, and an unrealized gain of $3 million recorded in other

comprehensive income for marking silver forward contracts to fair value.

These items were not displayed in separate captions as cumulative

effects of a change in accounting principle, due to their immateriality.

The fair value of the contracts is reported in other current assets or in

current liabilities.

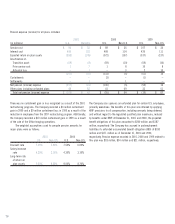

The Company has entered into foreign currency forward contracts

that are designated as cash flow hedges of exchange rate risk related to

forecasted foreign currency denominated intercompany sales. At

December 31, 2001, the Company had cash flow hedges for the Euro, the

Canadian dollar, the Australian dollar, and the Korean won, with maturity

dates ranging from January 2002 to July 2002.