Kodak 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company re c o rded a $3 million curtailment gain in 2000 and

a $9 million curtailment loss in 1999 as a result of the re d u c t i o n

in employees from the 1997 re s t ructuring program. Additionally,

the Company re c o rded a $10 million curtailment gain in 1999 as

a result of the sale of the Office Imaging business, which was

included in the gain on the sale.

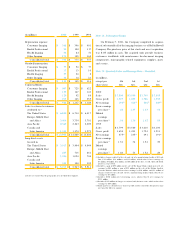

The weighted as s umptions us ed to compute pension

amounts for major plans were as follows:

2 0 0 0 1 9 9 9

U . S . N o n - U . S . U . S . N o n - U . S .

Discount rate 7 . 5 % 6 . 1 % 7 . 5 % 6 . 1 %

S a l a ry increase

r a t e 4 . 3 % 3 . 1 % 4 . 3 % 3 . 2 %

L o n g - t e rm rate

of re t u rn on

plan assets 9 . 5 % 8 . 7 % 9 . 5 % 8 . 7 %

The C ompany also sponsors an unfunded plan for certain U.S.

employees, primarily executives. The benefits of this plan are

obtained by applying KRIP provisions to all compensation, includ-

ing amounts being deferred, and without re g a rd to the legislated

qualified plan maximums, reduced by benefits under KRIP. At

December 31, 2000 and 1999, the projected benefit obligations

of this plan amounted to $187 million and $192 million, re s p e c-

t i v e l y. The Company had re c o rded long-term liabilities at those

dates of $171 million and $174 million, re s p e c t i v e l y. Pension

expense re c o rded in 2000, 1999 and 1998 related to this plan

was $34 million, $21 million and $26 million, re s p e c t i v e l y.

54

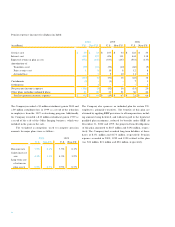

Pension expense (income) for all plans included:

2 0 0 0 1 9 9 9 1 9 9 8

(in millions) U . S . N o n - U . S . U . S . N o n - U . S . U . S . N o n - U . S .

S e rvice cost $8 9 $ 3 3 $1 0 7 $ 3 4 $ 1 2 2 $ 3 3

I n t e rest cost 4 0 8 1 0 7 4 2 6 1 1 1 4 4 4 1 1 8

Expected re t u rn on plan assets ( 5 7 2 ) ( 1 4 7 ) ( 5 3 7 ) ( 1 3 7 ) ( 5 5 1 ) ( 1 3 7 )

A m o rtization of:

Transition asset ( 5 9 ) ( 1 0 ) ( 5 9 ) ( 1 0 ) ( 6 0 ) ( 9 )

Prior service cost 1 8 1 0 8 1 2 8

Actuarial loss – 3 21 0 1 1 5

( 1 3 3 ) ( 6 ) ( 5 1 ) 1 6 ( 2 2 ) 1 8

C u rt a i l m e n t s ( 3 ) – ( 1 ) – 7 1

S e t t l e m e n t s – 1 – – – 1

Net pension (income) expense ( 1 3 6 ) ( 5 ) ( 5 2 ) 1 6 ( 1 5 ) 2 0

Other plans including unfunded plans 4 1 6 9 3 3 5 1 3 6 4 6

Total net pension (income) expense $( 9 5 ) $ 6 4 $( 1 9 ) $ 6 7 $ 2 1 $ 6 6