KeyBank 2007 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2007 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

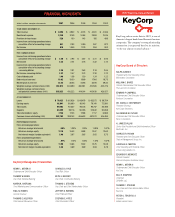

dollars in millions, except per share amounts 2007 2006 2005 2004 2003

YEAR ENDED DECEMBER 31,

Total revenue $4,998 $4,942 $4,723 $4,381 $4,506

Noninterest expense 3,248 3,149 3,054 2,884 2,816

Provision for loan losses 529 150 143 185 498

Income from continuing operations before

cumulative effect of accounting change 941 1,193 1,090 907 872

Net income 919 1,055 1,129 954 903

PER COMMON SHARE

Income from continuing operations before

cumulative effect of accounting change $2.40$2.95$2.67$2.21$2.06

Net income 2.35 2.61 2.76 2.32 2.14

Income from continuing operations before

cumulative effect of accounting change

–assuming dilution 2.38 2.91 2.63 2.18 2.05

Net income–assuming dilution 2.32 2.57 2.73 2.30 2.12

Cash dividends paid 1.46 1.38 1.30 1.24 1.22

Book value at year end 19.92 19.30 18.69 17.46 16.73

Market price at year end 23.45 38.03 32.93 33.90 29.32

Weighted average common shares (000) 392,013 404,490 408,981 410,585 422,776

Weighted average common shares

and potential common shares (000) 395,823 410,222 414,014 415,430 426,157

AT DECEMBER 31,

Loans $70,823 $ 65,826 $ 66,478 $ 63,372 $ 59,754

Earning assets 86,841 80,090 80,143 78,140 72,560

Total assets 99,983 92,337 93,126 90,747 84,498

Deposits 63,099 59,116 58,765 57,842 50,858

Total shareholders’ equity 7,746 7,703 7,598 7,117 6,969

Common shares outstanding (000) 388,793 399,153 406,624 407,570 416,494

PERFORMANCE RATIOS

From continuing operations:

Return on average total assets .99% 1.30% 1.24% 1.09% 1.07%

Return on average equity 12.19 15.43 14.88 13.07 12.63

Net interest margin (taxable equivalent) 3.46 3.67 3.65 3.62 3.73

From consolidated operations:

Return on average total assets .97% 1.12% 1.24% 1.10% 1.07%

Return on average equity 11.90 13.64 15.42 13.75 13.08

Net interest margin (taxable equivalent) 3.46 3.69 3.69 3.63 3.78

KeyCorp Board of Directors

RALPH ALVAREZ

President and Chief Operating Officer

McDonald’s Corporation

WILLIAM G. BARES

Retired Chairman and Chief Executive Officer

The Lubrizol Corporation

EDWARD P. CAMPBELL

Chairman and Chief Executive Officer

Nordson Corporation

DR. CAROL A. CARTWRIGHT

President Emeritus

Kent State University

ALEXANDER M. CUTLER

Chairman and Chief Executive Officer

Eaton Corporation

H. JAMES DALLAS

Senior Vice President and Chief Information Officer

Medtronic, Inc.

CHARLES R. HOGAN

President and Chief Executive Officer

Citation Management Group, Inc.

LAURALEE E. MARTIN

Chief Operating and Financial Officer

Jones Lang LaSalle, Inc.

EDUARDO R. MENASCÉ

Retired President

Verizon Enterprise Solutions Group

HENRY L. MEYER III

Chairman and Chief Executive Officer

KeyCorp

BILL R. SANFORD

Chairman

SYMARK LLC

THOMAS C. STEVENS

Vice Chair and Chief Administrative Officer

KeyCorp

PETER G. TEN EYCK, II

President

Indian Ladder Farms

FINANCIAL HIGHLIGHTS

KeyCorp, whose roots date to 1825, is one of

America’s largest bank-based financial services

companies. The company’s strong relationship

orientation is expressed best by its mission:

“to be our clients’ trusted advisor.”

2007 KeyCorp Annual Report

HENRY L. MEYER III

Chairman and Chief Executive Officer

THOMAS W. BUNN

Vice Chair, National Banking

KAREN R. HAEFLING

Chief Marketing and Communications Officer

PAUL N. HARRIS

General Counsel

THOMAS E. HELFRICH

Chief Human Resources Officer

CHARLES S. HYLE

Chief Risk Officer

BETH E. MOONEY

Vice Chair, Community Banking

THOMAS C. STEVENS

Vice Chair and Chief Administrative Officer

JEFFREY B. WEEDEN

Chief Financial Officer

STEPHEN E. YATES

Chief Information Officer

KeyCorp Management Committee