KeyBank 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

KeyCorp 2007 Key.com

Key

2007 KEYCORP ANNUAL REPORT

Investing

IN THE

Client

EXPERIENCE

Table of contents

-

Page 1

Key 2007 KEYCORP ANNUAL REPORT KeyCorp 2007 Key.com Investing IN THE Client EXPERIENCE -

Page 2

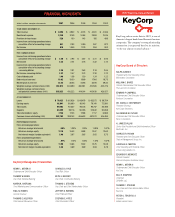

...accounting change -assuming dilution Net income-assuming dilution Cash dividends paid Book value at year end Market price at year end Weighted average common shares (000) Weighted average common shares and potential common shares (000) AT DECEMBER 31, Loans Earning assets Total assets Deposits Total... -

Page 3

2007 KEYCORP ANNUAL REPORT INSIDE 2 Key Addresses Unprecedented Market Conditions Interview with CEO Henry Meyer 8 Investing in the Client Experience Key's businesses launch wide-ranging initiatives 10 Key at a Glance A snapshot of Key's business units and markets 13 Financial Review Management's ... -

Page 4

... area of New York State. The company also made signiï¬cant investments in several of its businesses to enhance Key client experiences and expand product offerings. In December, KeyCorp's Board of Directors increased the company's ï¬rst quarter 2008 dividend to $0.375 per share, an increase of... -

Page 5

... the impact of the sale of our McDonald Investments branch network last year, trust and investment services income increased by 14 percent, driven by growth in both personal and institutional asset management income. Key's Board of Directors in December increased the quarterly dividend for the 43rd... -

Page 6

... shareholders will beneï¬t from our decision this past year to exit the dealer-originated prime home improvement lending and payroll processing businesses. As important, we have continued to invest in our equipment leasing, institutional asset management, education ï¬nance and commercial real... -

Page 7

... market. Our specialties in small business, middle market and private banking are excellent ï¬ts for current and prospective clients. Another beneï¬t is that deposits gathered in our branches represent a relatively stable and cost-effective form of funding. Key's branch in Niskayuna, New York... -

Page 8

... at a Key branch or through our call center - whichever channel clients prefer. the value of the check - a fee that typically is a fraction of that charged by store-front check-cashing operations. As important, KeyBank Plus provides ï¬nancial education, including courses on managing money and debt... -

Page 9

... location. Visit your area KeyBank branch to talk with a Key Investment Services representative about your education planning needs, call 1-888-KIS2YOU, or visit key.com/KISEdPlan. Investment products are offered through Key Investment Services LLC (KIS), member FINRA/SIPC. Insurance products... -

Page 10

... points out. "But other elements are equally important. That's why we're also investing in our employees and the technologies they rely on when suggesting solutions for our clients." For instance, in 2008, Key will begin to equip teller stations with Teller21, a new system that capitalizes on Key... -

Page 11

...of New York-based U.S.B. Holding Company, completed January 1, 2008. The combination increases Key's branch presence in attractive communities outside New York City, expands the banking solutions available to U.S.B. clients and adds new banking locations for current Key clients. Tom Bunn Vice Chair... -

Page 12

... Aristocrat" by Standard & Poor's for increasing its dividend for 25 or more consecutive years ) 79th on Business Ethics magazine's listing of the top U.S. companies for community involvement, employee programs, shareholder return, diversity, ethical governance and concern for the environment... -

Page 13

... businesses across the branch network. They offer a broad range of services, including commercial lending, cash management, equipment leasing, investments, succession planning, capital markets, derivatives and foreign exchange. ) FACILITIES AND FINANCIAL DATA BY REGION Northwest Branches ATMs Loans... -

Page 14

...progress is evident, Community is Key. At Key, we understand how teamwork, cooperation and respect for others are instrumental to everyone's professional success. That's why we support programs that help people advance in their careers, today and in the future. C O M M U N I T Y I S K E Y ©2008... -

Page 15

... of Changes in Shareholders' Equity Consolidated Statements of Cash Flows Summary of Signiï¬cant Accounting Policies Earnings Per Common Share Acquisitions and Divestitures Line of Business Results Restrictions on Cash, Dividends and Lending Activities Securities Loans and Loans Held for Sale Loan... -

Page 16

... markets products, and international banking services. Through its subsidiary bank, trust company and registered investment adviser subsidiaries, KeyCorp provides investment management services to clients that include large corporate and public retirement plans, foundations and endowments, high net... -

Page 17

... dividend payments, require the adoption of remedial measures to increase capital, terminate Federal Deposit Insurance Corporation ("FDIC") deposit insurance, or mandate the appointment of a conservator or receiver in severe cases. Financial markets conditions. Changes in the stock markets, public... -

Page 18

... risk-free U.S. Treasury obligations to make new investments. Regional and money center banks also experienced reduced liquidity and elevated costs for 30-day money market borrowings between ï¬nancial institutions. For this and other reasons, in December 2007 the Federal Reserve introduced the Term... -

Page 19

... 100.0% Represents core deposit, commercial loan and home equity loan products centrally managed outside of the four Community Banking regions. Key's National Banking group includes those corporate and consumer business units that operate nationally, within and beyond the 13-state branch network... -

Page 20

.... Key securitizes education loans and accounts for those transactions as sales when the criteria set forth in Statement of Financial Accounting Standards ("SFAS") No. 140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities," are met. If management were... -

Page 21

... "Loans held for sale" on page 37. Key's principal investments include direct and indirect investments, predominantly in privately held companies. The fair values of these investments are determined by considering a number of factors, including the target company's ï¬nancial condition and results... -

Page 22

... lending-related commitments Separation expense a During the ï¬rst quarter of 2007, Key completed the previously announced sales of the McDonald Investments branch network and the Champion Mortgage loan origination platform. Both transactions are consistent with Key's strategy of focusing on core... -

Page 23

... paid Book value at year end Market price at year end Dividend payout ratio Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT DECEMBER 31, Loans Earning assets Total assets Deposits Long-term debt Shareholders' equity... -

Page 24

...ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES offset the positive effect of a 4% increase in average earning assets, due largely to solid commercial loan growth. Excluding the $25 million increase attributable to the sale of the McDonald Investments branch network... -

Page 25

... educational institutions. The combination of the payment plan systems and technology in place at Tuition Management Systems and the array of payment plan products offered by Key's Consumer Finance line of business created one of the largest payment plan providers in the nation. LINE OF BUSINESS... -

Page 26

... sale of the McDonald Investments branch network. On January 1, 2008, Key acquired U.S.B. Holding Co., Inc., the holding company for Union State Bank, a 31-branch state-chartered commercial bank headquartered in Orangeburg, New York. U.S.B. Holding Company had assets of $2.8 billion and deposits... -

Page 27

... COMMUNITY BANKING DATA Year ended December 31, dollars in millions AVERAGE DEPOSITS OUTSTANDING NOW and money market deposit accounts Savings deposits Certiï¬cates of deposits ($100,000 or more) Other time deposits Deposits in foreign ofï¬ce Noninterest-bearing deposits Total deposits 2007 $19... -

Page 28

...fair values of certain real estate-related investments held by the Private Equity unit within the Real Estate Capital line of business and a $25 million gain recorded during the ï¬rst quarter of 2006 in connection with the initial public offering completed by the New York Stock Exchange, investment... -

Page 29

...term wholesale borrowings to support earning asset growth during the second half of 2007. Additionally, as part of the February 2007 sale of the McDonald Investments branch network, Key transferred approximately $1.3 billion of NOW and money market deposit accounts to the buyer. McDonald Investments... -

Page 30

... Total commercial loans Real estate - residential Home equity Consumer - direct Consumer - indirect Total consumer loans Total loans Loans held for sale Securities available for saled Held-to-maturity securitiesa Trading account assets Short-term investments Other investmentsd Total earning assets... -

Page 31

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES 2004 Average Balance Interest Yield/ Rate Average Balance 2003 Interest Yield/ Rate Average Balance 2002 Interest Yield/ Rate Compound Annual Rate of Change (2002-2007) Average Balance ... -

Page 32

... Key's relationship banking strategy. Additionally, during 2006, Key experienced tighter interest rate spreads as a result of competitive pressure on loan and deposit pricing, and a change in deposit mix, as consumers shifted funds from money market deposit accounts to time deposits. Average earning... -

Page 33

...securities portfolio. FIGURE 10. NONINTEREST INCOME Year ended December 31, dollars in millions Trust and investment services income Service charges on deposit accounts Investment banking and capital markets income Operating lease income Letter of credit and loan fees Corporate-owned life insurance... -

Page 34

... transfer of assets in connection with the sale of the McDonald Investments branch network. FIGURE 12. ASSETS UNDER MANAGEMENT December 31, dollars in millions Assets under management by investment type: Equity Securities lending Fixed income Money market Hedge funds Total Proprietary mutual funds... -

Page 35

...provision for losses on lending-related commitments, compared to a $6 million credit for 2006, and a $40 million increase in costs associated with operating leases. The sale of the McDonald Investments branch network resulted in a reduction of $38 million to Key's total nonpersonnel expense. In 2006... -

Page 36

...such as corporate-owned life insurance, earns credits associated with investments in low-income housing projects and records tax deductions associated with dividends paid on Key common shares held in the 401(k) savings plan. In addition, a lower tax rate is applied to portions of the equipment lease... -

Page 37

... commercial real estate loans Commercial lease ï¬nancing Total commercial loans CONSUMER Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect: Automobile lease ï¬nancing Automobile loans Marine Other Total consumer - indirect loans Total consumer loans Total a 2007... -

Page 38

... and on nonperforming status. Key's commercial real estate lending business is conducted through two primary sources: a 13-state banking franchise and Real Estate Capital, a national line of business that cultivates relationships both within and beyond the branch system. Real Estate Capital deals... -

Page 39

... asset quality statistics and yields on the portfolio as a whole. FIGURE 18. HOME EQUITY LOANS December 31, dollars in millions SOURCES OF LOANS OUTSTANDING Regional Banking Champion Mortgage Home Equity Services unit National Home Equity unit Total Nonperforming loans at year enda Net loan charge... -

Page 40

... loans. This fee income is reduced by the amortization of related servicing assets. In addition, Key earns interest income from securitized assets retained and from investing funds generated by escrow deposits collected in connection with the servicing of commercial real estate loans. These deposits... -

Page 41

... per diluted common share) during the ï¬rst quarter of 2007. This net loss was previously recorded in "net unrealized losses on securities available for sale" in the accumulated other comprehensive income (loss) component of shareholders' equity. In addition to changing market conditions, the size... -

Page 42

... primarily marketable equity securities. Weighted-average yields are calculated based on amortized cost. Such yields have been adjusted to a taxable-equivalent basis using the statutory federal income tax rate of 35%. Excludes securities of $63 million at December 31, 2007, that have no stated yield... -

Page 43

... borrowers' increased reliance on commercial lines of credit in the volatile capital markets environment, to compensate for the core deposits transferred in connection with the sale of the McDonald Investments branch network, and to satisfy a temporary need for additional short-term funding to... -

Page 44

... in shareholders' equity over the past three years are shown in the Consolidated Statements of Changes in Shareholders' Equity presented on page 63. Common shares outstanding. KeyCorp's common shares are traded on the New York Stock Exchange under the symbol KEY. At December 31, 2007: • Book value... -

Page 45

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES Figure 27 shows activities that caused the change in Key's outstanding common shares over the past two years. FIGURE 27. CHANGES IN COMMON SHARES OUTSTANDING 2007 Quarters in thousands SHARES... -

Page 46

... on loans and liability for losses on lending-related commitments Net unrealized gains on equity securities available for sale Qualifying long-term debt Total Tier 2 capital Total risk-based capital RISK-WEIGHTED ASSETS Risk-weighted assets on balance sheet Risk-weighted off-balance sheet exposure... -

Page 47

... services Technology equipment and software Other Total purchase obligations Total Lending-related and other off-balance sheet commitments: Commercial, including real estate Home equity When-issued and to be announced securities commitments Commercial letters of credit Principal investing... -

Page 48

... rates change by different amounts. For example, when U.S. Treasury and other term rates decline, the rates on automobile loans also will decline, but the cost of money market deposits and short-term borrowings may remain elevated. • A ï¬nancial instrument presents "option risk" when one party... -

Page 49

... change in short-term interest rates (i.e., -200 basis points or +200 basis points) and the accuracy of management's assumptions related to product pricing and customer behavior. From September 2007 through January 2008, the Federal Reserve reduced the Federal Funds Target rate by 225 basis points... -

Page 50

... Management Committee of the Board of Directors. Liquidity risk management Key deï¬nes "liquidity" as the ongoing ability to accommodate liability maturities and deposit withdrawals, meet contractual obligations, and fund asset growth and new business transactions at a reasonable cost, in a timely... -

Page 51

... cost, in a timely manner and without adverse consequences; and pay dividends to shareholders. Management's primary tool for assessing parent company liquidity is the net short-term cash position, which measures the ability to fund debt maturing in twelve months or less with existing liquid assets... -

Page 52

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES The parent has met its liquidity requirements principally through receiving regular dividends from KeyBank. Federal banking law limits the amount of capital distributions that a bank can make ... -

Page 53

... & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES Credit risk management Credit risk is the risk of loss arising from an obligor's inability or failure to meet contractual payment or performance terms. Like other ï¬nancial service institutions, Key makes loans... -

Page 54

... agricultural Real estate - commercial mortgage Real estate - construction Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect Total consumer loans Total Amount $ 392 206 326 125 1,049 7 72 31 41 151 $1,200 Amount... -

Page 55

... estate - construction Total commercial real estate loansa Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect Total consumer loans Net loans charged off Provision for loan losses from continuing operations (Credit... -

Page 56

... Commercial lease ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect Total consumer loans Total nonperforming loans Nonperforming loans held for sale OREO Allowance for OREO losses OREO, net of allowance Other nonperforming assets... -

Page 57

...Board. Primary responsibility for managing and monitoring internal control mechanisms lies with the managers of Key's various lines of business. Key's Risk Review function periodically assesses the overall effectiveness of Key's system of internal controls. Risk Review reports the results of reviews... -

Page 58

... in the fair values of certain real estate-related investments held by the Private Equity unit within the Real Estate Capital line of business. Trust and investment services income was down $11 million, since the sale of the McDonald Investments branch network reduced brokerage income. Excluding the... -

Page 59

... Cash dividends paid Book value at period end Market price: High Low Close Weighted-average common shares outstanding (000) Weighted-average common shares and potential common shares outstanding (000) AT PERIOD END Loans Earning assets Total assets Deposits Long-term debt Shareholders' equity... -

Page 60

... $97 million, resulting in an effective tax rate of 23.8%. The effective tax rate for the year-ago quarter was reduced by the settlement of various federal and state tax audit disputes, offset in part by an increase in effective state tax rates applied to Key's lease ï¬nancing business. Excluding... -

Page 61

...The Board of Directors discharges its responsibility for Key's ï¬nancial statements through its Audit Committee. This committee, which draws its members exclusively from the outside directors, also hires the independent auditors. Management's Assessment of Internal Control Over Financial Reporting... -

Page 62

.... Cleveland, Ohio February 22, 2008 REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM Shareholders and Board of Directors KeyCorp We have audited the accompanying consolidated balance sheets of KeyCorp and subsidiaries as of December 31, 2007 and 2006, and the related consolidated statements... -

Page 63

...Net loans Loans held for sale Premises and equipment Operating lease assets Goodwill Other intangible assets Corporate-owned life insurance Derivative assets Accrued income and other assets Total assets LIABILITIES Deposits in domestic ofï¬ces: NOW and money market deposit accounts Savings deposits... -

Page 64

... and investment services income Service charges on deposit accounts Investment banking and capital markets income Operating lease income Letter of credit and loan fees Corporate-owned life insurance income Electronic banking fees Net (losses) gains from loan securitizations and sales Net securities... -

Page 65

... 2007 Net income Other comprehensive income: Net unrealized gains on securities available for sale, net of income taxes of $30a Net unrealized gains on derivative ï¬nancial instruments, net of income taxes of $63 Foreign currency translation adjustments Net pension and postretirement beneï¬t costs... -

Page 66

...McDonald Investments branch network, net of retention payments Proceeds from sale of MasterCard Incorporated shares Cash used in acquisitions, net of cash acquired Net (increase) decrease in short-term investments Purchases of securities available for sale Proceeds from sales of securities available... -

Page 67

... and commercial banking, commercial leasing, investment management, consumer ï¬nance, and investment banking products and services to individual, corporate and institutional clients through two major business groups: Community Banking and National Banking. As of December 31, 2007, KeyBank National... -

Page 68

...asset management team is familiar with the life cycle of the leased equipment and pending product upgrades and has insight into competing products due to the team's relationships with a number of equipment vendors. In accordance with SFAS No. 13, "Accounting for Leases," residual values are reviewed... -

Page 69

...days past due. Key's charge-off policy for consumer loans is similar, but takes effect when the payments are 120 days past due. Home equity and residential mortgage loans generally are charged down to the fair value of the underlying collateral when payment is 180 days past due. Management estimates... -

Page 70

... balance sheet. The resulting asset ($118 million at December 31, 2007, and $115 million at December 31, 2006) is amortized using the straight-line method over its expected useful life (not to exceed ï¬ve years). Costs incurred during the planning and post-development phases of an internal software... -

Page 71

... Fair value is calculated using applicable market variables such as interest rate volatility and other relevant market inputs. Changes in fair value (including payments and receipts) are recorded in "investment banking and capital markets income" on the income statement. GUARANTEES Key's accounting... -

Page 72

... is presented on the income statement as a cumulative effect of a change in accounting principle. Key's cumulative after-tax adjustment increased ï¬rst quarter 2006 earnings by $5 million, or $.01 per diluted common share. Second, prior to the adoption of SFAS No. 123R, total compensation cost for... -

Page 73

... charge of $52 million to Key's retained earnings. Future earnings are expected to increase over the remaining term of the affected leases by a similar amount. Additional information related to Staff Position No. 13-2 is included in Note 17 ("Income Taxes") under the heading "Tax-Related Accounting... -

Page 74

... between the fair value of plan assets and the projected beneï¬t obligation. In addition, any change in a plan's funded status must be recognized in comprehensive income in the year in which it occurs. Except for the measurement requirement, Key adopted this accounting guidance as of December... -

Page 75

... SHARE Key's basic and diluted earnings per common share are calculated as follows: Year ended December 31, dollars in millions, except per share amounts EARNINGS Income from continuing operations before cumulative effect of accounting change (Loss) income from discontinued operations, net of taxes... -

Page 76

... company for Union State Bank, a 31-branch state-chartered commercial bank headquartered in Orangeburg, New York. U.S.B. Holding Co. had assets of $2.8 billion and deposits of $1.8 billion at the date of acquisition. Under the terms of the agreement, 9,895,000 KeyCorp common shares, with a value... -

Page 77

... assist high-net-worth clients with their banking, trust, portfolio management, insurance, charitable giving and related needs. Commercial Banking provides midsize businesses with products and services that include commercial lending, cash management, equipment leasing, investment and employee bene... -

Page 78

... equipment, capitalized software and goodwill held by Key's major business groups are located in the United States. From continuing operations. Community Banking results for 2007 include a $171 million ($107 million after tax) gain from the February 9, 2007, sale of the McDonald Investments branch... -

Page 79

... state income tax rate (net of the federal income tax beneï¬t) of 2.5%. • Capital is assigned based on management's assessment of economic risk factors (primarily credit, operating and market risk) directly attributable to each line. Developing and applying the methodologies that management uses... -

Page 80

... CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES SUPPLEMENTARY INFORMATION (COMMUNITY BANKING LINES OF BUSINESS) Year ended December 31, dollars in millions Total revenue (TE) Provision (credit) for loan losses Noninterest expense Net income Average loans and leases Average deposits Net... -

Page 81

... as market conditions change. 2006 Gross Gross Amortized Unrealized Unrealized Cost Gains Losses $ 94 14 7,098 336 151 165 - $ 1 13 2 57 10 $83 - - $110 4 - - $114 Fair Value $ 94 15 7,001 334 208 175 in millions SECURITIES AVAILABLE FOR SALE U.S. Treasury, agencies and corporations States and... -

Page 82

... Commercial lease ï¬nancing Real estate - residential mortgage Home equity Education Automobile Total loans held for sale 2007 $ 250 1,219 35 1 47 1 3,176 7 $4,736 2006 $ 47 946 36 3 21 180 2,390 14 $3,637 Commercial and consumer lease ï¬nancing receivables primarily are direct ï¬nancing leases... -

Page 83

...year Provision (credit) for losses on lending-related commitments Charge-offs Balance at end of year a a 2007 $53 28 (1) $80 2006 $59 (6) - $53 2005 $66 (7) - $59 Included in "accrued expense and other liabilities" on the consolidated balance sheet. - - $ 966 8. LOAN SECURITIZATIONS, SERVICING... -

Page 84

... the loans. This calculation uses a number of assumptions that are based on current market conditions. Primary economic assumptions used to measure the fair value of Key's mortgage servicing assets at December 31, 2007, and 2006, are as follows: • prepayment speed generally at an annual rate of... -

Page 85

... guaranteed funds is included in Note 18 under the heading "Return guarantee agreement with LIHTC investors" on page 99. Commercial and residential real estate investments and principal investments. Key's Principal Investing unit and the KeyBank Real Estate Capital line of business make equity and... -

Page 86

... Capital Management Divestiture of Champion Mortgage ï¬nance business BALANCE AT DECEMBER 31, 2006 Acquisition of Tuition Management Systems Cessation of Payroll Online services BALANCE AT DECEMBER 31, 2007 The intangible assets acquired in both years are being amortized using the straight-line... -

Page 87

... TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES 11. SHORT-TERM BORROWINGS Selected ï¬nancial information pertaining to the components of Key's short-term borrowings is as follows: dollars in millions FEDERAL FUNDS PURCHASED Balance at year end Average during the yeara Maximum month... -

Page 88

..., direct ï¬nancing and sales-type leases. Long-term advances from the Federal Home Loan Bank had weighted-average interest rates of 5.40% at December 31, 2007, and 5.35% at December 31, 2006. These advances, which had a combination of ï¬xed and ï¬,oating interest rates, were secured by real estate... -

Page 89

... federal income tax purposes. During the ï¬rst quarter of 2005, the Federal Reserve Board adopted a rule that allows bank holding companies to continue to treat capital securities as Tier 1 capital, but imposed stricter quantitative limits that take effect after a ï¬ve-year Capital Securities, Net... -

Page 90

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES of new activities, and could make our clients and potential investors less conï¬dent. As of December 31, 2007, KeyCorp and KeyBank met all regulatory capital requirements. Federal bank regulators apply certain capital ratios to ... -

Page 91

... vested performance shares that resulted in cash payments in either 2006 or 2005. The following table summarizes activity and pricing information for the nonvested shares in the Program for the year ended December 31, 2007: Vesting Contingent on Performance and Service Conditions Number of Nonvested... -

Page 92

... TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES Prior to 2007, the compensation cost of time-lapsed restricted stock awards granted under the Program was calculated using the average of the high and low trading price of Key's common shares on the grant date. Effective January 1, 2007... -

Page 93

...Total recognized in net pension cost and comprehensive income - $(106) 6 (28) $(128) $ 8 - - - $ 8 $ (2) - - - $ (2) $ (82) $ 53 $ 31 The information related to Key's pension plans presented in the following tables as of or for the years ended December 31 is based on current actuarial reports... -

Page 94

... service and interest costs resulting from a 25 basis point increase in the assumed discount rate, offset in part by a decrease in the amortization of losses and a $3 million curtailment gain recorded in 2007. Management determines the expected return on plan assets using a calculated market-related... -

Page 95

... reï¬,ected in the market-related value are amortized gradually and systematically over future years, subject to certain constraints and recognition rules. Management estimates that a 25 basis point decrease in the expected return on plan assets would increase Key's net pension cost for 2008 by... -

Page 96

... employees receiving beneï¬ts under Key's Long-Term Disability Plan will no longer be eligible for health care and life insurance beneï¬ts. Management estimates the expected returns on plan assets for VEBA trusts much the same way it estimates returns on Key's pension funds. The primary investment... -

Page 97

... Income before income taxes times 35% statutory federal tax rate State income tax, net of federal tax beneï¬t Tax-exempt interest income Corporate-owned life insurance income Tax credits Reduced tax rate on lease income Reduction of deferred tax asset Other Total income tax expense 2007 Amount $427... -

Page 98

...a number of bank holding companies and other corporations. The IRS has completed audits of Key's income tax returns for the 1995 through 2003 tax years and has disallowed all net deductions that relate to LILOs, QTEs and Service Contract Leases. Key appealed the examination results for the tax years... -

Page 99

... materially increase or decrease over the next twelve months as a result of developments in the AWG Leasing Litigation or any possible settlement of tax matters related to the leveraged lease transactions. However, management cannot currently estimate the range of possible change. The change in Key... -

Page 100

... in an amount estimated by management to approximate the fair value of KeyBank's liability. At December 31, 2007, the outstanding commercial mortgage loans in this program had a weighted-average remaining term of 7.6 years, and the unpaid principal balance outstanding of loans sold by KeyBank as... -

Page 101

... quarter of 2007, KeyBank recorded a charge of $64 million, representing the fair value of its potential liability to Visa based on available information and KeyBank's Visa membership share. In the event the IPO occurs, it is management's understanding that Visa expects to use the escrow account... -

Page 102

... and insurance obligations, investments and securities, and certain leasing transactions involving clients. 19. DERIVATIVES AND HEDGING ACTIVITIES Key, mainly through its subsidiary bank, KeyBank, is party to various derivative instruments that are used for asset and liability management, credit... -

Page 103

... uses "pay ï¬xed/receive variable" interest rate swaps to manage the interest rate risk associated with anticipated sales or securitizations of certain commercial real estate loans. These swaps protect against a possible short-term decline in the value of the loans that could result from changes... -

Page 104

... real estate mortgage loans and deposits do not take into account the fair values of related long-term client relationships. For ï¬nancial instruments with a remaining average life to maturity of less than six months, carrying amounts were used as an approximation of fair values. If management... -

Page 105

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES 21. CONDENSED FINANCIAL INFORMATION OF THE PARENT COMPANY CONDENSED BALANCE SHEETS December 31, in millions ASSETS Interest-bearing deposits Loans and advances to subsidiaries: Banks Nonbank subsidiaries Investment in subsidiaries:... -

Page 106

...debt Payments on long-term debt Purchases of treasury shares Net proceeds from issuance of common stock Tax beneï¬ts in excess of recognized compensation cost for stock-based awards Cash dividends paid NET CASH USED IN FINANCING ACTIVITIES NET INCREASE (DECREASE) IN CASH AND DUE FROM BANKS CASH AND... -

Page 107

... and shareholder services, including live webcasts of management's quarterly earnings discussions. ONLINE www.key.com/IR BY TELEPHONE Corporate Headquarters (216) 689-6300 Investor Relations (216) 689-4221 Media Relations (216) 828-7416 Financial Reports Request Line (888) 539-3322 Transfer Agent... -

Page 108

... under which corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., Member NYSE/FINRA/SIPC, and KeyBank National Association ("KeyBank N.A."), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and...