KeyBank 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

MANAGEMENT’S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES

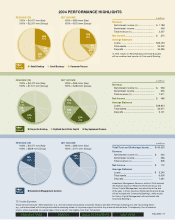

Consumer Banking

As shown in Figure 3, net income for Consumer Banking was $375

million for 2004, down from $412 million for 2003 and $445 million

for 2002. Two principal causes of the decline were the fourth quarter

2004 sale of the broker-originated home equity loan portfolio, and the

reclassification of the indirect automobile loan portfolio to held-for-sale

status. These actions resulted in significant decreases in noninterest

income and in the provision for loan losses, and a substantial increase

in noninterest expense. Excluding the effects of the above actions, net

income for Consumer Banking was $452 million for 2004.

Taxable-equivalent net interest income decreased by $34 million, or 2%,

from 2003, due to a less favorable interest rate spread on deposits. The

adverse effect of the lower deposit spread was partially offset by a

more favorable spread on average earning assets, a 9% increase in

average commercial loans and growth in average core deposits. Increased

deposits were primarily in the form of money market deposit accounts,

negotiable order of withdrawal (“NOW”) accounts and noninterest-

bearing deposits, reflecting client preferences for investments that

provide high levels of liquidity in a low interest rate environment.

Noninterest-bearing deposits also increased because we intensified our

cross-selling efforts, and focused sales and marketing efforts on our free

checking products.

Noninterest income decreased by $40 million, or 8%, due largely to a

$46 million loss recorded in connection with management’s decision to

sell the loan portfolios mentioned above and a $24 million reduction in

service charges on deposit accounts — primarily in Retail Banking. The

decrease in deposit service charges resulted from lower overdraft and

maintenance fees. These adverse changes were offset in part by a $32

million decrease in net losses incurred on the residual values of leased

vehicles in the Indirect Lending unit and a $6 million increase in income

from electronic banking activities.

The provision for loan losses decreased by $114 million, or 41%,

because of improved asset quality in each of the major lines of businesses

and a $21 million credit to the provision recorded in the fourth quarter

of 2004. The credit resulted from the reversal of provision recorded in

prior periods and was taken in connection with management’s decision

to sell the indirect automobile loan portfolio.

Noninterest expense rose by $68 million, or 5%, from 2003, due

largely to a $55 million write-off of goodwill recorded in connection with

management’s decision to sell Key’s nonprime indirect automobile loan

business and a $17 million rise in personnel expense.

During the second half of 2004, we improved our market share position

by acquiring EverTrust, headquartered in Everett, Washington with

assets of approximately $780 million and deposits of approximately

$570 million at the date of acquisition. We also acquired ten branch

offices and approximately $380 million of deposits of Sterling Bank &

Trust FSB in suburban Detroit, Michigan.

In 2003, the decrease in net income was attributable to a $19 million,

or 1%, reduction in taxable-equivalent net interest income, a $10

million, or 2%, reduction in noninterest income and a $43 million, or

3%, increase in noninterest expense. The adverse effects of these

changes were partially offset by a $20 million, or 7%, decrease in the

provision for loan losses, due to improved asset quality in the Indirect

Lending unit and the Retail Banking line of business.

NEXT PAGEPREVIOUS PAGE SEARCH BACK TO CONTENTS

Year ended December 31, Change 2004 vs 2003

dollars in millions 2004 2003 2002 Amount Percent

REVENUE (TAXABLE EQUIVALENT)

Consumer Banking $2,257 $2,331 $2,360 $(74) (3.2)%

Corporate and Investment Banking 1,511 1,467 1,486 44 3.0

Investment Management Services 808 783 822 25 3.2

Other Segments 15 56 2 (41) (73.2)

Total segments 4,591 4,637 4,670 (46) (1.0)

Reconciling Items (114) (81) (32) (33) (40.7)

Total $4,477 $4,556 $4,638 $(79) (1.7)%

NET INCOME (LOSS)

Consumer Banking $ 375 $412 $445 $ (37) (9.0)%

Corporate and Investment Banking 486 358 369 128 35.8

Investment Management Services 112 81 96 31 38.3

Other Segments 31 56 26 (25) (44.6)

Total segments 1,004 907 936 97 10.7

Reconciling Items (50) (4) 40 (46) N/M

Total $ 954 $903 $976 $ 51 5.6%

N/M = Not Meaningful

FIGURE 2. MAJOR BUSINESS GROUPS — TAXABLE-EQUIVALENT REVENUE AND NET INCOME