KeyBank 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 KeyBank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Table of contents

-

Page 1

BOARD INCREASES DIVIDEND FOR 40TH CONSECUTIVE YEAR Key At Key Is Driving Stronger Results 2004 2004 KEYCORP ANNUAL REPORT Total Return NEXT PAGE -

Page 2

... KeyCorp, Corporate Headquarters: 127 Public Square, Cleveland, OH 44114-1306; (216) 689-6300. KeyCorp Investor Relations: 127 Public Square, Cleveland, OH 44114-1306; (216) 689-4221 . Online: www.key.com for product, corporate and ï¬nancial information and news releases. Transfer Agent/Registrar... -

Page 3

...looking statements Corporate strategy Critical accounting policies and estimates Revenue recognition Highlights of Key's 2004 Performance Line of Business Results Consumer Banking Corporate and Investment Banking Investment Management Services Other Segments Results of Operations Net interest income... -

Page 4

... in 2004. Such results demonstrate that our work to reposition Key is paying off for shareholders. Over the past several years, we have been successfully transforming the company from a traditional provider of bank products to an organization that builds lasting client relationships by delivering... -

Page 5

...TOTAL RETURNS Investors were bullish on Key in 2004. They responded positively 20 to the company's improved ï¬nancial results, stronger management team and sharper focus on high-return, relationship-oriented businesses. Key 15 S&P 500 Banks S&P 500 10 5 0 -5 12/31/2003 12/31/2004 SEARCH... -

Page 6

... such as pension and union funds, accounted for much of the increase. Victory's management team, headed by Group President Rick Buoncore, continued building the line's deep research capabilities and its distribution network. They also ï¬nalized plans to further rationalize the business' product set... -

Page 7

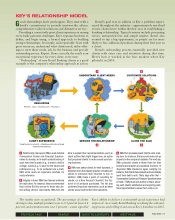

... provided new clients with extra care and attention during that time. Here's how it worked in the four markets where Key piloted it in 2004: 1 2 UNDERSTAND CLIENT NEEDS CUSTOMIZE SOLUTIONS ➞ RESOURCES PEOPLE • DATA • TECHNOLOGY • PRODUCT ➞ ➞ ➞ SERVICE THE RELATIONSHIP 4 CLIENT... -

Page 8

... who owns her own business or wants to start one. For years, we've worked with women across America to help make their dreams come true - big or small. Achieve anything. To learn more about Key4Women, visit Key.com/women. KeyBank is an SBA Preferred Lender. Member FDIC. NEXT PAGE ©2005 KeyCorp... -

Page 9

... banks that can build share in geographic markets where we already have a presence. We also are interested in organizations that can enhance our equipment leasing, commercial real estate and asset management businesses. All of our 2004 acquisitions reï¬,ect these areas of interest. At the same time... -

Page 10

... commercial and industrial lender (outstandings) CORPORATE BANKING KEYBANK REAL ESTATE CAPITAL KEY EQUIPMENT FINANCE VICTORY CAPITAL MANAGEMENT KEYBANK REAL ESTATE CAPITAL professionals provide construction and interim lending, permanent debt placements and servicing, and equity and investment... -

Page 11

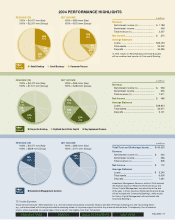

...Balances Loans...$28,844 Total assets...33,571 Deposits ...5,121 7% 20% 9% 28% 18% 52% 12% 23% 16% 32% 23% 45% %Key %Group â- Corporate Banking â- KeyBank Real Estate Capital â- Key Equipment Finance REVENUE (TE) 100% = $4,477 mm (Key) 100% = $808 mm (Group) NET INCOME 100% = $954 mm (Key... -

Page 12

...accepting deposits and making loans, KeyCorp's bank and trust company subsidiaries offer personal and corporate trust services, personal ï¬nancial services, access to mutual funds, cash management services, investment banking and capital markets products, and international banking services. Through... -

Page 13

..., small businesses and middle market companies. In addition, we focus nationwide on businesses such as commercial real estate lending, investment management and equipment leasing, in which we believe we possess resources of the scale necessary to compete nationally. • Build relationships. We work... -

Page 14

... for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities," are met. If future events were to preclude accounting for such transactions as sales, the loans would have to be placed back on Key's balance sheet, which could have an adverse effect on Key's capital ratios and... -

Page 15

... direct and indirect investments, predominantly in privately held companies. The fair values of these investments are estimated by considering a number of factors, including the investee's ï¬nancial condition and results of operations, values of public companies in comparable businesses, market... -

Page 16

... income Net income - assuming dilution Cash dividends paid Book value at year end Market price at year end Dividend payout ratio Weighted-average common shares (000) Weighted-average common shares and potential common shares (000) AT DECEMBER 31, Loans Earning assets Total assets Deposits Long-term... -

Page 17

... the ï¬nancial performance and related strategic developments of each of Key's three major business groups: Consumer Banking, Corporate and Investment Banking, and Investment Management Services. To better understand this discussion, see Note 4 ("Line of Business Results"), which begins on page... -

Page 18

... FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 2. MAJOR BUSINESS GROUPS - TAXABLE-EQUIVALENT REVENUE AND NET INCOME Year ended December 31, dollars in millions REVENUE (TAXABLE EQUIVALENT) Consumer Banking Corporate and Investment Banking Investment Management Services... -

Page 19

... and loan fees in the Corporate Banking and KeyBank Real Estate Capital lines of business, and a $31 million increase in income from investment banking and capital markets activities. In addition, Key Equipment Finance recorded a $15 million increase in net gains from the residual values of leased... -

Page 20

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 4. CORPORATE AND INVESTMENT BANKING Year ended December 31, dollars in millions SUMMARY OF OPERATIONS Net interest income (TE) Noninterest income Total revenue (TE) Provision for loan ... -

Page 21

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 5. INVESTMENT MANAGEMENT SERVICES Year ended December 31, dollars in millions SUMMARY OF OPERATIONS Net interest income (TE) Noninterest income Total revenue (TE) Provision for loan ... -

Page 22

... ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES FIGURE 6. AVERAGE BALANCE SHEETS, NET INTEREST INCOME AND YIELDS/RATES Year ended December 31, dollars in millions ASSETS Loansa,b Commercial, ï¬nancial and agricultural Real estate - commercial mortgage Real estate... -

Page 23

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES 2001 Average Balance Interest Yield/ Rate Average Balance 2000 Interest Yield/ Rate Average Balance 1999 Interest Yield/ Rate Compound Annual Rate of Change (1999-2004) Average Balance ... -

Page 24

... by management's strategies for improving Key's returns and achieving desired interest rate and credit risk proï¬les. • During the third quarter of 2003, Key consolidated an asset-backed commercial paper conduit as a result of an accounting change. This consolidation added approximately $200... -

Page 25

...services income Service charges on deposit accounts Investment banking and capital markets income Letter of credit and loan fees Corporate-owned life insurance income Electronic banking fees Net gains from loan securitizations and sales Net securities gains Other income: Insurance income Credit card... -

Page 26

...Key's clients have elected to use Key's free checking products or pay for services with compensating balances. Investment banking and capital markets income. As shown in Figure 11, stronger ï¬nancial markets contributed to increases in all components of investment banking and capital markets income... -

Page 27

...KeyBank Real Estate Capital and Corporate Banking lines of business. These improved results were due in part to a more disciplined approach to pricing in 2004, which considers overall customer relationships, and the June 2002 acquisition of Conning Asset Management. Higher fees from letter of credit... -

Page 28

... combined federal and state tax rate of 37.5%, due primarily to income from investments in tax-advantaged assets such as corporate-owned life insurance, and credits associated with investments in low-income housing projects. In addition, a lower tax rate is applied to portions of the equipment lease... -

Page 29

...real estate loans Commercial lease ï¬nancing Total commercial loans CONSUMER Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect: Automobile lease ï¬nancing Automobile loans Marine Other Total consumer - indirect loans Total consumer loans LOANS HELD FOR SALE Total... -

Page 30

... outstanding. Key conducts its commercial real estate lending business through two primary sources: a thirteen-state banking franchise and KeyBank Real Estate Capital, a national line of business that cultivates relationships both within and beyond the branch system. The KeyBank Real Estate Capital... -

Page 31

... OF LOANS OUTSTANDING Retail Banking (KeyCenters) and Small Business McDonald Financial Group and other sources Champion Mortgage Company Key Home Equity Services division National Home Equity unit Total Nonperforming loans at year end Net charge-offs for the year Yield for the year 2004 $ 9,011... -

Page 32

... year include $17.6 billion with ï¬,oating or adjustable rates and $2.3 billion with predetermined rates. FIGURE 18. LOANS ADMINISTERED OR SERVICED December 31, in millions Education loans Automobile loans Home equity loans Commercial real estate loans Commercial loans Commercial lease ï¬nancing... -

Page 33

...-equivalent basis using the statutory federal income tax rate of 35%. Includes primarily marketable equity securities. c FIGURE 21. INVESTMENT SECURITIES States and Political Subdivisions Weighted Average Yield a dollars in millions DECEMBER 31, 2004 Remaining maturity: One year or less After one... -

Page 34

...efforts, focused sales and marketing efforts on our free checking products, and collected more escrow deposits associated with the servicing of commercial real estate loans. Purchased funds, comprising large certiï¬cates of deposit, deposits in the foreign branch and short-term borrowings, averaged... -

Page 35

...ï¬nancial equity investments. b c KeyCorp's common shares are traded on the New York Stock Exchange under the symbol KEY. At December 31, 2004: • Book value per common share was $17.46, based on 407,569,669 shares outstanding, compared with $16.73, based on 416,494,244 shares outstanding, at... -

Page 36

... available-for-sale securities or trading account assets. The retained interests represent Key's exposure to loss if they were to decline in value. In the event that cash ï¬,ows generated by the securitized assets become inadequate to service the obligations of the trusts, the investors in the asset... -

Page 37

... services Telecommunications Professional services Technology equipment and software Other Total purchase obligations Total Lending-related and other off-balance sheet commitments: Commercial, including real estate Home equity Principal investing Commercial letters of credit Total a Within 1 Year... -

Page 38

... rate simulation modeling is based on a large number of assumptions and judgments. Primary among these for Key are those related to loan and deposit growth, asset and liability prepayments, interest rate variations, product pricing, and on- and off-balance sheet management strategies. Management... -

Page 39

...of December 31, 2004, based on the results of our simulation model, and assuming that management does not take action to alter the outcome, Key would expect net interest income to increase by approximately .73% if short-term interest rates gradually increase by 200 basis points over the next twelve... -

Page 40

... strategies to improve balance sheet positioning, earnings, or both, within the bounds of Key's interest rate risk, liquidity and capital guidelines. We actively manage our interest rate sensitivity through securities, debt issuance and derivatives. Key's three major business groups conduct... -

Page 41

... and foreign currency swaps were executed as hedges that are highly correlated to the underlying exposures. For more information about how Key uses interest rate swaps to manage its balance sheet, see Note 19 ("Derivatives and Hedging Activities"), which begins on page 84. Key's securities and term... -

Page 42

... watch credits during 2004 were commercial real estate and healthcare. These changes reï¬,ect the ï¬,uctuations that occur in loan portfolios from time to time, underscoring the beneï¬ts of Key's strategy to limit the concentration of credit risk in any single portfolio. 40 PREVIOUS PAGE SEARCH... -

Page 43

MANAGEMENT'S DISCUSSION & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES As shown in Figure 29, the 2004 decrease in Key's allowance for loan losses was attributable to developments in both the commercial and consumer loan portfolios. • Credit quality trends in ... -

Page 44

... ï¬nancing Total commercial loans Real estate - residential mortgage Home equity Consumer - direct Consumer - indirect lease ï¬nancing Consumer - indirect other Total consumer loans Net loans charged off Provision for loan losses Reclassiï¬cation of allowance for credit losses on lending-related... -

Page 45

... composition of Key's consumer loan portfolio that resulted from the fourth quarter 2004 sale of the broker-originated home equity loan portfolio. The improvement also reï¬,ects a greater emphasis placed on lending secured by real estate. Management expects the level of Key's asset quality in 2005... -

Page 46

...adverse market conditions or other events that could negatively affect the level or cost of liquidity. As part of the management process, we have established guidelines or target ranges that relate to the maturities of various types of wholesale borrowings, such as money market funding and term debt... -

Page 47

... to shareholders, service its debt, and support customary corporate operations and activities (including acquisitions), at a reasonable cost, in a timely manner and without adverse consequences. A primary tool used by management to assess our parent company liquidity is its net short-term cash... -

Page 48

... & ANALYSIS OF FINANCIAL CONDITION & RESULTS OF OPERATIONS KEYCORP AND SUBSIDIARIES Effective October 1, 2004, the parent company merged Key Bank USA, National Association ("Key Bank USA") into KBNA, forming a single bank subsidiary. Although this internal merger had no effect on Key's thirdparty... -

Page 49

... cost of employee beneï¬ts. In addition, comparisons to results for the year-ago quarter were affected by a fourth quarter 2004 reclassiï¬cation of $9 million of expense from "Franchise and business taxes" to "Income taxes." Provision for loan losses. Key's provision for loan losses was a credit... -

Page 50

... income taxes Net income PER COMMON SHARE Net income Net income - assuming dilution Cash dividends paid Book value at period end Market price: High Low Close Weighted-average common shares (000) Weighted-average common shares and potential common shares (000) AT PERIOD END Loans Earning assets Total... -

Page 51

... present fairly Key's ï¬nancial position, results of operations and cash ï¬,ows in all material respects. Management is responsible for establishing and maintaining a system of internal control that is intended to protect Key's assets and the integrity of its ï¬nancial reporting. This corporate... -

Page 52

... the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Key as of December 31, 2004 and 2003, and the related consolidated statements of income, changes in shareholders' equity, and cash ï¬,ow for each of the three years in the period ended... -

Page 53

... CONSOLIDATED BALANCE SHEETS December 31, dollars in millions ASSETS Cash and due from banks Short-term investments Securities available for sale Investment securities (fair value: $74 and $104) Other investments Loans, net of unearned income of $2,235 and $1,958 Less: Allowance for loan losses Net... -

Page 54

... CONSOLIDATED STATEMENTS OF INCOME Year ended December 31, dollars in millions, except per share amounts INTEREST INCOME Loans Investment securities Securities available for sale Short-term investments Other investments Total interest income INTEREST EXPENSE Deposits Federal funds purchased... -

Page 55

... CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY Common Shares Outstanding Common (000) Shares 424,005 $492 Accumulated Treasury Other Stock, Comprehensive at Cost Income (Loss) $(1,585) $ 2 $ 976 dollars in millions, except per share amounts BALANCE AT DECEMBER 31, 2001 Net income... -

Page 56

...real estate owned NET CASH USED IN INVESTING ACTIVITIES FINANCING ACTIVITIES Net increase in deposits Net decrease in short-term borrowings Net proceeds from issuance of long-term debt, including capital securities Payments on long-term debt, including capital securities Purchases of treasury shares... -

Page 57

... corporation and bank holding company headquartered in Cleveland, Ohio, is one of the nation's largest bank-based ï¬nancial services companies. KeyCorp's subsidiaries provide retail and commercial banking, commercial leasing, investment management, consumer ï¬nance, and investment banking products... -

Page 58

...of return on the outstanding investment in the lease, net of related deferred tax liabilities, in the years in which the net investment is positive. Leveraged lease revenue is impacted by assumptions related to estimated residual values, income tax rates and cash ï¬,ows. Net gains or losses on sales... -

Page 59

... Key sells education loans in securitizations. A securitization involves the sale of a pool of loan receivables to investors through either a public or private issuance (generally by a qualifying SPE) of asset-backed securities. Securitized loans are removed from the balance sheet and a net... -

Page 60

... systems applications that support corporate and administrative operations. Software development costs, such as those related to program coding, testing, conï¬guration and installation, are capitalized and included in "accrued income and other assets" on the balance sheet. The resulting asset... -

Page 61

...Share-Based Payment," which is described under the heading "Accounting Pronouncements Pending Adoption" on page 60. SFAS No. 123 requires companies like Key that have used the intrinsic value method to account for employee stock options to provide pro forma disclosures of the net income and earnings... -

Page 62

... Share-based payments. In December 2004, the FASB issued SFAS No. 123R, which requires companies to recognize in the income statement the fair value of stock options and other equity-based compensation issued to employees. As discussed under the heading "Stock-Based Compensation" on page 59, Key... -

Page 63

...ï¬ed Public Accountants ("AICPA") issued a Statement of Position that addresses the accounting for differences between contractual cash ï¬,ows and cash ï¬,ows expected to be collected from an investor's initial investment in loans or debt securities (structured as loans) acquired in a transfer if... -

Page 64

...-market companies, ï¬nancial institutions and government organizations. These products and services include commercial lending, treasury management, investment banking, derivatives and foreign exchange, equity and debt underwriting and trading, and syndicated ï¬nance. KeyBank Real Estate Capital... -

Page 65

... estate and retirement planning, and asset management services to assist high-net-worth clients with their banking, brokerage, trust, portfolio management, insurance, charitable giving and related needs. • Key's consolidated provision for loan losses is allocated among the lines of business based... -

Page 66

... deposits Net loan charge-offs Return on average allocated equity Average full-time equivalent employees $ Corporate Banking 2004 787 2 436 219 12,790 3,805 91 14.05% 1,156 $ 2003 795 171 429 122 12,783 3,411 217 7.27% 1,122 $ 2002 845 126 420 187 14,289 2,627 353 10.48% 1,181 KeyBank Real Estate... -

Page 67

... of cash ï¬,ow to pay dividends on its common shares, to service its debt and to ï¬nance its corporate operations is capital distributions from KBNA and its other subsidiaries. Federal banking law limits the amount of capital distributions that national banks can make to their holding companies... -

Page 68

... managed by the KeyBank Real Estate Capital line of business. Principal on these bonds typically is payable at the end of the bond term and interest is paid monthly at a ï¬xed coupon rate. The fair value of these investments is sensitive to changes in the market yield on CMBS. During the time Key... -

Page 69

... mortgage Home equity Consumer - direct Consumer - indirect: Automobile lease ï¬nancing Automobile loans Marine Other Total consumer - indirect loans Total consumer loans Loans held for sale: Real estate - commercial mortgage Real estate - residential mortgage Home equity Education Automobile Total... -

Page 70

... sold, but still serviced by Key. Related delinquencies and net credit losses are also presented. December 31, Loan Principal in millions Education loans Home equity loans Total loans managed Less: Loans securitized Loans held for sale or securitization Loans held in portfolio 2004 $ 7,585 14,215... -

Page 71

... including reserves, totaled $415 million. The fair value of mortgage servicing assets is estimated by calculating the present value of future cash ï¬,ows associated with servicing the loans. This calculation uses a number of assumptions that are based on current market conditions. Primary economic... -

Page 72

...of preferred securities and common stock. The debentures are recorded in "long-term debt" and Key's equity interest in the business trusts is recorded in "accrued income and other assets" on the balance sheet. Additional information on the trusts is included in Note 13 ("Capital Securities Issued by... -

Page 73

..."). These typically are smaller-balance commercial loans and consumer loans, including residential mortgages, home equity loans and various types of installment loans. Management applies historical loss experience rates to these loans, adjusted to reï¬,ect emerging credit trends and other factors... -

Page 74

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS KEYCORP AND SUBSIDIARIES 11. SHORT-TERM BORROWINGS Selected ï¬nancial information pertaining to the components of Key's short-term borrowings is as follows: dollars in millions FEDERAL FUNDS PURCHASED Balance at year end Average during the year Maximum ... -

Page 75

..., direct ï¬nancing and sales type leases. Long-term advances from the Federal Home Loan Bank had weighted-average interest rates of 2.87% at December 31, 2004, and 1.52% at December 31, 2003. These advances, which had a combination of ï¬xed and ï¬,oating interest rates, were secured by real estate... -

Page 76

... companies to continue to treat capital securities as Tier 1 capital, but with stricter quantitative limits. Management believes that the new rule, if adopted as proposed, would not have any material effect on Key's ï¬nancial condition. To the extent the trusts have funds available to make payments... -

Page 77

... of Key Bank USA into KBNA did not affect KBNA's ability to remain "well-capitalized." To Qualify as Well Capitalized Under Federal Deposit Insurance Act Amount Ratio Actual dollars in millions December 31, 2004 TOTAL CAPITAL TO NET RISK-WEIGHTED ASSETS Key KBNA TIER 1 CAPITAL TO NET RISK-WEIGHTED... -

Page 78

...WeightedAverage Price $13.30 17.49 23.34 27.25 31.39 43.63 $26.96 Information pertaining to Key's method of accounting for employee stock options and the pro forma effect on net income and earnings per share of applying the "fair value method" of accounting to all forms of stock-based compensation... -

Page 79

... million. Conversely, management estimates that a 25 basis point increase in the expected return on plan assets would decrease Key's net pension cost for 2005 by the same amount. In addition, pension cost is affected by an assumed discount rate (based on Moody's Aa-rated corporate bond yield) and an... -

Page 80

... market indices deemed most applicable to the plans' assets. The pension funds' investment allocation policies specify that fund assets are to be invested within the following ranges: Asset Class Equity securities Fixed income securities Convertible securities Cash equivalents and other assets... -

Page 81

... rate Expected return on plan assets 2004 6.00% 5.78 2003 6.50% 5.73 2002 7.25% 5.71 accordance with Key's current investment policies, weighted-average target allocation ranges for the VEBAs' assets are as follows: Asset Class Equity securities Fixed income securities Convertible securities Cash... -

Page 82

... income statement and totaled ($9) million in 2004, $20 million in 2003 and $26 million in 2002. The American Jobs Creation Act of 2004 provides for a special one-time tax deduction equal to 85 percent of certain foreign earnings that are "repatriated." Management is in the process of reviewing Key... -

Page 83

... times 35% statutory federal tax rate State income tax, net of federal tax beneï¬t Write-off of nondeductible goodwill Tax-exempt interest income Corporate-owned life insurance income Tax credits Reduced tax rate on lease income Reduction of deferred tax asset Other Total income tax expense 2004... -

Page 84

...and Exchange Commission and inquiries from the National Association of Securities Dealers ("NASD") and the State of New York Attorney General, seeking documents and information as part of their investigations into trading activity involving the mutual fund, brokerage and annuity businesses. McDonald... -

Page 85

... balance of loans outstanding at December 31, 2004. If payment is required under this program, Key would have an interest in the collateral underlying the commercial mortgage loan on which the loss occurred. Return guarantee agreement with LIHTC investors. KAHC, a subsidiary of KBNA, offered limited... -

Page 86

... or Visa debit card services when they accept MasterCard or Visa credit card services. These settlements reduced fees earned by KBNA from off-line debit card transactions. During 2004, the impact of the settlement reduced Key's pre-tax net income by approximately $12 million. It is management... -

Page 87

... balance sheet. ASSET AND LIABILITY MANAGEMENT Fair value hedging strategies. Key uses interest rate swap contracts known as "receive ï¬xed/pay variable" swaps to modify its exposure to interest rate risk. These contracts convert speciï¬c ï¬xed-rate deposits, short-term borrowings and long-term... -

Page 88

... value of loans. Fair values of time deposits, long-term debt and capital securities were estimated based on discounted cash ï¬,ows. Fair values of interest rate swaps and caps were based on discounted cash ï¬,ow models. Foreign exchange forward contracts were valued based on quoted market prices... -

Page 89

... CONDENSED FINANCIAL INFORMATION OF THE PARENT COMPANY CONDENSED BALANCE SHEETS December 31, in millions ASSETS Interest-bearing deposits Loans and advances to subsidiaries: Banks Nonbank subsidiaries Investment in subsidiaries: Banks Nonbank subsidiaries Accrued income and other assets Total assets... -

Page 90

...IN) INVESTING ACTIVITIES FINANCING ACTIVITIES Net increase (decrease) in short-term borrowings Net proceeds from issuance of long-term debt Payments on long-term debt Purchases of treasury shares Net proceeds from issuance of common stock Cash dividends paid NET CASH USED IN FINANCING ACTIVITIES NET... -

Page 91

... Relations website, Key.com/IR, provides quick access to useful information and shareholder services, including live webcasts of management's quarterly earnings discussions. ONLINE Key.com/IR BY PHONE Corporate Headquarters (216) 689-6300 KeyCorp Investor Relations (216) 689-4221 Annual Report... -

Page 92

... with conï¬dence. RAISING CAPITAL STRATEGIC ADVICE To learn more, call Steve Woods, National Sales Manager, at 216-689-3815, or visit Key.com. Achieve anything. Commercial Banking Form # 77-7700KC Commercial Financing subject to credit approval. KeyBank is Member FDIC. ©2005 KeyCorp PREVIOUS...