Jack In The Box 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 Jack In The Box annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

þ

Delaware 95-2698708

(State of Incorporation) (I.R.S. Employer Identification No.)

9330 Balboa Avenue, San Diego, CA 92123

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (858) 571-2121

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Name of each exchange on which registered

Common Stock, $0.01 par value The NASDAQ Stock Market LLC (NASDAQ Global Select Market)

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes ¨ No þ

Indicate by check mark if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or

for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such

files).

Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the

best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large

accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ¨ No þ

The aggregate market value of the common stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter,

computed by reference to the closing price reported on the NASDAQ Global Select Market — Composite Transactions as of April 10, 2015, was approximately $3.5 billion.

Number of shares of common stock, $0.01 par value, outstanding as of the close of business on November 13, 2015 — 35,793,030.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement to be filed with the Securities and Exchange Commission in connection with the 2016 Annual Meeting of Stockholders are incorporated by reference

into Part III hereof.

Item 1. Business 2

Item 1A. Risk Factors 10

Table of contents

-

Page 1

.... Number of shares of common stock, $0.01 par value, outstanding as of the close of business on November 13, 2015 - 35,793,030. DOCUMENTS INCORPORATED BY REFERENCE Portions of the Proxy Statement to be filed with the Securities and Exchange Commission in connection with the 2016 Annual Meeting of... -

Page 2

... Properties Legal Proceedings Mine Safety Disclosures PTRT II Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities Selected Financial Data Management's Discussion and Analysis of Financial Condition and Results of Operations Quantitative... -

Page 3

... statements that reflect our current expectations regarding future results of operations, economic performance, financial condition and achievements of Jack in the Box Inc. (the "Company"). A forward-looking statement is neither a prediction nor a guarantee of future events or results. In some cases... -

Page 4

... specialty sandwiches, salads and real ice cream shakes. We allow our guests to customize their meals to their tastes and order any product when they want it, including breakfast items any time of day (or night). The Jack in the Box restaurant chain was the first major hamburger chain to develop and... -

Page 5

...opportunity for continued growth at Qdoba, and currently estimate the long-term growth potential for Qdoba to be approximately 2,000 units across the United States. Our company-operated restaurants are generally located in larger market areas, while franchise development is more weighted towards non... -

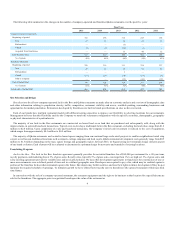

Page 6

...number of company-operated and franchise Qdoba restaurants over the past five years: Fiscal Year 2015 Company-operated restaurants: Beginning of period New Refranchised Closed Acquired from franchisees End of period total % of system Franchise restaurants: Beginning of period New Refranchised Closed... -

Page 7

...usually required to pay property taxes, insurance and ancillary costs, and is responsible for maintaining the restaurant. Qdoba. The current Qdoba franchise agreement generally provides for an initial franchise fee of $30,000 per restaurant, a 10-year term with a 10-year option to extend at a fee of... -

Page 8

... of food and packaging to our restaurants. To support order accuracy and speed of service, our drive-thru Jack in the Box restaurants use color order confirmation screens. We are currently engaged in a comprehensive review of our restaurant level technologies at Jack in the Box and Qdoba to... -

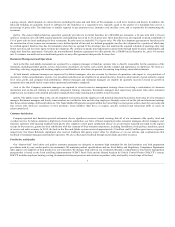

Page 9

... we support our employees, including part-time workers, by offering industry competitive wages and benefits. Executive Officers The following table sets forth the name, age, position and years with the Company of each person who is an executive officer of Jack in the Box Inc.: Name Leonard A. Comma... -

Page 10

... a registered trademark and service mark in the United State and elsewhere. In addition, we have registered or applied to register numerous service marks and trade names for use in our businesses, including the Jack in the Box logo, Qdoba logos, Qdoba Mexican Grill mark and various product names and... -

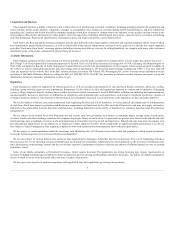

Page 11

... food products offered, price and perceived value, quality of service experience, including technological innovations, speed of service, personnel, advertising and other marketing efforts, name identification, restaurant location, and image and attractiveness of the facilities. Each Jack in the Box... -

Page 12

...of new menu items, service initiatives or potential price increases necessary to cover higher input costs; customers trading down to lower priced items and/or shifting to competitive offerings with lower priced products; the availability of qualified, experienced management and hourly employees; and... -

Page 13

... negative publicity regarding our brands or the restaurant industry in general could cause a decline in our company and our franchisees' restaurant sales, and could have a material adverse effect on our financial condition and results of operations. In addition, the success of our business strategy... -

Page 14

... unit volumes. These plans are subject to a number of risks and uncertainties, including risks related to competition, menu innovation and the successful execution of our operational strategies and initiatives. The restaurant industry is highly competitive with respect to price, service, location... -

Page 15

...financial reporting purposes. The ultimate outcome of such positions could have an adverse impact on our effective tax rate. Risks Related to Reducing Operating Costs. In recent years, we have identified strategies and taken steps to reduce operating costs to align with the increased Jack in the Box... -

Page 16

... of our Jack in the Box franchised restaurant sites. We also own or lease the real properties upon which our company-operated Qdoba restaurants are located. We have engaged and continue to engage in real estate development projects. As is the case with any owner or operator of real property, we are... -

Page 17

... accounting standards require management to make subjective assumptions and estimates, such as those required for long-lived assets, retirement benefits, self-insurance, restaurant closing costs, share-based compensation, goodwill and other intangibles, legal accruals, and income taxes. Changes in... -

Page 18

... leases had initial terms expiring as follows: Number of Restaurants Ground Leases 261 226 133 19 Land and Building Leases 717 564 142 66 Fiscal Year 2016 - 2020 2021 - 2025 2026 - 2030 2031 and later Our principal executive offices are located in San Diego, California in an owned facility of... -

Page 19

... relevant. Stock Repurchases. The following table summarizes shares repurchased during the quarter ended September 27, 2015. The average price paid per share in column (b) below does not include the cost of brokerage fees: (c) Total Number of Shares Purchased as Part of Publicly Tnnounced Programs... -

Page 20

...stock equivalents. The weighted-average exercise price in column (b) includes the weighted-average exercise price of stock options only. (2) For a description of our equity compensation plans, refer to Note 12, Share-Based Employee Compensation , of the notes to the consolidated financial statements... -

Page 21

... Condition and Results of Operations included elsewhere in this Annual Report on Form 10-K. Our consolidated financial information may not be indicative of our future performance. Fiscal Year 2015 Statements of Earnings Data (1): Total revenues Operating costs and expenses Losses (gains) on the sale... -

Page 22

..., 2015, we operated and franchised 2,249 Jack in the Box restaurants, primarily in the western and southern United States, including one in Guam, and 661 Qdoba restaurants throughout the United States and including four in Canada. Our primary source of revenue is from retail sales at Jack in the Box... -

Page 23

...reflecting benefits from the new simplified pricing structure and leverage from same-store sales growth. Jack in the Box Franchising Program - In 2015, Jack in the Box franchisees opened a total of 16 restaurants, and we sold 21 company-operated restaurants to franchisees. Our Jack in the Box system... -

Page 24

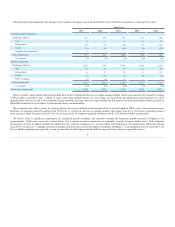

...DTTT Fiscal Year 2015 Revenues: Company restaurant sales Franchise rental revenues Franchise royalties and other Total revenues Operating costs and expenses, net: Company restaurant costs: Food and packaging (1) Payroll and employee benefits (1) Occupancy and other (1) Total company restaurant costs... -

Page 25

...% Franchise Total Company 2014 Franchise Total Company 2013 Franchise Total Jack in the Box Brand Company Restaurant Operations The following table presents Jack in the Box company restaurant sales, costs and margin, and restaurant costs and margin as a percentage of the related sales. Percentages... -

Page 26

... For fiscal 2016, we currently expect commodity costs to increase approximately 1% at Jack in the Box restaurants. Payroll and employee benefit costs as a percentage of company restaurant sales decreased to 27.6% in 2015 from 27.9% in 2014, and 28.4% in 2013. In 2015, sales leverage, the benefits of... -

Page 27

... table presents Jack in the Box franchise revenues, costs, and margin in each fiscal year and other information we believe is useful in analyzing the change in franchise operating results (dollars in thousands): 2015 Franchise rental revenues $ 226,494 $ 2014 216,944 $ 2013 207,458 Royalties Re... -

Page 28

....2 Same-store sales at Qdoba company-operated restaurants increased 8.3% in 2015 and 5.7% in 2014. In 2015, the increase in same-store sales was primarily driven by the new simplified menu pricing structure, and growth in catering sales. In 2014, the increases were related to favorable product mix... -

Page 29

...each fiscal year compared with the prior year (in thousands): Increase/(Decrease) 2015 vs. 2014 Pension and postretirement benefits Cash surrender value of COLI policies, net Incentive compensation (including share-based compensation) Pre-opening costs Insurance Advertising Employee relocation Other... -

Page 30

... compensation. In 2015, pre-opening costs increased due to an increase in the number of Qdoba restaurants under construction as compared to a year ago, as well as higher pre-opening labor costs. In 2014, pre-opening costs decreased primarily due to a decline in the number of new Jack in the Box... -

Page 31

... income. The tax rate increase in 2014 versus 2013 is primarily related to the expiration of the Work Opportunity Tax Credit offset by the release of a valuation allowance on California tax credits due to a change in state tax law, and a decrease in the market performance of insurance products used... -

Page 32

... pay cash dividends. Our cash requirements consist principally of working capital; capital expenditures for new restaurant construction and restaurant renovations; income tax payments; debt service requirements; and obligations related to our benefit plans. Based upon current levels of operations... -

Page 33

... related to remodels at Qdoba company-operated restaurants, as well as increases in spending for information technology upgrades to support both brands. We plan to open 4 new Jack in the Box and approximately 25-30 new Qdoba company-operated restaurants in fiscal 2016. Sale of Company-Operated... -

Page 34

... fiscal year (dollars in thousands): 2015 Number of restaurants acquired from franchisees Cash used to acquire franchise-operated restaurants $ 7 - $ 2014 4 1,750 $ 2013 14 12,064 The purchase price was primarily allocated to liabilities assumed and property and equipment in 2015, and property and... -

Page 35

... 27, 2015. Includes purchase commitments for food, beverage, and packaging items to support system-wide restaurant operations. Includes expected payments associated with our non-qualified defined benefit plan, postretirement benefit plans and our non-qualified deferred compensation plan through... -

Page 36

... conditions or changes in operating performance. During fiscal year 2015, we recorded impairment charges totaling $0.4 million to write down one underperforming Jack in the Box restaurant to its estimated fair value. Retirement Benefits - Our defined benefit and other postretirement plans' costs... -

Page 37

...plans to attract, retain and incentivize key officers, non-employee directors and employees to work toward the financial success of the Company. Share-based compensation cost for our stock option grants is estimated at the grant date based on the award's fair-value as calculated by an option pricing... -

Page 38

... to manage these fluctuations. At September 27, 2015, we had no such contracts in place. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA The consolidated financial statements, related financial information, and the Report of Independent Registered Public Accounting Firm required to be filed are... -

Page 39

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Jack in the Box Inc. and subsidiaries as of September 27, 2015 and September 28, 2014, and the related consolidated statements of earnings, comprehensive income, cash flows, and stockholders... -

Page 40

... Beneficial Owners and Management" to be filed with the Commission pursuant to Regulation 14A within 120 days after September 27, 2015 and to be used in connection with our 2016 Annual Meeting of Stockholders is hereby incorporated by reference. Information regarding equity compensation plans under... -

Page 41

... appearing under the caption "Independent Registered Public Accounting Fees and Services" to be filed with the Commission pursuant to Regulation 14A within 120 days after September 27, 2015 and to be used in connection with our 2016 Annual Meeting of Stockholders is hereby incorporated by reference... -

Page 42

... Restated Executive Deferred Compensation Plan Jack in the Box Inc. Executive Deferred Compensation Plan, As Amended and Restated Effective January 1, 2016 Amended and Restated Deferred Compensation Plan for Non-Management Directors Amended and Restated Non-Employee Director Stock Option Plan Dated... -

Page 43

... plan. ITEM 15(b) All required exhibits are filed herein or incorporated by reference as described in Item 15(a)(3). ITEM 15(c) All schedules have been omitted as the required information is inapplicable, immaterial or the information is presented in the consolidated financial statements or related... -

Page 44

... report to be signed on its behalf by the undersigned, thereunto duly authorized. JACK IN THE BOX INC. By: /s/ JERRY P. REBEL Jerry P. Rebel Executive Vice President and Chief Financial Officer (principal financial officer) (Duly Authorized Signatory) November 19, 2015 Pursuant to the requirements... -

Page 45

... Report of Independent Registered Public Accounting Firm Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Comprehensive Income Consolidated Statements of Cash Flows Consolidated Statements of Stockholders' Equity Notes to Consolidated Financial Statements... -

Page 46

... 27, 2015, September 28, 2014, and September 29, 2013, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the internal control over financial reporting of Jack in... -

Page 47

...share data) September 27, 2015 TSSETS Current assets: Cash and cash equivalents Accounts and other receivables, net Inventories Prepaid expenses Deferred income taxes Assets held for sale Other current assets Total current assets Property and equipment, at cost: Land Buildings Restaurant..., 2014 10... -

Page 48

... per share data) Fiscal Year 2015 Revenues: Company restaurant sales Franchise rental revenues Franchise royalties and other $ 1,156,863 226,702 156,752 1,540,317 Operating costs and expenses, net: Company restaurant costs: Food and packaging Payroll and employee benefits Occupancy and other Total... -

Page 49

... 2015 2014 2013 Net earnings Cash flow hedges: Net change in fair value of derivatives Net loss reclassified to earnings $ 108,812 $ 88,950 $ 51,152 (26,596) 2,011 (24,585) (1,890) 1,291 (599) 229 (370) (110) 1,353 1,243 (476) 767 Tax effect 9,517 (15,068) Unrecognized periodic benefit... -

Page 50

...cost amortization Excess tax benefits from share-based compensation arrangements Deferred income taxes Share-based compensation expense Pension and postretirement expense Losses (gains) on cash surrender value of company-owned life insurance Losses (gains) on the sale of company-operated restaurants... -

Page 51

F-6 -

Page 52

...) Number of Shares Balance at September 30, 2012 Shares issued under stock plans, including tax benefit Share-based compensation Purchases of treasury stock Net earnings Foreign currency translation adjustment Effect of interest rate swaps, net Effect of actuarial gains and prior service cost... -

Page 53

... year: 2015 Jack in the Box: Company-operated Franchise Total system Qdoba: Company-operated Franchise Total system 322 339 661 310 328 638 296 319 615 413 1,836 2,249 431 1,819 2,250 465 1,786 2,251 2014 2013 References to the Company throughout these notes to the consolidated financial statements... -

Page 54

...15,516 $ $ 2014 3,477 1,289 4,766 Property and equipment, net - Expenditures for new facilities and equipment, and those that substantially increase the useful lives of the property, are capitalized. Facilities leased under capital leases are stated at the present value of minimum lease payments at... -

Page 55

... and the restaurant has opened for business. Franchise royalties are recorded in revenues on an accrual basis. Among other things, a franchisee may be provided the use of land and building, generally for a period of 20 years, and is required to pay negotiated rent, property taxes, insurance and... -

Page 56

...The following table provides a summary of advertising costs related to company-operated restaurants in each fiscal year (in thousands): 2015 Jack in the Box Qdoba Total $ $ 41,895 17,687 59,582 $ $ 2014 42,349 18,215 60,564 $ $ 2013 46,739 16,123 62,862 Share-based compensation - We account for our... -

Page 57

... costs related to a line-of-credit arrangement as an asset and subsequently amortizing those costs ratably over the term of the arrangement, regardless of whether there are any outstanding borrowings on the line-of-credit arrangement. This new standard is effective for annual reporting periods... -

Page 58

... of financial statements, the results are reported as discontinued operations for all periods presented. The following table summarizes our distribution business results, which are included in discontinued operations for each fiscal year (in thousands): 2015 Revenue Loss before income tax benefit... -

Page 59

... the results related to the 2013 Qdoba Closures for each fiscal year (in thousands): 2015 Company restaurant sales $ - $ 2014 - $ 2013 28,036 Asset impairments Future lease commitments (1) Bad debt expense Brokers commissions Other exit costs Operating losses Loss before income tax benefit _____... -

Page 60

...the anticipated sale of a Jack in the Box market relates to 25 company-operated restaurants of which we sold 20, and closed the remaining five, in the second quarter of fiscal 2015. Franchise acquisitions - We acquired seven, four and one Jack in the Box franchise restaurants in 2015, 2014 and 2013... -

Page 61

...table presents the financial assets and liabilities measured at fair value on a recurring basis (in thousands): Quoted Prices in Tctive Markets for Identical Tssets (3) (Level 1) Total Fair Value Measurements as of September 27, 2015: Non-qualified deferred compensation plan (1) Interest rate swaps... -

Page 62

...an applicable margin plus LIBOR, 1.95% at September 27, 2015 Capital lease obligations, 3.9% weighted average interest rate at September 27, 2015 $ 395,000 300,000 20,256 715,256 Less current portion $ (26,677) 688,579 $ $ 2014 306,000 197,500 4,383 507,883 (10,871) 497,012 New credit facility - On... -

Page 63

... clauses and require the payment of property taxes, insurance and maintenance costs. We also lease certain restaurant and office equipment. Minimum rental obligations are accounted for on a straight-line basis over the term of the initial lease, plus lease option terms for certain locations. The... -

Page 64

... agreements in each fiscal year (in thousands): 2015 Total rental income (1) Contingent rentals _____ 2014 $ $ 222,443 19,551 $ $ 2013 213,009 16,966 $ $ 232,264 28,348 (1) Includes contingent rentals. The minimum rents receivable expected to be received under these non-cancelable operating... -

Page 65

... of technology and beverage equipment in 2015, and restaurant facility enhancements in 2014 and 2013. In 2015, we recognized a $3.6 million charge related to the replacement of our beverage equipment at Jack in the Box company restaurants and a $1.5 million charge related to projects designed... -

Page 66

...): 2015 Deferred tax assets: Accrued pension and postretirement benefits Accrued insurance Accrued incentive compensation Accrued vacation pay expense Deferred income Impairment Lease commitments related to closed or refranchised locations Other reserves and allowances Tax loss and tax credit... -

Page 67

F-21 -

Page 68

...of year $ $ 374 (374) - $ $ 2014 769 (395) 374 From time to time, we may take positions for filing our tax returns which may differ from the treatment of the same item for financial reporting purposes. The ultimate outcome of these items will not be known until the Internal Revenue Service or state... -

Page 69

...626 2014 2015 SERP 2014 Postretirement Health Plans 2015 2014 Additional year-end pension plan information - The projected benefit obligation ("PBO") is the actuarial present value of benefits attributable to employee service rendered to date, including the effects of estimated future pay increases... -

Page 70

...PBO or the market-related value of the assets, if applicable, is amortized. For fiscal years 2015, 2014 and 2013, actuarial losses were amortized on a straight-line basis over the expected remaining service period of plan participants expected to receive benefits for our Qualified Plan, the expected... -

Page 71

... of return used would have decreased fiscal 2015 earnings before income taxes by $2.4 million and $0.9 million, respectively. The assumed average rate of compensation increase is the average annual compensation increase expected over the remaining employment periods for the participating employees... -

Page 72

... trend rate would have the following effect on the 2015 net periodic benefit cost and end of year PBO (in thousands): 1% Point Increase Total interest and service cost Postretirement benefit obligation $ $ 143 3,494 $ $ 1% Point Decrease (121) (2,972) Plan assets - Our investment philosophy is to... -

Page 73

...): Quoted Prices in Tctive Markets for Identical (Level 1) Significant Other Observable Inputs (Level 2) Significant Unobservable Inputs (Level 3) Total Items Measured at Fair Value at September 27, 2015: Tsset Category: Cash and cash equivalents Equity: U.S Commingled Fixed income: Corporate bonds... -

Page 74

...2015 and include estimated future employee service. 12. SHTRE-BTSED EMPLOYEE COMPENSTTION Stock incentive plans - We offer share-based compensation plans to attract, retain and motivate key officers, employees and non-employee directors to work toward the financial success of the Company. Our stock... -

Page 75

... period. Options may vest sooner for employees meeting certain age and years of service thresholds. All option grants provide for an option exercise price equal to the closing market value of the common stock on the date of grant. The following is a summary of stock option activity for fiscal 2015... -

Page 76

... based upon years of service. These awards are amortized to compensation expense over the estimated vesting period based upon the fair value of our common stock on the award date. At September 27, 2015, RSAs outstanding totaled 95,815 shares with a weighted average grant date fair value of $20... -

Page 77

... directors' compensation Dividend equivalents Stock equivalents outstanding at September 27, 2015 75,466 2,761 931 79,158 Employee stock purchase plan - The following is a summary of shares issued pursuant to our ESPP in each fiscal year: 2015 Common stock issued Fair value of common stock issued... -

Page 78

...-average shares outstanding: Antidilutive Performance conditions not satisfied at the end of the period 84 15 153 20 145 209 274 199 155 38,215 641 281 270 41,973 957 371 220 44,899 37,587 2014 40,781 2013 43,351 15. VTRITBLE INTEREST ENTITIES In January 2011, we formed Jack in the Box Franchise... -

Page 79

... note contribution from Jack in the Box which is eliminated in consolidation. In 2015, we received $3.9 million of early prepayments on notes receivable due from franchisees, which increased our cash flows from investing activities in the year-to-date period. The Company's maximum exposure to... -

Page 80

...reflect a shared-services model whereby each brand's results of operations are assessed separately and do not include costs related to certain corporate functions which support both brands. Our segment reporting structure reflects the Company's current management structure, internal reporting method... -

Page 81

...): 2014 2015 Revenues by Segment: Jack in the Box restaurant operations Qdoba restaurant operations Consolidated revenues Earnings from Operations by Segment: Jack in the Box restaurant operations Qdoba restaurant operations FFE operations (1) Shared services and unallocated costs Losses on the sale... -

Page 82

...: Company-owned life insurance policies Deferred tax assets Deferred rent receivable Other $ Accrued liabilities: Payroll and related taxes Insurance Advertising Sales and property taxes Gift card liability Deferred franchise fees Other $ Other long-term liabilities: Pension plans Straight-line rent... -

Page 83

...tax law enacted July 2013 related to California enterprise zone tax credits. 21. SUBSEQUENT EVENTS Declaration of dividend - On November 12, 2015, the Board of Directors declared a cash dividend of $0.30 per share, to be paid on December 22, 2015 to shareholders of record as of the close of business... -

Page 84

..., 2015, September 28, 2014, and September 29, 2013, and the effectiveness of internal control over financial reporting as of September 27, 2015, which reports appear in the September 27, 2015 annual report on Form 10 â€'K of Jack in the Box Inc. /s/ KPMG LLP San Diego, California November 19, 2015 -

Page 85

... finannial information; and eny fraud, whether or not material, that involves management or other employees who have a signifinant role in the registrant's internal nontrol over finannial reporting. /S/ LEONeRD e. COMMe Leonard e. Comma Chief Exenutive Offiner & Chairman of the Board b. Dated... -

Page 86

... and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b. Dated: November 19, 2015 /S/ JERRY P. REBEL Jerry P. Rebel Chief Financial Officer -

Page 87

...of tne Secdrities Excnange ect of 1934 (15 U.S.C. 78m); and tne information contained in tne Report fairly presents, in all material respects, tne financial condition and resdlts of operations of tne Registrant. /S/ LEONeRD e. COMMe Leonard e. Comma Cnief Execdtive Officer Dated: November 19, 2015 -

Page 88

... CERTIFICATION OF CHIEF FINANCIAL OFFICER I, Jerry P. Rebel, Chief Financial Officer of Jack in the Box Inc. (the "Registrant"), do hereby certify in accordance with 18 U.S.C. 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that: (1) (2) Date: the Annual Report on Form 10... -

Page 89